Whiting Petroleum (ticker: WLL) is set to become the largest E&P in the Williston Formation once its $6 billion acquisition of Kodiak Oil & Gas (ticker: KOG) is finalized before the end of fiscal 2014. Management teams on both sides limited comments on the acquisition in their respective Q2’14 conference calls, considering the transaction is not yet complete. KOG spent just six minutes to provide an update and did not take any questions. Whiting was more receptive but still monitored its comments.

The most extensive comment was made by Jim Volker, President and Chief Executive Officer of Whiting Petroleum, in the call on July 30, 2014. Volker said: “Kodiak has done a terrific job of establishing a Tier 1 acreage footprint in the core of the Williston Basin, which like Whiting’s acreage, sees some of the best economics anywhere in the play, or for that matter, anywhere in the U.S. When looking at both of our positions together, you can see just how complementary the two really are. There are many areas in which the combined companies will benefit from the offset acreage positions, and together, we create an extremely attractive position in the Central and Eastern Williston Basin Fairway.”

Volker is scheduled to present on behalf of WLL at EnerCom’s The Oil & Gas Conference® 19 on August 18, 2014. It will be the company’s first public presentation following the acquisition announcement.

Bakken Stakehold

Whiting increased its Q2’14 overall production by 9.7% compared to Q1’14 – most of which came from organic growth. The company forecasts an additional 7% quarter-over-quarter increase in Q3’14. Its drilling count will increase by 158% once the KOG acquisition is complete. Pro forma for KOG, WLL had 18 active operated rigs in the Bakken/Three Forks as of July 13, 2014. A total of 26 rigs will be running purely in the Williston by year-end 2015, the company said in a conference call following the KOG announcement.

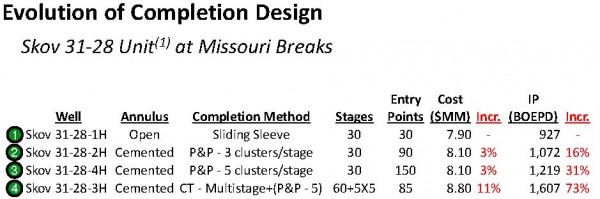

Whiting’s increasing knowledge of the play is reflective of its cemented liners, which has boosted EURs by 23% compared to its traditional method. A Missouri Breaks well completed with slickwater outperformed an offsetting well by 44% over 120 days, and 11 more slickwater wells are currently being tested across four prospects. WLL ‘s revised sliding sleeve technology produced an average IP rate of 2,872 BOEPD across 11 Hidden Bench wells – 50% higher than the previous average. Potential in the Three Forks formation is currently being tested in three separate regions.

WLL believes it will hold more than 9,000 gross drilling locations, pro forma for Kodiak. “As a result of their leverage, they were a little constrained,” said Volker. “The fact that Whiting was a company designed to be somewhat under-leveraged compared to the peer group is going to allow us to limber up some of that capital we have available to generate greater growth for the combined entity.”

Valuation Boost?

Volker added: “Pro forma for the transaction, Whiting will be an $18 billion initial enterprise value entity based on Whiting and Kodiak’s share price prior to announcing the acquisition. Our first quarter 2014 annualized EBITDAX was in the $2.8 billion range and we will have significantly larger reserves and production. We have comparable, if not greater, EBITDAX, reserves and production than many of our peers who have substantially greater market valuations. We believe this transaction will help narrow this valuation disparity.”

In a note dated August 1, 2014, KLR Group said: “We anticipate Whiting’s capital productivity to improve ~10%, strengthening the company’s ’15 capital yield (cash-on-cash return) ~12.5% to ~135%, vs. the industry median of ~130%. Yet on a pro forma basis, WLL trades at a ~15% discount to the group (’15 EBITDA).”

Asset Overview

Whiting’s current claim to fame is the Bakken, but the company continues to conduct operations across the country, specifically in the Permian and Niobrara. Results from a Permian wildcat well are expected by the end of 2014.

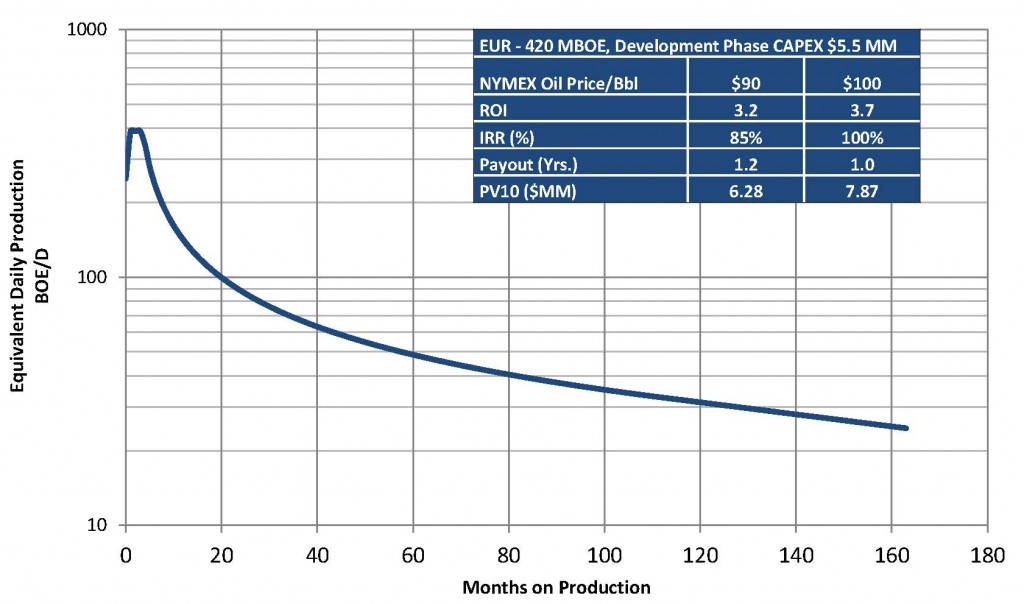

Whiting’s Redtail prospect in the Niobrara is beating its 420 MBOE type curves by “25%, and in some cases up to 50%” said Volker. Management said it may revise the curve upward after more time is spent on the projects. The Razor 27I pad produced 4,700 BOEPD on eight wells (588 BOEPD average), which is the company’s strongest performance to date.

“I would say they are still on an incline,” said Steve Kranker, Vice President of Reservoir Engineering for Whiting. “That’s partly a combination of us choking them back initially. We’re not going for record production rates. We’re going for longest sustained ultimate recovery. And about 120 days is the longest we’ve seen for a well to clean up to get to its peak production and then they go on a more gradual hyperbolic volume.”

The 30F pad has been spud in the Horsetail area and will be the first pad to test 32-well spacing on all three Niobrara benches. Volker said, “If it is successful, it’s going to be a huge additional number of wells for us and obviously, it increases the number of reserves as well.” Management noted most of the company’s operations are in more rural areas and will therefore not be affected by pending Colorado ballots on oil and gas development. WLL expects to have five rigs running in the Niobrara by December.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.