It’s been a wild week for the oil market.

Oil prices began an unprecedented drop on Monday that saw the West Texas Intermediate May futures contract, which expires on Tuesday, slide into negative territory for the first time ever. The May and June contracts remained under serious pressure Tuesday as the more actively traded June contract fell nearly 25%.

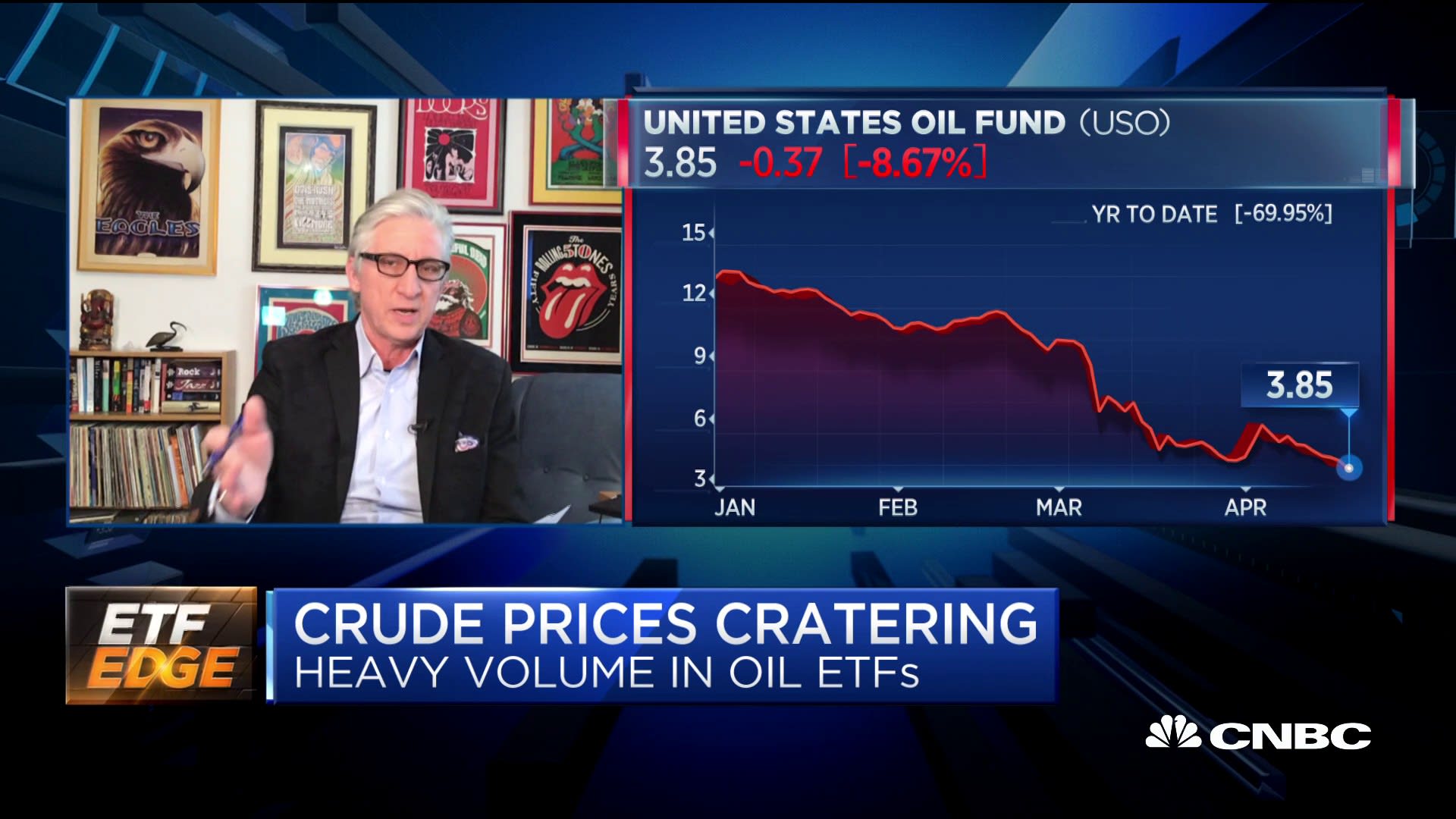

In the days leading up to the historic plunge, the United States Oil Fund (USO) — the market’s largest crude oil ETF by assets — saw notably higher trading volumes as short- and long-term buyers sought to express their views on crude, ETF analysts told CNBC on Monday.

Some market watchers criticized USO for playing a role in the implosion in oil prices given its sizable, roughly 25% position in the May futures contracts. But Mike Akins, founding partner of ETF Action, told CNBC’s “ETF Edge” on Monday that likely wasn’t the case.

“It’s important to note that USO is no longer in the May contract. USO’s methodology is to roll out of their contracts two weeks prior to expiration, so, actually, they rolled out of May into June the week of April 7,” Akins said. “So, with respect to what’s going on currently with … that huge disconnect between the price of May contracts and June contracts, it is not directly related to USO even though USO … does own a significant percentage of contracts of the month they’re currently holding.”

Akins was more concerned about how buyers might interpret the spike in USO’s trading volumes. The increase was evidenced by higher share creation in the fund, which is when an ETF issues new blocks of shares to sell on the open market.

“I think it’s important to point out to the audience that, historically … the price of USO has been an inverse relationship to the shares outstanding. That meaning that as price goes down, shares outstanding have historically gone up and vice versa. And the rationale for that is because [of] the demand,” Akins said.

“As volatility increases in the price of oil, the demand for this product goes up,” he said. “But it’s very important not to use that as a way to assume that people are getting long the price of oil, because these strategies, these are trading tools. They’re not allocation tools alone. And as a result, as you mentioned, flows don’t dictate the position of the actual traders.”

In short, if you’re interested in buying shares of something like USO in such a volatile time for the underlying commodity, it’s important to know what you own and understand the risk, Akins said.

You may be a long-term investor, but in times of heightened uncertainty, there could be people short selling, or betting against, the very same ETF you’re holding, he warned.

“I always say, with respect to these trading tools, there’s a lot of tools at Home Depot I can buy that I have no business using. And that’s very important to note, that a lot of these ETFs, you can buy them, but you need to really understand them before you start using them,” he said.

Bryon Lake, head of Americas ETF distribution at J.P. Morgan Asset Management, echoed Akins’ sentiments in the same “ETF Edge” interview.

“First of all, this is a really efficient way for investors to express a view. And so, if they’re able to use this ETF to express that view, that’s a tool that is helpful to their portfolio,” Lake said.

“The second thing is, just taking it back to a little bit of history here and why the futures contracts were invented in the first place, it’s next to impossible to get spot price or to store oil. It’s very expensive,” he said. “In fact, I was Googling it earlier [Monday]: I think a used oil tanker is about $42 million right now and you can only hold about 2 million barrels of oil on that. So, you create a futures contract in order to give yourself the ability to get the exposure or hedge your exposure or your risk within your portfolios.”

When packaged in the ETF structure, that can become “a helpful tool for investors to express their views,” Lake said. “They just need to make sure they understand how they work.”

USO fell almost 18% to a new all-time low of just above $3 a share.

[contextly_sidebar id=”mJ1jW405UfrzGEzjdhxRVPWdtz0plvtX”]