Russian giant Rosneft Oil Company (ticker: ROSN) reported a Q1 2018 net income of USD$1.5 billion (RUB$81 billion) with a spending budget of $3.9 billion (RUB$223 billion).

More multistage fracs, horizontal wells

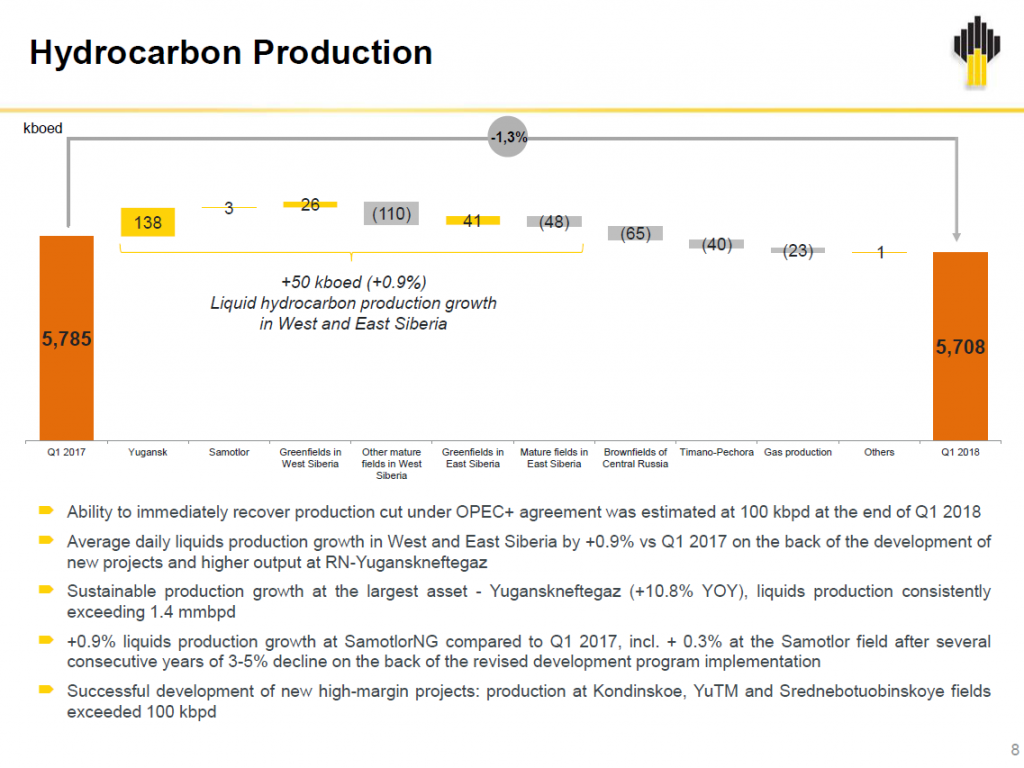

The company produced 5.71 MMBOE in Q1 2018. The number of new wells commissioned increased by 22% to 809 wells, Rosneft said, with horizontal wells up to 39%. The number of new horizontal wells with multistage fracs is up by more than 65% year-over-year.

In the quarter, development drilling was at 2.8 million meters, with in-house drilling at 60%.

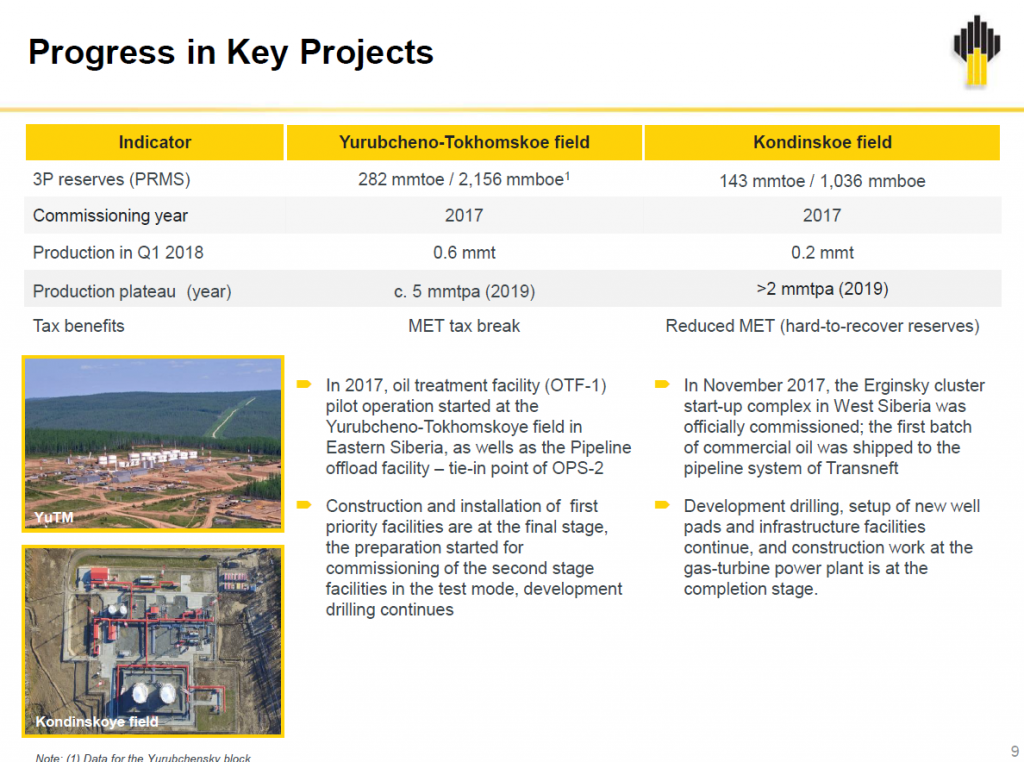

Key projects

Rosneft’s largest asset, RN-Yuganskneftegaz, demonstrated a stable production growth. On the back of advanced drilling technology applied last year and development of the Tyumen suite, oil output is exceeding 190 kilotons per day, up by 10.8% year-over-year.

According to the company, production levels at the greenfields – including the Kondinskoye, the Yurubcheno-Tokhomskoye and the Srednebotuobinskoye – exceeded 100 MBPD.

In Q1 2018, Rosneft’s average production was reported to be 5,708 MBOEPD. In Q1 2017, the company produced 5,785 MBOEPD.

Conference call Q&A excerpt

Q: Your production capacity is down 1,000 barrels a day, how long to recover this production?

Rosneft: Thank you very much for the opportunity to respond to a question in as far as being able to recover our pre-OPEC level.

Principally speaking, if you recall, we restricted our output based on the capability to be able to quickly come back to the production level which we have before OPEC contract.

So, the level of possible recovery in terms of the timeframe for this particular purpose will take up to two months, while the main output in terms of the biggest volume of recovery, we’ll be able to do within just 30 days.