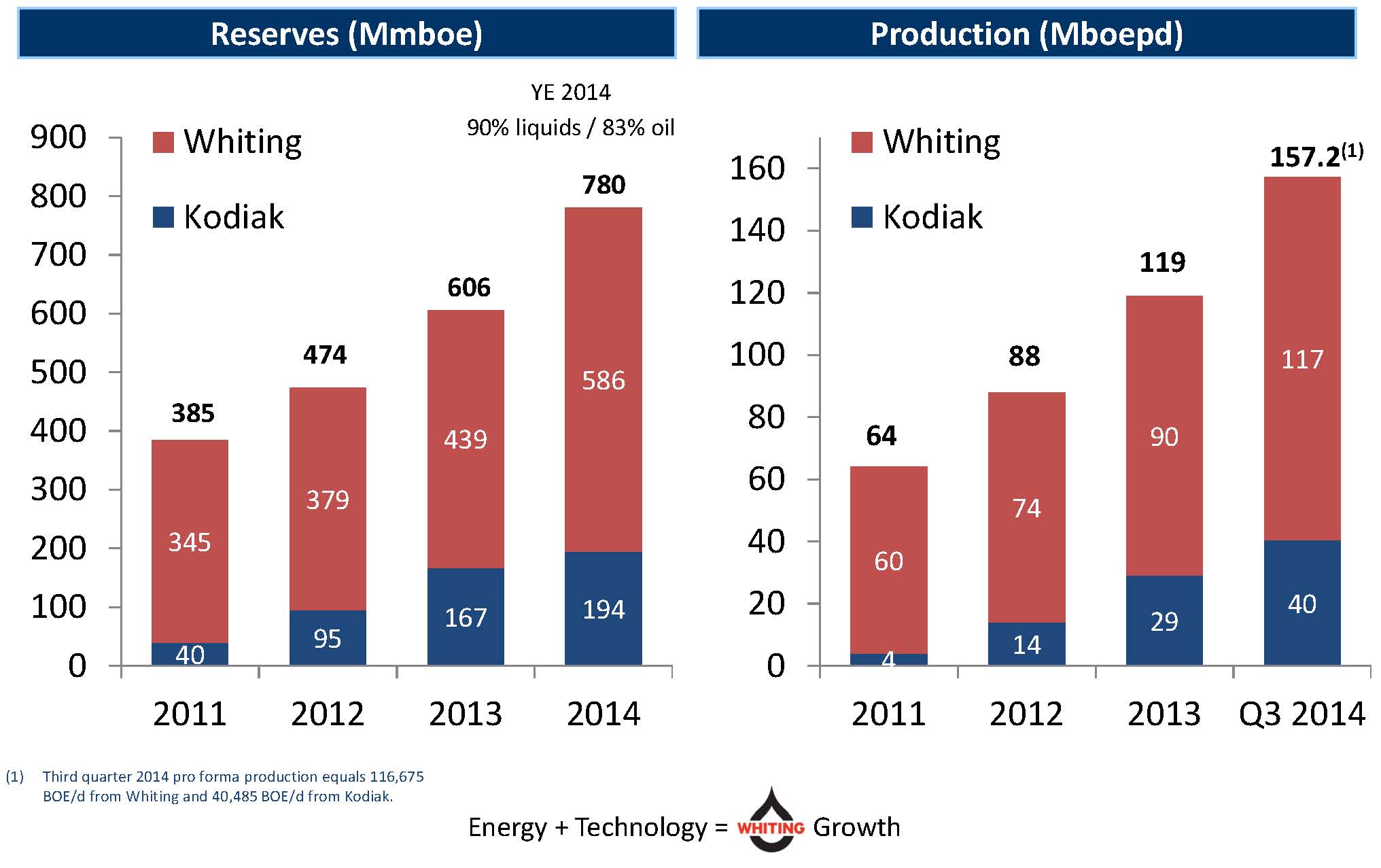

Whiting Petroleum (ticker: WLL), the largest producer of the Bakken/Three Forks shale play, announced estimated reserves of 780 MMBOE (83% oil) in a news release on December 22, 2014. The report was independently commissioned by a third party and represents a year-over-year increase of 29%, including the assets of Kodiak Oil & Gas. Whiting completed its $6 billion, all-stock acquisition of Kodiak earlier this month.

More Reserves = More Credit

In conjunction with the reserves increase, WLL’s bank syndicate increased its credit commitment to $4.5 billion. WLL management believes the company will have $1.4 billion drawn by year-end 2014, leaving a total of $3.1 billion of liquidity. James Volker, President, Chairman and Chief Executive Officer of Whiting, said the company is “pursuing monetization of select assets that would reduce debt and create up to $1 billion in additional liquidity.” Its assets besides the Bakken include the Redtail Niobrara of Colorado and the North Ward Estes enhanced oil recovery program in South Texas. The respective areas contributed production of 8,610 and 9,500 BOEPD in 2014, according to Whiting’s latest presentation.

Guidance is expected to be released with its Q4’14 results in February 2015.

Bakken Asset Primer

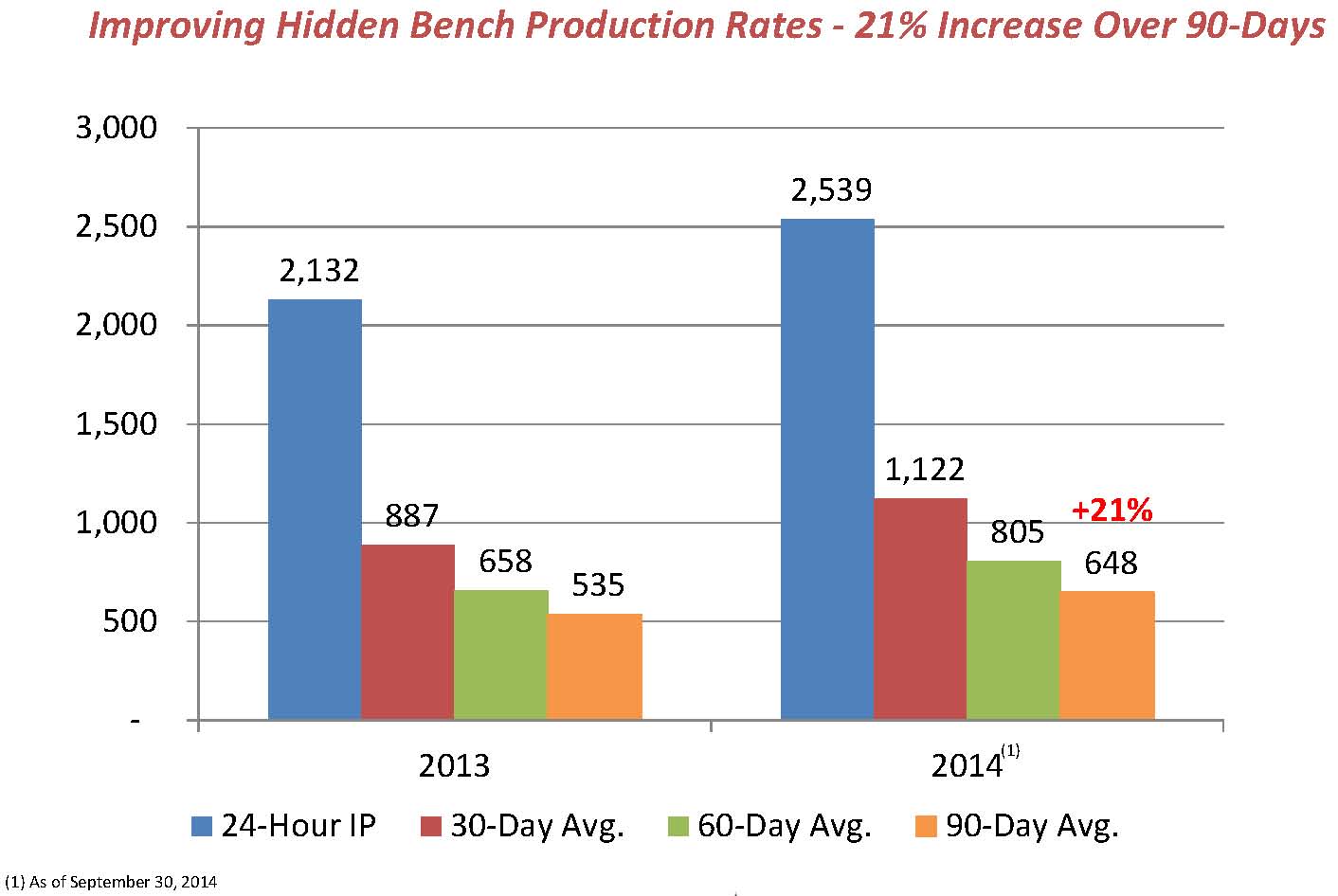

Whiting’s position in the Bakken/Three Forks spans 885,000 net acres with more than 3,460 net drilling locations. Original plans consisted of increasing the Bakken rig count to 23 from 18 by year-end 2015, as management said in the company’s Q3’14 conference call. The region accounted for 91% of production in the latest quarter and WLL says its slickwater techniques are improving efficiency rates. Type curves estimate 600 MBOE per well with an average cost of $8 million.

On an absolute basis, 42% of WLL’s total property is considered proved undeveloped. Its asset intensity (defined as the amount of capital required to maintain production on its current assets) is 52%, meaning the remaining 48% can be allocated to growth projects, acquisitions, or returned to shareholders. Its increasing efficiencies are producing a trailing twelve months cash margin of $52.03/BOE. The return ranks second among its group of 20 Mid-Cap peers in EnerCom’s E&P Weekly Database. WLL ranks sixth when compared to the entire group of 86 peer E&P companies.

Coverage Update

Moody’s Investor Service initiated coverage on Whiting within the last week. In the release, Volker said: “We intend to tailor our 2015 plans to maintain strong liquidity, keep a responsible debt to EBITDAX level and deliver moderate year over year production growth. We believe the company’s strong outlook is further reflected by Moody’s Investors Service (Moody’s) recent upgrade of Whiting Petroleum Corporation’s corporate family rating to Ba1 from Ba2, just one notch below investment grade.”

Two other services, Standard & Poor and Egan-Jones, also cover WLL. Each has a rating of BB+, which is a grade similar to Moody’s determination.

Oppenheimer Funds initiated coverage on Whiting last week, opening with a “Market Outperform” rating. A total of 34 investment firms currently cover WLL, and 28 have assigned a rating of either “Overweight,” “Buy” or “Outperform.”

According to EnerCom’s E&P Weekly, Whiting’s debt to market cap percentage of 48% is well below the 76% median of the entire group. Its price to cash flow per share multiple is 2.6x – below the median of 3.6x. EnerCom’s models predict the price to cash flow per share multiple to reach 2.9x in 2015.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.