According to the IEA’s Oil 2018 report, released today, oil production growth from the U.S., Brazil, Norway and Canada will keep world supply of oil above needed levels until 2020. More investments, the IEA said, will be needed after 2020 to increase output and meet demand.

The United States, investments

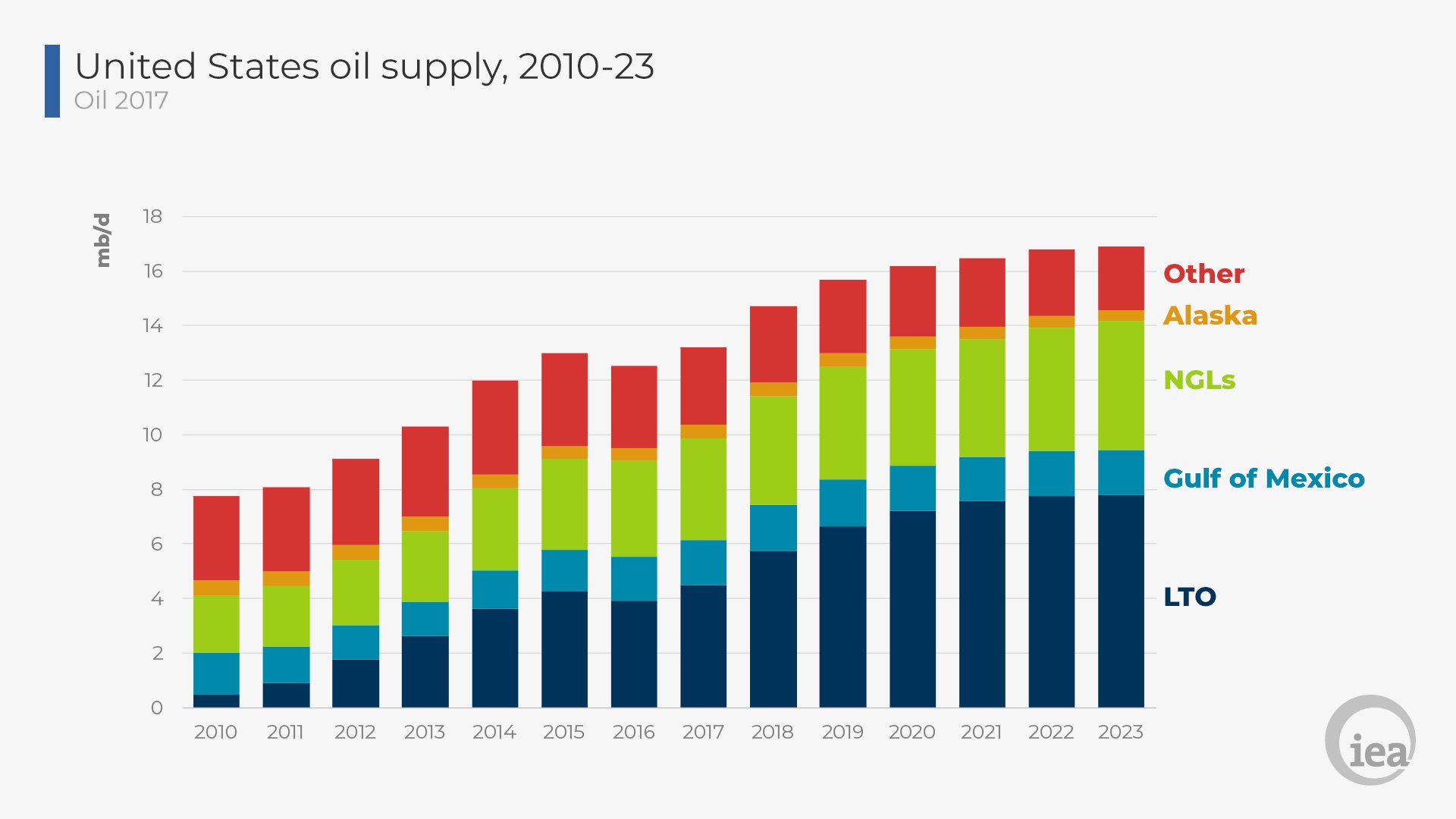

The Oil 2018 report predicts that over the next three years, increased production from the U.S. will cover 80% of the world’s demand growth. Canada, Brazil and Norway will cover the world’s remaining needs. All of these countries are IEA members.

During the downturn the oil industry felt a sharp drop in investments in 2015 and 2016, and the recovery is still ongoing. More investments will be needed in 2020. However, the IEA said that it sees little-to-no increase in upstream spending outside of the U.S. in 2017 and 2018.

“The United States is set to put its stamp on global oil markets for the next five years,” said Dr. Fatih Birol, the IEA’s executive director.

“But as we’ve highlighted repeatedly, the weak global investment picture remains a source of concern. More investments will be needed to make up for declining oil fields – the world needs to replace 3 million barrels per day of declines each year, the equivalent of the North Sea – while also meeting robust demand growth.”

Asia, LNG trucks and petrochemicals

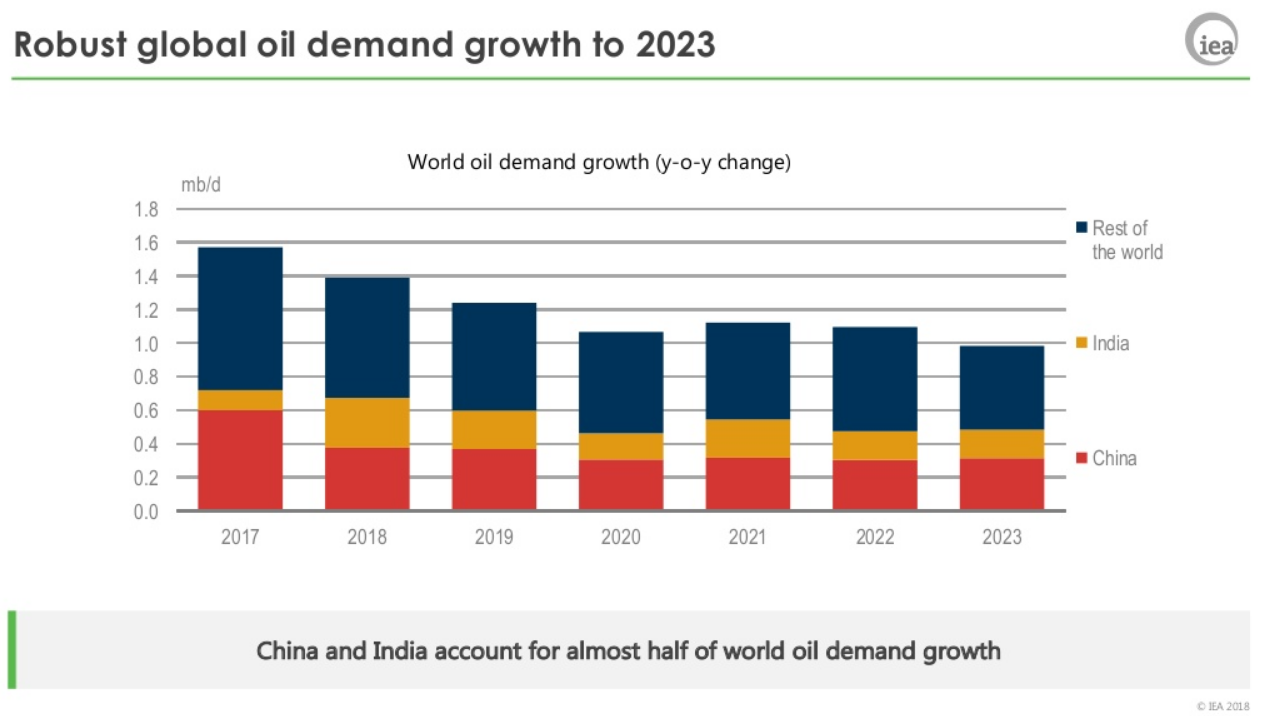

According to the IEA, Asia’s economic growth and a resurging U.S. petrochemical industry is driving global oil demand up by 6.9 million barrels per day by 2023 to 104.7 million barrels per day. China will drain more barrels than any other country, but concerns over air pollution will slow growth.

The IEA notes that LNG trucks and electric buses are expected to have a bigger impact on curbing transport fuels (i.e., gasoline, diesel) consumption than electric passenger vehicles.

Furthermore, fuel-economy standards in the U.S. will curb gasoline demand, but petrochemicals will continue to grow due to low-cost ethane, the IEA said, and new global petrochemicals capacity will account for 25% of oil demand growth by 2023.

Permian-mania

Global oil production should grow by 6.4 million barrels per day to reach 107 million barrels per day by 2023, the IEA said. The shale revolution has the U.S. leading the march, with total liquids production reaching nearly 17 million barrels per day in 2023 – up from 13.2 million in 2017, according to the IEA report.

The Permian Basin leads, where output is expected to double by 2023.

Infrastructure

Midstream and downstream investments should ease current bottlenecks, the IEA said, and U.S. crude export capacity should reach nearly 5 million barrels per day by 2020.

The IEA believes Corpus Christi will solidify its position as the primary North America crude-oil outlet.

OPEC

Almost all of OPEC’s output growth comes from the Middle East. In Venezuela, oil production has fallen by more than half in the past 20 years, and declines are set to accelerate, the IEA said. Sharply falling production in Venezuela will offset gains in Iraq – this will result in OPEC crude oil capacity growth of 750,000 BPD by 2023.

OPEC will need to improve its foundation, if not, the effective global spare capacity cushion will fall to 2.2% of demand by 2023 – the lowest number since 2007.