Every year, oil and gas companies are required by the Securities Exchange Commission (SEC) to report their proved oil and gas reserves. By reporting these reserves, companies give their investors a meaningful understanding of the resources the company controls that it believes it could economically produce, establishing the size of the company’s reserves.

To qualify under SEC guidelines as “proved reserves,” the resources in place must meet three key standards:

- The reserves must be reasonably certain of recovery, meaning a company has a good idea of what producing from a position will entail and what they will see in terms of production;

- The reserves must be economic to produce at SEC prices; and

- A development plan must be adopted indicating that they are scheduled to be drilled within the next five years.

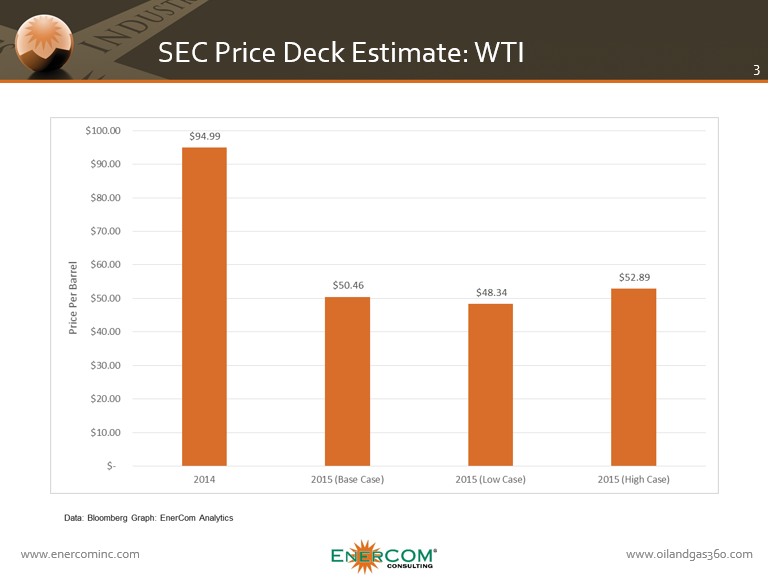

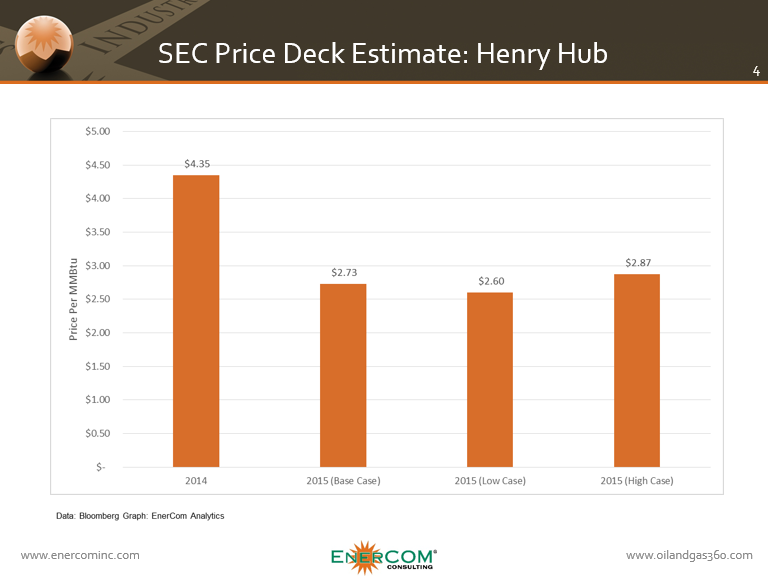

As the calendar year comes to an end, bringing with it the annual reserves determination, companies are preparing to see their proved reserves affected by the dramatic decrease in prices from last year. The SEC price deck, against which companies compare their well economics to book their reserves, is set by an average price of the first day of every month of the year. The SEC price deck set at year-end 2014 for 2015 was $94.99 per barrel for crude oil, while companies were able to book gas reserves at $4.35 per MMBtu, even as both commodities’ prices dropped precipitously.

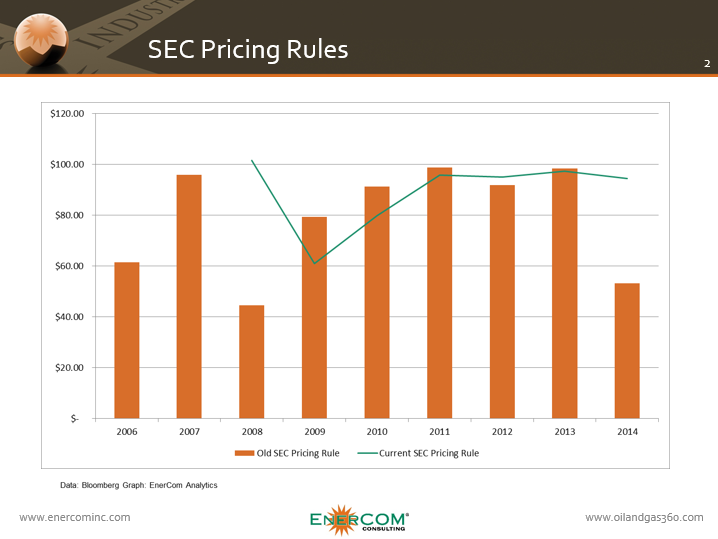

From 2006 to 2008, the SEC determined the price deck by taking the price from the last day of the preceding year. This methodology was changed following 2008, when the SEC began using the average price from the first day of each month to determine the price deck. The new system created buffers in downcycles, like the one seen in 2008, as well as the most recent one at the end of 2014.

The SEC price deck for 2016 will not have the benefit of a substantial buffer from $100+ per barrel oil, however. Using the average price for the first day of the month from January to September, and then extending September’s price out for the last three months of the year, EnerCom® determined a base-case for the 2016 SEC price deck at $50.46, or 47% lower than the price deck for 2015.

EnerCom’s Price Deck Calculations

To estimate a high and low case for the potential SEC price deck, 10% per month was either added or subtracted per month for the last three months of the year, forecasting a high case of $52.89, and a low case of $48.34. Even taking the high case as an example, producers will be booking their reserves at an oil price 44% lower than they used in 2015, while a low-case SEC price deck would mean booking reserves at 49% below last year’s price.

The story for gas priced at Henry Hub is much the same as it is for WTI: using the same methodology, the average price from the first day of each month of 2015 will be $2.73 per MMBtu, with a high and low case of $2.87 and $2.60, respectively. That represents a price deck 34% lower in the high case, 37% lower in the base case, and 40% lower in the low case from the SEC price for Henry Hub of $4.35 that was used to book reserves at the end of 2014.

Company reserves likely to see broad-sweeping reserve revisions

Even as prices were falling at the end of last year, the SEC’s rules on setting its price deck left companies with breathing room when they were booking their reserves for 2015. But with even the best-case scenario for the SEC price deck for next year coming in 44% lower for oil and 34% lower for gas, companies are going to see much of this year’s cushion disappear.

“Reserve replacements have not been as big of a deal over the past ten years, because companies were drilling wells with very high rates of return,” Scott Rees, chairman and CEO of Netherland, Sewell & Associates, Inc. (NSAI) told to Oil & Gas 360®. “Companies could make a few mistakes, and spend 10% to 20% of their budget on wells that didn’t make any money, because the returns on their other stuff was so good they were still seeing good reserve replacements and F&D costs.”

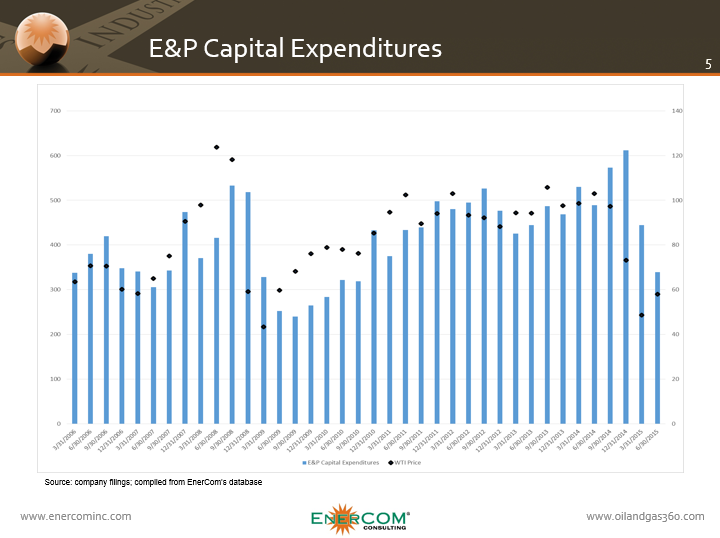

Now that oil prices are less than half of their value from this time last year, companies have right sized their capital expenditures to match their expected cash flows and well economics. To what degree companies decided to make those cuts, and what outlooks those companies chose to use could have a substantial effect on the companies’ five-year plans.

“Some companies were doing their year-end 2014 late enough in the year that their capital budget development plan was already back-loaded a little bit. They already had lower levels of activity in 2015 forecasted, and from there it would increase over those five years as prices were predicted to rebound. If they drilled nearly what they said they were going to drill at that lower level, they get the chance to add another year (at year-end 2015) to help make up for some of what was left over in their drill plans,” said Rees.

Said another way, companies that were conservative and said they would drill 50 planned undeveloped reserves (PUDs) in 2015, but only drilled 35, have five more years to work the additional 15 wells into their drilling plan while still trying to step up drilling over time.

Companies that were overly-optimistic about how much they could drill now face the challenge of working in more wells over the next five years, or losing those reserves. “[Companies] might have drilled half the PUDs they said they were going to drill, and now they have to find a way to drill the rest, or they go away,” said Rees. “They also have to, to some extent, reduce their 2016 program in order to match their 2015 program.”

Ceiling Test: impairment charges on lower reserves

Another challenge that will face companies as the SEC price deck lowers is having to write down reserves that exceed a ceiling test. A ceiling test is prescribed under SEC rules and determines the limit on the book value of oil and gas properties. The limit is calculated as the after-tax, present value of the future net revenues from proved crude oil and natural gas reserves. If the net book value of the reserves exceeds the ceiling, an impairment, or non-cash write-down, is required.

“The non-cash impairments will not mean a whole lot for reserves,” said analysts at EnerCom Analytics. “It will not affect cash-flow, but it does give us a window into what might happen to reserves at year-end.” Because the ceiling tests are done quarterly, they give a more frequent look at what companies are seeing as the value of their reserves on a three-month basis. For the six month period ending June 30, 2015, the 135 U.S. and Canadian listed E&P companies in EnerCom’s proprietary database have written down more than $58 billion through impairments. We note that those same companies reported SEC (or Canadian 51-101 equivalent) PV-10 values at year-end 2014 of approximately $717 billion.

No way around it

Most companies will be looking at lower reserves this year, said Rees. “Lower capital spending will reduce reserve replacements. There’s almost no way around that,” but some companies will be in a better position than others.

“It comes down to how optimistic people were at year-end 2014 … Those who were looking at prices staying lower for longer are probably going to have fewer revisions to their drilling programs at the end of the this year, and they are probably going to be in better shape than those who expected a faster rebound in prices.”

Hold On There Cowboy

This is a resilient industry. Yes, when commodity prices are up, company executives spend more to generate higher levels of revenues. Wellhead expenses also rise, giving the OilServices segment higher revenue and cash flow streams.

When faced with a lower and long-sustaining commodity deck, executives initiate changes – both long-term and positively disruptive, meaning applied technologies that increase production flows and proven reserve amounts, like applying a Core Laboratories (ticker: CLB) HERO to an extended reach lateral well. Using technologies that improve efficiencies, there are cost benefits that also result in improved rates of return on capital – even with a lower commodity deck.

At EnerCom’s The Oil & Gas Conference, management teams made the case that a well drilled today can generate a company-targeted return. President and CEO of Whiting Petroleum (ticker: WLL) Jim Volker stressed that even in the current price environment, companies can be successful.

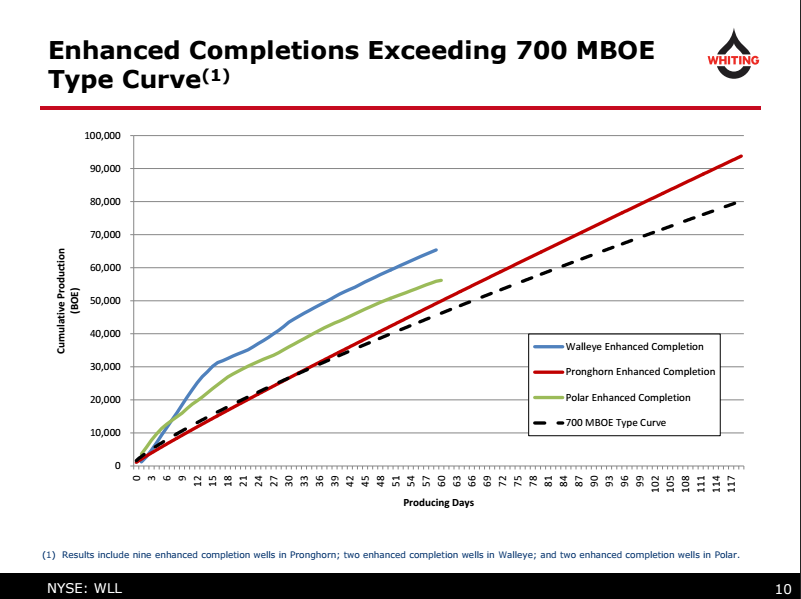

“We rigged the company to run at $30, $40 and $50 oil,” said Volker at EnerCom’s The Oil & Gas Conference 20®. “The plan is to continue to explore and develop inside discretionary cash flow… We can still grow.” Whiting is seeing 3-to-1 returns on its wells in the Williston by improving completions and lowering well costs, Volker said during his presentation.

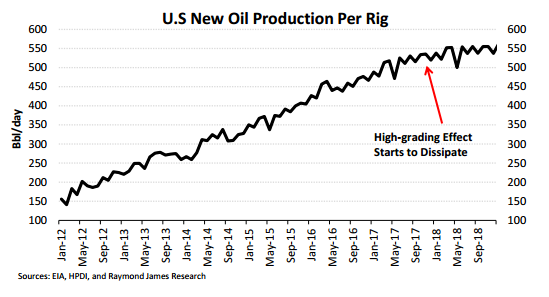

The increase in drilling efficiencies has been so significant in the U.S. over the last year that, even if the total U.S. rig count only recovers to about 75% of its previous high by 2017, U.S. oil and gas production growth should still exceed what was seen in late 2014, according to Raymond James. “Outside of the Fed, [the] reversal in U.S. oil and gas well productivity has been the single biggest factor of change in the U.S. economy, the U.S. trade deficit, global geopolitics, and even global currencies,” said the analysts’ note.

Focusing on efficiencies will only further enhance the effects of the positively disruptive technologies companies are using. If a company is paying less to get more from its drilling program, the application of those positive disruptive technologies per-well can only improve their long-term value as the volumetric quantity per well is increased and costs shrink.

Driving much of the efficiency will be new technologies. “In response to low prices, producers are getting creative looking for time-saving technologies that could have a more lasting impact,” a note from Wunderlich said. “We are seeing brand new technologies as well as the reemergence of older technologies … [and] believe E&Ps will continue to use newer and better rigs to become even more efficient.”

Whiting, for one, has turned to using a scanning electron microscope (SEM) to better understand how to get the most from its fracs. The SEM has allowed Whiting’s geologist to gain knowledge from “detailed mineralogy down to two nanometers,” allowing for “a true 3D representation of [its] reservoirs,” Whiting SVP Mark Williams said at AAPG in Denver.

Oil & Gas 360® spoke with Williams at Whiting’s Denver headquarters about the company’s hi-tech approach to understanding its reservoirs. Williams said multi-stage completions opened up the Bakken, but it also raised questions. “One of the fundamental differences was that the pore space (in the minerals) was much, much smaller than in conventional plays … We knew it was in the same size range as the oil molecules were asking to pass through this network of pores. It proved to be quire frustrating for us,” said Williams. Using the SEM and other technology to better understand the Bakken allowed Whiting to gain a true understanding for the resources in place, and how best to recover them.

Sign up for Closing Bell to be the first to know when OAG360 releases its exclusive video interview with Mark Williams and Whiting’s geologists about the use of SEM in the Bakken.

Click here to sign up.

No doubt that the commodity deck is not what it was a year ago. But the reserves produced per well are rising. It takes less drilling rigs to keep production flat for those companies with Tier 1 and Tier 2 acreage. Year-end reserve quantities and valuation will likely be impacted by the 50%+ downdraft in commodity prices, but management teams are taking action to mitigate and reduce the price deck impact.

Through persistent effort to improve returns, technological advancements and repeatability, oil and gas companies will continue to meet with success, even as prices remain low.