Whiting plans to grow production within cash flow in 2018

Whiting (ticker: WLL) announced third quarter results today, showing a net loss of $286 million, or ($0.79) per share. After adjusting for special charges, Whiting experienced a net loss of $50 million, or ($0.14) per share, which beat analyst expectations of ($0.20) per share.

Whiting reports that Q3 production averaged 114,350 BOEPD, up from the 112,660 BOEPD it produced in Q2. This growth was achieved despite the sale of the company’s Fort Berthold Indian Reservation assets and an outage at a third-party gas processing plant. After adjusting for these factors, Whiting Q3 production came in at the high end of guidance, and is poised for further growth.

Whiting intends to grow by 10% sequentially in Q4, to average 126,000 BOEPD. According to Jim Volker, Whiting’s Chairman, President and CEO, the company will be able to hold at that level of production relatively cheaply. “We estimate our maintenance capital to maintain 126,000 BOEs per day is only $650 million,” he said. “Therefore, at current prices, we estimate we can generate growth in 2018 spending the cash flow.”

Redtail

Whiting has seen significant growth in its Redtail area, located in northeast Colorado. The company completed 58 wells in the area in Q3, which allowed production to grow 78% sequentially. Whiting continues to draw down its DUC inventory in the area, and now expects only 39 drilled uncompleted wells will be left at year-end.

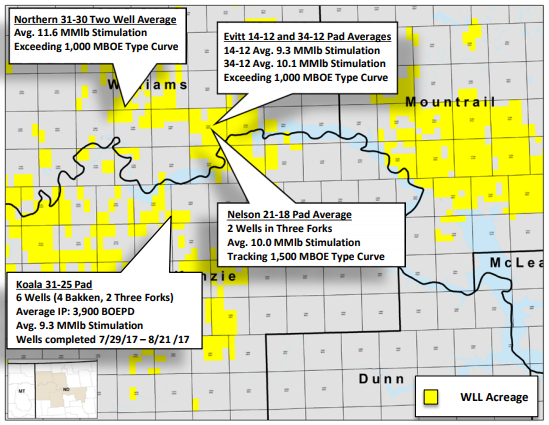

Results from the company’s Bakken acreage are also encouraging, with strong recent well results. The company reports that its new McKenzie and Williams County wells are all tracking the 1.5 MMBOE type curve, which would mean a 118% IRR at $50 oil. Whiting expects it will have a larger amount of DUCs in the Bakken, with 50 remaining at the end of 2017.

From the WLL Q3 2017 conference call Q&A

Q: Do you think you’ve hit diminishing returns or what you could potentially see on an average size for some of these frac jobs in 2018?

Rick A. Ross: Regarding our Williston Basin completions, we think, probably 9 million to 10 million pounds is our optimum right now, so that’s kind of our standard job. You’ll see some larger jobs on the slides, that Jim talked about earlier that in specific cases we may bump it up a little bit, but in general we think the optimum is in that 9 million to 10 million-pound range.

Q: On Redtail, we had those 15 wells that were completed back in 2Q on those two razor pads and now that those have been online for about 90 days, I’m just wondering if we could have some sort of an update, maybe how those are tracking relative to kind of the original EUR range?

Rick A. Ross: As you mentioned, we did do a couple of completion experiments in Redtail and those wells are on production and have been flowing back. And as you mentioned that usually takes 60 days to even 90 days to hit a peak. I guess what we would say at this point is we experimented both with additional stages and with additional proppant and we believe that additional stages add value. And at this point we think 5 million pounds of proppant is probably the optimum amount of sand.

Q: Going forward, what would it take to put a rig back in the Niobrara? Is it just commodity price or are you going to plan to keep one there every once in a while?

James J. Volker: Well in short, I would say looking at our results there and planning for 2018, we basically plan to just complete the remaining DUCs and we’ll have about 39 of those at year end 2017 to complete in the first half of 2018. Beyond that, whether or not we put a rig back there would be essentially oil price related, so we’ll wait and see.

To try to be specific to you, probably something in the $55 range would make us start thinking about it. But with the results that we’re having in the Williston, we really at this time due to the higher IRRs, higher ROI and of course the huge acreage position that we have up there, prefer to spend the capital and get the rates of return available to us in the Williston.

Q: I wanted to ask you to give a little bit more color on the calculus around the $650 million to keep that 126,000 a day flat or so at the end of the year. I know that that numbers walked down from the $850 million level or so in the beginning of the year. And granted I know there’s been some sales, but how do you think about what contributes to that $650 million. I guess it sounds like it’s all Bakken driven with the benefit of some of those DUCs at Redtail. Is that using sort of a 1,200 to 1,500 or 1 MMBOE type curve. And just describe a little bit more about how you think about that?

WLL: Well I would say it’s just based upon the results that we’ve seen over the year, really from January on here in 2017. Efficiencies have been continued to improve our results. We’re confident about the areas in which we’re drilling through the end of the year and really through the end of 2018. And we’re concentrating as you’ve said in the Williston Basin. So those things really contribute to what we view as contracting maintenance capital.