OPEC’s meeting to decide the future of production cuts is quickly approaching, and many expect that the group will extend their deal through at least the end of this year.

The production cuts, when they were first initiated, helped to bring both WTI and Brent crude oils back above $50 per barrel, but prices have struggled to maintain that position or go higher as unconventional drilling and U.S. production continue to ramp up.

In EnerCom Analytics’ Monthly Energy Industry Data & Trends for April, the firm examined the possible effects of OPEC’s decision making on WTI prices and forecasted that oil prices would hit $49.29 per barrel if the group maintained cuts and the members exempt from the deal reached their production targets.

When the deal was originally announced, Iran, Libya and Nigeria were given exemptions from production cuts.

Iran has stated that it hopes to achieve 4 MMBOPD of output, the same amount it was producing prior to the implementation of international sanctions. Production in the Islamic Republic ramped up quickly following the end of sanctions, but many believe that it will need to attract foreign investment and partners in order to hit its 4 MMBOPD mark as it stretches its existing projects to the limits of their current capacity.

Libya has repeatedly claimed force majeure on its production as the country continues to struggle with a civil war, and Nigeria’s oil infrastructure continues to be a target for factions that are unsatisfied with the current government, making it difficult for either to increase and maintain, production.

If all three were able to reach their targets, however, with Iran hitting 4 MMBOPD, Libya maintaining its production at its peak of 1.1 MMBOPD, and Nigeria pushing output back to levels seen in 2015 as OPEC ramped up production, WTI prices would reach $49.29 per barrel, assuming compliance with the production deal remained high, according to EnerCom Analytics. WTI closed at $49.35 today, six cents higher than EnerCom’s April prediction.

At this point, it seems that the market has largely priced in the extended production cuts. If the group does confirm that cuts will continue, oil prices will likely remain largely unchanged.

Failure to extend cuts: $47.54 oil

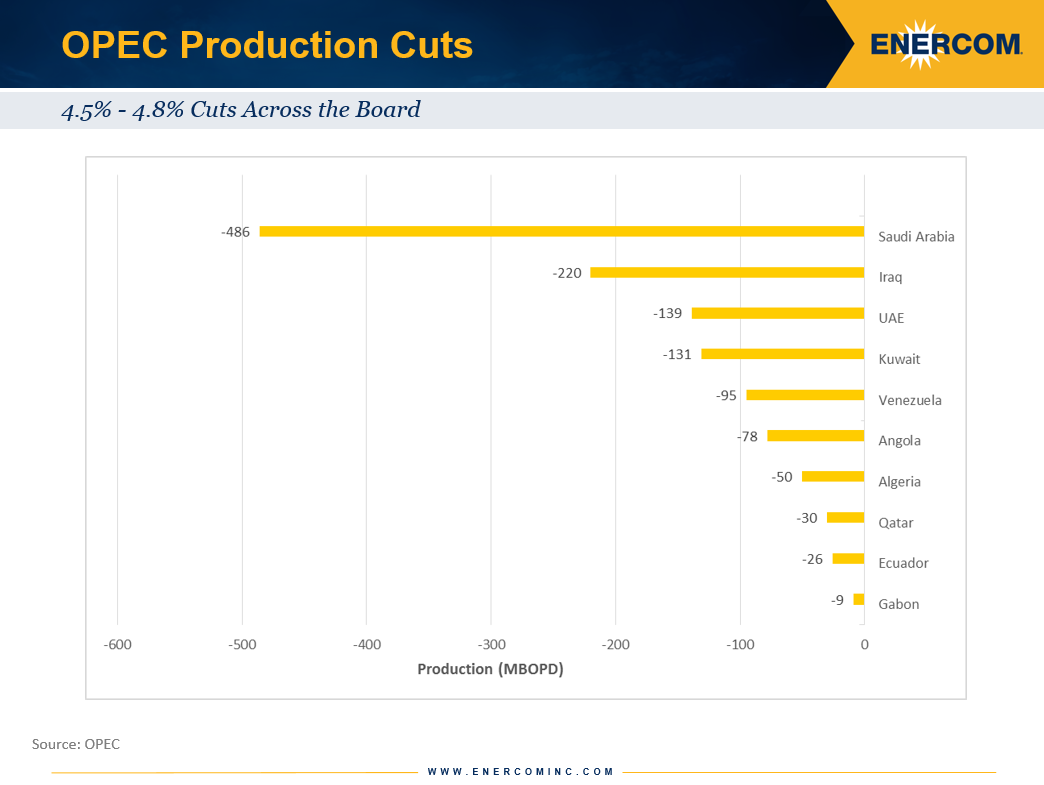

If the group is unable to reach an agreement on further production cuts and increases output to levels seen in December 2016, WTI could go as low as $47.54 as markets begin to absorb the increased production, according to EnerCom’s models. Even at those prices, however, most U.S. basins would remain economic, the report said.

At $45 WTI, the Eagle Ford, Delaware, Midland and Bakken are all able to generate 20% IRRs or better, meaning that even if oil fell to $47.54, many operators would be able to continue drilling. This, in turn, caps how far oil price would be able to rise beyond that point, however.

Adjusting for inflation, these prices are somewhat below the historical average going back to 1974. Over the last 43 years, WTI has averaged $36.26 nominally, but $54.67 per barrel once adjusted for inflation.

If you like to receive EnerCom’s predictions as soon as they are released, as well as the firm’s insight on a number of other topics, subscribe to Energy Industry Data & Trends. To learn more about the scenarios run by EnerCom, and how U.S. policies and increases in the strength of the dollar might affect WTI oil prices, sign up for Energy Industry Data & Trends here.