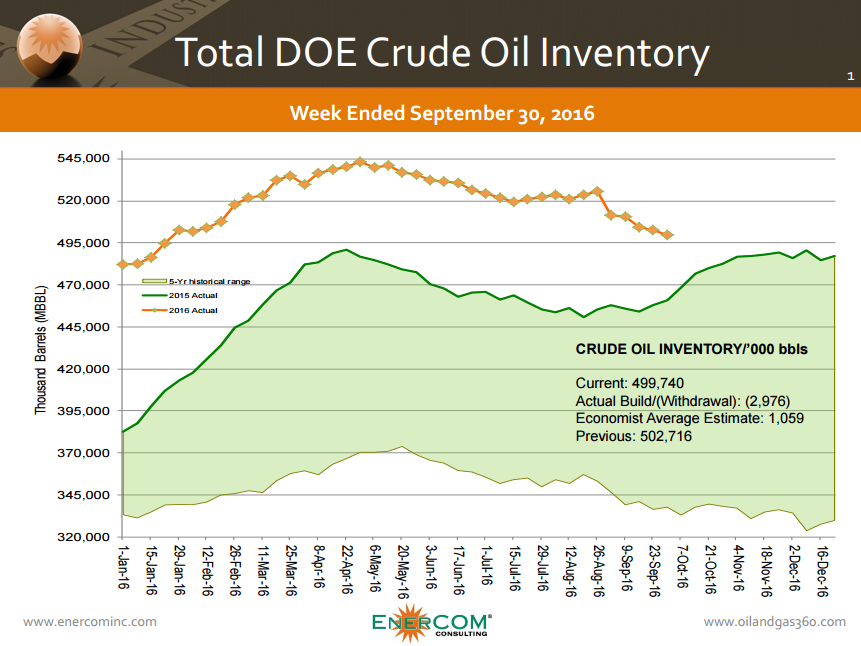

Crude oil inventories fell roughly 3.0 MMBO, sending WTI prices higher

U.S. crude oil futures were up over 2% today, extending gains from earlier this week, as the Department of Energy announced a surprise draw in crude oil inventories. The average estimate for this week’s crude oil data indicated that stockpiles would build 1.06 MMBO, but the data released by the DOE today showed a draw of 2.98 MMBO.

This week’s crude oil draw marks the fifth-consecutive reduction in crude oil storage. The total 26 MMBO pulled out of inventories since September has surprised many market participants, as it comes toward the end of summer and has carried into autumn, when driving drops and U.S. refineries shut in for seasonal maintenance.

OPEC production cuts still ‘urgently needed’

The steady decline in U.S. crude oil stockpiles also coincides with lower crude oil imports, and may not indicate the global glut is easing, as many hope it does. The EIA reported Wednesday that crude imports fell by 125 MBO during the week ended September 30.

“For as long as falling U.S. crude oil stocks are attributable only to lower imports, this does not by any means imply a reduction in the global oversupply: instead, the oil is likely to be pressuring the market elsewhere,” Commerzbank analysts wrote Wednesday. “OPEC’s production cuts are still urgently needed, in other words.”

Oil prices have seen support in the last week from OPEC as the group discusses setting a production cap. The group agreed to cut production for the first time in eight years to 32.5-33.0 MMBOPD. Importantly, it appears that Saudi Arabia and Iran have been able to come to an agreement in which Iran will not be subject to a production cap. The last time OPEC tried to reach a deal on production, the talks fell apart when Iran said it would not stop increasing output before reaching pre-sanction levels.