Whitecap Resources Inc. (ticker: WCP) announced that it closed its acquisition of light oil assets in southeast Saskatchewan for cash consideration of $940 million before closing adjustments.

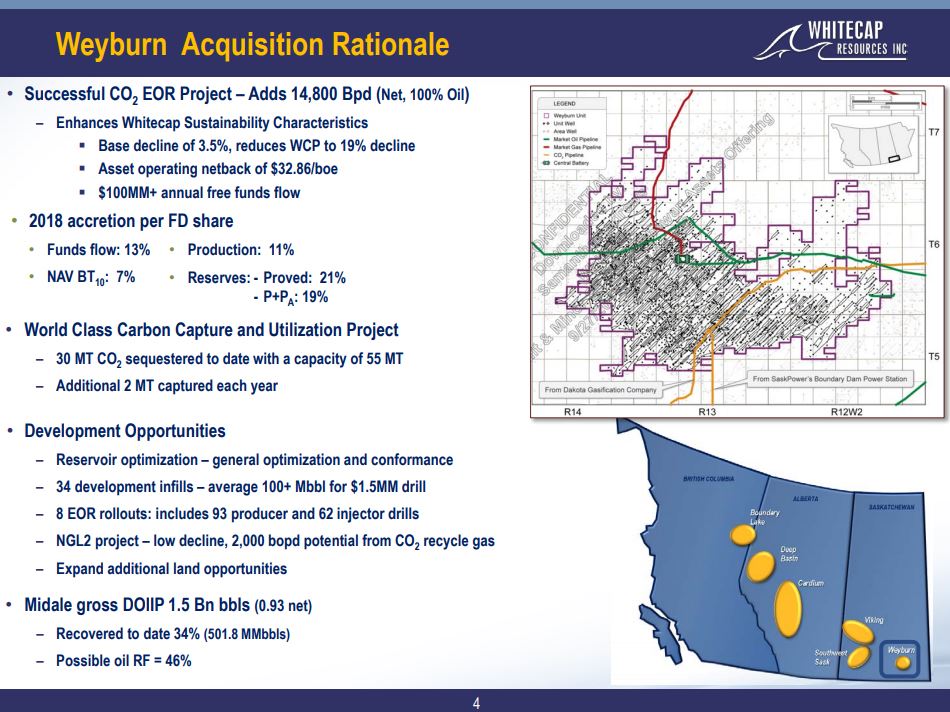

The acquisition includes a 62.1% operated working interest in the Weyburn Unit (14,600 BOEPD) and 200 BOEPD of production from minor assets in southeast Saskatchewan. The Weyburn Unit is a carbon dioxide enhanced oil recovery development with a low base decline rate of less than 5%, high operating netback of $31.86/BOE, and significant short and long-term development and expansion opportunities. The assets also include extensive infrastructure in place to facilitate future development plans.

In 2018, Whitecap’s base case assumptions are to invest 35% of the net operating income from these acquisitions to maintain production at 14,800 BOEPD which is anticipated to result in significant additional free funds flow of approximately $112 million. The company estimates that over the next five years, the base assets have the potential to grow to approximately 17,700 BOEPD and generate cumulative free funds flow of $459 million, using a flat operating netback of $31.86/BOE.

Concurrent with closing of the acquisition, Whitecap’s borrowing base has been increased to $1.7 billion from $1.3 billion. As part of the $1.7 billion borrowing base increase, Whitecap intends to issue $195 million in senior secured notes which will have an annual coupon rate of 3.9% and mature in 9 years. The closing of the senior secured notes is expected to be on December 20, 2017, at which time Whitecap will then have $595 million of term debt at attractive long-term fixed interest rates, with terms of five, seven, and nine years.

Whitecap continues to maintain a strong balance sheet with 2018 estimated net debt to funds flow of 1.6 times and considerable financial flexibility with approximately 50% of net debt under long-term notes and approximately $500 million of unutilized credit capacity based on estimated 2018 net debt.

The acquisition was partially funded through a $92.5 million non-brokered private placement and a concurrent $332.5 million bought-deal, equity financing co-led by National Bank Financial Inc. and TD Securities Inc. which closed on December 4, 2017.

Pursuant to the financings, Whitecap issued 48,297,000 subscription receipts at a price of $8.80 per subscription receipt for gross proceeds of approximately $425 million. In accordance with their terms, each subscription receipt was exchanged for one common share upon the closing of the acquisition and the proceeds from the sale of the subscription receipts were released from escrow. Holders of subscription receipts are not required to take any action in order to receive common shares.