Will Mexico’s new president divert Mexico’s energy sector away from successful reform?

Reuters reported last week that Mexico’s President-elect Andres Manuel Lopez Obrador (nicknamed ‘AMLO’) told reporters that Mexican oil auctions are suspended pending a review of the contracts awarded to date.

“They are suspended right now until the contracts are reviewed,” Lopez Obrador said, according to Reuters.

Lopez Obrador takes the helm as Mexico’s new chief executive in December. This follows his landslide election in July when outgoing President Enrique Peña Nieto entered the final six months of his six-year term.

But Mexico’s National Hydrocarbons Commission (CNH), the Mexican government energy regulator, had already postponed in July the country’s oil auctions until February 2019.

On a phone interview last week between Oil & Gas 360® and Oscar Roldan Flores, the CNH executive in charge of managing Mexico’s oil and gas auctions, Flores reversed an earlier Reuters story that said a new Mexican oil & gas policy exists that would replace the lease auctions.

According to Flores, “The Mexican Ministry of Energy is the only government body that has the authority to decide the country’s energy policies, launch bidding rounds and the like,” Flores said. He was referring to an earlier Reuters story that said an official had shown media outlets a new policy document for Mexico’s oil development that called for stopping the auctions and allowing Pemex, Mexico’s national oil company, select its own partner companies for future oil and gas development.

Flores said the document that Reuters is referencing was proposed by someone who was not a government official, but was attempting to land a position at Pemex, and it was not an official policy.

Flores’ staff at CNH manages all the activity from the beginning announcement of bid rounds to awarding contracts, technical management, and supervision of all exploration activities.

Mexico’s national hydrocarbons commission CNH was established in November 2008 as an organization with technical and financial autonomy to regulate, oversee, and evaluate all hydrocarbons exploration and production activities in the country, including its collection from points of production, transportation and storage.

CNH manages tendering processes for contracts for the exploration and extraction of hydrocarbons and is responsible for increasing the response capacity, efficiency and transparency of the processes. CNH is dependent on Mexico’s federal executive power and is headquartered in Mexico City.

Production history – why energy reforms were instituted in Mexico

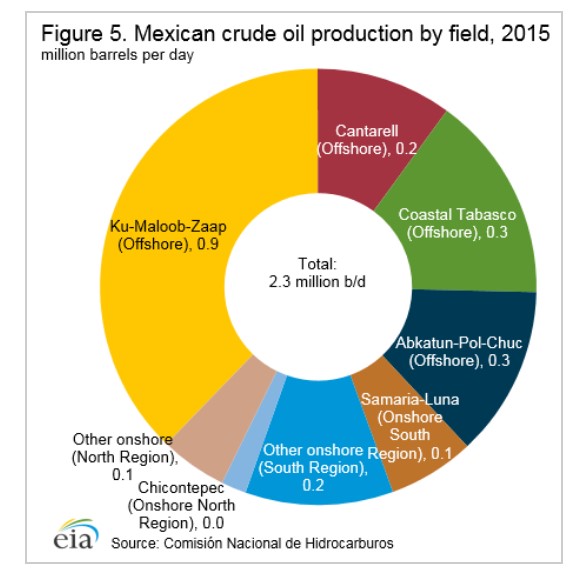

Mexico’s oil production has steadily decreased since 2005 as a result of production declines from Cantarell and other large offshore fields, the EIA reports in a country brief.

Nearly half of Mexico’s oil production comes from two offshore fields in the northeastern region of the Bay of Campeche—Ku-Maloob-Zaap (KMZ) and Cantarell. Another important source of oil production is southwest in the same bay, offshore the state of Tabasco. Most of the oil produced at KMZ and Cantarell is heavy and marketed as Maya blend (API specific gravity of 21 to 22 degrees), while the oil produced offshore Tabasco is a lighter grade.

Cantarell was once one of the largest oil fields in the world, but its output has been declining significantly for a decade. Production at Cantarell began in 1979 but stagnated as a result of falling reservoir pressure, according to EIA.

In 1997, PEMEX developed a plan to reverse the field’s decline by injecting nitrogen into the reservoir to maintain pressure, which was successful for a few years. However, production rapidly declined beginning in 2005—initially at extremely rapid rates, and more gradually in recent years. In 2015, Cantarell produced an average of 228,000 b/d of crude oil. This level was about 90% below the peak production level of 2.1 million b/d reached in 2004 and 29% lower than the year before.10 As production at the field declined, so has its relative contribution to Mexico’s oil sector. Cantarell accounted for just 9% of Mexico’s total crude oil production in 2015, compared with 63% in 2004.

Mexico’s total oil production has fallen 32% from its peak in 2004. Notably, crude oil production in 2015 was at its lowest level since 1981, and it continued to decline in 2016, the EIA reported.

“In August 2014 in an effort to address the declines of its domestic oil production, the Mexican government enacted constitutional reforms that ended the 75-year monopoly of Petroleós Mexicanos (PEMEX), the state-owned oil company,” the EIA said in its brief.

”PEMEX remains state-owned, but is being given more budgetary and administrative autonomy and will have to compete for bids with other firms on new projects. As stipulated by the reforms, PEMEX was allowed first refusal on developing Mexican resources before private companies began bidding. This phase was known as Round Zero and resulted in PEMEX being awarded the right to develop 83% of Mexico’s proved and probable oil reserves and 21% of total prospective resources. The reforms also call for expanding the regulatory authorities of SENER and CNH, and for creating a new environmental protection agency, the Agencia de Seguridad, Energía y Ambiente (ASEA).”

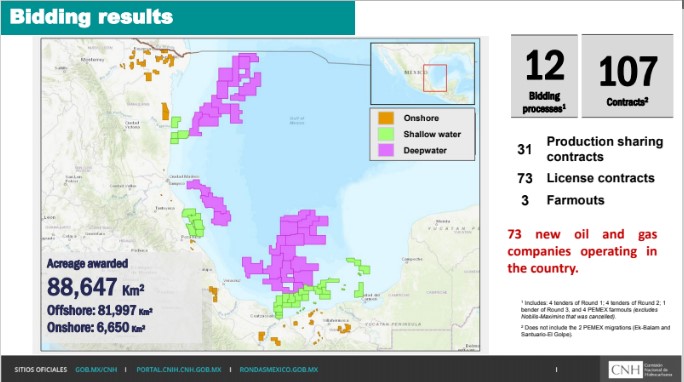

At the time when Mexico’s now outgoing President Enrique Peña Nieto opened the oil and gas sector to foreign investment for the first time in almost eight decades, Mexico launched a series of oil and gas lease auctions, opening oil and gas development in Mexico to outside companies starting in 2015.

There have been four bid rounds on exploration acreage in shallow waters, deep waters, onshore, and already discovered reserves. The final two rounds of the third phase of bidding is scheduled for February 2018 for onshore gas, and unconventional oil.

Government reform and regulatory changes allowing foreign investor involvement along the provision of a large amount of data on potential reservoirs offshore in the Gulf, and onshore Mexico, were the combination of factors needed to bring in outside companies to help Mexico develop its resources.

And the global oil and gas industry has become increasingly interested in joining with Mexican companies to participate in oil and gas auctions of assets to develop.

Mexico’s energy sector: an expert panel updates the industry

At EnerCom’s recent The Oil & Gas Conference® in August, presenters talked about a lot more than oil prices. A panel discussion was held on recent developments in the oil and gas sector in Mexico, including seismic data compilation, onshore horizontal-drilling, and offshore production.

The panel included various companies that are all highly involved in the developing region. The list of panelists included panel sponsor TGS, Mexico’s national oil and gas regulator CNH, Mexican onshore operator International Frontier Resources, Mexican downstream giant IDESA, and offshore driller Talos Energy.

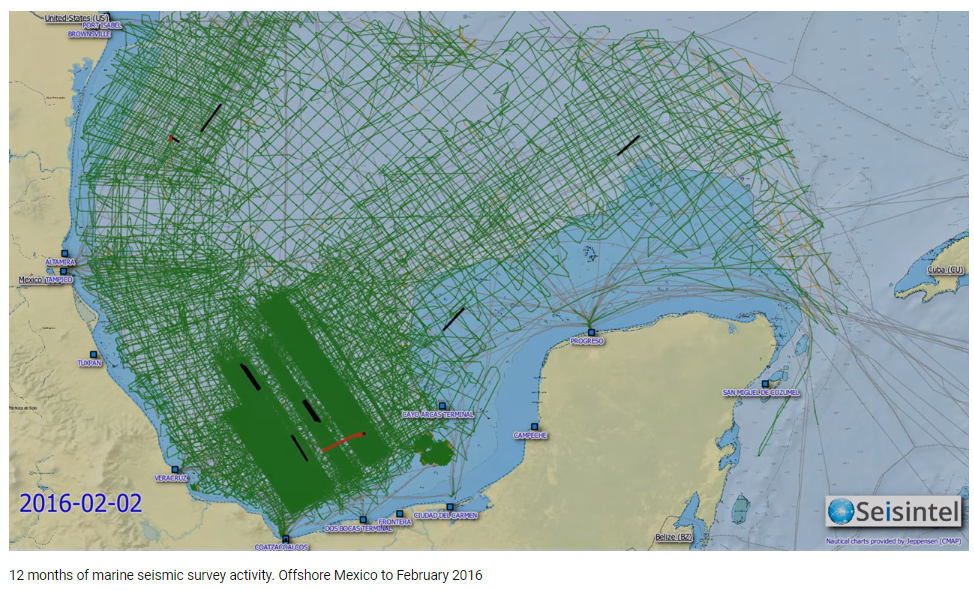

During a presentation by TGS, the panel previewed a video showing the buildup of 3D-seismic vessel activity in the Gulf from 2015 to 2016.

In the video the black dots represent 3D-Seismic vessels, and the green lines are the areas where seismic data has been collected. TGS delivers global geoscientific data to the oil and gas industry to assist with licensing rounds and the preparation of regional data programs.

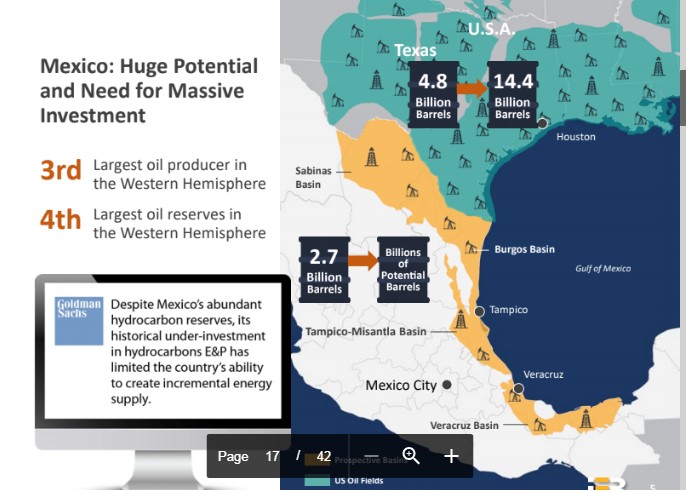

At the EnerCom Mexico panel, the head of the National Data Repository for CNH, Oscar Roldan Flores, said “Mexico is one of the most prolific areas in the Americas for off-shore exploration, the most prolific region for onshore exploration in Latin-America, and probably contains the largest area of unexplored resources in the world.”

Flores said that with just 12% and 34% of U.S. and Brazil’s offshore exploration wells respectively, Mexico produced 1.6 times more hydrocarbons than the U.S. and 2.6 times more than Brazil.

The average onshore oil fields discovered in Mexico are producing approximately 48 MMBOE and contain three times more hydrocarbons than the average recoverable reserves in Colombian and Brazilian fields, Flores said.

Steve Hanson, president and CEO of International Frontier Resources (ticker: IFR), a Canadian company working onshore in Mexico, said, “Mexico’s government in the last four years has gone through massive energy reforms to allow foreign investment to bring an incredible amount of potential for upstream development.”

IFR’s “Five year Plan” for Mexico contemplates the award of 579 blocks, totaling more than 239,000 km^2 and an estimated resource equivalent of 42,680 million barrels of oil equivalent.

IFR’s said that while Mexico’s current onshore exploration operations are only a fraction of the U.S.’s, the barrel potentials reach into the billions.

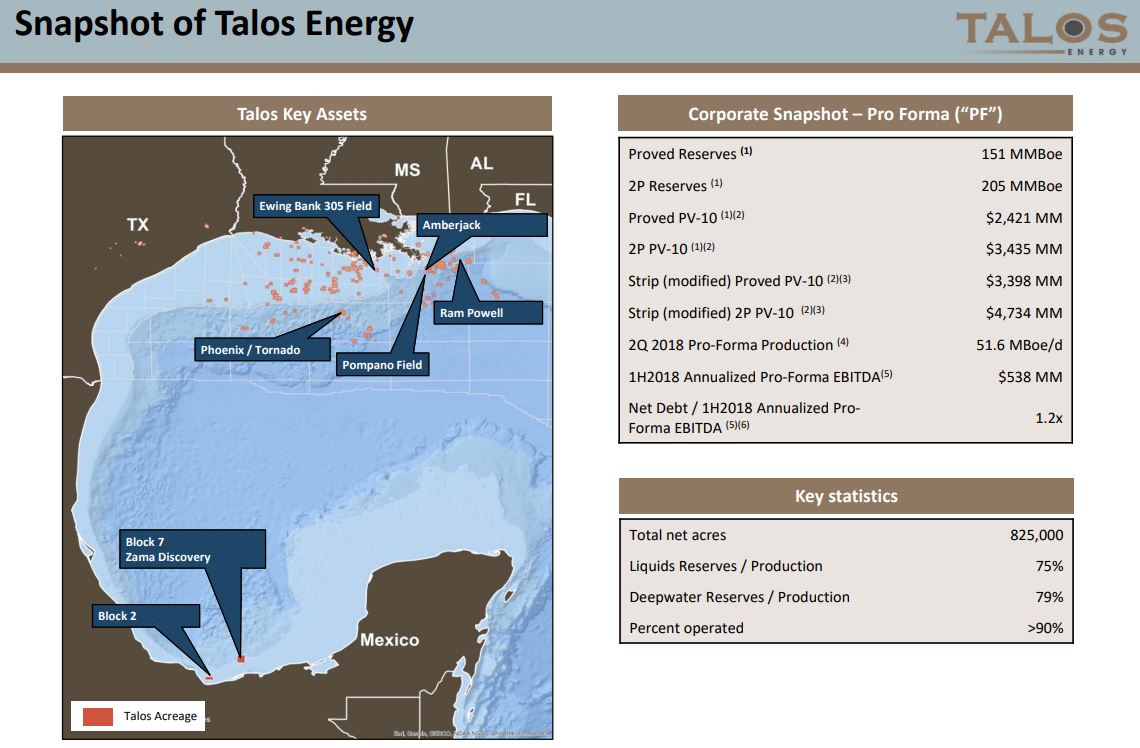

The last speaker on the panel was Talos Energy (ticker: TALO) President and CEO, Timothy Duncan. Duncan said Talos Energy is the first foreign operator to win the bid for the only two competitive blocks in phase 1.1 of the lease auctions in July 2015.

Talos described offshore Mexico as one of the hottest exploration basins in the world. Duncan said the shallow water depth of the reservoir decreases the development costs and will greatly shorten the cycle time to produce first oil. Duncan added that Talos’ Zama discovery is predicted to contribute nearly 10% of the Mexico’s total oil production by 2024.

See the archived Mexico panel webcast here.

What’s next for Mexico’s energy sector?

The industry will be watching to see if the strong energy reforms launched by outgoing President Enrique Peña Nieto, who was elected president of Mexico in 2012, will remain in place after his term ends this year. After Mexican citizens voted for leftist candidate Andrés Manuel López Obrador, the former mayor of Mexico City, in a landslide election, some uncertainty began to arise. Following his victory, Lopez Obrador sent a letter to President Trump promising many changes.

Forbes reported just after the July election that Lopez Obrador had indicated he would ‘respect’ the energy reforms in Mexico.

“Despite some previous nationalistic talk, President-elect AMLO will not bring regression to Mexico’s critical 2013 Energy Reforms that are required to evolve the country’s oil, natural gas, and electricity sectors. In particular, the U.S.-Mexican oil and natural gas alliance will hold tough.

“Besides the physical connections (e.g., pipelines and transmission lines), the partnership is built on three market pillars: Mexican crude oil to the U.S., U.S. gasoline to Mexico, and U.S. natural gas to Mexico. This strong trade is bolstered by an equally strong NAFTA, which AMLO has promised to “respect.” The reforms are now written into the Mexican Constitution. The contracts already signed with state-owned Pemex (oil and gas) and CFE (gas and power) are going to be almost impossible to erase. Although he could slow new offerings, AMLO knows that Mexico’s newly opened energy sector for outside private investment has been a clear success, with over $200 billion in new investments,” Forbes said.