Department of Interior looking to triple federal offshore acreage for wind development

In a press release on Monday, the Department of Interior announced that more than 742,000 acres offshore Massachusetts will be offered for commercial wind energy development in a January 29, 2015, competitive lease sale.

According to an analysis prepared by the U.S. Department of Energy’s National Renewable Energy Laboratory, if fully developed, the area being offered could support between 4 and 5 gigawatts of commercial wind generation, enough electricity to power over 1.4 million homes. By way of comparison, Xcel Energy’s (ticker: XEL) Prairie Island Nuclear Generating Station is a 520-acre site about 40 miles southeast of Minneapolis-St. Paul that has a total output of about 1,100 megawatts, enough electricity to power about 1 million homes.

Twelve companies have qualified to participate in the auction for the Massachusetts Wind Energy Area. Of those, ten companies have expressed interest in the lease area, according to the federal Bureau of Ocean energy Management (BOEM).

To date, BOEM has awarded seven commercial wind energy leases off the Atlantic coast: two non-competitive leases (Cape Wind in Nantucket Sound off Massachusetts and an area off Delaware) and five competitive leases (two offshore Massachusetts-Rhode Island, two offshore Maryland and another offshore Virginia). Competitive lease sales have generated more than $14 million in high bids for more than 357,500 acres in federal waters.

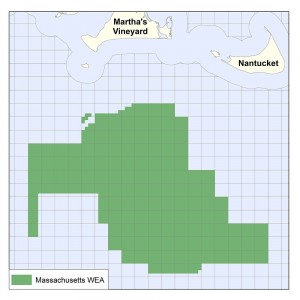

The Massachusetts Wind Energy Area starts about 12 nautical miles offshore Massachusetts; from its northern boundary, the area extends 33 nautical miles southward and has an east/west extent of approximately 47 nautical miles.

BOEM has determined that the following twelve companies are legally, technically and financially qualified to participate in the upcoming lease sale:

- Deepwater Wind New England, LLC

- EDF Renewable Development, Inc.

- Energy Management, Inc.

- Fishermen’s Energy, LLC

- Green Sail Energy, LLC

- IBERDROLA RENEWABLES Inc.

- NRG Bluewater Wind Massachusetts, LLC

- OffshoreMW, LLC

- RES America Developments, Inc.

- Sea Breeze Energy, LLC

- S. Mainstream Renewable Power (Offshore), Inc.

- S. Wind, Inc.

Offshore wind projects were first developed in 1991. Since then, they have primarily operated in Europe, reports the Huston Chronicle. The federal government has been trying to promote them in the United States, since more than half the country’s population lives in coastal areas, and winds tend to blow more forcefully and uniformly offshore than over land.

Globally, about 4.45 gigawatts of offshore wind capacity have been installed across more than 50 projects, according to the Bureau of Ocean Energy Management.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.