Three Native American tribes whose land hosts up to one third of North Dakota’s 1 million BOPD production have asked oil companies to pay royalties on the natural gas they are burning off, or flaring, from oil wells on Indian lands in Fort Berthold. The reservation’s one million acres are home to the Mandan, Hidatsa and Arikara tribes.

“The Three Affiliated Tribes outlined its plan to impose fees in a six-page document sent to oil companies,” according to the Associated Press. “In it, the tribes said companies would be required to pay royalties for “flaring” natural gas to compensate for lost revenue when the gas isn’t brought to market and sold.”

This comes on the heels of North Dakota’s state regulators and governor taking action to reduce the practice of flaring, going so far as to halt oil production entirely if companies did not abide by the flaring rule.

The predominance of flaring has become an issue in North Dakota in the past few years. The oil boom from the Bakken Shale has outpaced infrastructure, leaving operators with no way to capture, process or ship the natural gas from their wellhead locations. E&Ps often elect to burn off the gas coming out of the Bakken in order to produce its oil – the more economically desirable commodity. Unlike Pennsylvania’s and West Virginia’s Marcellus Shale, which has been primarily productive for natural gas and natural gas liquids, the Bakken shale is an oil producing deposit. Oil is priced around $100 per barrel and is clearly much more attractive to producers than investing millions in infrastructure and selling natural gas at prices of roughly $4.00 per Mcf.

By comparison, the Marcellus benefits from the prior installation of pipelines and other gas processing infrastructure to prepare and move the gas to market for several years. Despite the buildout, its infrastructure has also not kept pace with the escalation of hydrocarbon production.

The state of North Dakota claims it is losing about $1 million per month in revenue from flared gas, and the state wants to capitalize on its revenue that figuratively disappears into thin air. According to the North Dakota Pipeline Authority web site, North Dakota produced roughly 25 Bcf of natural gas in December 2012 alone. That month, 71% of North Dakota’s natural gas was captured and sold to consumers, while 29% of the natural gas was flared due to a lack of pipelines or space on existing pipelines.”

Source: North Dakota Pipeline Authority

Outside Pressure

According to the most recent data available from the U.S. Energy Information Administration and World Bank, North Dakota accounted for 27.6% of total U.S. flaring and 1% of world flaring. The practice of flaring is a safer and more environmentally friendly method of handling the natural gas than simply venting into the atmosphere. By flaring the gas, it converts the methane to carbon dioxide (CO2) which reduces greenhouse gases 25-fold.

But environmental groups with money and legal muscle are pressing the issue. Oil and gas operations are extending to areas where residents are unaccustomed to such projects, and new communities are being built next to producing properties. This leads to homeowners lodging complaints about gas flares, truck traffic or other energy development activities.

If North Dakota producers halt production of oil due to flaring rules, the state stands to lose potentially hundreds of millions of dollars in revenue. The Three Affiliated Tribes would lose royalty revenue if companies either choose to or are forced to shut in wells to comply with state flaring rules or to avoid making “royalty” payments for gas that is not sold.

North Dakota passed bills in 2013 that addressed flared gas and provided some exemptions for specific circumstances. These rules can be read in summary here. But the tribes are seeking to make their own demands on operators, apart from the state’s rules.

“Three Affiliated Tribes officials said money from the fees would help pay to monitor the effect of greenhouse gas emissions on tribal members, and help develop a natural gas system to make electricity for the reservation,” according to the AP. “More than ever before, the tribe supports cleaner energy, cleaner air,” the Tribes’ letter said.

Additional Natural Gas Infrastructure on the Way

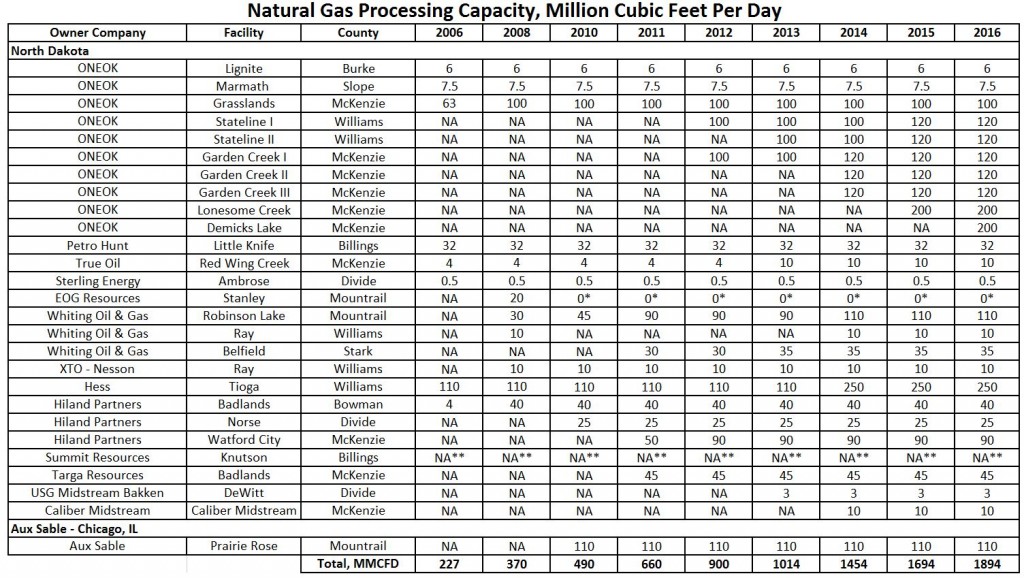

ONEOK Partners, announced in July that it plans to invest between $515 and $617 million in North Dakota’s natural gas gathering, processing and transportation infrastructure. The investments include $330 million to $430 million for the construction of the Demicks Lake natural gas processing plant and $185 million to $240 million for the construction of related natural gas infrastructure, including natural gas gathering pipelines and natural gas compression facilities.

The Demicks Lake processing plant will be built in McKenzie County, North Dakota, where ONEOK’S existing Garden Creek natural gas processing plant is located. The Garden Creek II and III natural gas processing plants, under construction now, are expecting to be complete within 2014. Once finished, the Demicks Lake plant will be ONEOK Partners’ second 200 MMcf/d plant in North Dakota, along with its 200 MMcf/d Lonesome Creek plant, which is targeting completion in late 2015.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.