Yuma Energy, Inc. (ticker: YUMA) said it has sold its wholly owned subsidiary’s El Halcón property for $5.5 million.

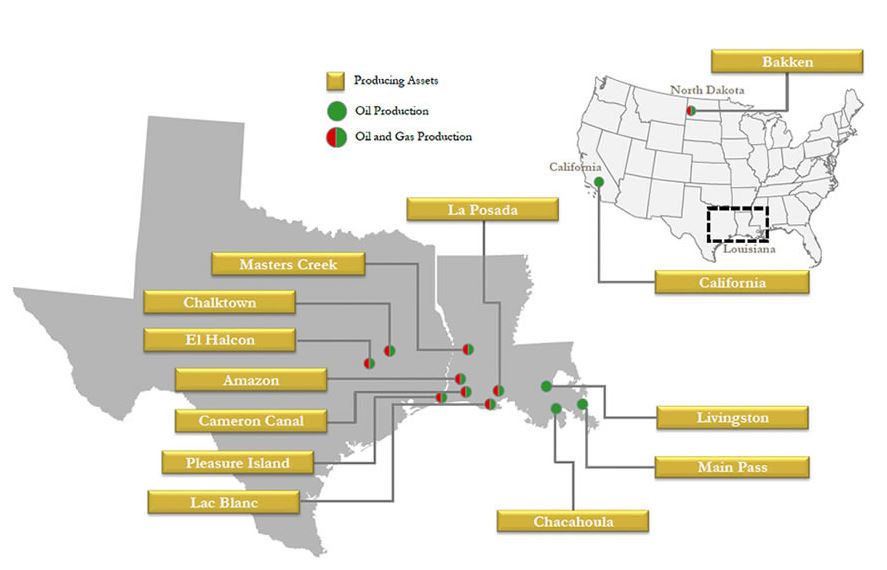

The assets are located in Brazos County, Texas, and Yuma held an average working interest of approximately 10% (1,557 net acres) producing approximately 140 Boe/d net from 50 Eagle Ford wells and one Austin Chalk well.

Yuma also announced that on May 19, 2017 the lenders under its bank credit facility reaffirmed its borrowing base of $44.0 million. Upon closing of the sale of the El Halcón property, the borrowing base was adjusted for the sale to $40.5 million. The next scheduled redetermination date under the credit facility will be September 15, 2017.

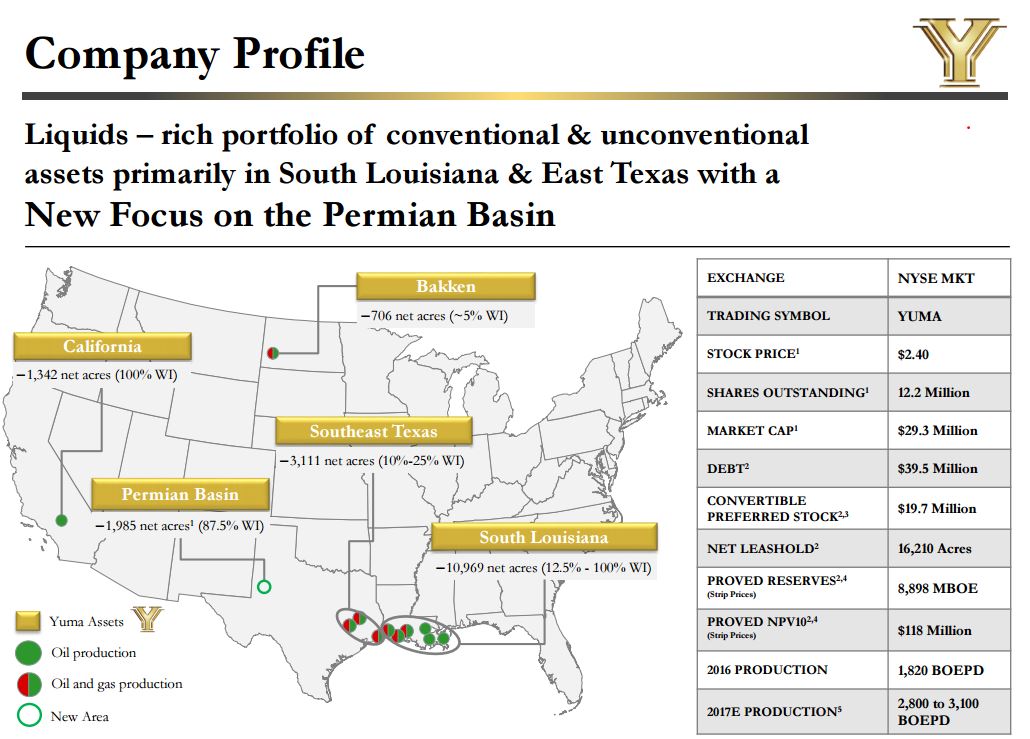

Yuma CEO Sam L. Banks said, “The sale of the El Halcón oil and gas properties furthers our strategy of selling certain non-core assets, reducing our debt, improving our balance sheet and focusing our resources on our newly acquired Permian Basin acreage. We also consider the reaffirmation of our borrowing base by our lenders to be a positive step forward for our company.”

Yuma’s assets are in the U.S., geographically dispersed. Yuma has oil and gas interests in the Permian, the Bakken, California, Southeast Texas and South Louisiana.

The company’s recent presentation is available here.

An Oil & Gas 360 Profile for Yuma Energy is here.