The price of U.S. benchmark WTI crude is becoming increasingly volatile

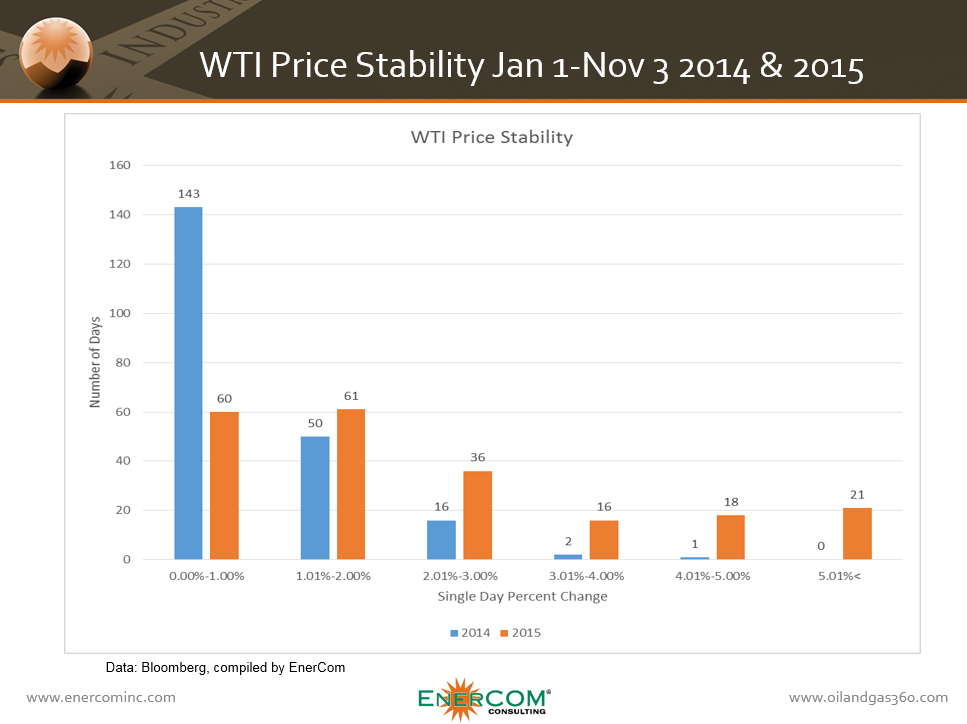

The price of U.S. crude oil benchmark West Texas Intermediate (WTI) has been increasingly volatile since November of last year, following the decision by OPEC to maintain production over defending oil prices. The chart above shows the number of days the price of oil changed by a certain percentage of its value at close the previous day for January 1st through November 3rd for both 2014 and 2015.

In 2014, leading up to the OPEC decision, WTI prices remained relatively stable, trading within 1% of their value from the previous day 67% of the time, with the number of days the price saw volatility declining inversely to the size of the volatility.

WTI prices have been much less stable in 2015, year-to-date. Looking at the same time period for this year, WTI has traded inside 1% of its previous day’s value just 28% of the time, with price swings above 5% seen about 10% of 2015.

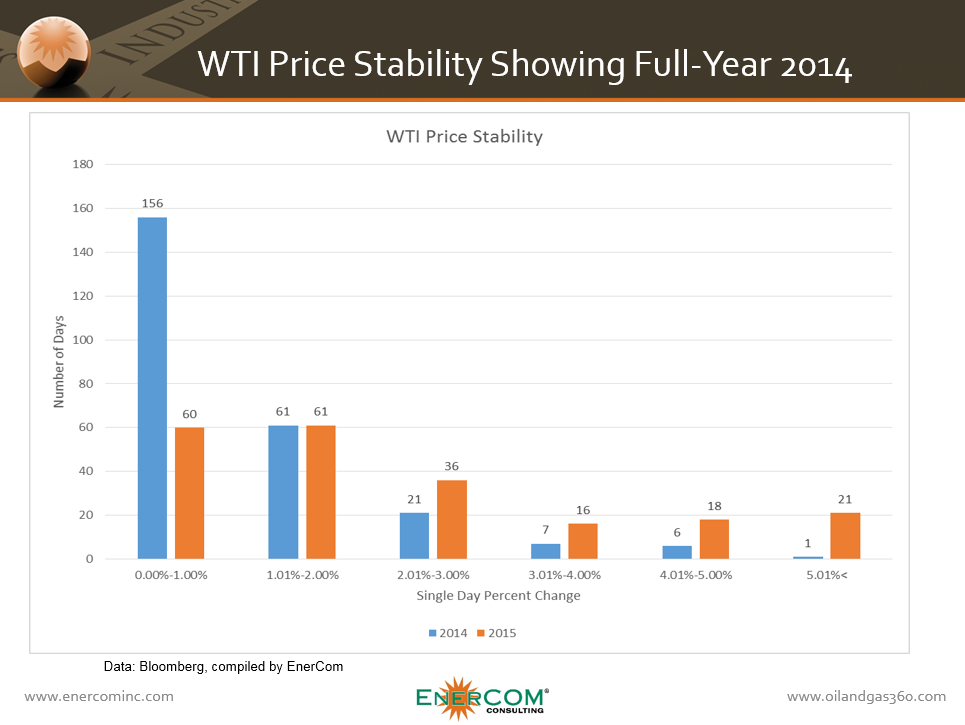

Adding in the remainder of 2014’s days to the same chart, price volatility for the year increased following OPEC’s Thanksgiving Day decision. With daily swings in the price greater than 3% increasing from just three for the first three quarters of the year to 14 by the end of Q4’14.

Prices are a concern to OPEC members: infighting over cartel’s strategy increases as December meeting approaches

As the year mark approaches for OPEC’s decision to change policy away from defending crude oil prices, members of the group are increasingly fighting over the best direction for the future. With OPEC’s next meeting slated for December 4, the group has released a draft report on its long-term strategy (LTS). The 44-page document is followed by 11 pages of comments from member countries, many of whom would like to see a change in OPEC policy,

“OPEC should be prepared to establish and defend a price floor, in particular, and to accept a temporary trade-off between lower market share and higher revenues,” Algeria commented in the draft report.

“It is our recommendation to agree upon a fair and reasonable price (band) then try to support it as long as this price seems a fair and reasonable price,” read one of Iran’s comments.

Iraq, which has boosted production despite its lower rig count following OPEC’s November decision, made comments to the draft LTS that called for greater individual autonomy for members. “OPEC member-countries should determine their own policies regarding the long term strategy (LTS) by creating a model for achieving maximum revenue through a balance between market share and prices,” Iraq wrote in the draft’s appendix.

Top producer Saudi Arabia, however, says the market determines oil prices. The kingdom did not make a comment on the draft report.