Worsening conditions prove there is no such thing as home field advantage

Production in the Permian Basin was impacted this last week due to freezing rain and temperatures dropping into single digits, according to news releases from Energen (ticker: EGN) and Pioneer Natural Resources (ticker: PXD). Reuters reports Apache Corp. (ticker: APA) was also affected by the adverse conditions which are expected to persist through Sunday before temperatures climb above freezing by early next week.

As it turns out, E&P producers are no less shielded from the elements than the unfortunate NFL playoff teams that must make trips to the wintry conditions of New England and Green Bay this weekend. Pioneer’s press release said, “An extensive recovery period is expected, and it is likely to be several weeks before the full impact of this event can be determined.”

Energen’s was more optimistic, saying: “Given the timing of the storm, the company’s Q4’14 production is expected to be minimally affected (less than 100 MBOE); additional production impacts will be felt in the Q1’15 and will be reflected in the company’s 2015 guidance.”

The lost production amounted to roughly 2.3 MMBO, according to Genscape. The loss equals more than an entire day of production, considering the Energy Information Administration (EIA) projects January 2015 volumes to exceed 1.8 MMBOPD (35% of all domestic oil production).

Brutally cold temperatures are the norm up north in the Williston Basin of North Dakota, where wind chills plunged to 50 degrees below Fahrenheit on Monday. Volumes from virtually all producers in the Basin suffered from last year’s winter, which yielded the third coldest month of December on record. So cold, in fact, that diesel fuel and hydraulic fracturing fluid froze solid. Companies have yet to report on any impact from the current Bakken winter season.

Natural Gas Prices Rising in the Northeast

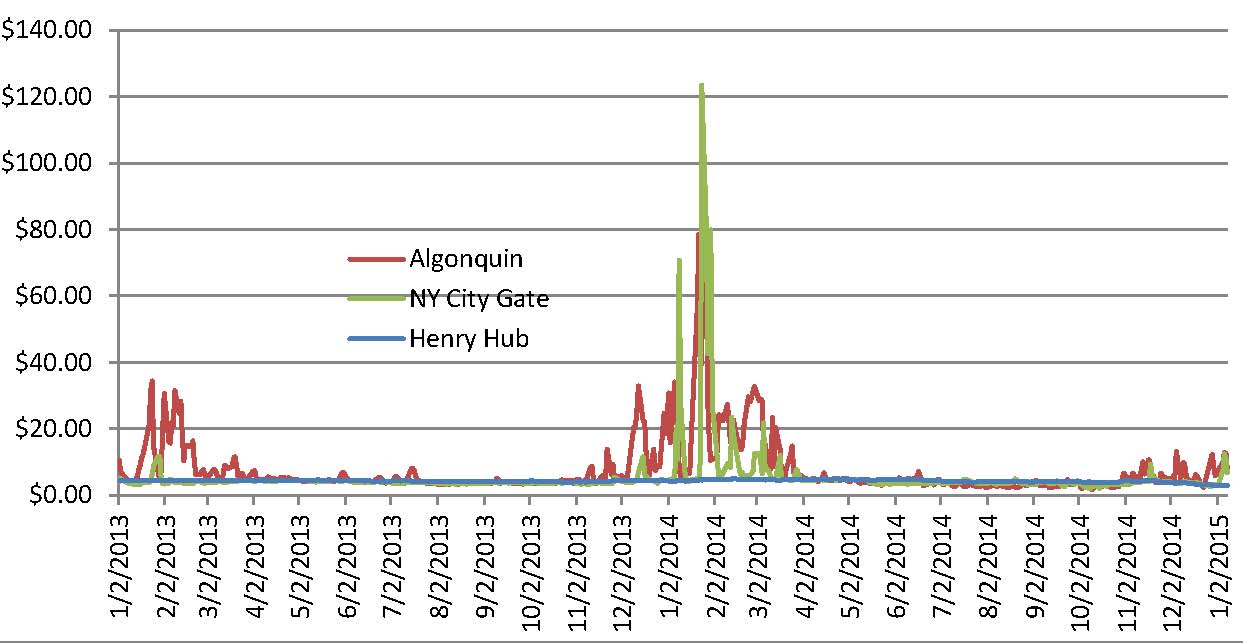

The New York City Gate spot price has been creeping up in recent weeks, surpassing the $10.00 mark yesterday. Rising natural gas prices in the Northeast are typical in colder months due to limited infrastructure and, of course, increased heating demand. It remains to be seen if we will have prices like last year, when the frigid temperatures froze pipelines and skyrocketed single day spot prices in the Algonquin and New York TETCO pipelines to nearly $80/Mcf. The Transco Six Zone (NY) surpassed $120/Mcf for a brief period in January 2014.

Midstream providers are addressing the issue by creating bi-directional pipelines to better allocate the Appalachian production to nearby states. The EIA expects nearly one-third of Northeast pipelines to be bi-directional by 2017. The added flow will increase total takeaway capacity in the Northeast by 8.3 Bcf/d. Additional projects aim to boost capacity by 35 Bcf/d in the same time frame.

Forecast

Weather Services International (WSI), a division of The Weather Company, believes the eastern United States will experience temperatures colder than the 30-year average, while the remainder of the country will be spared from the freeze and experience warmer than normal temps. The cooler weather will extend to the south central U.S. by March, with all other regions expected to stay within their projected range.

“Natural-gas prices could get a minor boost in January due to a shift to colder temperatures in the population-rich eastern half of the country,” according to Chris Kostas, Senior Power and Gas Analyst at ESAI Power LLC. “While natural-gas prices in New England are expected to be strong in January, a slightly larger winter reliability program this year will combine with much lower fuel-oil prices to temper some of the region’s gas-price volatility.”

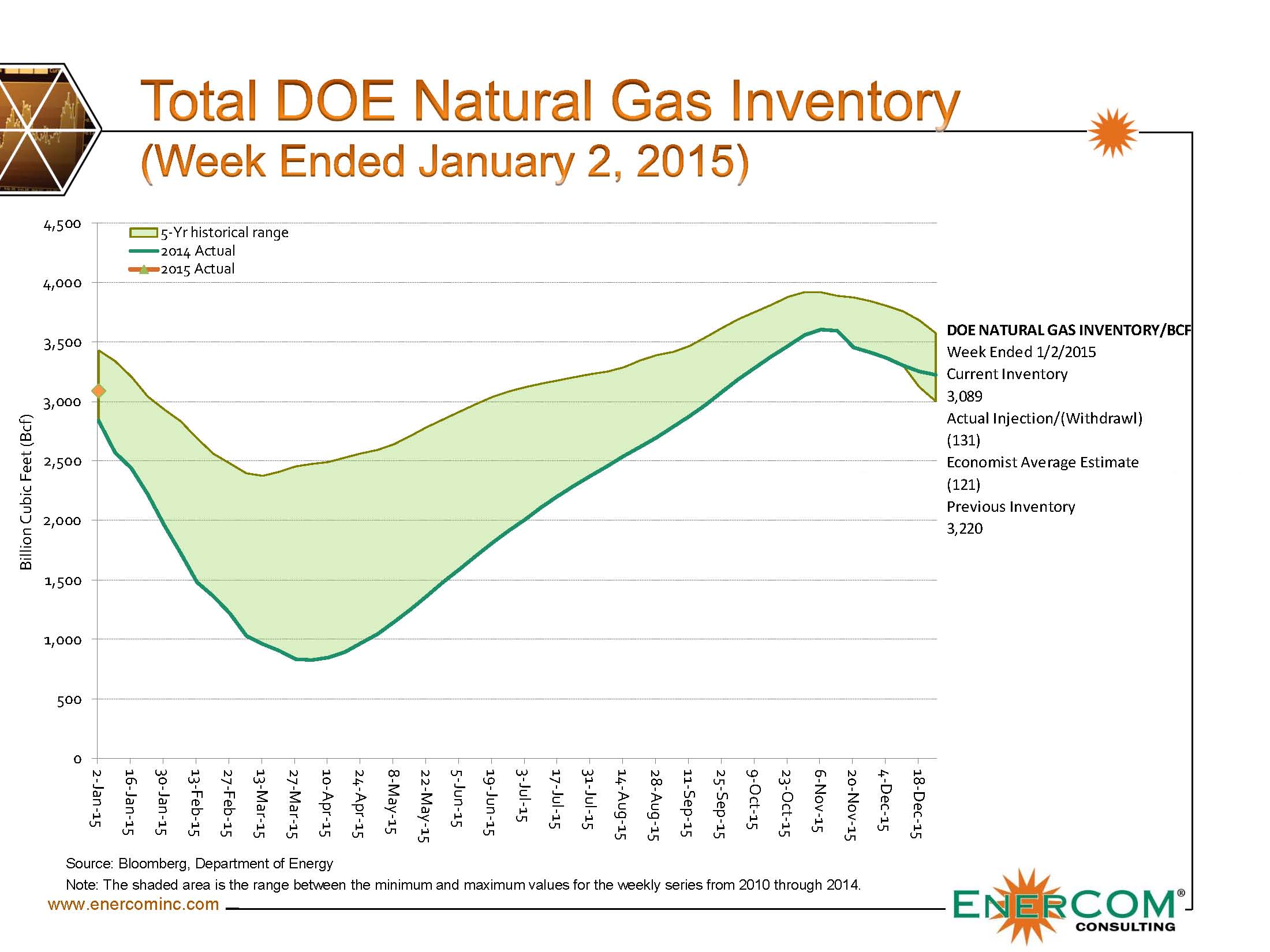

Kostas added that the persistent cold in the Northeast could provide “strength” to gas prices in February, aided by increased demand and inventory withdrawals. Inventories have recovered to the five-year range after spending the majority of 2014 playing catch-up, as evidenced by EnerCom’s Natural Gas Roundup report. Inventories are still roughly 7% below the five year average.

“Significant gains in year-over-year production levels (production is 5 Bcf/d higher than last year), should help to temper the cold weather and keep Henry Hub prices in check,” said Kostas.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.