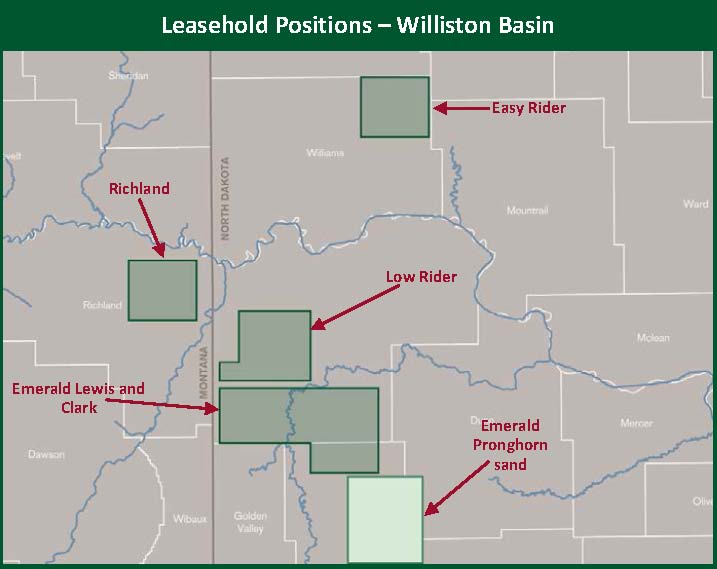

Emerald Oil (ticker: EOX) is an independent exploration and production operator that is dedicated to acquiring acreage and developing wells in the Williston Basin of North Dakota and Montana, targeting the Bakken and Three Forks shale oil formations. The company sold substantially all of its non-operated assets in 2013 to become a fully focused Williston operator.

Recent Earnings Results

Emerald Oil posted increases in production, total proved reserves and sales in its Q4’13 earnings release on March 12, 2014. Quarterly production averaged 2,430 BOEPD and total 2013 production averaged 1,688 BOEPD, increases of 101% and 80%, respectively, for the same time periods in 2012. Sales nearly doubled, ending the year at $52 million. Additionally, EOX now holds 13.2 MMBOE (87% oil) in total proved reserves, according to Netherland, Sewell & Associates. Roughly 85,000 net acres are held in the Williston, representing a year over year increase of 147%. Approximately 20,800 net acres were acquired in January 2014 for $74.6 million, with roughly 90% of the acreage immediately next to its Low Rider assets.

EOX reported a loss of $10.9 million ($0.17 per share) for Q4’13 and a loss of $31.2 million ($0.75 per share) for fiscal 2013. In a conference call following the release, management said it expects expenditures to drop as the company increases its knowledge and drilling efficiency in the Williston region. The company also believes operating expenses will decrease as there will be less impact on startup costs and infrastructure is centralized. General administrative expenses for the year reached $30.5 million (136% higher than in 2012 and higher than the street’s expectations) as EOX bolstered its workforce to assist with its growth.

Production on the Rise

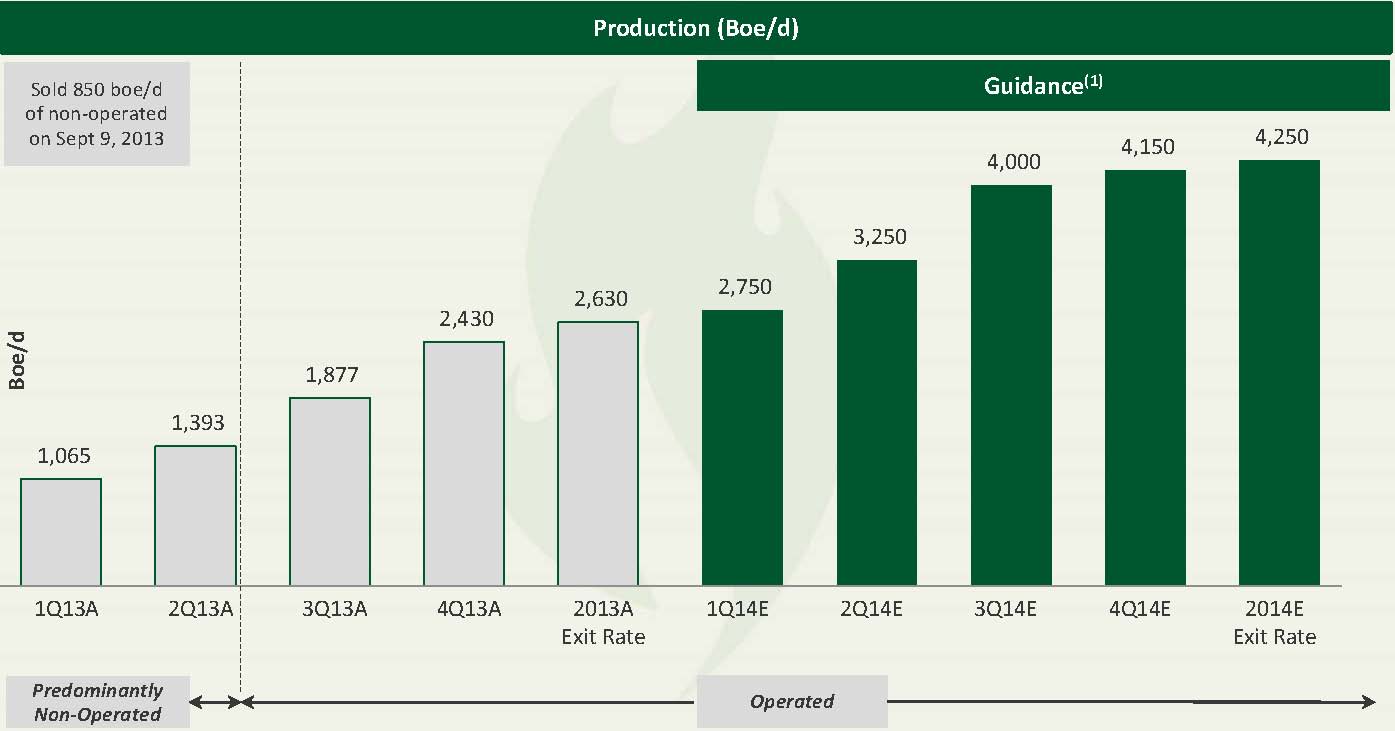

EOX is running two rigs in its Low Rider project area and anticipates adding a third by April 2014. The addition will accelerate its drilling program by an expected six years. In turn, year-end 2014 production is expected to reach 4,250 BOEPD, with a revised yearly average of 3,550 BOEPD. Both represent increases compared to the respective guidance rates of 4,000 BOEPD and 3,300 BOEPD provided in November 2013. The company reported 2,630 BOEPD at year-end 2013, exceeding its previous guidance rate despite the difficulties of a harsh winter season.

Transformation to Operator

Much of 2013 was dedicated to divesting non-core assets and acquiring acreage in the Williston Basin. Now, Emerald Oil has identified 435 potential drilling locations (320 operated) to date and has added roughly 67,700 net acres in the Basin since 2013. A total of 17 wells have been drilled since March 2013 and averaged a 30-day initial production rate of 768 BOEPD. An additional 18.2 net operated wells are expected to be drilled by the end of 2014 and will target the Bakken, Pronghorn and Three Forks formations. A total of 12.8 net wells were drilled in 2013.

Production Growth

EOX said Q1’14 production will likely be lower than anticipated due to the cold. However, management said it predicts the largest production increase to occur in Q2’14 as its hydraulic fracturing operations ramp up. Completion operations were delayed in January due to temperatures dipping below negative 20 degrees Fahrenheit for more than 60 straight days. The company will continue to use a seven well spacing assumption (four in the Middle Bakken, three in the Three Forks) as operations progress.

To put it simply: Emerald plans to grow this year. By year-end 2014, the company plans to exit the year producing 4,250 BOPD, an increase of more than 62%. Fourth quarter 2014 production is expected to be 71% higher than the comparable quarter in 2013.

Liquidity

The company has allotted $307 million for 2014 – $182 million for drilling expenses and $125 million for land acquisition. The company, which currently holds an estimated $140 million in liquidity, believes its capital budget will be funded through the current year.

The budget includes the $75 million purchase in February 2014, leaving $50 million remaining on the acquisition front.

Upcoming Catalysts

We believe the street will keep an eye on G&A and other associated costs as the production ramp continues. As with most fast-growing small cap E&Ps, managing costs is difficult in the early stages. Management reaffirmed its focus on generating better operational efficiencies in 2014.

But perhaps more incremental will be well-performance in the Bakken and Three Forks. The company continues to successfully drill operated wells that produce better than initial expectations in both formations. The company’s recent operated-well drilling results are producing above the company’s estimated type curve with some analysts targeting EURS in the 600,000 BOE range.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.