Water is not a traded commodity in the U.S., like iron ore, copper or coal, but it has become a critical factor to the companies that produce oil and gas from North America’s shale basins

One of the biggest environmental and oil and gas production cost factors in the ongoing development of the U.S.’s massive shale basins is how the industry handles water.

“Water is a huge issue,” Whiting Petroleum’s SVP of Exploration & Development Mark Williams told Oil & Gas 360®. “It’s a major component in all of our plays and will likely increase in importance going forward.”

In this special report, Oil & Gas 360® takes a detailed look at the topic of water and why operators need it, how they use it, handle it, treat it or dispose of it. Water is critical to production from the shale basins.

In the major U.S. basins, water produced along with the oil and natural gas may total volumes as high as 20 million barrels per day

According to the EIA’s Drilling Productivity Report, the major U.S. shale basins are producing 6.039 MM barrels of oil per day combined. Looking at the typical water cuts in each basin tracked by the USGS, and looking at the oil produced from each basin, it’s reasonable to assume that between 15-20 million barrels of water are being produced every day from the major onshore U.S. shale basins. The National Energy Technology Laboratory reports that water production from the U.S., including (1) the major onshore shale basins, and (2) Alaska, and (3) the Gulf of Mexico, is roughly 57 million barrels per day. However, the focus of our report is production coming from the major U.S. shale basins.

The USGS calculates that in 2010, about 355,000 million gallons per day of water was withdrawn for use in the United States for domestic consumption–including household use, irrigation, hydroelectric power generation, commercial and industrial use. (All 2010 water use information is from the report Estimated use of water in the United States in 2010.) That converts to 8.5 billion barrels of water per day.

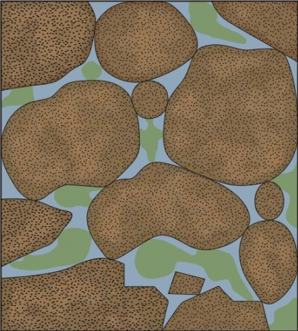

How much water is already in the formation and where is it coming from: water cut

The term water cut, or water saturation, relates to the percentage of formation’s pore volume that is filled with water. If the pore space is completely saturated with water, the water cut will be equal to 1, or 100%. According to IHS Markit, typical water cut values of produced liquids in the Permian range from 30% to 90%, while the Eagle Ford demonstrates produced water cuts closer to 30%. Water cuts in the Bakken and Three Forks formations are typically lower than the Permian (15-25%).

According to a study by University of North Dakota, water cuts tend to increase over time. As hydrocarbons are depleted from the reservoir, the decrease in reservoir pressure allows for increased water migration into the rock formations. Also, as reservoirs are developed over time, new wells are drilled farther from the center of the basin, and they display higher water cuts than the primary wells drilled into the formation.

Produced water

Produced water is water that is trapped in the target formations that is brought to the surface during oil and gas operations. The water trapped in the underground formations has been in contact with the hydrocarbons for centuries, and its composition is influenced by geology of the formation and the hydrocarbons themselves.

Produced water includes water injected into the formation, water pre-existing in the formation, and any additives included during drilling, production, or stimulation.

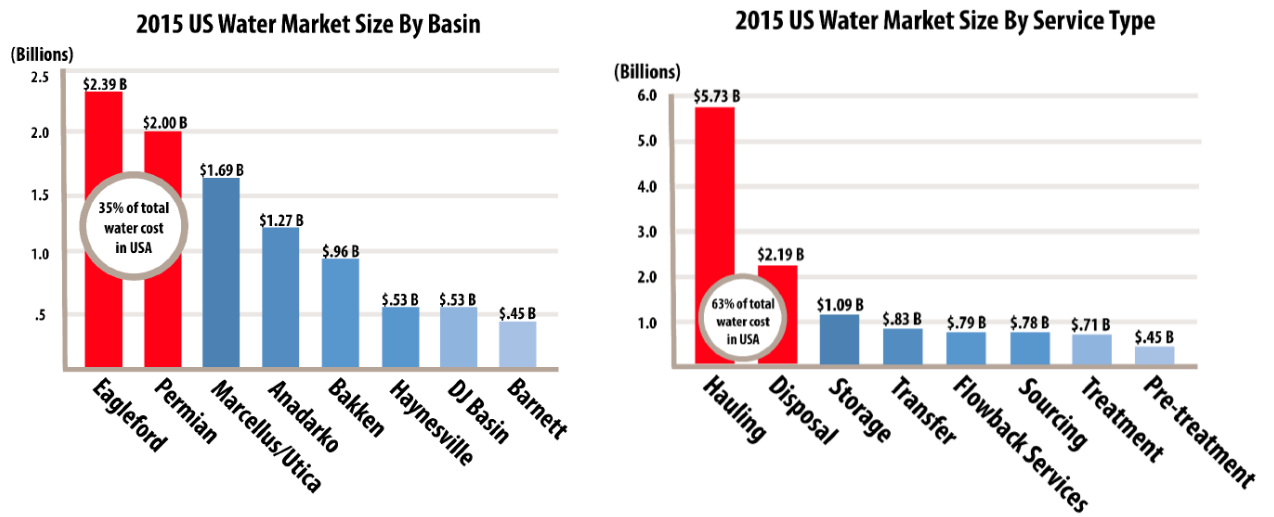

Transporting is the main cost when it comes to handling water

The main cost associated with handling produced water is transportation. To cut back on transportation costs, disposal wells are being drilled and pipelines are being constructed within reasonable proximity to oil and gas operations. In addition, alternative methods are being explored for water treatment that can cut back on water transportation costs.

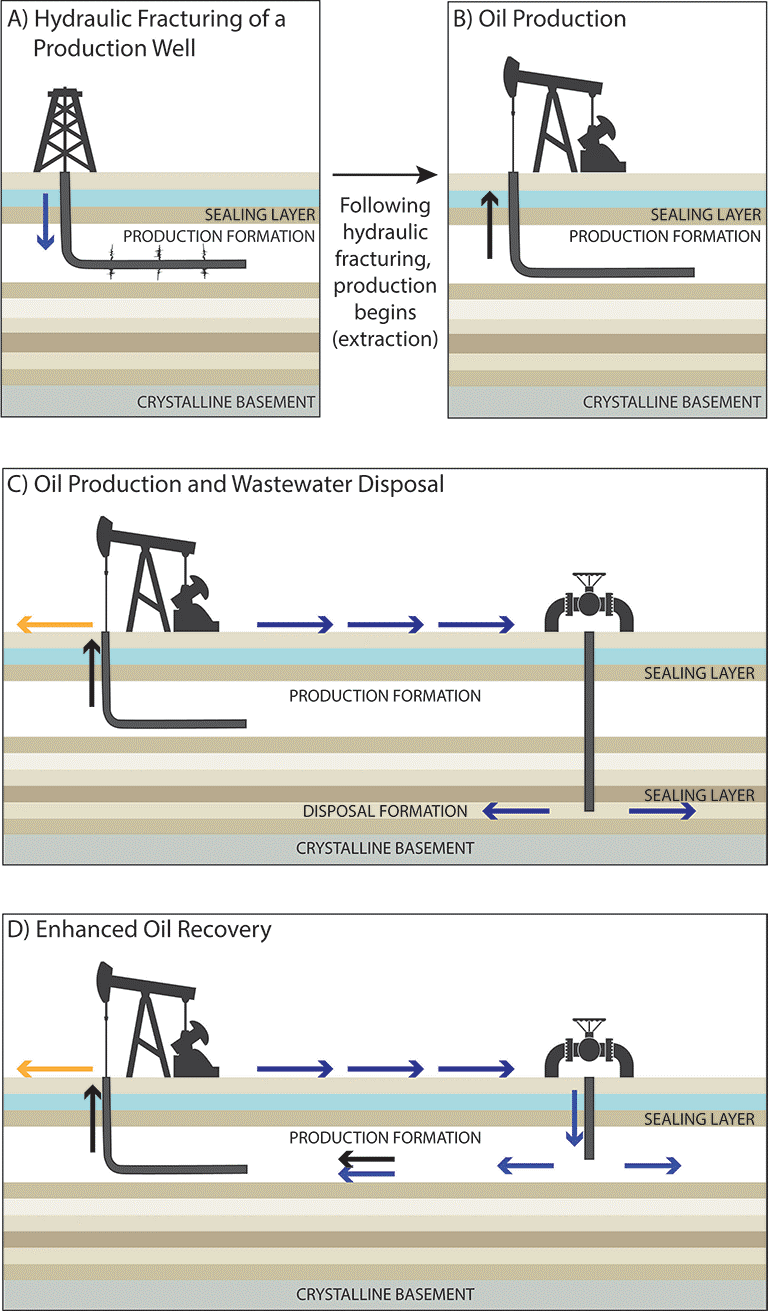

Why hydraulic fracturing needs a lot of water – some background

In unconventional reservoirs, hydrocarbons were deposited in tight formations with low hydraulic connectivity. To economically produce hydrocarbons from unconventional reservoirs composed of shale or tight (low permeability) rock, the reservoir must be stimulated through a process such as hydraulic fracturing. Fracing increases the flow capability by inducing cracks, and fills them with a permeable media that will allow fluids (hydrocarbons that can be sold) to move out of the reservoir rock and into the wellbore.

In the unconventional plays like shale, because the hydrocarbons were deposited into the tight rock formations, the water-oil-ratio (WOR) will be lower than in conventional reservoirs that have increased pore space and connectivity. Fracing requires large volumes of water to be pumped into the reservoir to carry proppant and other fluids into the fractures. That water flows back after the frac is complete. The flowback water is considered produced water and must be handled in the same manner as other produced water.

Haliburton’s strategic business manager speaking to Bakken Breakout said that water flowback volumes can range between 600,000 to 900,000 gallons (roughly 14,000 to 21,000 barrels) per well. It’s a lot of water to handle and transport.

Due to the high-cost of using freshwater for hydraulic fracturing during well completions, many companies are considering re-using the brackish produced water instead. Companies considering this sustainable form of fracing include: Apache Corporation, Fasken Oil and Ranch Ltd, Energen Corporation, and Newfield Exploration Company.

Hydraulic fracturing technology has revived production in the Permian basin. For a century the Permian has produced from conventional reservoirs. But the advent of fracing has allowed companies to tap into immense oil reserves held in less permeable unconventional shale formations in the same area. The new technology is turning the historic conventional Permian play into an unconventional play, according to a study performed by the University of Texas, and horizontal drilling and fracturing have almost brought oil production back up to the 1970s peak. The U.S. Geological Survey estimates that the Permian’s Wolfcamp Shale formation alone could hold 20 billion barrels of oil, making it the largest unconventional resource ever evaluated by the agency.

When comparing conventional and unconventional reservoirs, the University of Texas researchers found that unconventional wells require much more water than conventional ones for drilling and completions. However the unconventional wells will produce much less water over time once production starts, the researchers said.

Handling the produced water

How much water is produced? Typical volumes of water produced vary from 1-7 barrels for each barrel of oil. The method used for produced water handling depends on the geology of the formation from which the water is being produced, as well as the technology and infrastructure available in the region.

Some basins produce salt water, some brackish, some fresh

An article published by the U.S. Department of the Interior examines how different basins produce water with varying compositions. For instance, due to the high salt content in produced water from the Bakken, many operators have no choice but to pay for transportation to dispose of the produced water.

Geology during deposition

Salt concentrations in the underground rock formations are a result of the environment during deposition millions of years ago. Basins that produce water with a lower salt concentration can better utilize alternative solutions for water disposal. Basins like the DJ, Piceance, and San Juan were deposited in a brackish marine environment while basins like the Powder River were formed in a fresh water environment.

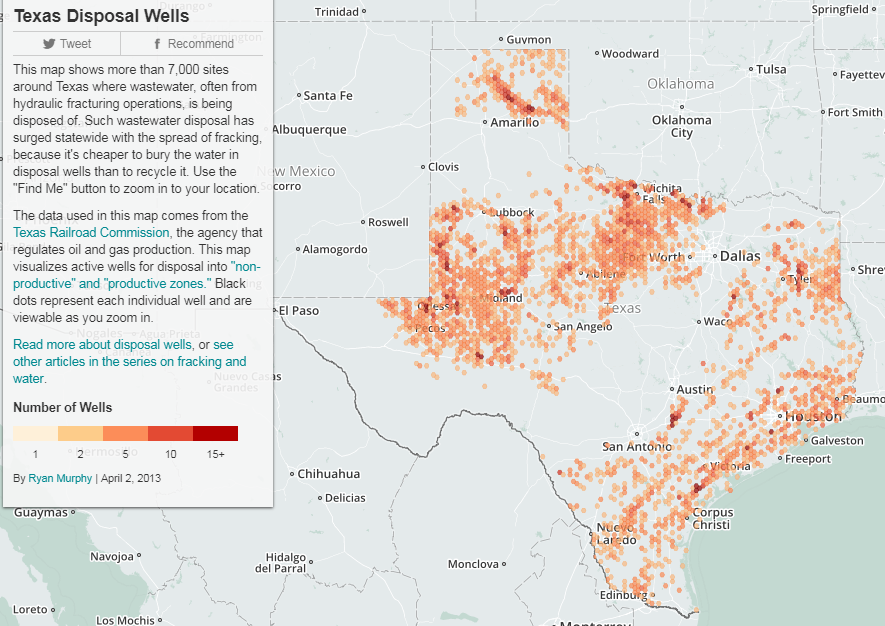

Most operators pay service companies to truck the water away to dispose of it by injecting it back into the subsurface rock

Service companies will truck produced water from the well head to disposal areas where the water is injected into porous media thousands of feet below the drinking water table. The typical lithology of the porous media is either sandstone or limestone. The produced water, as mentioned earlier typically contains a high salt content along with other chemicals, heavy metals, and naturally occurring radioactive minerals.

Injection wells and seismic activity

One drawback of injecting waste water underground is a phenomenon that has come to the forefront in recent years—increased seismic activity in the area. Studies have linked the seismic activity not to drilling and completing oil and gas wells, but to injection wells.

USGS (U.S. Geological Survey) announced its own findings about injection wells and the link to seismic activity.

The USGS found that induced seismic activity can occur at distance of 10+ miles away from the injection well. Also, the USGS study found that not all injection wells will cause an increase in seismic activity. There are multiple parameters that affect the ability to induce earthquakes, including:

- injection rate and total volume,

- pre-existing faults,

- stresses in the rock matrix, and

- hydraulic connectivity of the pathways for the fluid to travel through.

Produced Water Disposal Wells in Texas

EOR

Enhanced oil recovery (EOR) methods include injecting water into a pressure depleted formation with the idea of moving residual hydrocarbons into the well bore where they can be pumped to the surface. EOR historically has been used in older oil fields to get the last hydrocarbons out of formations late in the formation’s production lifecycle.

Using waste water as a mechanism of EOR is a widespread practice whereby produced water is injected into the hydrocarbon producing formation. The injected water increases the reservoir pressure, and since water is denser than oil, it pushes the oil towards the producing well.

But the relatively new possibility of inducing earthquakes with EOR injection into producing formations presents less risk than commencing water disposal into an untouched formation, the study found.

While in conventional reservoirs, it is common for the produced water to be used as a mechanism of EOR, in unconventional reservoirs injecting into the producing formation is much more difficult because of the low permeability of the rock.

Due to the increasingly more common link between injection wells and seismic activity, technologies that recycle and reuse produced water are appealing for unconventional reservoirs. But how do you get the water to the treatment location and how is it treated?

Source: USGS

Trucking water in for fracing, and trucking the produced water out: not ideal in heavily populated areas

With oil production projected to increase in the Permian and Williston basins, the volume of produced waste water will grow. Because of poor road development, heavy traffic, costs of trucks, and downtime spent loading the trucks, the primary method of water disposal—trucking—has plenty of room for improvement.

Trucks are constantly bringing water, equipment, and chemicals on sight and transporting wastewater and oil away from the well. To reduce the number of trucks on the roads, E&P companies are implementing water pipeline construction and drilling disposal wells where possible and economically prudent, but different basins have different challenges to overcome when considering pipeline construction.

Layflat hoses

Another method for water transportation is to pump it through layflat hoses. A layflat hose is durable, abrasion resistant, portable hose that can transport water distances greater than six miles. Layflat hoses are less prone to corrosion than metal pipelines due to their chemical structure. Layflat hoses are most commonly used as a temporary solution while operators and service companies plan pipelines to remove produced water over extended periods of time—i.e. in basins like the Permian where heavy drilling, completions and production is expected to last for many years. According to Big D Co., a service company is Texas and New Mexico, layflat hoses can transfer a range of liquids such as water, liquid manure, industrial sludges & slurries, contaminated liquids, fertilizers, oils, medium and heavy hydrocarbons, diesel fuels, & many chemicals in solution.

Layflat hoses can range from rubber, reinforced rubber, to wire reinforced vinyl. The standard rubber hoses strain pumps more because the pump not only works to transport the fluid, but also to keep the hose expanded when starting and stopping.

Another reason layflat hoses are appealing to operators is because of their rapid deploy time which reduces downtime. Also, after use the hose can be easily cleaned, reeled up, and relocated without the dismantle costs associated with more permanent pipelines.

The costs of handling water from wellsite to disposal

A “pick up the phone” marketplace is what determines pricing for water handling in the oilfield

There has never been an organized water market online or offline. No trading floor exists where traders and investors, or buyers and sellers, compete for water contracts. Because of this, water pricing and other market information has been plagued by minimal recorded data, and pricing can vary drastically between basins.

Experienced water handling services will be able to receive a fair price for moving and supplying water, but much water buying and handling is tied to one-off contracts. The market for water is driven by oil and gas operators’ water mangers calling and emailing water service companies to negotiate a price when they need the water.

With thousands of water service providers and hundreds of thousands of wells, finding the best deal can be a major task. Over time, business is built through a mutual understanding of pricing, locations, volumes, availability, and water quality.

The decision for an operator to use pipelines, trucks to haul water, or invest in onsite water treatment is dependent on the following parameters:

- volume of water,

- distance between assets,

- water quality,

- environment and regulations.

Since pipelines require large upfront capital investment, they are only utilized in areas that are predicted to have the need to handle substantial amounts of water over an extended period.

As the distance between assets increases, pipeline construction becomes the optimal water transportation method. However, using trucks or hoses to transport water can be the better choice for smaller distances.

Water quality has a profound impact on the selected transportation method. Formations producing water with poor quality will require additional operation and maintenance costs, and extra costs for pipeline construction.

The cost formula for water

In its 2016 Upstream Cost Study, the EIA looked at the growing focus on water handling as operators examine all components of the cost formula when drilling and completing wells.

“As water resources become more and more scarce, operators are being forced to come up with better solutions for the amount of water used for each well, especially in arid regions, such as the Permian Basin and the Eagle Ford in South Texas. This is also important in environmentally sensitive areas.”

“Many companies are using recycled water for drilling and completion operations instead of having water trucked in or out. Using recycled water also reduces operators’ costs. For example, Apache was paying upwards of $2.00 per barrel to dispose of water in the Permian Basin, but pays only $0.17 per barrel to recycle,” the EIA reported in its 2016 report.

How do costs compare among the different methods of handling water? Like almost everything else about water, it’s a question that doesn’t have a single, straightforward answer.

Tzahi Y. Cath, PHD is a professor at Colorado School of Mines who studies oilfield water handling. He specializes in water characterization and wastewater treatment.

Dr. Cath talked about water handling with Oil & Gas 360®. He emphasized that produced water is contaminated with various organic and inorganic compounds, particulate matter, grease, and oil. And the values of these is constantly changing in concentration during production, posing additional challenges for treatment. In a recent interview, Dr. Cath explained some of the costs associated with water handling.

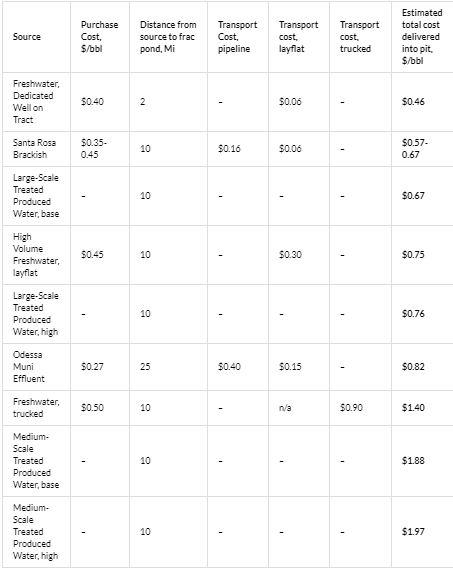

While produced water with low salt concentration can be easier to treat, water with high salt concentrations requires processes such as desalination for treatment. Scale of desalination makes a big difference.

For large scale water desalination, costs are approximately 25 cents per barrel, according to Cath.

This is cheaper than typical cost for disposal, which is about 50 cents per barrel; however, small scale water desalination along with pre- and post-treatments can range anywhere from 75 cents to $1.75 per barrel. Additionally, approximately an additional $1 per barrel can be added to the total disposal costs for every 100 miles of trucking.

Truck or treat

When asked about what impacts an operator’s decision to truck or treat the water, Dr. Cath said, “Oil and gas operators will always try to find the cheapest solution for their water management. They are in the business of producing oil and gas, not in the business of treating water. And they want to minimalize handling of water.

“Oil and gas operators will first try to minimally treat the water and use it internally for hydraulic fracturing, and if this application is irrelevant in the region, it will be a tradeoff between the cost of treating and discharging to the environment or the cost of trucking and deep-well disposal.”

Estimated Water Handling Costs in the Permian

Examining water costs – different factors in every basin

In the Permian basin, multiple benches of the below ground formations are being produced. Each of the formations contaminates the water separately, and when they become mixed at the surface, scaling can be a great concern.

But in North Dakota produced water is coming from two sources, the Bakken and the Three Forks formations. Since the water composition is more consistent in this region, scaling is less of an issue than in the Permian basin. Scale refers to chemical precipitation on a metal surface due to chemical reactions, changes in pressure and temperature, or change in composition of a solution.

Hydrogen sulfide is also found in much higher concentrations in the Permian basin, which poses additional concerns for water treatment.

North Dakota has less hydrogen sulfide and less scaling problems than the Permian and other areas, but the topography provides additional costs for water transportation. High pressure pumps are required to flow the water up elevation gains, which is not a concern for flatter areas such as the Permian.

Due to climate, specifically severe winters, pipeline construction in the North Dakota region is subject to pipeline freezing and limited construction windows, compared to West Texas or New Mexico for example.

Pipelines in North Dakota must be buried at least five feet deep because the frost line can reach depths of four feet. Also, due to the harsh weather conditions, pipeline construction must be completed in the warmer seasons. For these reasons, in North Dakota, water transportation via truck will likely remain the dominant method. Typical formations in North Dakota have lower water cuts compared to formations in Texas, so less water is needed to be transported per barrel of oil.

The operators’ view of water handling

From an operator’s perspective, handling the produced water with minimal costs and minimal environmental impact are top priorities.

Whiting

Whiting Petroleum (ticker: WLL) posts a statement on its website outlining its recognition of the importance of how it handles water usage: “We recognize that our water use affects neighboring communities, governments, businesses and industries, and remain dedicated to using water responsibly and effectively while developing energy resources. Whiting sources its fresh water from nearby water resources and minimizes our water use by using only the necessary volume of fresh water. Where possible, we utilize pipelines to transport fresh water, eliminating haul trucks and their associated emissions and road traffic.”

Apache

According to Apache Corportion’s (ticker: APA) sustainability report, its produced water is collected and separated during production activities and stored in closed tanks or highly engineered, lined and continuously monitored impoundments.

Apache reported that the company routinely inspects holding tanks and transfer pipes to ensure prevention of leaks. Loss of primary containment is rare, but, should it occur, the company said it has secondary containment and detailed spill prevention, countermeasure and control plans to address losses.

Apache said whenever possible it reuses produced water for enhanced oil recovery and well completion activities. When this is not possible, Apache disposes of produced water in permitted injection wells in accordance with regulatory requirements.

Oxy

Another major operator in the Permian, Occidental Petroleum Corporation (ticker: OXY) explains environmental stewardship and how important water management is to its operations.

“Occidental separates produced water, which is typically saline, from the produced oil and gas, and recycles it in a closed loop by reinjection into mature oil and gas reservoirs as part of its improved oil recovery (IOR) or enhanced oil recovery (EOR) operations,” the company said.

“Generally, since the ratio of water to oil and gas extracted increases over time, the extraction, processing, treatment and reinjection of produced water is integral to the design and efficient operation of Occidental’s mature oil and gas fields.

“Occidental has implemented major water treatment, reuse and recycling projects in many locations, including the United States and Oman. Occidental also is developing or enhancing water-related technologies.

“These include new approaches for the treatment of produced water and wastewater streams, such as a pilot project testing recycled produced water in Hobbs, New Mexico. Occidental continues to evaluate new opportunities for beneficial reuse of water, such as for agricultural and ecological use or ranching operations.”

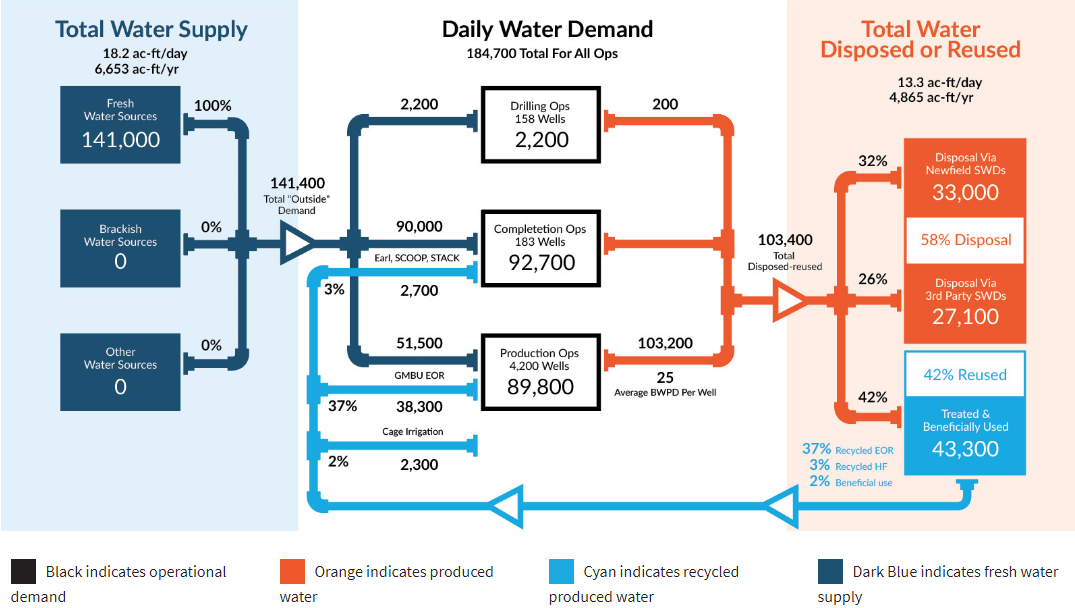

Newfield

Newfield Exploration Co. (ticker: NFX), said it’s goal is to use less water than it has permission to use, and it offsets freshwater needs by recycling produced water. “In Utah, a water stressed area, we recycled 96 percent of the water used in our operations in 2015 while disposing of only four percent,” the company said.

Source: Newfield Exploration Co.

In the SCOOP and STACK plays of Oklahoma, Newfield installed buried water pipeline systems infrastructure early in the development phase to lower operating expenses and decrease the opportunity for spills and accidents that have a higher likelihood when moving water by truck.

Over the past three years Newfield spent nearly $15 million constructing produced water storage pits in both the SCOOP and STACK plays and accumulated a total storage capacity of 4.8 million barrels.

A discussion with RRIG Water Solutions: developing pipelines to deliver fresh water to the Permian

RRIG Water Solutions is a water service company operating out of the Permian Basin. RRIG recently purchased a 475-mile pipeline located in the Eastern Delaware Basin.

RRIG owns the fresh water source—properties with fresh water producing wells that currently produce 30,000 barrels of water per day each, with plans to expand the source to produce up to 125,000+ barrels of water per day.

With a water source and pipeline, RRIG believes it can save operators money in the long term for fresh water, compared to costs of trucking significant water volumes.

RRIG intends to serve eastern Delaware basin operators with a fresh water supply that doesn’t require trucking the water. RRIG will extend branches from its main pipeline to reach operators’ wells. RRIG plans to construct water disposal pipelines and to drill disposal wells, enabling operators to receive fresh water on site, and dispose of the produced water at the same location.

In an exclusive Oil & Gas 360® interview with RRIG Water Solutions President Stratton Haley, Haley talked about the company’s water provision strategy in the Delaware basin and its long-term plans for removal of produced water.

OAG360: How do you connect your pipeline with an operator’s drilling pad that may be miles away?

RRIG Water Solutions President Stratton Haley: The pipeline recently purchased, which has a potential to move 2.3 million barrels of water per day, has multiple laterals branching off from the main trunk line. However, these laterals may not reach directly to the areas needed. RRIG will spend its own capital either laying a new line or installing temporally above ground lines (lay flat hoses) to connect an operator’s well with their main water source. This allows RRIG to be mobile and adaptive when getting the product to their customer.

OAG360: Can you explain the outlook on handling, transporting, and disposing produced water? What additional challenges will you face working with produced water?

RRIG Water Solutions President Stratton Haley: Our current pipeline is made completely out of steel, and cannot handle the corrosion associated with transporting produced water. In a 3-5 year plan, we will look to acquire property to install salt water disposal wells within a close distance to the main pipeline.

Connections would be made with corrosion resistant poly pipes to the disposal wells. The goal is to be a one-stop shop where operators can have freshwater transported on sight for completions or fracs, then turn around and transport the produced water to one of our salt water disposal wells. All transportation will be done via pipeline instead of by truck.

OAG360: What kind of time frames are expected to drill and operate a salt water disposal wells?

RRIG Water Solutions President Stratton Haley: From start to finish, the SWD permitting process takes about two months. While the permit is being approved, construction supplies is ordered and delivered, drilling contracts are made with the drilling rigs, and pipeline is constructed. Once we have the permit in hand, it will take another two to three months to drill the actual Salt Water Disposal Well and to complete the actual salt water disposal facility.

However, with all the leg work that we do during the “waiting time” (the permit approval process and drilling/constructing the actual SWD well and facility), we are able to start taking water as soon as the facility and well are completed.

OAG360: Do operators provide freshwater required forecasts for a given area or do companies operate on a day-by-day basis?

RRIG Water Solutions President Stratton Haley: We are open to both. Ideally, we would like to have an estimate so that our we can allocate our water to the operators efficiently. At the same time, we won’t turn away day-by-day requirements for freshwater use.

OAG360: What is the variance in water quality wanted by your customers?

RRIG Water Solutions President Stratton Haley: We can send fresh drinking water to all of customers, which is the highest quality of water found. Some operators are considering using a lower quality brackish water for fracs, but we currently do not have the capability to control brackish water. Down the road we have considered constructing a salt water disposal plant, but instead of pumping the produced water downhole we would offer operators the re-used brackish water for fracs at a discounted rate.

OAG360: What are the economic comparisons between constructing and operating a water pipeline vs trucking?

RRIG Water Solutions President Stratton Haley: While the pricing may be similar between the two options, where we have a competitive advantage is the time saved. Our pipeline capacity can deliver approximately 75,000 barrels of water per day through a 16-inch SDR11 pipeline. For a truck to transport the same amount of water it would take approximately 625 truckloads. A typical truck load can carry approximately 120 barrels of water per load.

Typical times for loading a truck is roughly 30 minutes. After running the numbers, trucks would have to operate non-stop for over 10 days to transport the same amount of water our pipeline can carry in one day. And poor road quality only causes trucking times to increase.

OAG360: What are typical distances that you can reach with your pipelines?

RRIG Water Solutions President Stratton Haley: If the economics work, we do not have a maximum range. We are willing to take risks with the operator to get the pipeline where it needs to go. As far as our lay-flat hoses go, we feel comfortable extending upwards of five miles if we have the plan to construct the permanent pipeline. We do not want to have our lay flat hoses to be used any longer than a month, maybe a month and half. That period should be plenty of time to finish the permanent pipeline.

RRIG can be reached for additional details at Stratton@RRIGwater.com or 817-887-9371

[EDITOR’S NOTE: RRIG Water Solutions is an Oil & Gas 360® advertiser]

Water recycling

In addition to drilling disposal wells and constructing pipelines, many service companies have found a niche in the market through developing and offering operators water recycling technology and related services. Each service company has its own line-up of technology that offers solutions specific to the water being produced from each well.

Water treatment methodology and technology varies significantly. Examples include:

- Oil Water Separators: an oil/water mixture flows into a machine that applies dynamic forces as it passes. External forces cause particles to spin, breaking the bond with the other liquids in the mixture. The water and oil particles will cluster together and form layers that can be pumped out separately.

- Reverse Osmosis: a process where water is pressurized to overcome osmotic pressure and reverse natural osmosis. Removes 99%+ above suspended solids, bacteria, and 95-99% of total dissolved solids (TDS).

- Electrocoagulation: a process where multiple reactions take place. Electrons flow through the water, destabilizing surface charges on suspended solids and emulsified oils. Through this process, clumps of dissolved metals, suspended solids, and emulsified oils will form, which make them easier to remove in a downstream purification step.

- Evaporation: a process where water is heated, allowing the water molecules to escape in the form of free gas. This process will release clean water into the air and leave behind a brine solution that can be used for drilling, completions, or workover fluids.

A discussion with MGX Minerals: reducing water handling costs by extracting the minerals, purifying the water

MGX Minerals Inc. (ticker: XMG) is a water handling company with current operations in Canada, but the company’s plans call for moving into select U.S. unconventional reservoirs. The company’s key value proposition to oil and gas operators is twofold: mineral extraction and water purification. Mineral extraction primarily focuses on lithium and magnesium, but also includes a variety of salts.

Extracting minerals from produced water

MGX has patented a nano-filtration technology that allows specific elements to be filtered out of produced water and collected separately. The technology is skid-mounted, and unit containerized with a significantly smaller footprint then traditional trucking. While the minerals can be sold, the remaining treated water is also ideal for reuse in drilling or other industrial use.

In plays where the mineral concentrations are less than 100 mg/L of Lithium, operators will have MGX’s technology for water treatment and re-use, and focus less on mineral extraction.

Evaporation technology that purifies water to drinking water standard

MGX also has a patent-pending evaporation technology that would purify water to drinking standard, but it will have higher costs. The evaporation technology would allow the MGX-treated water to be directly introduced into natural environments such as streams or lakes. The technology would have the least impact on the environment and would offer an alternative solution to down-hole disposal.

MGX provides portable treatment facilities that can be used on site, with its goal to eliminate expensive trucking of water. MGX’s technology separates it from other water handling companies because it can handle produced water with extremely high concentrations of total dissolved solids (TDS).

The only alternative to treating water with high contamination is desalination, which is much more expensive than the nano-flotation technology.

MGX President and CEO Jared Lazerson said in an interview with Oil & Gas 360®, “The units are designed for smaller operations that currently rely on trucking, but large water systems that handle 100,000 – 200,000 barrels of water per day can greatly benefit from mineral extraction. MGX offers a hybrid solution and will target what is most profitable in areas of potential growth.”

Lazerson said that areas with high mineral content and expensive water handling can profit the most from MGX’s technology. “Not only will operators’ water disposal costs be reduced, but the operator will also receive mineral credit from the elements extracted.”

Treating water: removing dissolved minerals at a lower cost

“Typically removing dissolved solids from produced water poses a great challenge and requires high energy solutions,” Lazerson said, “whereas MGX’s nano-flotation technology can recover 99% of dissolved magnesium and other dissolved solids with comparably lower capital and operating expenditures.”

Lazerson said MGX plans to move into the Uinta and Marcellus basins because of the high mineral content and room for improvement on existing water handling methods.

Looking at cost factors in different basins

Currently, MGX offers water handling for roughly $1 per barrel for water separation from oil and gas, and an additional $1 per barrel for mineral extraction.

These prices will vary among regions, but MGX is cutting those costs rapidly with the goal to cut costs in half by the end of next year. Regions in the northeast have a high demand for sodium for salt production during cold winters. Because of this, produced water coming from the northeast region can have a higher value per barrel compared to the same quality of water being produced from a different region.

If the water produced can generate a profit from mineral extraction greater than $1 per barrel, the revenue from selling the minerals can offset the costs of treating the water. A percentage of the revenue that MGX collects from selling the extracted minerals is returned as a credit or royalty back to the oil and gas producer.

In certain areas with high TDS compositions, the revenue collected from selling the minerals can completely offset the costs for water handling, MGX said.

In addition to the upside from selling the extracted minerals, bringing the dissolved solids out of solution decreases the total volume of waste product. If an operator chooses not to re-use the treated water, then the water being sent down hole will be less contaminated and have a reduced volume.

For additional information, MGX Minerals Inc. can be contacted through its CEO and president, Jared Lazerson, at jared@mgxminerals.com.

[EDITOR’S NOTE: MGX Minerals is an Oil & Gas 360® advertiser]

Who are possible users of treated produced water

Clean, filtrated produced water has benefits within and beyond the oil and gas industry.

E&P companies can reduce their operations costs significantly with a reliable process for recycling and reusing their produced water. Due to the geology of some formations like the Piceance basin, highly saline produced water can be used for fracing with minimal treatment required. Other basins will require more treatment before produced water can be re-used for fracs.

Treated, produced water gas many benefits outside of the oil and gas industry. According to a study by Colorado Energy Office & Colorado Mesa University Water Center, treated produced water is being considered to use for wildlife and stock ponds located near drill pads.

Produced water is also used as a method to suppress dust on dirt roads. Salinity levels in produced water may be comparable to salinity levels in magnesium chloride solutions commonly used for dust suppression, but operators have thousands upon thousands of barrels of produced water they are paying to dispose of. In the dust-suppression scenario, little treatment is required for the water, because the high content of dissolved solids is beneficial for suppressing dust.

According to an SPE paper discussing produced water, “Direct potable reuse can be a possible option for inland production fields located in arid areas where other freshwater sources are limited, especially if the produced water is of relatively high quality. However unknown toxic effects and public acceptance are important barriers.”

For this to occur, the produced water would first be treated with a process such as reverse osmosis. The high-quality water collected from reverse osmosis would then be introduced to drinking water sources via aquifer soil treatment.

The farming and agriculture sector also benefits from using treated, produced water. According to a study of the use of produced water from oil and gas operations by the Cawelo Water District in Kern County, California, tests confirmed that low level organic elements found in produced water were not absorbed by potatoes or carrots.

The same results were also found for citrus crops such as mandarins, oranges, or lemons. A third-party toxicologist conducted a water quality test for Cawelo’s produced water which tested for approximately 70 organic compounds. The tests showed that the water was within the safe drinking quality standards, which has tougher standards than what is required for irrigation water.

Using the produced water to meet the needs of livestock and crops can significantly reduce costs for famers.

In a study conducted by Texas A&M Agrilife Research, the effects of using produced water to irrigate cotton plants were observed. The study concluded that irrigating that cotton crops with treated produced water blended with groundwater did not reduce the cotton yield or lint quality. While the treated water tested for higher levels of boron, soil characteristics were similar between the blended water and pure groundwater source.

A discussion with Goodnight Midstream: engineered water handling in the Permian and Bakken

Goodnight Midstream is an oil and gas midstream company that specializes in an engineered approach to water handling in the Permian and Bakken basins. Goodnight Midstream develops creative approaches to water handling so that it can provide a custom fit for an operator’s needs.

In a recent interview with Oil & Gas 360®, Goodnight Midstream’s CEO Patrick Walker explained how this custom engineering separates Goodnight Midstream from other water handling companies.

“Trucking water has been the most widespread practice for operators in the Permian and Bakken basins since the U.S. shale boom in the 2000s, but trucking is expensive, noisy and heavy truck traffic causes problems for local infrastructure,” Walker said. “Goodnight Midstream designs the geography of its pipelines to include multiple pads allowing it to collect the produced water from multiple wells at one centralized source and move it via pipeline, improving disposal efficiency all around.”

Walker said Goodnight Midstream works with producers up to six months in advance of drilling and development of a field so it can be ready to provide the right water disposal infrastructure. Looking ahead to future production and water transportation needs allows Walker’s engineering team to design the pipelines to be built strategically, based on the operators’ well locations.

“Goodnight Midstream’s management team has a deep bench in the midstream sector. We take efficiencies seriously,” Walker said. “We base bonuses off a 99% or greater uptime.”

Poor efficiency associated with trucking produced water away is going to be under scrutiny as production increases in the basin, and a scientific approach to handle produced water will prove its value to operators in the long run, Walker told Oil & Gas 360®.

Walker said that approximately two to four barrels of water are produced for every barrel of oil in the Permian. According to a report by the EIA, the current oil production from the Permian is 2.613 million barrels per day, meaning that there would be roughly ten million barrels of water produced every day from the Permian, and the costs of handling and disposing of the produced water falls upon the producers.

As oil and gas operators continue to seek ways to shave pennies off their costs to produce a barrel of oil, the methods they use to handle produced water will take a bigger role in shaping the economics of the basins.

As water saturation increases over time, the demand for more efficient, more environmentally friendly, less costly techniques to handle produced water will undoubtedly accelerate. The best techniques for water handling vary widely between basins. An operator can choose between recycling and reuse, disposal via pipeline or trucking to a water injection well.

Water handling is already a major concern and a significant cost item for oil producers. The most forward-thinking oil and gas producing companies are carefully considering available water handling methodologies as well as new water treatment and handling technologies as they create the operational models that will allow them to most efficiently extract hydrocarbons from U.S. shale basins in the decades going forward.