The United States crude export ban was lifted less than two weeks ago, and domestic companies are wasting no time transporting American oil abroad.

On December 30, 2015, ConocoPhillips (ticker: COP) and NuStar Energy (ticker: NS) announced its first cargo is expected to complete the loading phase by December 31. The shipment is expected to be the first U.S. crude export since the oil embargo was enacted in 1975. A week prior to the COP/NS announcement, Enterprise Products Partners (ticker: EPD), one of the country’s largest midstream providers, issued a similar press release saying its first shipment is scheduled for the opening week of 2016.

Vitol Group, a trading and distribution company with more than 40 offices worldwide, will be on the receiving end of both of the historic shipments.

Off the Starting Blocks

The quick responses from the companies above can be attributed to their foresight. In addition to COP and EPD, only Pioneer Natural Resources (ticker: PXD) and Royal Dutch Shell (ticker: RDS.B) were permitted by the United States government to send crude products abroad. And there was a catch: the product had to be refined.

Producers, particularly those operating in the Eagle Ford Shale, have a strong geographical advantage to export outlets in the Gulf Coast region. Although the U.S. still imported more than 9 MMBOPD in 2014, the light-sweet and light-sour grades destined for the Gulf region have virtually disappeared. The previously mentioned companies were gearing up to take advantage of the Eagle Ford’s lighter grades.

Producers, particularly those operating in the Eagle Ford Shale, have a strong geographical advantage to export outlets in the Gulf Coast region. Although the U.S. still imported more than 9 MMBOPD in 2014, the light-sweet and light-sour grades destined for the Gulf region have virtually disappeared. The previously mentioned companies were gearing up to take advantage of the Eagle Ford’s lighter grades.

No More Need for Loopholes

The crude oil export ban was a popular topic among the energy community in the past few years, and companies began to explore ways to broaden the markets where they could sell product.

Producers like BHP Billiton exported products roughly one year ago without a government ruling, saying the product met all legal requirements. Sources of Reuters said the U.S. port authority began encouraging certain companies to exploit loopholes in the export ban, such as “self-classifying” the cargo. The first “easing” of the embargo surfaced in September when the U.S. Bureau of Energy and Security green-lighted crude oil swaps with Mexico.

Producers like BHP Billiton exported products roughly one year ago without a government ruling, saying the product met all legal requirements. Sources of Reuters said the U.S. port authority began encouraging certain companies to exploit loopholes in the export ban, such as “self-classifying” the cargo. The first “easing” of the embargo surfaced in September when the U.S. Bureau of Energy and Security green-lighted crude oil swaps with Mexico.

Proponents of ending the ban celebrated the news upon its approval, marking a silver lining in what has otherwise been a year that the oil and gas industry cannot forget soon enough. Jim Teague, Chief Operating Officer of Enterprise Products Partners, complimented both Congress and President Obama following the announcement.

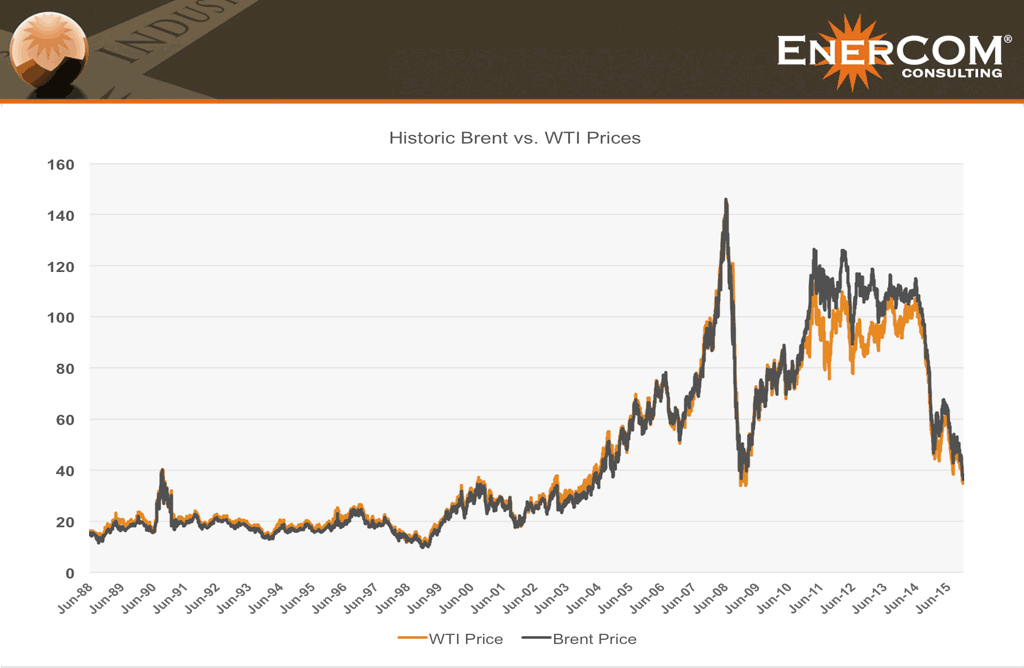

The spread between Brent and West Texas Intermediate prices evaporated within days of the news, and WTI has actually been trading at a premium to Brent for the last three days. The last time such a stretch occurred was in June 2010.