How? Treat the $1 billion as a thousand $1 million decisions – McCollum

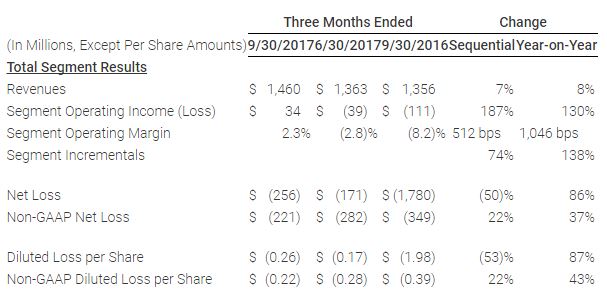

Swiss-based oilfield service giant Weatherford International plc (ticker: WFT) reported a net loss of $256 million, or ($0.26) per share on revenues of $1.46 billion for the third quarter of 2017. Weatherford reported segment operating income of $34 million.

Weatherford President and CEO Mark A. McCollum said, “Our highest priority is free cash flow generation.” McCollum said the company was targeting operating results improvements of $1 billion. “We are driving this plan on a timeline to achieve these savings over the next 18-24 months. Specific actions to achieve $300 million in cost savings are already underway.”

Financial overview

Weatherford said that the increase in Q3 2017 net loss compared to Q2 was primarily due to the $127 million gain on the outstanding warrant in Q2 that did not repeat, which was partially offset by improved segment operating income in Q3.

Non-GAAP adjustments, net of tax, of $35 million in charges for Q3

- $34 million in severance and restructuring charges

- $7 million in charges related to the fair value adjustment of the outstanding warrant

- $6 million in other net credits

Cash flow and financial covenants

Net cash used in operating activities was $243 million for Q3 2017 and includes cash payments of $183 million for debt interest, $46 million for cash severance and restructuring costs, and $30 million for the final installment of the SEC legal settlement.

In the third quarter, capital expenditures of $65 million increased by $23 million or 55% sequentially, and increased $3 million or 5% from the same quarter in the prior year.

New technology commercially released in Q3

- The AutoTong™ system is the world’s first technology to automate pipe makeup and provide autonomous connection evaluation. By eliminating the element of human error from the physical makeup and connection validation processes, the AutoTong™ system sharply increases the safety and efficiency of well construction operations.

- The ISO Extreme retrievable well barrier is qualified to ISO 14310 V0 standards for gas-tight isolation in high-pressure, high-temperature wellbores. The barrier has a large operational envelope to reduce the loss-of-containment risk in extreme environments. It can be deployed using a variety of options, including electric line, slickline, tubing and coiled tubing.

- The PressurePro® control system is a fully integrated rotating control device (RCD) and choke system for wellbore pressure management on land, it combines the SafeShield® 5M RCD with the PressurePro® set-point choke. The system can be used for managed pressure drilling (MPD), underbalanced drilling and foam drilling applications.

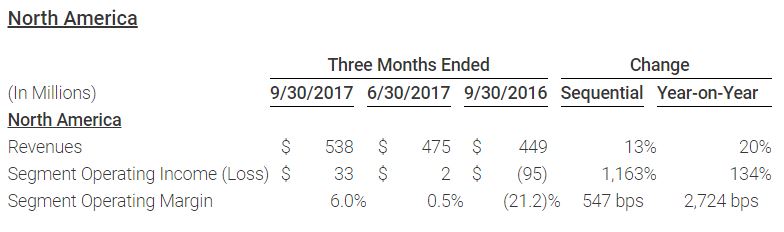

North America highlights

- Weatherford was awarded a contract to install the ForeSite™ production optimization platform on approximately 1,800 reciprocating-rod lift units in the United States

- Weatherford was awarded a two-year, extendable contract for MPD services in the Gulf of Mexico. The contract scope includes work in waters offshore the United States, Mexico, Trinidad and Tobago.

- By deploying the MetalSkin® monobore openhole liner, Weatherford enabled an operator in the U.S. Gulf of Mexico to extend existing casing and thereby access additional pay. The operation enabled immediate access to additional production without the time and expense of installing new production facilities.

International highlights

- By deploying an MPD and underbalanced drilling program for a customer in Colombia, Weatherford enabled the operator to drill an additional 3,000 feet beyond the planned target depth. Even with the additional length, the well was drilled 7 days more quickly than previous wells in the field. The customer also saved nearly $1 million by eliminating costs related to mud losses.

- Work on the integrated services contract in the shallow-water Gulf of Mexico continued through Q3. Weatherford worked with the operator to improve well construction procedures, which delivered a reduction of 43 days in rig time.

- Weatherford had record-setting directional drilling results in several fields across Russia. In one well, the company had a daily drilling progress of 1,125 meters and acquired high-quality logging-while-drilling data in the production casing section, eliminating the need for an additional logging trip.

For a full list of international highlights and financial details, the Weatherford press release can be found here.

Conference call Q&A

Q: How will the business get towards positive free cash over the next several quarters?

WFT CFO Bausch: So for the fourth quarter, I think one thing to understand is the third quarter, to put it in perspective. So in the third quarter we had a working capital build, it’s about $140 million. Part of that capital build was for projects we were executing in the fourth quarter, and that is about $80 million broadly. We had a little bit of delay on customer collections because of Harvey and people were flooded out, so we’re going to recover that and then go back to normal in the fourth quarter.

We also had an inventory build in the third quarter for some contracts which are going to be delivered in the fourth quarter. So you’ll see an improvement in working capital. You’ll also see a reduction in the interest payment. As I said Q1, Q3 usually is high on interest cash payments and fourth quarter will come down. From our perspective, we have no SEC payment, that was the last one we paid this quarter.

If you look into next year overall, we haven’t finished our plan yet completely, so we’re working on that as we speak. But we’re targeting to go on a breakeven cash flow level for 2018. We still have working capital to work out, and our inventory levels are still pretty high, so we have some cash to get out of that. You have some cost improvements which we’ll see going in, and we look at capital efficiency overall to make sure that our capital expenditure remains very diligent.

Q: Chesapeake has done a debt deal, Transocean has done a debt deal. The debt people I talked to said the window is still open. Is there any consideration of maybe pushing maturities out another couple of years, if you don’t raise your interest cost much and give yourselves a little more breathing room to get to your $1 billion in savings?

WFT CEO McCollum: We’re looking at that, but it has to make economic sense, so you have to look at the bonds trade and what the rates are you can get. When it makes economic sense, we’ll do that. But right now, based on our analysis, it’s not the right timing.

Q: Can you talk a little bit about the incremental $700 million? You estimated the next 18 to 24 months. Is most of that, in terms of the cycle time for that realization, is that closer to the 18 months or the 24 months?

CEO McCollum: I would say closer to 24 months. Where the incremental plans are going to necessarily come from, are going to be areas that require process change to achieve some of the savings. I mean, the $300 million are projects that – we have the $115 million, that was the organization realignment. The incremental from there are projects that were already underway, to be completed by the middle of next year.

Just to give you one example, in supply chain and in procurement and supplier management, we have some level of category management, but we don’t category manage as much as we possibly could. The way that we’ve been organized hasn’t facilitated the gathering of data to be able to go in and negotiate well.

The second thing is that we haven’t had any ability to track and enforce on-contract buying. We might have the right contract in place, but our on-contract buy is a very low percentage, whereas benchmarking would tell you it should be a very, very high percentage. And when we just take the difference there, the numbers start accumulating to be a fairly large number.

My anecdote to the organization is this $1 billion is a thousand $1 million decisions and there’s a lot of that that’s happening across the organization that we’re going to target and go after.