An Exclusive Interview with Keith Burdette, Secretary of Commerce for West Virginia

An Exclusive Interview with Keith Burdette, Secretary of Commerce for West Virginia

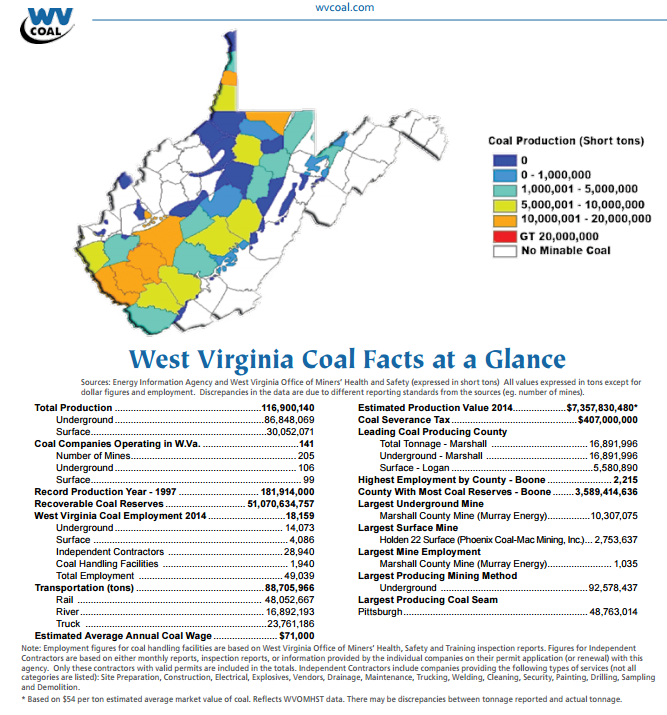

Coal has powered West Virginia’s economy for centuries. Generations of West Virginians have come and gone in the Mountain State, and its stalwart blue-collar coal industry continuously attracts the next wave of young people in search of a career in the rolling hills of Appalachia.

But the latest generation of West Virginia coal miners—and the ones coming up behind them—are faced with unprecedented uncertainty: do we have a future?

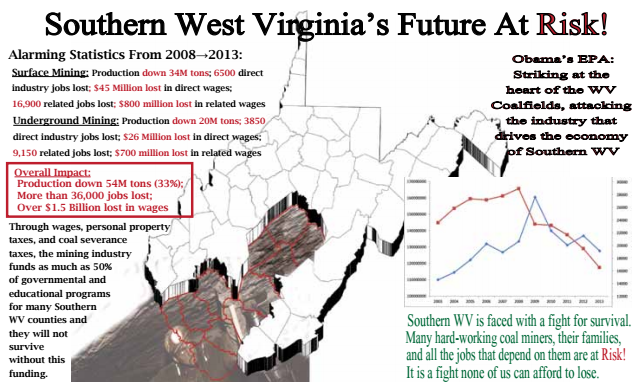

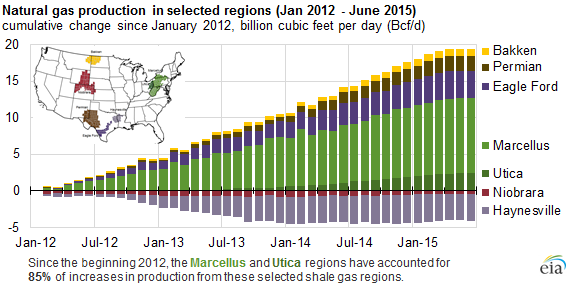

The Environmental Protection Agency’s severe regulatory enforcements on coal-fired power plants, combined with the evolution of natural gas as a less carbon intensive fuel generator—sometimes referred to as a “bridge fuel” by environmental policy makers—are threatening the viability of the Appalachia’s most relied-upon resource.

Keith Burdette, Secretary of Commerce for West Virginia, has watched the state’s economy develop throughout his lifetime. Burdette was elected to the West Virginia State Senate at only 27 years of age and named the President of the State Senate seven years later in 1989. Throughout the next two decades, he held various legislative positions while starting and managing his own consulting firm.

Burdette is currently West Virginia’s Secretary of Commerce, a role he assumed in 2010 after the election of Governor Earl Ray Tomblin.

Secretary Burdette spoke to OAG360® from his office in Charleston, West Virginia, in this exclusive interview.

WEST VIRGINIA’S COAL INDUSTRY

OAG360: Would it be fair to say that your state is being attacked, considering the effects that the Clean Power Plan will have on West Virginia’s work force and overall economy?

BURDETTE: I don’t get into the war on coal. I leave that to the other political leaders in the state.

However, there are a multitude of issues that are creating challenges for coal. Federal regulations, no question about it, are placing a burden on the coal industry. The cheap pricing and abundance of natural gas is placing a burden on the coal industry. Remember, seven years ago we were trying to figure how to import natural gas. Now we’ve got it coming out of our ears. In West Virginia, there are other dynamics. In the southern coal fields, the difficult topography makes it more expensive to mine. We end up competing against pit mining in the Midwest, which is actually cheaper to do.

West Virginia, Kentucky and Virginia Provided the Fuel that Powered the U.S.A.’s Growth

I don’t throw the blame at any one issue, but I think the Administration does need to consider that their changes in policy are creating a huge economic challenge in the coal fields, especially in Appalachia. It doesn’t matter if you’re from eastern Kentucky, Virginia or from southern West Virginia. These are all very topographically challenged areas that have provided coal to this country since before the Industrial Revolution, and has quite literally provided the fuel for this country’s growth.

Those southern coal fields have largely produced a one-item economy… What exactly do you do with 100,000 people? These people have been in the coal business for multiple generations and have earned a great deal of money. Now we’re trying to convince coal miners to retrain for other careers, because we’re not going to need as many of those workers in the future, regardless of what happens with the EPA plan.

Coal Provided Six-Figure Incomes Straight out of High School, but those Livelihoods are Drifting Away

If you live in southern West Virginia and were willing to go underground and mine for coal, you could have earned six figures straight out of high school if you were willing to work overtime. So now we we’re trying to convince them to go back to school, incur some debt, and then make half as much money as they used to. So it’s not just an economic challenge, it’s a cultural challenge too.

Now, I do happen to believe that challenges present an opportunity to create diversity in the coal regions. But it’s not going to be easy for many of us. It’s going to require a lot of investment to get the infrastructure in place because everything is currently suited for the coal industry. I don’t want to sound too needy here, but I think the government kind of owes it to us. And I’m not meaning just West Virginia, I mean the whole region. The [government] policy is changing the livelihoods of many, many people. And they need to recognize the fact that their changes are expected to come along pretty quickly, and they need to give hope to those people who are watching their livelihoods drift away from them.

We’re Just Training People to Leave

I encourage the Federal Government to look at this situation with compassion and recognize this is not simply a situation of training people. Right now, we’re just training people to leave, because currently, the jobs are not in the coal fields. We’re doing way more than training people, we’re repositioning entire communities.

OAG360: Would you say you feel blindsided by these regulations?

BURDETTE: Well that’s a great question, and I’m not sure that I have a great answer for you. I don’t feel blindsided, but I think the magnitude and the speed of the reaction has been surprising to us.

State’s Revenue Drop is Dramatic and Massive

I’ll give you an example as far as the state budget is concerned. This fiscal year in West Virginia started on July 1, and it was expected to be a break-even year. Sixty days into the year at the end of August, we were missing our revenue estimates by about $12 million – not terrible, certainly manageable. But then by the end of September, we were $60 million down. At the end of October, we were $90 million down. So, the speed by which it has affected the state’s revenue caught everybody off guard. I don’t think anybody expected it to be that dramatic and massive.

Did we see the cost from the battle with coal? Yes. Did we understand that the policies in Washington, DC, were going to make coal sales more challenging? Yes we did. But, that doesn’t make it any easier to turn the ship around. If you prefer to take a glass half-full approach, I think everybody understands that there’s going to have to be some pretty dramatic changes. All of these families are like anybody else – mouths to feed, mortgages to pay, car payments to make.

Just Relocate and Find other Jobs

Consider this equation also: some people say, “Well, you just need to relocate and find other jobs.” But it’s very hard to relocate when you have basically your entire life’s savings tied up in your house and you can’t sell it because everybody is leaving town. Who would buy it now? So there are a lot of challenging problems that won’t be solved with what I call the ‘bumper sticker mentality’. It will require some very fundamental shifts in the coal fields. We have to give these families some hope.

WEST VIRGINIA’S NATURAL GAS INDUSTRY

OAG360: Broadly speaking, can you talk about some of the trends and differences you have noticed in West Virginia as the Marcellus and Utica shales have emerged in oil and gas drilling and production?

BURDETTE: Well you’ve probably noticed that energy states are struggling right now from what has become a perfect storm. The abundance of both coal and gas has driven commodity prices into the basement. Coal is struggling. Oil is, quite frankly, at almost record lows. Of late, the state’s been struggling to keep up with the changing dynamic. We have some severance taxes in West Virginia and those have seen some pretty dramatic changes.

That’s the bad side, but the trend lines overall have been good. I think last year we had about 13,000 West Virginians work at wages exceeding $1 billion, and wages from oil and gas jobs have increased by about a half billion dollars in just the last seven years. A lot of the change is being driven by infrastructure building. There have been a lot of gains in pipeline construction and support activities for natural gas. In the fourth quarter of 2014, employment was at 13,834, but in the first quarter of 2015, employment was down fairly significantly to about 11,666. However, the first quarter of every year is usually the lowest employment period due to seasonality.

That’s the bad side, but the trend lines overall have been good. I think last year we had about 13,000 West Virginians work at wages exceeding $1 billion, and wages from oil and gas jobs have increased by about a half billion dollars in just the last seven years. A lot of the change is being driven by infrastructure building. There have been a lot of gains in pipeline construction and support activities for natural gas. In the fourth quarter of 2014, employment was at 13,834, but in the first quarter of 2015, employment was down fairly significantly to about 11,666. However, the first quarter of every year is usually the lowest employment period due to seasonality.

Much Needed Natural Gas Infrastructure

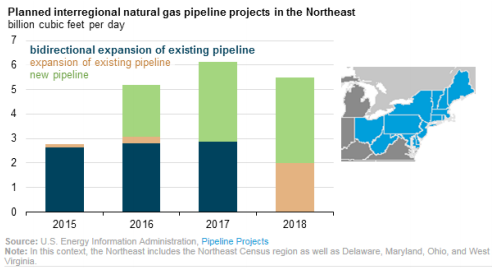

But the glut and the low prices, while they haven’t exactly put the industry in hibernation, have certainly slowed down drilling. I think the larger companies are still spending significantly on their infrastructure to support the wells that they’ve drilled. All things considered, we’ve still drilled faster than we can build out [pipelines and other infrastructure]. That’s why we’ve seen the larger companies shift to investing in long-term infrastructure, and we believe that’s a solid strategy.

Pipeline infrastructure as a whole began to decrease after 2012, the year it peaked. That trend may reverse itself again – there is a logjam of large pipe projects including several still in play that require FERC approval. One is a $3 billion project that goes from Wetzel County to a site in Virginia, and there are several projects of that magnitude that are on the drawing board to try to get our product to market. If we can get some others approved in the course of the next twelve months I think you’ll see those numbers start to increase again.

Pipeline infrastructure as a whole began to decrease after 2012, the year it peaked. That trend may reverse itself again – there is a logjam of large pipe projects including several still in play that require FERC approval. One is a $3 billion project that goes from Wetzel County to a site in Virginia, and there are several projects of that magnitude that are on the drawing board to try to get our product to market. If we can get some others approved in the course of the next twelve months I think you’ll see those numbers start to increase again.

There’s a pretty clear shift in industrial usage away from other fuels and into natural gas. We’re seeing a lot of companies, especially big users, make the conversion, including quite a few from coal to natural gas. Given the price structure and other considerations, it’s not particularly surprising. But overall, we’re still bullish and optimistic on the price of natural gas – we see it as a growth industry for us. We’ve only permitted about 10% of the fields in West Virginia, so there’s still a lot of opportunity.

The number one challenge moving forward, however, is simply getting the gas to the marketplace.

OAG360: Was the infrastructure buildout a focus of the Tri-State Shale Summit that concluded in October? Or is that mainly a general collaboration between Ohio, Pennsylvania and West Virginia?

BURDETTE: Actually, the states have never jointly collaborated on infrastructure projects. In any sense, we’d have to take baby steps on that subject.

The majority of the Tri-State Conference was really about identifying future trends and how to respond to them, but it was also about coordinating things that we know how to coordinate. We won’t ever stop competing for the next big project that comes along – there’s no sense in acting like that won’t occur, although I think all three states realize that development (like the ethane crackers, for example) have a big regional impact. We’re still looking to compete for those individually, but it’s clear that the region needs to develop collaborative efforts as far as attracting and building the work force.

Governor Tomblin (WV), Lieutenant Governor Taylor (OH) and Governor Wolf (PA) signed that agreement. Although it was admittedly a modest first step, it was, in fact, a first step. I think clearly developing an infrastructure that supports the region is going to be very, very important for all of us.

Governor Tomblin (WV), Lieutenant Governor Taylor (OH) and Governor Wolf (PA) signed that agreement. Although it was admittedly a modest first step, it was, in fact, a first step. I think clearly developing an infrastructure that supports the region is going to be very, very important for all of us.

Ethane Storage Needed in West Virginia to Allow the State to Compete with the Gulf Coast

We talked about the needs of West Virginia to develop a storage structure, especially for ethane since it’s such a big byproduct of the natural gas. We can compete with the Gulf Coast much more effectively if we have a storage strategy that creates consistency in supply and price, along with a reliable network that can supply gas to the region. These are longer range goals, but nevertheless, you have to start developing a strategy now.

OAG360: A local newspaper named The Exponent Telegram published a piece suggesting severance taxes be raised on natural gas liquids in order to keep more revenue from West Virginia’s natural gas production in the state. Has the state administration touched base on that yet?

BURDETTE: I believe you’re referring to a study conducted by a state group that encouraged us to create a tax credit that would offset raising tax prices on ethane.

We don’t have an immediate plan to do that, and that’s because we don’t have a network of users yet. So we’re kind of cutting off our nose to spite our face, but Governor Tomblin has been very aggressive in telling our producers that we expect them to give attention to every opportunity that comes along in our region and to create value-added manufacturing that comes along with the production of the Marcellus region.

While that certainly seems to be a no brainer, the truth of the matter is that sometimes those companies have trouble putting together supply contracts for a lot of different reasons. It can be complicated to develop those contracts for five, seven or even 20 years out.

But, we’ve made it very clear to our suppliers that we expect them to give it special attention. I would say they have done so, for the most part. I don’t think we have to beat them over the head, but we’re certainly not above beating them over the head if we can’t get a cooperative contract for the region. I don’t think that’s going to be a short-term need, but it is very much on our mind. That’s an opportunity that needs to be available in our region, first and foremost.

OAG360: What’s a typical storage season like for West Virginia, considering you’re such a big storage provider to the northeast and injection rates are above five-year highs?

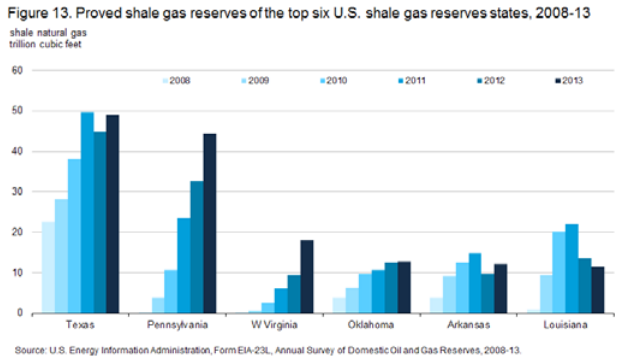

BURDETTE: I’m not sure this will be a big injection season, quite honestly because we’re still producing more than we can sell. Our annual delivery capacity this year is about 260 to 262 Bcf. The only state in the region that surpasses that is Pennsylvania. So we can meet our winter demands without storing gas from other states. We used to have that need, but we don’t any more. In fact, most of the gas that we sell to the northeast is still difficult to get there because of the lack of infrastructure. So, we haven’t asked for any kind of report on the injection season, but I believe the builds should be very modest.

OAG360: You touched earlier on regional jobs and employment. What have the local universities done to take advantage of those opportunities?

BURDETTE: For specifics, I’d had to defer you to President Gordon Gee’s office. But in general, West Virginia University and President Gee understand this opportunity. Mr. Gee was previously the President of Ohio State University and he knows what’s at stake. I believe he has been aggressively engaging companies and others in a discussion about the “what ifs,” and are developing several programs.

Gee Wants to Capitalize on the Shale Opportunity

On a related note, President Gee was actually at the Tri-State Shale Summit the whole time. It was funny, college presidents usually come in, give a speech and then run out the door, but President Gee sat in the back of the room for almost the entire day and he wasn’t even on a discussion panel. He just came to learn and listen – he certainly understands how significant this opportunity is, and how we have to be careful not to squander it.

OAG360: Have you and Governor Tomblin taken a stance on the Clean Power Plan?

BURDETTE: Governor Tomblin announced at the Shale Summit that we will submit a plan. It makes no sense to have the federal government impose something on us. But there is an official release on the Governor’s site that says we will conduct a feasibility study and move forward from there.