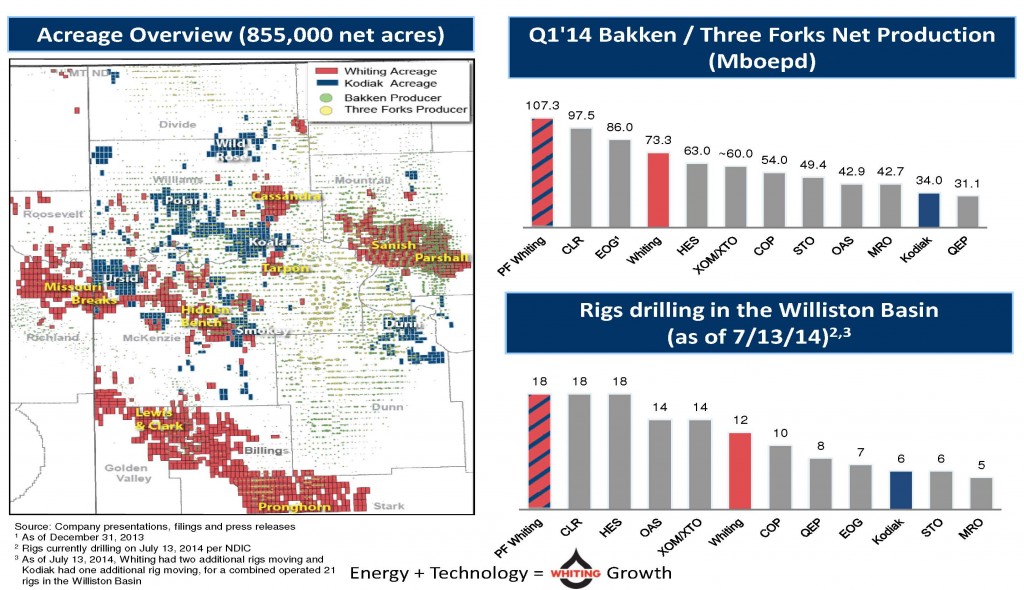

Whiting Petroleum (ticker: WLL) is officially the largest producer of the Bakken/Three Forks shale play, following its $6.0 billion purchase of Kodiak Oil & Gas on December 8, 2014. The transaction was first announced on July 13, 2014, and involves the $2.2 billion assumption of Kodiak net debt. Kodiak shareholders now hold approximately 29% of WLL.

Whiting arranged $3.5 billion in bank commitments to finance the transaction and has sold roughly $1.1 billion in properties since the beginning of Q3’13. Its debt to market cap ratio is currently 62%. By comparison, the average of 86 peer companies in EnerCom’s E&P database has a median debt to market cap ratio of 86%. Whiting currently has only $100 million drawn on its credit facility. Its estimated borrowing base is expected to be roughly $4.5 billion.

The New Whiting

As of year-end 2013, the combined company has more than 600 MMBOE of proved reserves – 80% of which is in the Bakken/Three Forks. Q3’14 combined production was 157,160 BOEPD, with 127,965 BOEPD (81.4%) flowing from the Williston Basin.

Whiting’s pro forma position in the Bakken/Three Forks spans 885,000 net acres with more than 3,460 net drilling locations. In a conference call following the acquisition announcement in July, Whiting management said it plans on increasing the combined rig count to 26 by year-end 2015. The combined company had 18 running rigs at the time of the acquisition announcement. Five of the eight rigs added to the fleet would be placed on the acquired Kodiak acreage.

Companies were Raising Williston Production Independently

Kodiak’s Q3’14 production of 40,485 BOEPD was 6% higher than Q2’14 and 14% higher than Q3’13, according to the company’s last quarterly release.

Whiting, meanwhile, produced an average of 116,675 BOEPD in Q3’14, increases of 6% and 26% compared to Q2’14 and Q3’13, respectively. Its production from the Williston Basin averaged 87,480 BOEPD in the latest quarter, accounting for 75% of all volume. Overall, its Williston production has increased at a quarterly average of 9% since the beginning of fiscal 2014.

In WLL’s Q3’14 conference call, Jim Volker, Chairman and Chief Executive Officer of Whiting, said “The Whiting and Kodiak asset base sits in the Williston Basin fit hand in glove, which allow us to operate more efficiently as we continue to execute on pad drilling and decreased mobilization time and costs from well site to well site.”

The efficiencies include an expected $700,000 in cost savings per well, as previously mentioned in the acquisition conference call in July. The cost savings are anticipated as soon as January 2015. Well completion costs in the most recent quarter were running in the $8.0 to $8.5 million range.

The Redtail: “A Whiting within a Whiting”

The Bakken/Three Forks is clearly Whiting’s calling card, but its downspacing project in the Redtail of the Niobrara has commonly been referred to as a “Whiting within a Whiting” by company management. Initial targets are the Niobrara A and B formations, but recent discovery wells targeting the Niobrara C and Codell/Fort Hays formations were announced in the most recent conference call, with 10-day IP rates averaging 712 BOEPD and 570 BOEPD per well, respectively. The Codell discovery is believed to be prospective for 50% of its current acreage, boosting its gross well count to 4,125 locations. Management believes the Niobrara C may yield similar characteristics, which would increase gross drilling locations to nearly 5,000. At the time of the earnings release on October 30, management said net production was exceeding 10,000 BOEPD – more than 16% greater than average production for Q3’14. A total of five rigs are currently running in the play, located in Weld County, Colorado.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.