The International Energy Agency (IEA) released a new Oil Market Report (OMR) today.

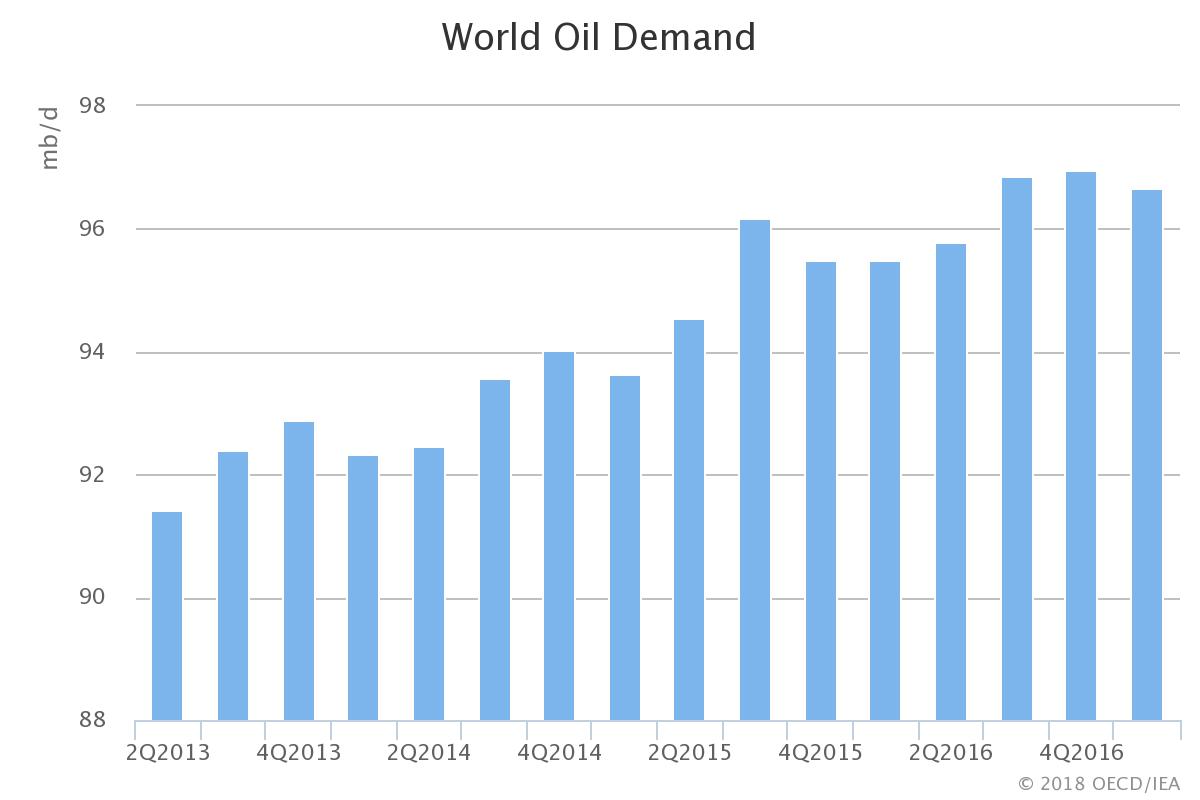

In its OMR, the IEA said countries across the globe have been steadily consuming more and more oil over the past few years.

The IEA said that global oil demand growth for 2018 has increased slightly to 1.4 million barrels per day (mb/d), partly due to an optimistic GDP forecast from the IMF. This is down from 2017’s gain of 1.6 mb/d, but still remains higher than 2013-15’s level of demand.

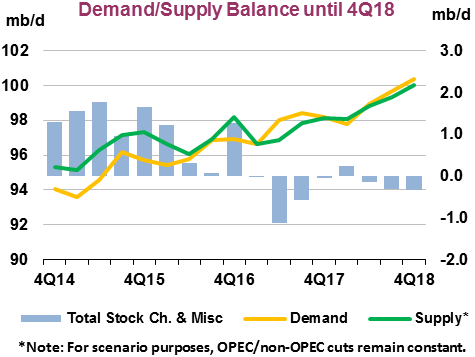

OECD commercial stocks fell in December 2017 by 55.6 million barrels (m/b), the steepest drop since February 2011, to reach 2,851 m/b. In 4Q17, stocks fell sharply by 1.3 mb/d across the OECD. The United States experienced several bouts of extreme winter cold, leading to record draws. Overall, stocks drew by 154 m/b during 2017 and ended the year 52 m/b above the five-year average, the IEA said.

Production cuts made by leading producers (OPEC and non-OPEC partners), has contributed to the rapid fall in OECD oil stocks, IEA said. A year ago, stocks were 264 m/b above the five-year average, but as mentioned above, stocks are now only 52 m/b above the five-year average.

2018 will see more production from OECD countries, namely, the United States.

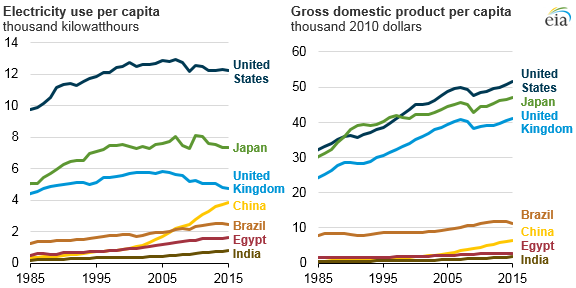

Shifting to the U.S. Energy Department’s data, on the demand side, the EIA attributed the lion’s share of future demand growth to China and India. Since 1990, China and India have accounted for 57% of the total increase in world energy consumption.

Back in November 2017, the EIA put out data that revealed that the world’s developing countries used higher amounts of electricity than OECD countries. In a graph, the heavy users were China, India, Brazil and Egypt, with the U.S., UK and Japan being close to zero growth or below zero growth for electricity usage.