An OAG360® Exclusive: Interview with Alaska Governor Bill Walker

Alaska’s North Slope has produced more than 17 billion barrels of oil since the discovery of the Prudhoe Bay oil field in 1968, when Arco’s Prudhoe Bay State No. 1 exploratory well produced oil at a maximum test rate of 2,415 barrels per day.

Prudhoe Bay is the largest oil field in North America. Regular oil production from the field began in October 1969 and peaked in January 1987 at 1.63 MMBOD. With oil production in decline since 1988, Alaska now produces approximately 7% of U.S. oil (down from a high of 25%). Today the Trans-Alaska Pipeline is running at three-quarters empty.

Alaska’s Resource Development Council estimates the state still has 50 billion barrels of conventional oil remaining to be developed on the North Slope and offshore areas of the Alaska Arctic, with the majority of the remaining resource residing on federal lands and offshore areas “where access has been blocked either by federal policy, environmental litigation, or a complex and ever-changing regulatory regime.”

NOTICE OF SALE ALASKA PENINSULA AREAWIDE 2015 AND COOK INLET AREAWIDE 2015W COMPETITIVE OIL AND GAS LEASE SALES

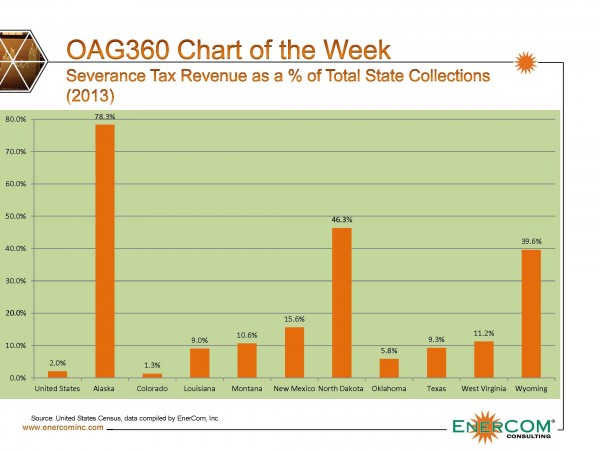

Oil production is the economic locomotive of Alaska, funding about 90 percent of the state’s general fund revenue. The oil industry accounts for one-third of Alaska jobs and about one-half of the overall economy, according to Alaska’s Resource Development Council. When oil production expands or contracts, Alaska’s economy follows.

Oil & Gas 360® had an opportunity to speak with Alaska Governor Bill Walker about some of the state’s energy development and budget issues, particularly in light of the current oil price downturn. Walker, 64, is Alaska’s second native-born governor. He paid for college working on the construction of the Trans-Alaska pipeline. Walker was sworn in as Alaska’s 11th chief executive on Dec. 1, 2014.

OAG360: Governor, you have discussed in your ‘State of the Budget’ talk that about 90% of Alaska’s general fund comes from oil revenue, driven by oil price and production. Could you talk about the current oil price slide that we’re going through and the effect that it’s having on Alaska?

GOV. WALKER: Well, it’s significant. It virtually cuts our revenues nearly in half, and it is rather sudden. We’ve certainly been through this before. There’s been a period since the start-up of the Trans-Alaska oil pipeline in the late seventy’s where we’ve seen the downturn in the in the oil prices, so it’s not new to us. We have to adjust for it so that’s what we’re doing.

OAG360: How does this downturn compare to some of the previous cycles that the state’s been through. How would you say Alaska is positioned in 2015 compared to some of the past swings?

OAG360: How does this downturn compare to some of the previous cycles that the state’s been through. How would you say Alaska is positioned in 2015 compared to some of the past swings?

GOV. WALKER: In many ways we’re better positioned now than we were in the past just because we have significant reserve accounts built up that were wisely put aside during the high oil prices. And so we are drawing upon those. That’s the good news. The bad news is we’re drawing upon those at the rate of about $3.5 billion to $4.0 billion dollars a year. So that’s not going to be a long term solution, and also what is different this time is we don’t see this being quite the short term decline as we’ve seen in the past. We’re going to be with this for a while and so we need to work out a long-term strategy associated with that.

OAG360: When you say ‘long term’, how long are you thinking?

GOV. WALKER: Well certainly this could be multiple years. But I think what we want to do is make sure that we don’t end up in the situation again that we have, that we’re not so highly dependent on revenues solely from oil revenues.

OAG360: The state has other [industries] — mining, tourism, etc. — how are those other industries progressing?

GOV. WALKER: Well the other industries are progressing fine; what is different though is [that] we looked at this in the mid-eighties—1985—it was a fairly significant downturn in the mid-eighties. But as they looked at the long term resolution of this, the price of oil began to rise, and as it continued to rise, the issue was no longer on the table. So we’re going to look at that as far as additional revenue sources for our state, other than [relying] solely on oil.

OAG360: Governor, the Department of Interior recently upheld a 2008 lease sale in the Chukchi Sea and that’s going to allow Shell to move towards next steps to advance its plan for exploration in the Arctic. This could open up a tremendous fiscal advantage for Alaska. How do you see Arctic exploration and the effect it will have on the state?

GOV. WALKER: Well, it’ll certainly create some jobs and that’s good. It will create some revenue in the private sector, [but] it doesn’t produce any dollars in the state. Sort of unique to Alaska is that our offshore development, we don’t receive any share of that revenue; it all goes to the federal government. So unlike Florida, as an example, which receives 37.5% of the tax revenue offshore, [that] goes to the state, we don’t have that in Alaska. That’s something that we’re working on. We’re certainly very supportive of safe and responsible offshore development, but we also believe that we as a state should share in the revenues from that.

OAG360: Governor, what has the state done in recent years to strengthen the oil and gas industry in Alaska and attract new investment?

GOV. WALKER: I can only speak from December 1–that’s when I was sworn in, so I’ll limit it to that. But what we want to do is, when I look at other states such as North Dakota, New Mexico, Texas, Wyoming, and I look at their permitting processes and how long it takes to get a permit to explore for oil.

It’s rather shocking how quickly they can [issue drilling permits] versus how long it takes us. Much of our land–62% of our land–is federal land in Alaska, and the permitting process is multiple years. Whereas in other locales, it’s a matter of weeks and in some cases days for permits to be issued.

It’s rather shocking how quickly they can [issue drilling permits] versus how long it takes us. Much of our land–62% of our land–is federal land in Alaska, and the permitting process is multiple years. Whereas in other locales, it’s a matter of weeks and in some cases days for permits to be issued.

So what we want to do this administration is look at ways that we can help expedite the process without cutting out, removing, the public process in any way. We don’t want to do that, but we’ve got to come up with a way, and we’re working on ways of bringing down the cost of doing business in Alaska on the oil exploration side.

One of the ways we’re doing that is we’re working with the federal government in ways that the state may be able to participate in the infrastructure development up in the Arctic, such as building roads–access roads, etc.–that would be used somewhat as a toll road for those companies that come in to develop. They may not want to build a road all of their own, but we [would] open up the Arctic with infrastructure and access–we’d look at that. Of course that would be only after consultation with the various tribes and communities in the area to make sure that their concerns are taken into consideration as well.

OAG360: Last question, Governor. How does one strike a balance between things like oil and gas development and other natural resource development–mining, etc.–the economic side of running a state–and when you compare that at the same time, the need to protect the environment and natural beauty of your state?

GOV. WALKER: Well, you know one thing, from every incident that takes place, we learn something from it. We certainly learned from the oil blowout in the southern Gulf–what happened there and what prevention has come into play as a result of that. And also we learned from the Exxon Valdez incident as far as how to do it safely. We would like to learn these things before there’s a problem, but we learned from each of those, and now on the oil side we have certainly the safest transiting system, ship escort response and oil spill response system–I think in the world–here in Alaska. So, we want to do it right, we want to do it properly. And we’re absolutely confident that it can be.

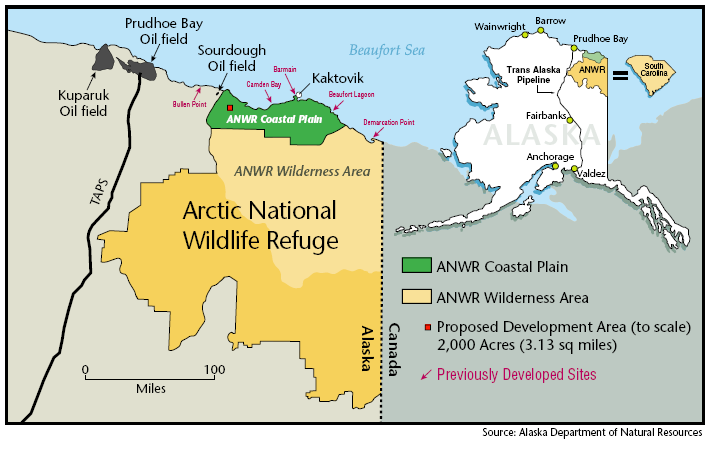

I will be very aggressive on being able to develop portions of the ANWR–the Arctic National Wildlife Refuge–that has specifically been set aside for exploration. So what’s frustrating for me a bit, is that Wyoming is the same approximate size as the North Slope of Alaska, and Wyoming has drilled I believe 19,000 wells, and we’ve drilled about 600.

I will be very aggressive on being able to develop portions of the ANWR–the Arctic National Wildlife Refuge–that has specifically been set aside for exploration. So what’s frustrating for me a bit, is that Wyoming is the same approximate size as the North Slope of Alaska, and Wyoming has drilled I believe 19,000 wells, and we’ve drilled about 600.

So we know that there are lots of development opportunities–lots of oil exploration opportunities on the north slope. We just need to make sure that we provide the appropriate infrastructure to assist those, so that the next wave of companies coming into Alaska–they are coming in–the independents–so it shortens the time between their acquisition of leases and being able to drill. It also brings their costs more in line with the opportunity.

OAG360: I know that’s music to the ears of a lot of our readers, Governor, in the industry, so that’s something that we can look forward to as things further develop for Alaska from the independents coming in and drilling.

Thank you very much for spending some time with us today on a quick update from Governor Bill Walker, governor of Alaska. Governor, thank you very much for speaking with Oil & Gas 360®.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.