Industry-wide divestiture levels were down on a year-over-year basis in 2015, but WPX Energy (ticker: WPX) did more than its fair share on the mergers and acquisitions front.

On December 31, 2015, the Tulsa-based exploration and production company announced the sale of its gathering system in the San Juan Basin for approximately $309 million. In accordance with the transaction, WPX exceeded its 2015 deleveraging plan which aimed to divest anywhere from $400 to $500 million in assets before year-end 2015. Its sale process is listed below and follows its initial deleveraging announcement on August 5, 2015.

Date |

Asset |

Location |

Proceeds |

| August 31 | Gathering System | Williston Basin / Van Hook | $185 million |

| September 1 | Coalbed Methane | Powder River Basin | $80 million |

| December 31 | Gathering System | San Juan Basin | $309 million |

TOTAL: |

$574 MILLION |

All of the previously mentioned transactions were executed with privately held buyers. The company plans on selling an additional $400 to $500 million in properties in 2016.

Aside from the divestitures completed as part of its deleveraging plan, WPX closed on an additional $800 million in three separate transactions in the first half of the year. The divestitures included the $294 million disposition of its assets in Argentina and a total of nearly $500 million realized from selling its operations and marketing contracts in the Marcellus Shale.

The company has sold more than $2 billion in assets since the beginning of 2014 and has been involved in more than $4 billion of transactions in the same time frame. “We have demonstrated are ability to execute, and if we believe it’s within the best interest of the company we’re going to follow through on it,” said David Sullivan, Manager of Investor Relations for WPX Energy, in an interview with Oil & Gas 360®. “One of the big things we’ve heard back on the sell-side reports is that WPX delivers on things we say we will do. Our team achieved that with the announcement we made on New Year’s Eve.”

The company has sold more than $2 billion in assets since the beginning of 2014 and has been involved in more than $4 billion of transactions in the same time frame. “We have demonstrated are ability to execute, and if we believe it’s within the best interest of the company we’re going to follow through on it,” said David Sullivan, Manager of Investor Relations for WPX Energy, in an interview with Oil & Gas 360®. “One of the big things we’ve heard back on the sell-side reports is that WPX delivers on things we say we will do. Our team achieved that with the announcement we made on New Year’s Eve.”

Rebalancing the Portfolio

The deleveraging goal was not a knee-jerk reaction to the commodity downturn – it followed the largest transaction in WPX’s history.

On July 14, 2015, WPX acquired privately held RKI Exploration and Production for $2.75 billion, securing 92,000 net acres in the Delaware Basin. WPX has added about 40,000 net acres in the San Juan Basin since August 2014.

Its transformation follows WPX’s goal to become a more liquids-focused producer. The commodity downturn has presented opportunities for those seeking to change their portfolio. “As with any business, the time to buy is when prices are down,” said Rick Muncrief, President and Chief Executive Officer of WPX, in a July conference call. “When oil prices are stronger again, we probably won’t be buying, we’ll be busy drilling and developing.”

The Permian was the company’s most active region at year-end 2015, considering the region held four of its eight rigs at the time of its Q3’15 release.

What’s Next?

What’s Next?

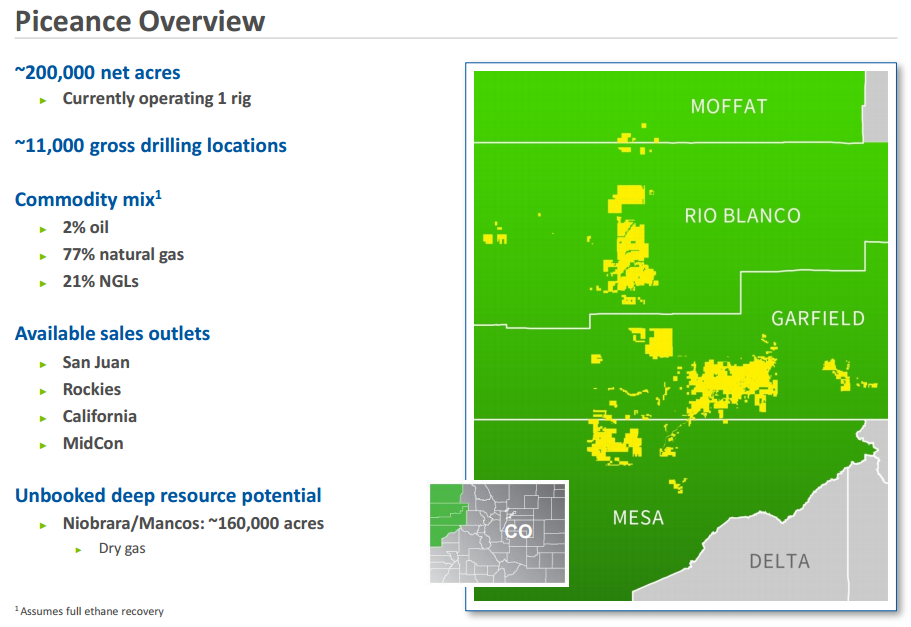

In an 8-K filed on December 15, WPX acknowledged it is “considering options for unlocking the value of our assets in the Piceance Basin.” Management said discussions have been held regarding either a partial or full-scale divesture of the properties, which include 200,000 net acres, 569 MMcfe/d of production, an estimated 11,000 gross drilling locations and a water treatment system. The Piceance garnered roughly 18% of WPX’s 2015 capital expenditure plan.

Capital One Securities values the position at $1.15 billion, but believes the property would likely yield $0.8 to $1.0 billion in the current environment. “Ways to unlock Piceance value have been discussed by the company in the past,” said analyst Brian Velie in the note. “However, it does sound like interest in the properties is high and an announcement may be coming soon.”

Following the landmark RKI acquisition, WPX said its goal was to reduce its net debt to EBITDA multiple to 2.0x by year-end 2017. Its estimated multiple for year end 2015 is slated at 3.0x to 3.2x, and KLR Group believes $400 million in monetizations in the upcoming year could reduce its year-end 2016 multiple to 2.5x.

Although the Piceance appears to be flagged as a sure-fire sale, management did not entirely rule out the possibility of additional sales. “It’s important to note that we have numerous other monetization options that could be acted on for further debt reductions if, and only if, necessary,” said Muncrief in the company’s Q3’15 call.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.