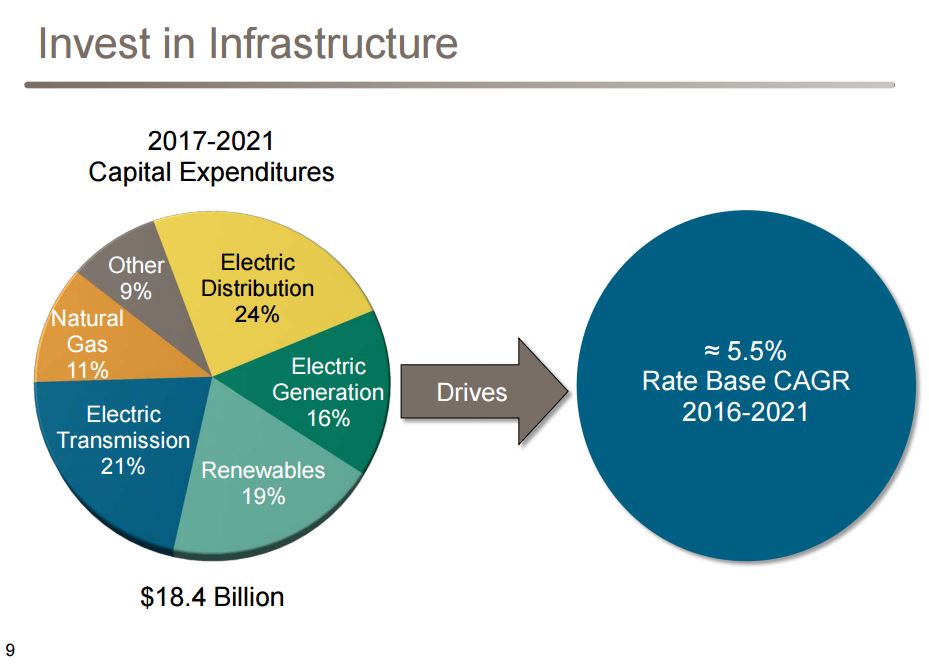

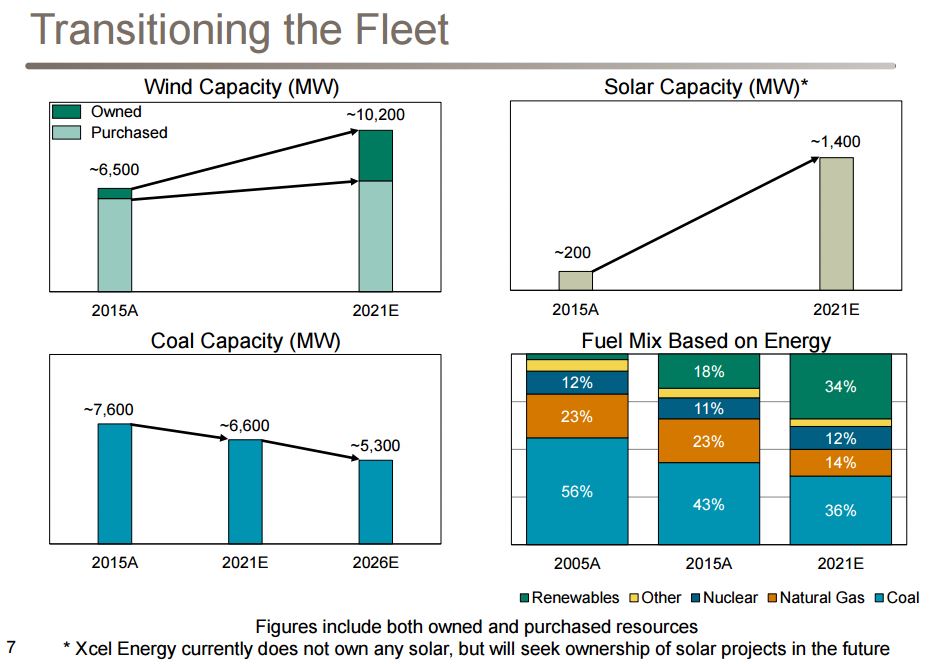

With a proposed ~$4 billion investment in wind generation starting now, Xcel Energy wants to make wind 35% of its total energy mix by 2021

Xcel Energy (ticker: XEL) announced what it called the largest multi-state investment in wind capacity in the country—$3.5-$4.4 billion worth. This week the company said it has proposed 11 new wind farms in seven states, which would add a total of 3,380 megawatts of new wind generation to its system.

Lost almost entirely in its press release was the once heavily emphasized environmental aspect of wind generation.

Why wind now?

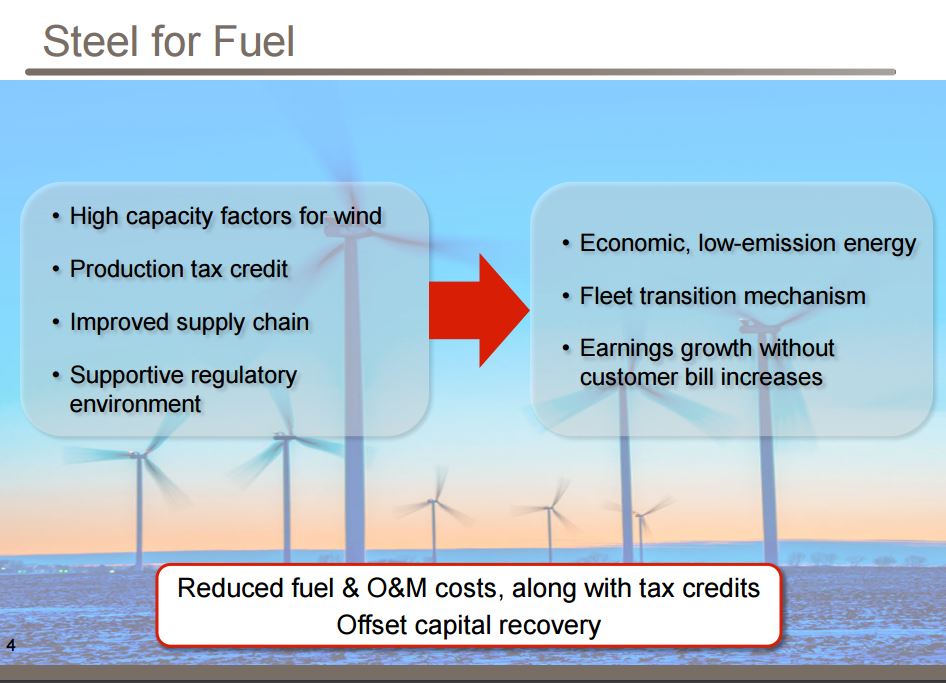

“We’re investing big in wind because of the tremendous economic value it brings to our customers,” Xcel CEO Ben Fowke said in a press release this week. Xcel said using wind generation will save its customers $7.9 billion over 30 years. In a recent conference call, referencing the company’s “Steel for Fuel” move toward wind, Fowke said,“We expect wind projects will generate hundreds of millions of dollars in fuel savings for our customers, which will more than offset the capital cost.”

“When you look at the economic price point … that we are seeing with wind, I think we have opportunities potentially in Texas and New Mexico too, just on the economic merits alone,” Xcel CFO Bob Frenzel said on the company’s Q3 call. That prognosis was borne out in this week’s announcement.

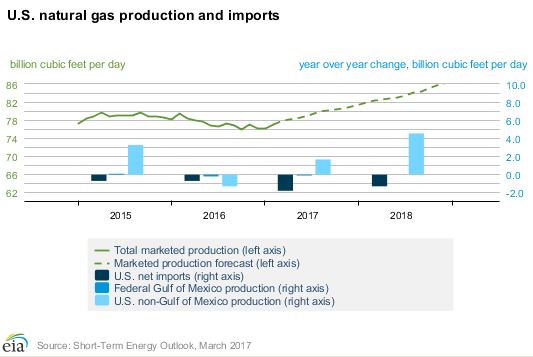

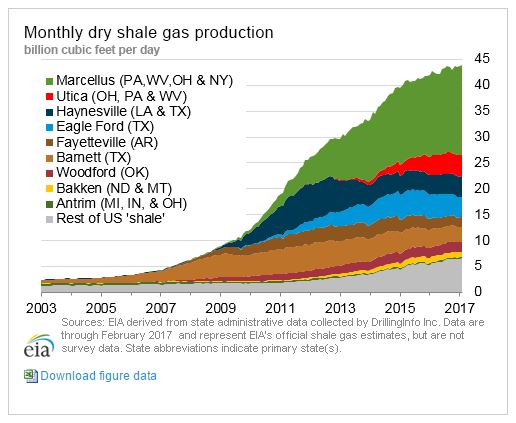

In its recent Short Term Energy Outlook, the U.S. Energy Information Administration (EIA) has forecasts showing rising gas prices in 2018. Fears of increasing fuel costs may have contributed to the utilities’ rush into wind. But the EIA also expects production from U.S. shale beds to rise, and supply additions would tend to pressure gas prices. Gas prices have traded between $2 and $4 per Mcf during the past 12 months. Today natural gas April contracts closed at $3.05.

Uncle Sam is helping with wind’s economics

Xcel said in its announcement that it would use federal production tax credits to secure low wind energy prices. The federal government’s Renewable Electricity Production Tax Credit program is a corporate tax credit that favors wind energy developers going forward.

In December 2015, Congress passed an omnibus spending bill that included a provision to extend the expired production tax credit (PTC) for five years. The U.S. House of Representatives approved the legislation in a 316-113 vote, and the U.S. Senate followed suit with a 65-33 vote. President Obama signed the legislation into law, alleviating uncertainty from the future of wind in the U.S. for the next few years.

The American Wind Energy Association said the PTC is considered to be “the U.S. wind industry’s most important federal tax incentive.”

It’s administered by the Internal Revenue Service using a one-page form known as Form 8835, which provides tax rebates for wind generation.

Wind energy producers can get a federal tax rebate per kilowatt hour of wind generation for a facility’s first 10 years in service. It applies as follows, according to the Department of Energy website:

- Systems Commencing construction after December 31, 2016:

Wind: $0.0184/kWh for first 10 years of operation

All other technologies: Not eligible

Wind facilities commencing construction by December 31, 2019, can qualify for the credit, whose value steps down in 20% increments in 2017, 2018 and 2019.”

A tax rebate that helps only wind producers going forward

For all other technologies, the credit is not available for systems whose construction commenced after December 31, 2016, according to the DOE.

However, systems having commenced construction prior to January 1, 2017 are eligible for the following tax credit, itemized by type:

Wind, Geothermal, Closed-loop Biomass, and Solar Systems not claiming the ITC: $0.023/kWh

Other eligible technologies: $0.012/kWh

Applies to first 10 years of operation

The DOE defines the federal renewable electricity production tax credit (PTC) as an inflation-adjusted per-kilowatt-hour (kWh) tax credit for electricity generated by qualified energy resources and sold by the taxpayer to an unrelated person during the taxable year. The duration of the credit is 10 years after the date the facility is placed in service for all facilities placed in service after August 8, 2005.

Wind is booming because power companies have economic reasons to invest in wind

Oil & Gas 360 contacted Xcel Energy and asked why wind over natural gas? The response was simply, “I would refer you to the cost of wind.”

Utility Dive assessed the current popularity of wind generation with utilities in a recent report entitled “Utility wind rush set to strengthen as low prices allow resource to spread across nation.”

“Wind’s growth has been so rapid and its price has dropped so fast that a more important long term trend is often missed: it is quickly expanding its addressable marketplace. … IOUs, co-ops and municipalities alike are turning to wind for economics, not just mandates.”

“It is a buyer’s market for utilities in wind right now,” Tammie McGee of Duke Energy Renewables told Utility Dive. “They can still get 80% of the production tax credit [PTC] benefit before it is stepped down to 60% at the end of this year. And power purchase agreement [PPA] prices are now in many places competitive with fossil fuel generation, so it is a cost-effective way to diversify an energy portfolio.”

Total investments in U.S. wind deployments hit $13.8 billion last year, according to the American Energy Wind Association (AWEA).

“That trend is expected to continue into 2017, with utilities of all types expanding their investments in wind energy through PPAs or direct ownership. Meanwhile, the steady decline in PPA prices is allowing utilities in new regions of the U.S. take advantage of the wind boom. Transmission capacity, however, remains a major constraint,” Utility Dive reported.

The long-term extension of the PTC was the catalyst that started the movement of new utility wind project ownership—Xcel’s wind initiative being the latest example. But other electricity providers are already on the wind bandwagon.

U.S. electric cooperatives have seen a four-fold increase in wind since 2012, the National Rural Electric Cooperative Association said, reporting that 561 cooperatives in 37 states have either developed wind resources themselves or are purchasing wind capacity.

PPA prices dropping

In the U.S. interior, the average PPA price for wind in 2015 was just above $20/MWh, according to Lawrence Berkeley National Laboratory data, “a precipitous drop from the $55/MWh average in 2009,” reports Utility Dive.

More incentive to add wind: when policy makers legislate renewable growth

In February, California’s senate saw the introduction of a bill that would take the state’s Renewable Portfolio Standard to 100% renewable energy by 2045 for retail sales of electricity. The bill reads:

“In order to attain a target of generating 20 percent of total retail sales of electricity in California from eligible renewable energy resources by December 31, 2013, 33 percent by December 31, 2020, 50 percent by December 31, 2025, and 100 percent by December 31, 2045, it is the intent of the Legislature that the commission and the Energy Commission implement the California Renewables Portfolio Standard Program described in this article.”

This February, Maryland increased the renewables generation target in its renewable portfolio standard (RPS) to 25% of retail electricity sales by 2020, replacing the earlier target of 20% by 2022. The change occurred as legislators in both houses of the state’s General Assembly voted to override the governor’s veto of legislation they had first passed in 2016.

Other states are moving on legislation that encourages adoption of renewables. Wind will benefit.

Where the wind blows

Summary of 2016 wind project installations compiled by the American Wind Energy Association:

- The U.S. wind industry installed 6,478 MW of wind capacity during the fourth quarter, the second strongest quarter for installations on record.

- For the year, the U.S. installed 8,203 MW.

- 19 states commissioned a total of 47 projects during the fourth quarter. Texas led with 1,790 MW, followed by Oklahoma (1,192 MW), Kansas (615 MW), North Dakota (603 MW) and Iowa (551 MW).

- Oklahoma surpassed California to become the third-ranked state in the nation with over 6,600 MW of installed capacity; Kansas surpassed Illinois as the fifth-ranked state with more than 4,400 MW.

- There are now 82,183 MW of installed wind capacity in the United States, with more than 52,000 wind turbines operating in 40 states plus Guam and Puerto Rico.

- The U.S. commissioned its first offshore wind project during the fourth quarter, the 30 MW Block Island wind project off the coast of Rhode Island.

- GE Renewable Energy and Vestas captured a combined 85% of the U.S. wind turbine market during 2016; including Siemens, the three turbine manufacturers captured 95% of the market.

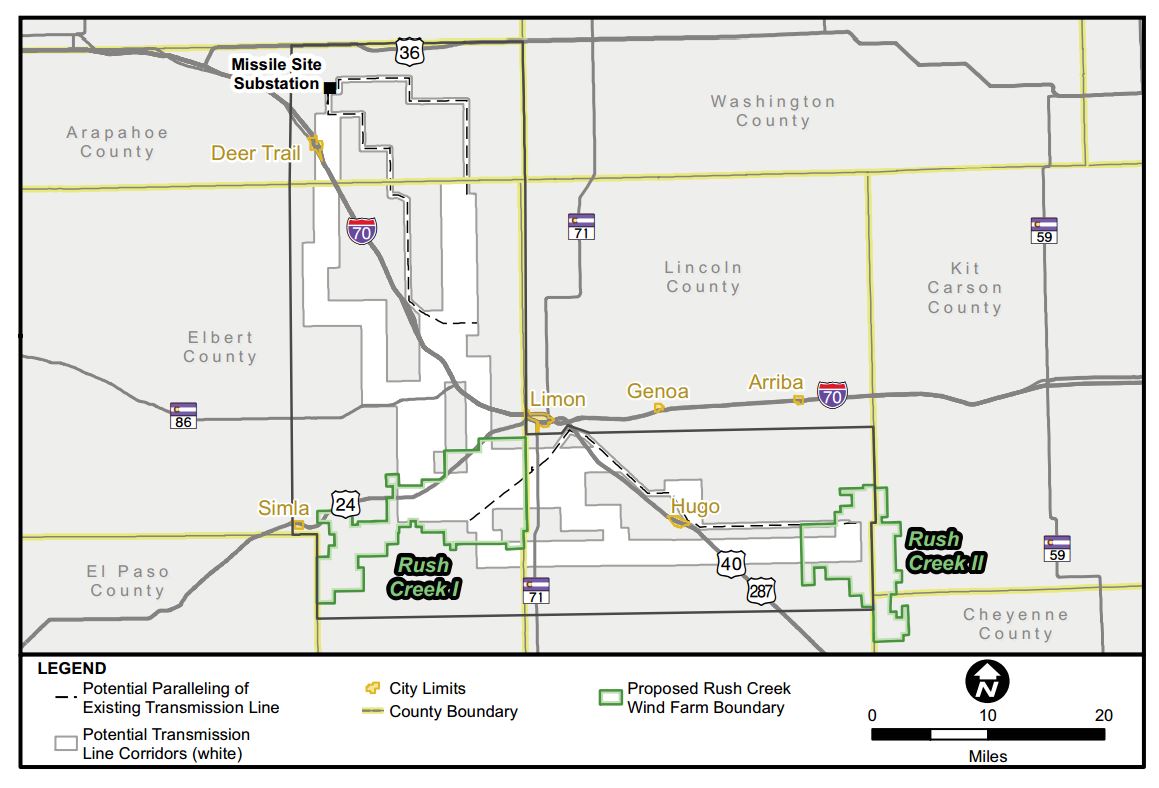

Where Xcel is building wind generation

Xcel said its planned wind generation capacity is located across its power system:

- 1,230 megawatts of new wind energy in Texas and New Mexico. It plans to build two wind farms and buy wind energy from another facility through a long-term contract.

- 1,550 megawatts of new wind energy to its Upper Midwest system, including seven new wind farms in Minnesota, North Dakota, South Dakota and Iowa.

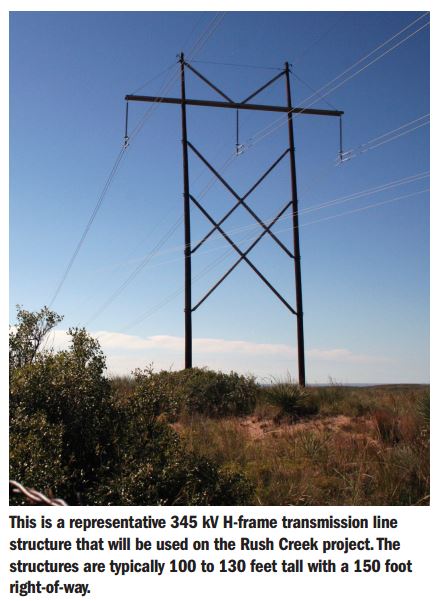

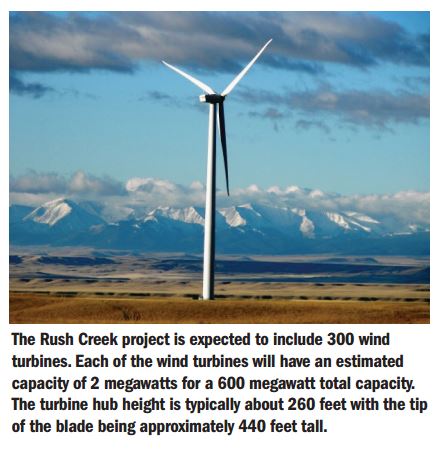

- 600 megawatts In Colorado’s Rush Creek Wind Farm, which is the largest wind farm of its kind in the state and is expected to begin construction spring 2017.

Xcel said its wind expansion will generate nearly $400 million in property taxes over the life of the projects and bring more than 2,000 construction or full-time jobs to the communities it serves. Project life within the industry is often defined as 30 years.

Who are Xcel’s wind development partners?

Southwest

- Sagamore Wind, a 522 MW self-build project located in Roosevelt County, New Mexico developed by Invenergy

- Hale Wind, a 478 MW self-build project located in Hale County, Texas, developed by a subsidiary of NextEra Energy Resources

- Bonita, a 230 MW power purchase agreement project in Cochran and Crosby Counties, Texas developed by NextEra Energy Resources

- Upper Midwest

- Freeborn Wind Energy, a 200 MW self-build project located in Freeborn County, Minnesota, and Worth and Mitchell Counties, Iowa developed by Invenergy

- Foxtail Wind, a 150 MW self-build project located in Dickey County, North Dakota, developed by NextEra Energy Resources

- Blazing Star 1, a 200 MW self-build project located in Lincoln County, Minnesota, developed by Geronimo Energy

- Blazing Star 2, a 200 MW self-build project located in Lincoln County, Minnesota, developed by Geronimo Energy

- Crowned Ridge Wind Project, a 300 MW build-own-transfer project and a 300 MW power purchase agreement. The project will be located in Codington, Deuel and Grant Counties, South Dakota, developed by a subsidiary of NextEra Energy Resources

- Lake Benton Wind Project, a 100 MW build-own-transfer project in Pipestone County, Minnesota, developed by a subsidiary of NextEra Energy Resources

- Clean Energy 1, a 100 MW power purchase agreement project in Morton and Mercer Counties, North Dakota, developed by ALLETE Clean Energy

- Colorado

- Rush Creek, a 600 MW self-build project in Cheyenne, Elbert, Kit Carson and Lincoln Counties, developed by Invenergy