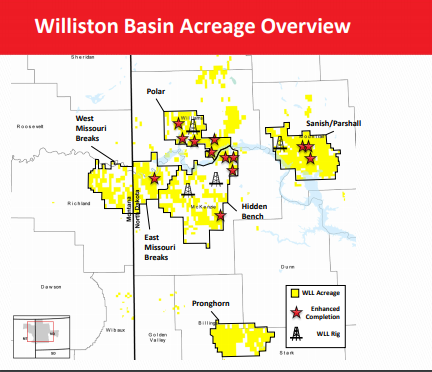

Whiting Petroleum (ticker: WLL) has a 2018 capital budget of $750 million, of which $600 million will be invested in Williston Basin operations. The capital budget forecasts a production growth of 9% from Q4 2017 to Q4 2018, with an estimated average annual production of 128,400 BOEPD. In the Williston Basin alone, production is forecasted to grow 14% from Q4 2017 to Q4 2018.

The remaining $150 million in the capital budget will be allocated as follows:

- $50 million will be spent on non-op development activities in the Williston Basin

- $75 million will be spent completing DUC wells in the Redtail field

- $25 million will be dedicated to land and facilities.

In Q4 2017 Whiting’s average production increased by 12% from Q3 2017, producing approximately 11.8 MMBOE.

Drilling, completions and production update

Whiting finished 2017 with 51 DUC wells in its Bakken/Three Forks play in the Williston Basin and 39 DUC wells its DJ Basin/Redtail field in Weld County, CO. Throughout 2018 Whiting plans to drill an additional 120 wells in the Bakken/Three Forks formation, however, Whiting does not plan to drill new wells in the Redtail area. Furthermore, Whiting plans to put 123 wells on production in the Bakken/Three Forks play and 22 wells in the Redtail area.

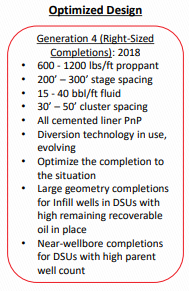

Whiting said it plans to implement a new operating philosophy in 2018 designed to maximize capital productivity at the corporate level through determining the optimal well configuration and cost by operating area. This philosophy includes completing wells with proppant loads that range from 6-12 million pounds across 33-50 stages.

In Q4 2017, Whiting drilled 27 wells in the Williston Basin, and no wells in the Redtail area. 21 wells were put on production in the Williston Basin and 25 wells were put on production in Redtail.

Financial results

Capital expenditures for Q4 2017 was $171 million, which was $38 million below guidance. Q4 net cash provided by operating activities of $287 million exceeded capital expenditures by $116 million.

In the fourth quarter of 2017, the company added to its hedges and Whiting is now 70% hedged for 2018. Additionally, Whiting paid $61 million to settle a volume contract associated with its Redtail field. The contract commitment equaled 20,000 gross BOPD through April 2020 and had an associated fee of $3.93 per barrel.

Year-end 2017 proved reserves totaled 617.6 MMBOE. Proved developed producing reserves equaled 54% of total reserves versus 47% of 2016 year-end reserves.