Borrowing base stays at $475 million

Unit Corporation (NYSE: UNT) reported Q3 today; highlights include:

- Net income of $3.7 million and adjusted net income of $5.3 million.

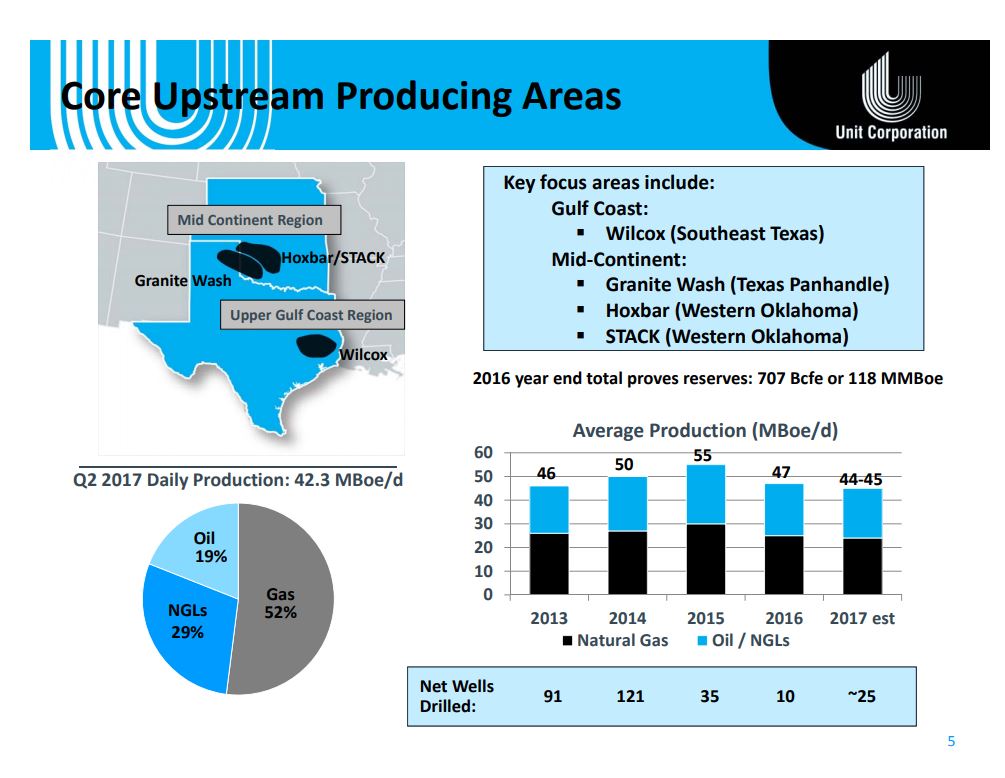

- Oil and natural gas segment production increased 5% over the second quarter of 2017.

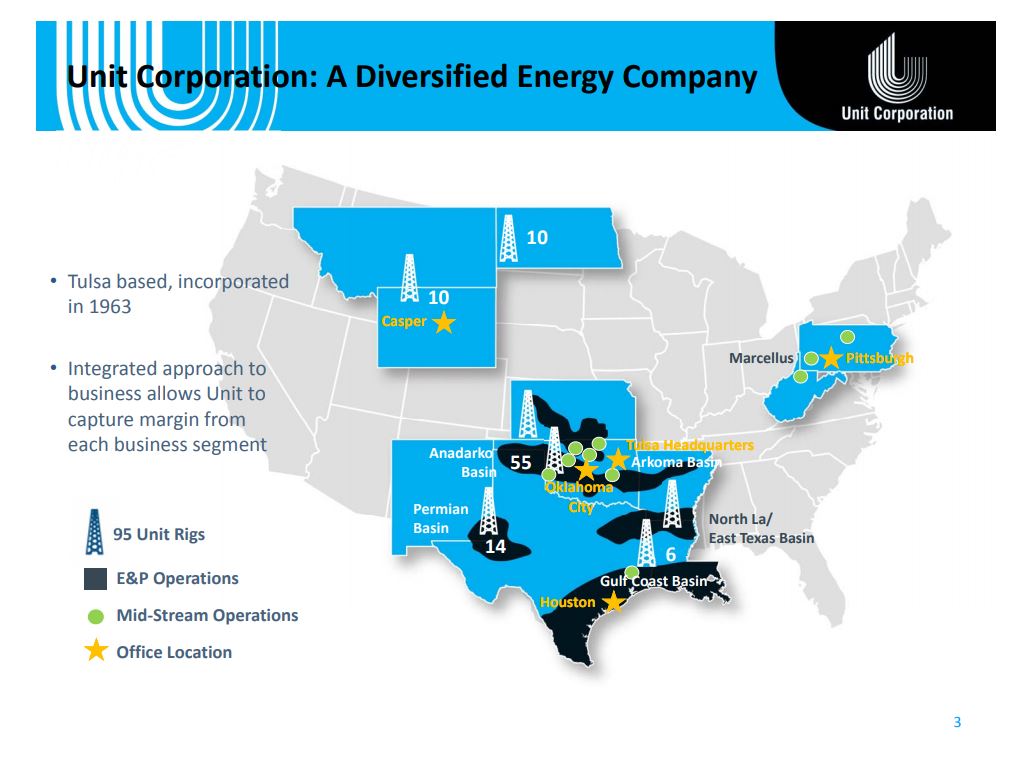

- Contract drilling segment’s average drilling rigs utilized increased 20% over the second quarter of 2017.

- Midstream segment increased gas processed and liquids sold volumes 4% and 1%, respectively, over the second quarter of 2017.

- Reduced long-term debt by $2.3 million from the end of the second quarter.

- October redetermination of credit agreement borrowing base amount maintained at $475 million.

Unit recorded net income of $3.7 million for the quarter, or $0.07 per diluted share, compared to a net loss of $24.0 million, or ($0.48) per share, for the third quarter of 2016.

Total revenues were $188.5 million (45% oil and natural gas, 28% contract drilling, and 27% midstream), compared to $153.4 million (51% oil and natural gas, 17% contract drilling, and 32% midstream) for the third quarter of 2016. Adjusted EBITDA was $78.9 million, or $1.52 per diluted share, the company said.

Total production for the quarter was 4.1 million barrels of oil equivalent (MMBOE), a 5% increase over the second quarter of 2017. Oil and natural gas liquids (NGLs) production represented 46% of total equivalent production. Oil production was 6,884 barrels per day. NGLs production was 13,506 barrels per day. Natural gas production was 142.2 million cubic feet (MMcf) per day. Total production for the first nine months of 2017 was 11.7 MMBOE.

Unit’s average realized per barrel equivalent price was $20.63, a 1% decrease from the second quarter of 2017. Unit’s average natural gas price was $2.36 per Mcf, a decrease of 4% from the second quarter of 2017.

Plant outages and delays attributable to hurricane Harvey reduced quarterly production by approximately 100 MBOE, the company said. The effects of Harvey were principally due to NGL bottlenecks from fractionation plant partial shut-downs and operational delays on new wells and recompletions. After the end of the quarter, the third-party processing plant for the majority of Unit’s natural gas production in the Gulf Coast area went down due to equipment failure. The plant was down seven days before operations resumed. Cumulatively, hurricane Harvey, the Texas Panhandle ice storm in the first quarter, and third-party plant downtimes will reduce production for the year by approximately 460 MBOE.

Taking these issues into account, Unit anticipates 2017 production to be approximately 16 MMBOE.

Unit Chief Executive Officer and President Larry Pinkston said, “As is our custom, we have focused on keeping our capital expenditures in line with anticipated cash flows during the year. Much of our total capital expenditure budget is directed toward our oil and natural gas segment where we have many highly economic prospects.

“The pace at which we develop these prospects is dependent on cash flow; therefore, unexpected downtime and delays can have an adverse effect on our production.”