Falling oil prices have helped sell a lot of Rolaids lately, particularly in places like Houston where U.S. E&Ps are trying to plan their future drilling commitments, based on uncertain commodities prices in 2015.

On Monday, some NYMEX options traders said they viewed $80 as a bottom, even on the heels of Goldman’s revised bearish oil forecast it released over the weekend that called for $75 West Texas Intermediate (WTI) crude oil prices in Q1 2015 and $70 WTI in Q2.

“From a trader’s standpoint, I wouldn’t see [oil] fall out of bed going forward. I think their prediction of softer prices going into 2015 is accurate, but as far as falling out of bed another 10% in the next couple of weeks I think is a little farfetched… ,” Michael McPartland of McNamara Options told BNN on Monday. “They’re talking $70 crude, … technically we haven’t stayed in the $70 handle … for a while, so a consistent $70-$80 price I think it’s a little bit of a stretch, and again [oil has] just come off over 10% in the last couple of months.”

“From a trader’s standpoint, I wouldn’t see [oil] fall out of bed going forward. I think their prediction of softer prices going into 2015 is accurate, but as far as falling out of bed another 10% in the next couple of weeks I think is a little farfetched… ,” Michael McPartland of McNamara Options told BNN on Monday. “They’re talking $70 crude, … technically we haven’t stayed in the $70 handle … for a while, so a consistent $70-$80 price I think it’s a little bit of a stretch, and again [oil has] just come off over 10% in the last couple of months.”

“With all the shale drilling going on in the United States and oversupply, you would think the market would come off, but with all the [speculators] out there waiting in the wings, [if] you have something go wrong geopolitically, or [if] someone says the wrong thing coming out of Saudi Arabia for example, you [could] see a panic with oil and it really rallies to the upside real quick… ,” McPartland said.

“$80 is a strong level of support for WTI, while Brent has mostly been able to hold above $85,” Oliver Jakob of PetroMatrix told Reuters. “We see the market being fairly stable this week, and I think we are within $5 of a longer-term floor,” Jakob said.

Last week John Gerdes, Head of Research for KLR Group, told Oil & Gas 360®: “The cash breakeven is $73 oil, with no return. If we end up at $85 NYMEX, we’ll see a 10% activity reduction level. If it’s $80 NYMEX, we’ll see a 20% activity reduction level starting next year. At $80 to $90 NYMEX, you’ll see adjustments over the next six quarters. I see conclusions suggesting the industry is free cash flow neutral at $90 oil and $4.00 gas, but if we stay sub-$90 we’ll see adjustments.”

Harold G. Hamm, chairman and CEO of Continental Resources (ticker CLR), spoke with CNBC on Tuesday about Goldman’s revised forecast for oil:

“First of all, there’s not a glut in the market at all. What we’re seeing is people out here projecting next year that we might see that. … I frankly don’t believe it’s going to happen. … They discount what’s going on in the rest of the world. The oil supply is going down in Venezuela, the North Sea, Argentina and all these other places; even ours in Alaska and California is going down. The only place is onshore U.S. that’s going up. We’ve had challenges in Gulf offshore… so that supply has been cut, so the only place is onshore U.S., and demand is there in the world. … Even though China’s economy may be soft, those people are still buying cars and building roads.”

OPEC Members Getting Antsy as Saudi Awaits U.S. Shale Downturn

“Some of the other factors are out there right now: the Saudis [are] weighing in. Frankly, they don’t have the excess capacity to do what they’ve done historically for the last 40 years, so that threat should be off the table,” Hamm told CNBC. … “They’re probably going to maintain their market share, but let’s look at OPEC. OPEC’s production has been flat for several years [where] it had been going up. They’re having to do what we’re doing—convert over to horizontal drilling, so their production is going to be expensive as well.”

Hamm told CNBC that the recent price drop in crude oil has been precipitous, rather than a gradual drop caused by supply and demand imbalance. “Basically [the sharp price drop] was due to the Saudis’ comments. But they’re getting ready for a very, very important meeting Nov. 27, so they’re pulling everybody together with their rhetoric.”

Bloomberg reported that “Among OPEC countries, Iraqi production is seen increasing by 200,000 Bopd and Libya’s output stabilizing at about 700,000 Bopd, compared with recent production of about 900,000 Bopd. Iranian production and exports are unlikely to see further growth because Goldman analysts do not expect a resolution to the country’s nuclear dispute with the West by the Nov. 24 deadline, meaning sanctions on Tehran will not be lifted.”

“‘U.S. shale is the marginal swing barrel in the new order’, Goldman said in its report, adding that a slowdown in production will happen when WTI falls to $75 per barrel. Once prices fall and U.S. production slows, Goldman expects cutbacks among OPEC producers including Saudi Arabia, which has been content to let prices fall in the hope of forcing U.S. shale producers out of the market,” according to Bloomberg. “Any near-term OPEC production cut will be modest until there is sufficient evidence of a slowdown in U.S. shale oil production growth,” the report said.

Citigroup commodities research strategist Eric Lee told CNBC that U.S. shale production growth won’t slow down—even if WTI hits $70 per barrel. Lee discussed what outcomes might be from a showdown between shale and OPEC.

At an energy conference in Singapore, analysts weighed in on the falling price of oil, U.S. shale oil production, Saudi’s stance and the upcoming November meeting of OPEC.

“Saudi Arabia surprised the market when it vowed to hold production levels, while giving price breaks to Asian customers, but the slide in prices may be too painful for other OPEC members, analysts say. OPEC meets on Nov. 27,” CNBC reported Monday. “I think there’s going to be big downward pressure on prices into the OPEC meeting and the market is going to force their hand,” said Again Capital analyst John Kilduff, CNBC reported.

Kilduff said OPEC may react if WTI reaches $75 or lower. “I think it would stabilize (prices), but the U.S. shale numbers are unbelievable. We’re going to be pushing 10 million barrels next year. There’s been the questions in the market about oil field depletion, etc., but now there’s the realization that it’s the real deal,” Kilduff told CNBC.

“The increase in demand is going to be met by increases in Canadian and U.S. production, which leaves OPEC on the sidelines,” said Andrew Lipow of Lipow Oil Associates told CNBC.

“I actually do think these oil prices are going to force OPEC to act,” Lipow told CNBC. “Even though Saudis and Kuwaitis could stand an extended period of low prices, they live in a difficult neighborhood and their neighbors cannot endure an extended period of low prices.”

Platts’ Asia Editorial Director Vendana Hari discusses possible outcomes from the upcoming OPEC meeting in detail in the following video.

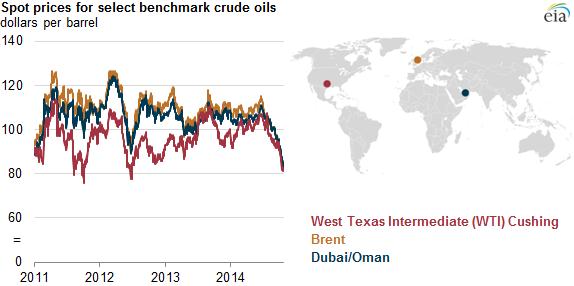

The Benchmark Crudes: WTI vs. Brent vs. Dubai/Oman

Source: U.S. Energy Information Administration, from Bloomberg

Note: Dubai/Oman price calculated by taking the average of Dubai and Oman spot prices.

Today, the EIA compared characteristics of the three primary crude oil pricing benchmarks, Brent, West Texas Intermediate (WTI), and Dubai/Oman:

“When energy analysts and the media discuss the price of crude oil, they are typically referring to one of a small group of specific types of crude oil that are widely and actively bought and sold.

“Brent, is the most widely used global crude oil benchmark and includes four separate light, sweet crude streams that are produced in the North Sea: Brent and Forties (produced offshore the United Kingdom) as well as Ekofisk and Oseberg (produced offshore Norway). In 2013, Brent crude oil loadings averaged 0.86 million barrels per day (bbl/d), representing about 1% of total world crude oil production of 76 million bbl/d. Brent is used to price light, sweet crude oil that is produced and traded not only in Europe, the Mediterranean, and Africa, but also in Australia and some countries in Asia.

“West Texas Intermediate (WTI) is a light, sweet crude oil produced in the United States that is priced at the crude oil trading hub of Cushing, Oklahoma. WTI is used as a benchmark for other types of crude oil produced in the United States, such as Mars, a medium, sour crude produced in the Gulf of Mexico, and Bakken, a light, sweet crude produced in North Dakota. WTI is also used as a benchmark for imported crude oil that is produced in Canada, Mexico, and South America.

“Dubai/Oman is a third major benchmark crude. The prices of Dubai and Oman crudes, both of which are medium and sour, are often averaged to create a benchmark that is typically used to price crude oil produced in the Middle East and exported to Asian markets. Dubai crude oil production has steadily declined for more than two decades, and in 2013 was only 34,000 bbl/d. As a result, Oman crude oil, which reached 0.94 million bbl/d of production in 2013, has been used to support the continued use of Dubai crude as a benchmark. Saudi Arabia’s state-owned oil company, Saudi Aramco, uses the Dubai/Oman benchmark when determining the price of its crude oil sold for delivery to Asia.”

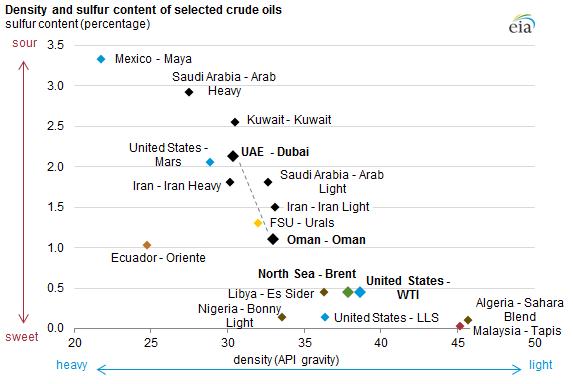

Source: U.S. Energy Information Administration, based on Energy Intelligence Group—International Crude Oil Market Handbook

At the time of this posting, WTI was trading at $81.16 and Brent at $85.89 per barrel.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.