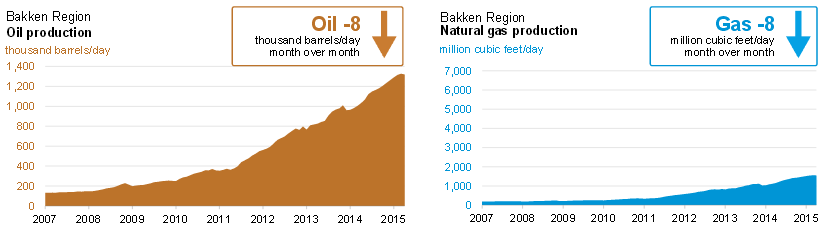

North Dakota has been the poster child of the United States shale boom, boasting skyrocketing production, high economic growth rates and miniscule unemployment numbers. The discovery and exploitation of the Williston Basin has increased crude output in the state by more than six times from 2008 to 2014, ending the most recent year with average volumes of 1,087 MBOPD. North Dakota’s climb accounted for 25% of all oil production growth in the United States, as the shale revolution changed the world’s hydrocarbon landscape.

North Dakota’s Breakneck Pace

Almost overnight, North Dakota transformed from a state counting for just three of the 538 electoral votes to the nation’s leader in economic growth every year since 2010. Harold Hamm, Chairman and Chief Executive Officer of Continental Resources, said in May 2014 that production could eventually top 2 MMBOPD, just months before volumes topped the 1 MMBOPD milestone. Employment rates in 2013 were the highest in the country, and the state landed at the top of several Gallup polls regarding standard of living and economic benefits.

The North Dakota oil industry grew so fast its surrounding infrastructure almost immediately fell behind. The midstream availability was so limited that producers opted to dismiss gas and focus on oil – an easy choice, considering oil prices were $100/barrel and gas prices were in the $3/MMcf range. Most producers chose to flare this excess gas, but the volume at which gas was being burned raised concerns. An alarming 96 Bcf (approximately 356 MMcf/d) was burned away in 2013, which was nearly half of all natural gas consumed by the state of Maryland in the same year. The North Dakota Industrial Commission stepped in with an ultimatum: cut flaring levels by 43% by Q1’15 or production levels will be capped.

E&Ps immediately began addressing the flaring issue and by December 2013, an estimated 19.6% of gas was flared off, compared to 33% in July 2013.

The Downturn

The Downturn

Flaring has consistently hovered around the 20% range in recent months, but the lower volumes are partially a result of the drilling slowdown. The oil price downturn has hit North Dakota hard – its rig count dropped to 98 in the latest report from Baker Hughes (ticker: BHI), which is the lowest since April 2010. The number of active rigs in the basin today is less than half as many as were drilling in July 2012.

Lynn Helms, director of North Dakota’s Department of Mineral Resources, admitted the slowdown has helped curb the flaring issue, but at a high cost. Production has hit the skids and is expected to decline in April, while the amount of tight oil volumes nearly halved in March 2015 on a month-over-month basis.

“They just don’t have as many rigs to look after, as many completions to worry about and so the scheduling of those [flaring requirements] is quite a bit easier,” Helms said. The Department said 24% of gas was flared in December 2014, and E&Ps are required to scale down that number to 10% by 2020.

Bakken Cost Sensitivies

Bakken Cost Sensitivies

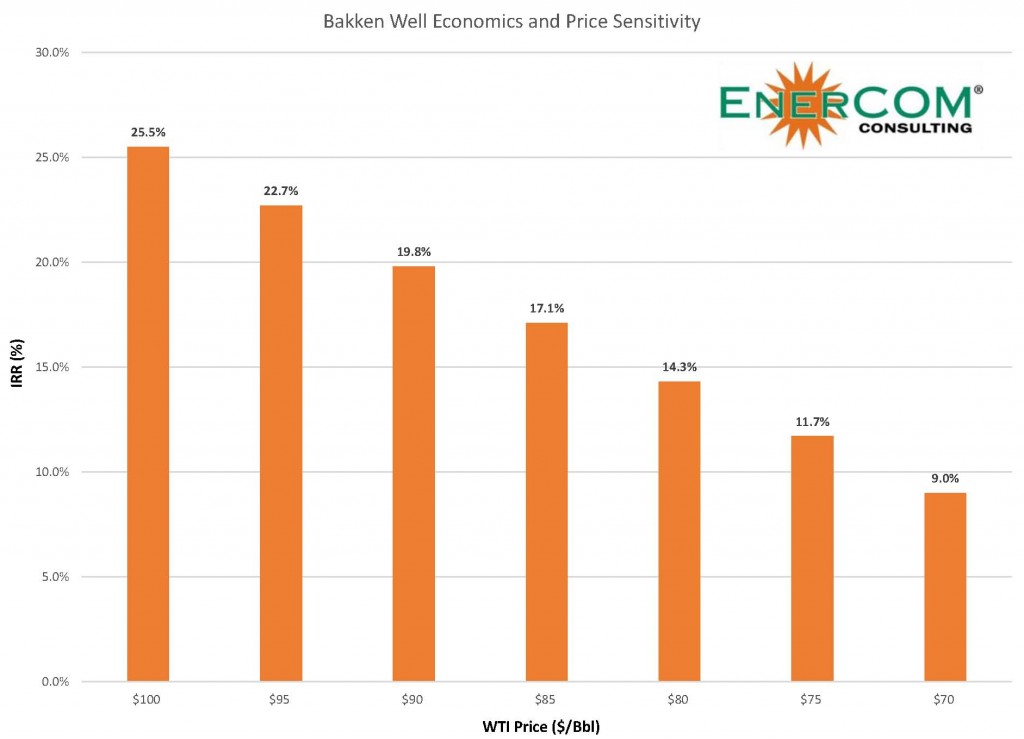

On December 12, 2014, EnerCom’s Analytics Team ran an analysis of well costs for various basins. The “Current Well Costs” as depicted in the graph consider WTI at $58.00/barrel and gas at $3.80/MMBtu, and determine the minimum investment to generate a 20% internal rate of return (IRR). The steep decline on the Bakken side shows how much E&Ps must cut costs in order to maintain that rate of return since the margins are lower than other oil field competitors like the Eagle Ford and Permian. The bar on the right in each basin is the closest representation of the current prices of $47/barrel and $2.70/MMBtu. Although the costs may be unrealistic, it provides a general idea of the cost cuts necessary to maintain a 20% IRR.

Core Laboratories (ticker: CLB) is very active in the Williston Basin with its reservoir enhancement technology and said in its Q2’14 conference call that the flared-off gas could be utilized in existing operations. David Demshur, Chief Executive Officer of Core Lab, told Oil & Gas 360® by email that the company continues to be involved in several large projects for its clients. “We are testing floods that utilize heavy and light hydrocarbon gases, nitrogen, CO2 and low salinity water – in different levels of concentrations,” he said. “We expect to see pilot projects to be initiated at the field level later in 2015 and into 2016.”

Demshur added that CLB’s clients “have not altered their approach to capture higher returns on their invested capital, as opposed to looking just to cut costs due to commodity prices that are currently, and temporarily, weak…”

State Budget Takes a Hit

The effects of lower oil prices are trickling down to the economy as a whole. Some OPEC producers like Libya and Venezuela are on the verge of bankruptcy. North Dakota is not nearly in as difficult of a spot, but the decreased revenues from oil and gas taxes are apparent in the state’s budget. In its revised budget outlook for March 2015, North Dakota is projecting $3,398.3 million in oil tax revenues through 2017. The number is about $869.7 million (20%) less than its original estimation of $4,268.1 million.

The home of the Williston Basin is not alone – Texas’ revenue from oil and natural gas has fallen by 48% and 41%, respectively, since September 2014. Alaska, which relies on crude production for 90% of its operating budget, has been hit especially hard, with revenues in January 2015 declining 76% from August 2014. Oklahoma’s revenues declined 31% in the same time frame even though production was relatively flat.

Infrastructure Difficulties

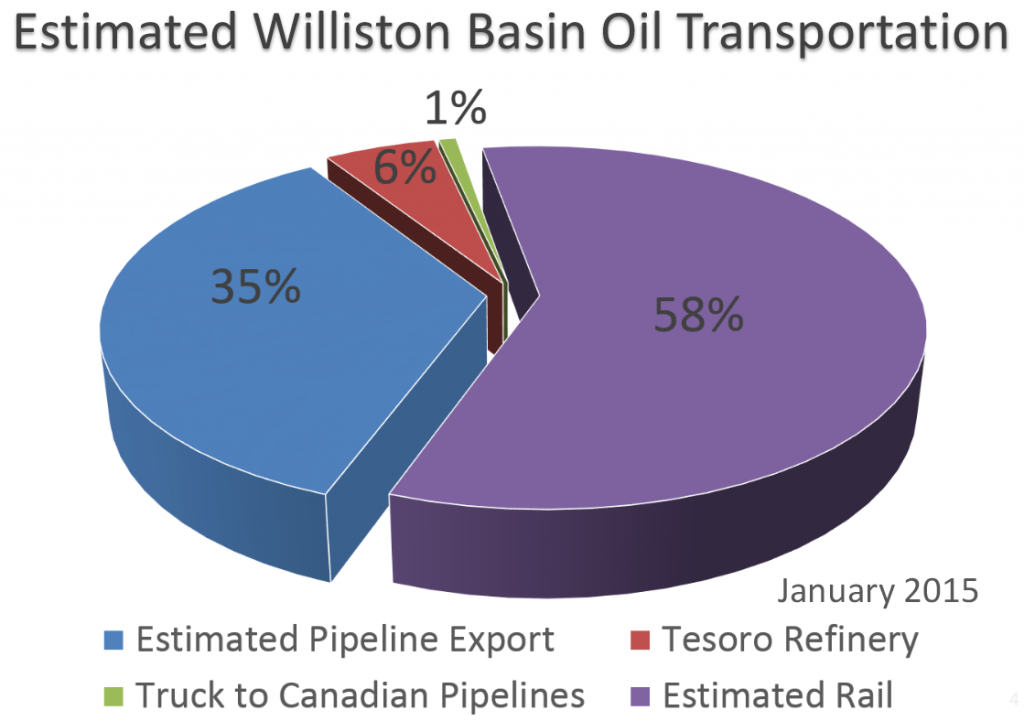

The Williston’s location and infrastructure buildout has historically made the product more difficult to get to market, and its frigid winters are capable of literally freezing operations. North Dakota’s revenue estimations take a 15% discount to West Texas Intermediate into consideration, which has stayed consistent since 2012. The lack of infrastructure is also the direct reason gas is flared off as companies were previously trying to get as much oil as fast as they could.

The Williston’s location and infrastructure buildout has historically made the product more difficult to get to market, and its frigid winters are capable of literally freezing operations. North Dakota’s revenue estimations take a 15% discount to West Texas Intermediate into consideration, which has stayed consistent since 2012. The lack of infrastructure is also the direct reason gas is flared off as companies were previously trying to get as much oil as fast as they could.

Companies with interests in the Williston have been looking for ways to correct this problem. Midstream companies have invested billions into North Dakota infrastructure to handle the surging hydrocarbon volumes. ONEOK, Inc. (ticker: OKE) is the largest gas processor in the Bakken and has increased its pipeline mileage to 673,000 miles in September 2014 compared to 350,000 miles in April 2012. In that time, OKE’s anticipated expenditures ballooned to as much as $8.2 billion through 2016, compared to estimates of $1.8 billion in investment from 2012 to 2014. Eight new natural gas plants operated solely by OKE have either been completed or are in the process of completion since 2010, allowing the midstream provider to have 11 times the processing capacity by 2016.

Overall, North Dakota has 18 processing plants and is on schedule to place six more online in the near future.

Will this Allow Infrastructure to Gain Ground?

The North Dakota Pipeline Commission has an expansive breakdown on takeaway availability on its site, divided into pipeline/refining exports along with rail loading facilities. Pipelines have struggled to keep pace until recent years – capacity is expected to expand to 827 MBOPD in 2015, which double the amount of 2011. Availability by rail has developed at a much faster pace, increasing its capacity more than sixfold in the same time frame and now can move approximately 1,490 MBOPD. Moving forward, more than 1,000 MBOPD of pipeline projects are in the works but have yet to be approved, let alone break ground for construction. Rail loading facilities, meanwhile, have no additional projects in the works.

Even though production is expected to be temporarily stagnant, midstream providers are not about to stretch the limits with new projects. ONEOK suspended plans for its Demicks Lake processing plant in McKenzie County until prices improve, and Enterprise Products Partners scrapped plans for a 340 MBOPD (initial capacity) pipeline in December after an unsuccessful open season. Massive projects by both Enbridge (ticker: ENB) and Energy Transfer Partners (ticker: ETP) are still in place for the time being.

“Big Surge”

Lynn Helms does not believe the projects will have much time to sit on the sidelines. He believes North Dakota oil production is in line for a “big surge” in June, and state-mandated time limits along with major tax incentives are to blame. Platts reports as many as 1,000 wells are uncompleted statewide, along with 850 that have supposedly not been hydraulically fractured. In all, about 125 of those wells must be moved online by June in order to comply with time limits. Producers are also subject to a 6.5% oil extraction tax, but North Dakota’s tax commissioner said the levy may be lifted in order to encourage higher production. The tax removal is likely, considering the WTI price has stayed below North Dakota’s barometer of $55.09/barrel for more than five months.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.