WPX Establishes Fourth Core Area

Wells Provide 30% Return at $60/barrel

WPX Energy (ticker: WPX) is moving into the most prolific oil play in the United States.

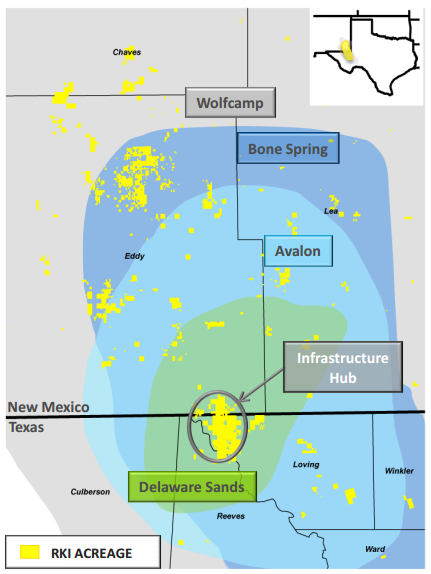

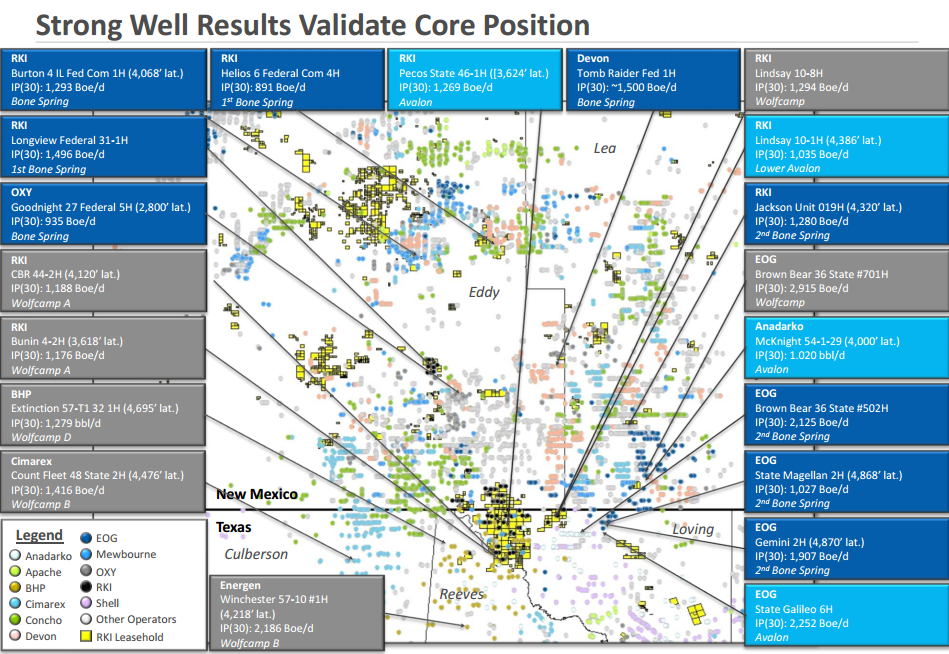

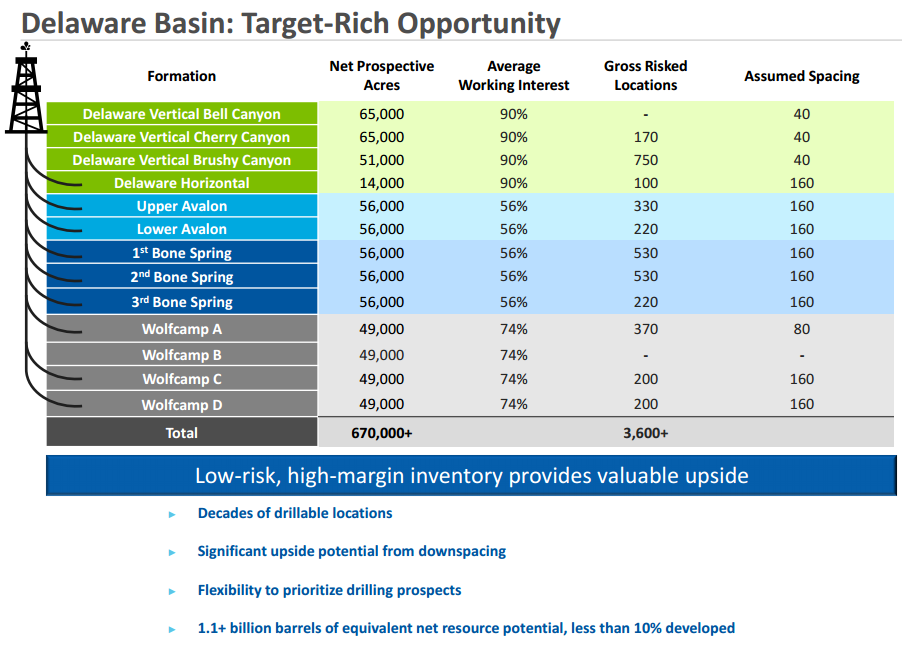

On July 14, 2015, the Tulsa-based company announced the acquisition of privately held RKI Exploration & Production, LLC for $2.75 billion (including $0.4 billion of debt). In return, WPX receives 92,000 net acres (98% held by production) in the Delaware Basin on the New Mexico-Texas border. The properties include 22,000 BOEPD of existing production, 3,600 gross risked drilling locations and more than 375 miles of existing midstream infrastructure. RKI was running four rigs in the region.

Rick Muncrief, WPX president and chief executive officer, said “This further drives high-margin oil growth, accelerates our portfolio transition to more liquids, and solidifies our premier position in the western United States, which enjoys the advantages of established infrastructure and higher realized commodity prices.”

Per terms of the agreement, RKI will divest its Powder River Basin assets before completing the merger with WPX. The private company will retain both its staff and offices and will be fully integrated into the WPX structure upon its closing in Q3’15.

WPX Energy is scheduled to present at EnerCom’s The Oil & Gas Conference® 20 next month in Denver, Colorado.

Permian Game Plan

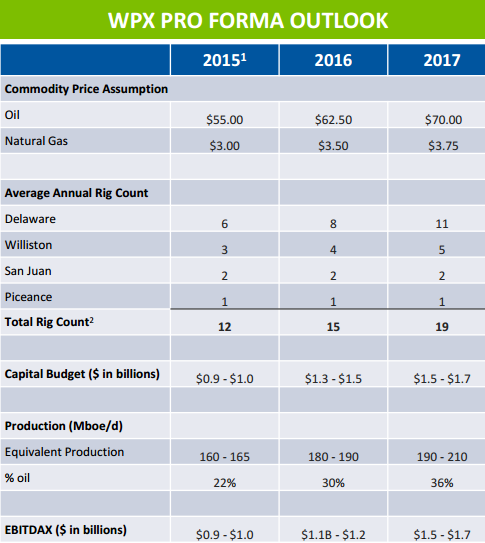

WPX outlined its Permian growth efforts in a presentation accompanying the announcement. The company plans on adding roughly two rigs annually to its exploits in the region, meaning six rigs will be running by year-end 2015 and as many as 11 could be in operation by 2017. Production will more than double in that time frame, aided by a 2016 drilling program projected to direct more than $500 million to the Permian alone.

Capital One Securities weighed in on the acquisition in a note, saying: “We think the acreage acquired is in a high-class neighborhood with a rare combination of quality, existing infrastructure, and no leasehold pressures to drill. WPX did pay a fair price for the acreage, but there is certainly upside from here offered by the 12 stacked reservoirs.”

R.W. Baird said the transaction “further supplements the industry’s ongoing positive bias towards the Delaware Basin, which held most preferred status in our 2Q15 survey.” Global Hunter Securities offered a similar sentiment, saying: “WPX is acquiring the scale and additional oil inventory it has been looking for …The Delaware Basin continues to be one of the most desirable basins in the US, and at $12,500/acre, we believe WPX has made a nice acquisition at an attractive price.”

More Liquids!

The Permian acquisition falls directly in line with WPX’s intention of garnering a greater focus on liquids. Its oil volume growth increased by double digits in each of the last three years, and its newest asset projects pro forma growth of 125% from 2015 to 2017.

“As with any business, the time to buy is when prices are down,” said Muncrief in a conference call. “When oil prices are stronger again, we probably won’t be buying, we’ll be busy drilling and developing.”

The transaction comes roughly two weeks after WPX upgraded its Williston Basin type curves to 750 MBOE – an increase of 25%. In a company release, Muncrief said WPX could generate returns greater than 30% at current commodity prices. Similarly with its new Permian assets, RKI was delivering 30% returns at $60/barrel prices. WPX volumes from the Gallup oil window of the San Juan Basin have jumped nearly four-fold on a year-over-year basis and encouraged the company to tack on 14,300 acres in the play last month. Although WPX management raved about its new addition, there will be no changes in the development timeline of its current operations.

Pro forma, WPX’s proved liquids reserves rose to 268 MMBO, an increase of 33%. Overall reserves jumped to 828 MMBOE (14% increase). The company’s crude production has jumped by 79% compared to Q1’14 and is expected to continue to grow. Oil is forecasted to account for 36% of volumes by 2017, when WPX believes it will produce a midpoint of 200,000 BOEPD. Approximately 4,600 identified drilling locations lie in WPX’s oil territories alone.

The increased liquids focus is projected to boost 2017 cash margins and flow by 45% and 25%, respectively.

The Transformation Continues

WPX has sold more than $1.5 billion of assets since 2014, consisting of acreage in the Marcellus, Piceance and Powder River Basins. “The progress we’ve made focusing our business and strengthening our balance sheet has positioned us to be opportunistic,” Muncrief said.

WPX guided Q2’15 volumes at 165,000 BOEPD (19% oil), a slight decline from Q1’15 numbers but above its fiscal 2015 midpoint average of 155,000 BOEPD. Approximately $320 million in unrestricted cash and cash equivalents were on hand as of June 30, 2015.

The Numbers Game

WPX plans on financing the acquisition with cash on hand, equity and long-term debt. The company issued a public offering of $1.2 billion in senior unsecured notes, 27 million shares of common stock and $300 million aggregate liquidation. Underwriters hold an option to purchase an additional 4.05 million shares for total proceeds of $45 million to WPX. The Overall, WPX will add about $1.8 billion through debt and equity to pad its previous $1.8 billion of total liquidity. RKI unit holders will receive 40 million shares of WPX stock valued at $470 million.

WPX is aiming to achieve a net debt to EBITDAX ratio of 2.0x by the end of 2017 and may include the sale of non-operated assets or midstream infrastructure. R.W. Baird said the goal looks achievable, and “even an immediate post-deal leverage position of 3.0-3.5x would place WPX in middle or better of U.S. onshore E&P peers.”