Global oil and gas operator Vermilion Energy (tickers: VET) holds producing acreage worldwide. The company’s assets are spread across three main regions: North America, Europe, and Australia. Its oil and gas assets are located in 10 countries.

Vermilion’s focus on commodity diversification—oil and natural gas—creates stable cash flow and reduces the effect of volatility in individual commodity prices.

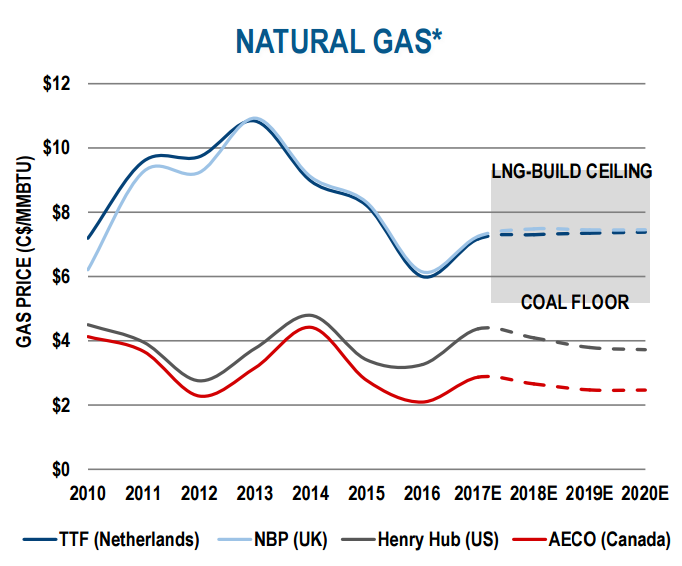

European gas

Vermilion expects future security in its European natural gas assets, primarily sourced from its fields in the Netherlands, Ireland, and Germany—which produce 39.92 Mmcf/day, 64.82 Mmcf/day, and 19.39 Mmcf/day, respectively.

Incremental coal-to-gas switching in European markets is driving Vermilion’s European gas expectations, wherein it expects an approximately $4/Mmbtu (C$5.30/Mmbtu) price floor with potential to reach approximately $7/Mmbtu (C$9.30/Mmbtu).

Vermilion estimates that U.S. LNG potential in Europe necessitates a European gas market price of approximately $4.50-$5/Mmbtu, and also anticipates that incremental growth in U.S. LNG exports will be absorbed by European coal-to-gas and nuclear-to-gas switching.

European commodity diversification

Vermilion’s European assets are found within France, Netherlands, Germany, Ireland, and Croatia, with additional exploration acreage in Hungary and Slovakia.

Vermilion is France’s largest domestic NatGas producer

In France, where Vermilion is the largest domestic producer, responsible for three-quarters of domestic production, the company’s assets are divided between the Paris basin and the Aquitaine basin. The French assets have been the target of workovers, recompletions, infill drilling, and waterflooding since Vermilion’s 1998, 2012, and 2016 acquisitions.

For its French assets Vermilion reported 1P reserves of 43.0 million BOE and average production of 10,836 BOEPD in Q1, 2017.

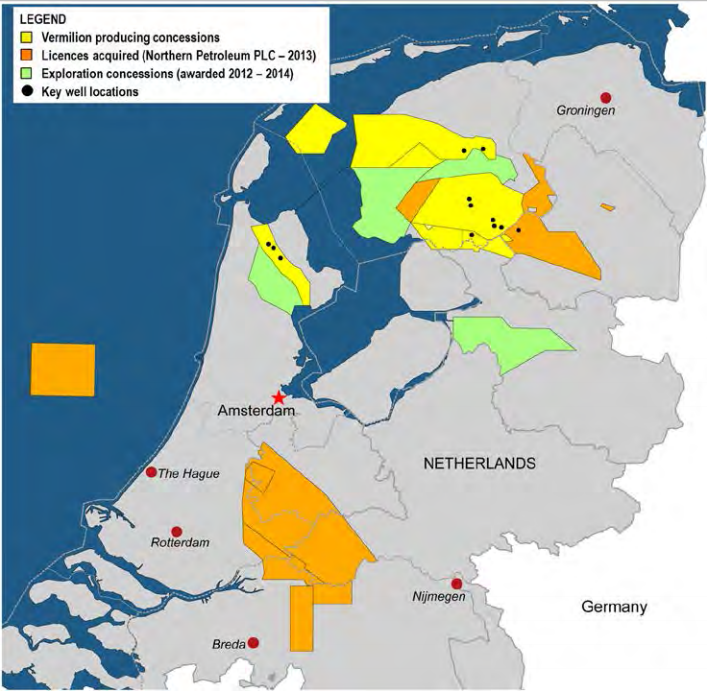

Second largest gas producer in the Netherlands

Vermilion is the second largest gas producer in the Netherlands and holds a significant potential drilling inventory with approximately 800,000 undeveloped net acres on land.

The Netherlands assets produced approximately 6,700 BOEPD during Q1, 2017 which is expected to decrease to an average of 6,500 BOEPD during the remainder of 2017—due to restrictions in well licensing. The company expects that additional production from wells experiencing licensing issues will be available during 2018.

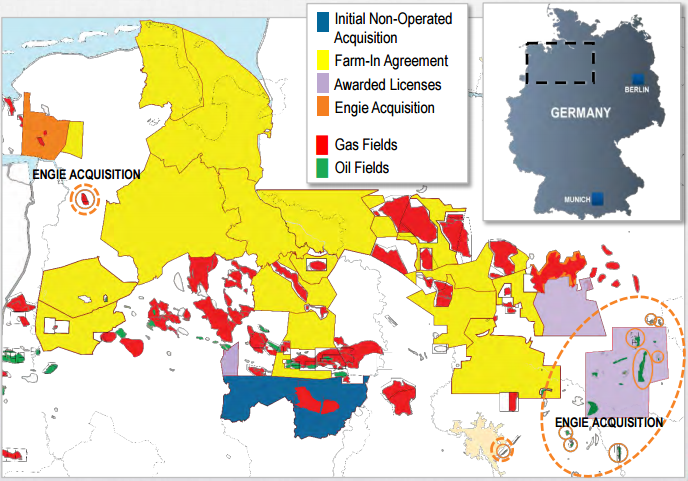

Germany

Vermilion’s position in Germany is substantial, at 1.1 million net acres, 97% of which is undeveloped—making the German assets a prime target for future growth. The German assets as a whole produce approximately 4,200 BOEPD, 77% of which is gas. Vermilion is operating as a farm-in alongside Exxon and Shell in 850,000 net acres of undeveloped land.

Ireland

Vermilion also holds an 18.5% non-operating interest in the Corrib gas field in Ireland, which accounts for approximately 95% of Ireland’s total natural gas production. The Corrib field produces 65 Mmcf/day of natural gas—limited by the capacity of the Bellanaboy gas plant. Of the total Corrib production, approximately 10,900 BOEPD is owned by Vermilion.

Croatia and Slovakia

Vermilion is engaged in exploration concessions in Croatia, where it holds 2.35 million net acres with a 100% working interest, and in Slovakia, where it is engaged in a joint exploration venture for 183,000 acres at 50% working interest. Vermilion was also awarded concessions in 2014 and 2015 in Hungary covering more than 320,000 acres at 100% working interest.

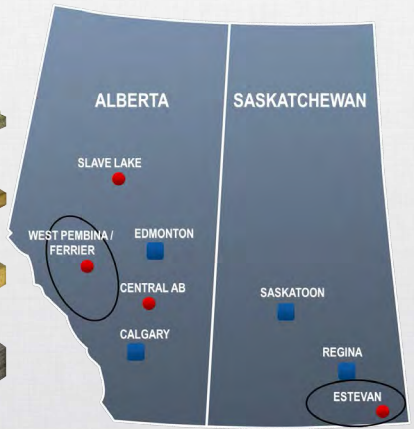

Canada

The company holds two major assets in Canada: the West Pembina and the Northgate. The West Pembina asset is comprised of approximately 425,000 net acres. Two components—the Cardium light oil play and the Mannville liquids-rich gas play, totaling 90,000 and 220,000 net acres, respectively—are currently under development. In Q1, 2017, the Cardium produced 5,800 BOEPD and the Mannville produced 12,000 BOEPD.

The West Pembina also holds the Duvernay liquids-rich gas play, totaling 115,000 net acres, which is in the appraisal phase.

Vermilion’s Northgate asset, in SE Saskatchewan, covers approximately 61,500 net acres with approximately 91% working interest.

In Q1, 2017, Vermilion’s Canadian assets as a whole produced an average of 24,947 BOEPD.

U.S.

Shifting to Vermilion’s U.S. operations, it holds 81,500 net acres in the Powder River Basin, Wyoming, with 100% working interest. The Powder River Basin acreage is 99% undeveloped and is targeting the tight oil Turner Sand development.

Offshore Australia

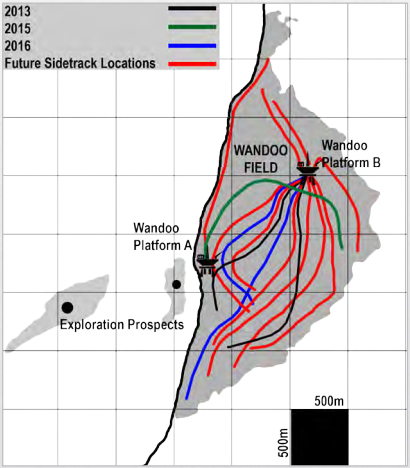

Vermilion holds the Wandoo asset in Australia, which is an offshore oil-play generating approximately 6,581 BOPD in Q1, 2017. Vermilion is utilizing two offshore platforms with 18 wells and five lateral side-tracks. In 2017, the company intends to de-bottleneck fluid handling systems, which is expected to result in 600-700 BOEPD of additional production.

New wells are sidetracked from existing wellbores, and the company has identified 12 new drilling opportunities.

Vermilion is presenting at EnerCom’s The Oil & Gas Conference®

Vermilion will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.