$700 million proceeds for Gallup oil play

‘Our bias for action has completely reshaped our story’ – Rick Muncrief

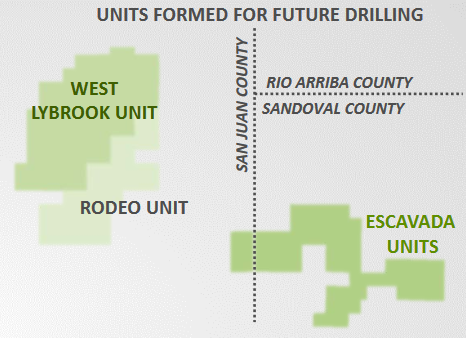

WPX Energy (ticker: WPX) announced its exit from the San Juan Basin, selling its assets in the Gallup oil play.

WPX will divest its remaining San Juan assets, in the Gallup oil play, for $700 million, completing its exit from the basin.

WPX did not disclose the identity of the buyer. WPX reports its Gallup assets produced about 10.8 MBOPD in Q3, but had limited drilling prospects. Overall, the Gallup position represented less than 5% of the company’s gross undeveloped locations. The sale is expected to close in Q1.

Based on Q3 production WPX received $64,815 per flowing barrel of production, well above the standard flowing BOE valuation of $35,000. Reserves and acreage associated with the sold assets were not disclosed, so these valuation metrics are not available.

WPX received nearly $1.2 billion for San Juan operation

This is the third major San Juan sale by WPX, as the company sold its legacy natural gas assets for $175 million and a gathering system in the basin for $309 million. The buyer of WPX’s Gallup assets is also assuming the associated transportation commitments, so WPX no longer has any commercial obligations in the basin.

WPX will use the proceeds from the sale to pay down debt, accelerating its deleveraging efforts. While the company originally targeted a net debt/EBITDAX of 2.0x in 2019, this sale means it will now target 1.5x.

Capital for Permian, Williston

WPX also updated guidance to reflect the Gallup sale. The company now forecasts 75-80 MBOPD of oil production and about 120 MBOEPD of total output, down from previous estimates of 85 MBOPD and 137 MBOEPD.

Overall CapEx forecasts are unchanged, as capital that was earmarked for the Gallup play will be reallocated to the company’s Permian and Williston assets. WPX planned 0-1 rigs in the basin in 2018 and exited 2017 with 12 DUCs.

Pro forma, WPX is producing about 80% liquids and 20% natural gas, exactly the opposite of its production profile five years ago.

Rick Muncrief, WPX chairman and CEO, said, “WPX is now completely focused on our outstanding assets in the top two oil-prone basins in North America– the Permian’s Delaware Basin and North Dakota’s Williston Basin. Our bias for action has completely reshaped our story and our outlook, evidenced by the positive trends in our financial results.”