30-Day Rates on New Pads Exceeding 1,000 BOEPD

Oil and gas companies are focusing on efficiencies more than ever before, and Whiting Petroleum Corporation (ticker: WLL) continues to progress on its industry-leading acreage in the Williston Basin.

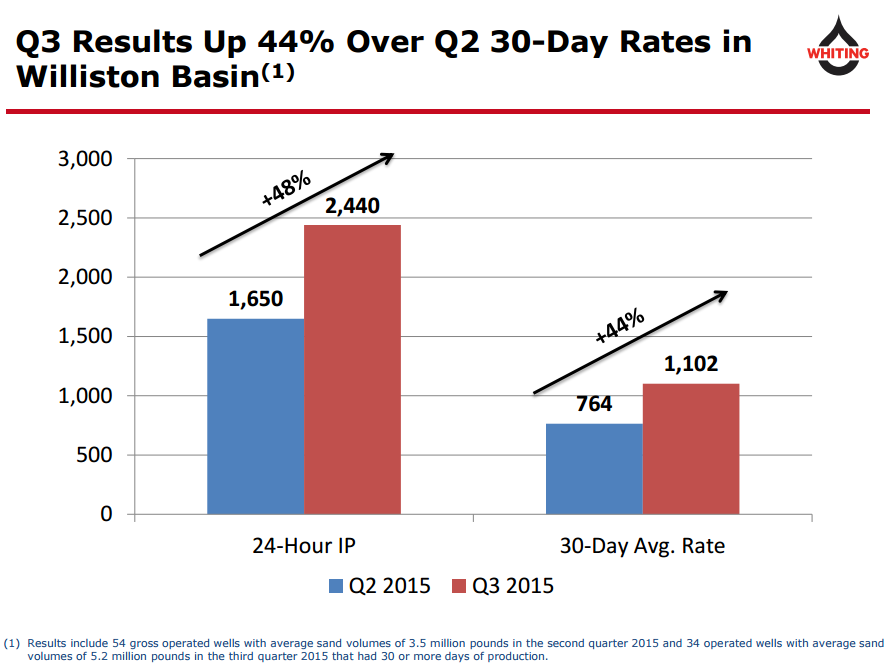

Enhanced completions led to a quarter-over-quarter productivity increase of 44% in the Bakken/Three Forks play, the company said in its Q3’15 earnings release. The latest achievement is in line with its Q2’15 results, which reported sequential production uplifts of 40% to 50%.

The P Johnson pad, located in the Cassandra area, tested at an average of 5,224 BOEPD per well – the highest rate seen from any producer in the area, according to a note from SunTrust Robinson Humphrey on October 28, 2015. The pad incorporated 7.0 million lbs. of sands per completion, above its previous method of 5.0 million lbs., but estimated well costs of $6.6 million are still about 18% lower than well costs from Q3’14.

Production Update

Overall volumes for Q3’15 averaged 160,590 BOEPD, a decrease of about 6% from Q2’15, as the company continues to test larger volume completions across its 667,668 net acres in the Williston. A total of 34 operated wells were completed with average sand volumes of 5.2 million lbs., compared to 54 completed operated wells with an average of 3.5 million lbs. of sand in the previous quarter. The average 30-day rate of Q3 wells was 1,102 BOEPD, compared to previous results that were yielding 30-day rates of approximately 770 BOEPD. Several analysts firms lauded the results, with Capital One Securities saying, “It seems that the point of diminishing returns for sand loading has not been reached.”

Williston type curves are still set at 700,000 BOE, but management anticipates an uplift once the curves are revisited. A possibility as to why the type curves have not been reevaluated could be due to the early stages of the play. “We don’t have tremendous amount of history behind those wells yet,” said Michael Stevens, Chief Financial Officer of Whiting Petroleum, in a conference call following the release. “In the last two or three months, we’ve been employing a lot of techniques to try and increase our number of entry points, and that’s where we’re really seeing the big productivity gains right now.”

Mark Williams, Senior Vice President of Exploration and Development, acknowledged that WLL is testing even greater sand volumes in select spots. The Williston currently yields about 82% of Whiting’s production, and the company plans on running eight rigs in the region during Q4’15.

Whiting’s other priority asset in the Denver Julesburg Basin provides about 10% of volumes, with Q3’15 averages reaching 16,575 BOEPD (up about 28% compared to Q1’15). Whiting plans on finishing a “significant” amount of uncompleted wells in Q1’16, benefitting from its current two-rig plan. The takeaway is aided by a recently-commissioned gas plant with capacity expected to reach 70 MMcf/d in the first half of next year. In a breakout session at EnerCom’s The Oil & Gas Conference® 20, James Volker, Chairman and Chief Executive Officer of Whiting Petroleum, said the Redtail can return a profit at prices of $30/barrel, and volumes can eventually reach 100,000 BOEPD net to WLL. Completion costs have dropped to $4.5 million from initial costs of $6.5 million.

Balance Sheet Review

Whiting’s 2016 goal involves balancing capital spending and cash flow at $1 billion, and management says it is currently “on track” to reach the target. Approximately 45% of its 2016 volumes are hedged, relative to September 2015 production averages. Volumes are projected to average 153,000 BOEPD in fiscal 2016.

Nothing is drawn on its $4.0 billion borrowing base, of which $3.5 billion is the elected commitment. Cash on hand as of September 30, 2015 was $38 million, and the credit line does not mature until December 2019. The company has sold off approximately $400 million in non-core assets in 2015 and expects further divestures in the fourth quarter, with management saying its midstream assets and gas plants could be purchased for the right price. Seaport Global Securities believes as much as $700 million in asset sales could be in the works.