Petro River Oil is Participating in a Portfolio of Conventional Assets in Oklahoma and California in 2016, with a Northern Ireland Exploration Test on Tap for Q2

When Scot Cohen founded Iroquois Capital Opportunity Fund, the seasoned portfolio manager kept an eye open for contrarian opportunities.

These days Cohen is focused on Petro River Oil Corp. (ticker: PTRC; Petro Riveroil.com), a junior oil and gas company that’s on a different path from most small E&Ps. Cohen recapitalized Petro River in 2015, and now he serves as the company’s executive chairman.

Last week Scot Cohen and Dr. James Rector, the company’s chief technology and geophysical advisor, presented Petro River to a presentation room full of institutional investors at EnerCom’s The Oil & Services Conference™ in San Francisco. Petro River was the only non-shale, pure-play conventional E&P on the agenda.

“Commodities prices will continue to fluctuate and markets will continue to be volatile,” Cohen told Oil & Gas 360® during an interview on the sidelines of the conference.

“Our goal with Petro River is to create an energy company that can withstand commodities price swings,” Cohen said. “We’re building this company to be able to succeed regardless of whether oil is selling at $100 or $10. That means taking minority interests, joint ventures and farm-outs in conventional plays that have low drilling and completion costs, and where advanced 3D seismic has not been effectively utilized.”

In addition to Cohen and Rector leading the capital and technical efforts, respectively, for Petro River, former president & CEO of Constellation Energy Partners, Stephen R. Brunner, became president of Petro River in November 2015. Jonathan Rudney, CEO of Horizon Energy Partners, serves Petro River as senior advisor.

Petro River’s Core Asset Positions

-

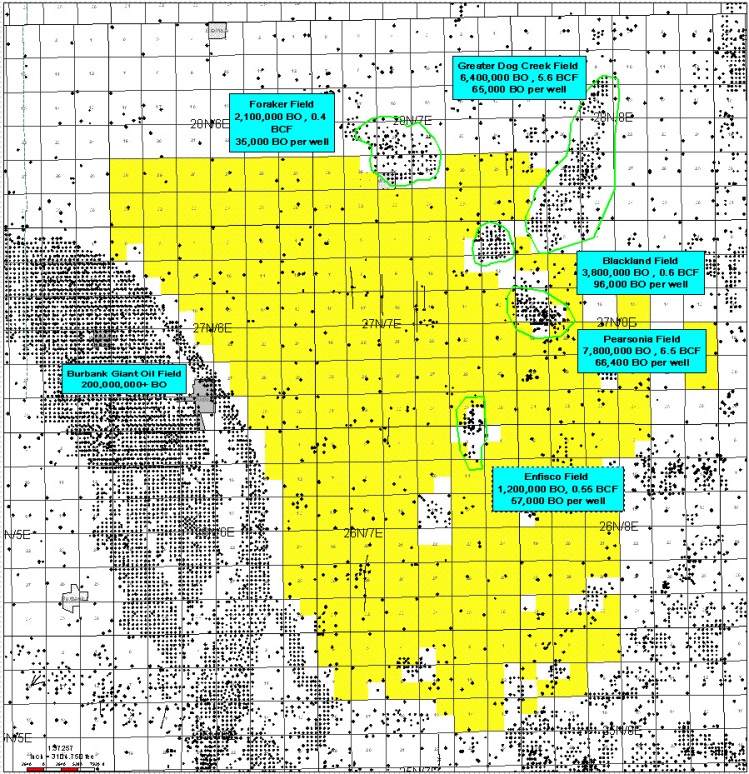

Osage County, Oklahoma – Pearsonia West

106,000 gross contiguous acres

50% ownership

36 sq. miles of 3D seismic

2016 drilling plan: 6 vertical wells at approx. $300,000 per well

-

Kern County, California

7,000 gross acres

13.75% direct working interest, 5.5% indirect interest through Horizon Energy Partners

Acquiring new 3D seismic in 2016; Horizon plans to drill 1 well at an estimated cost of $1.5 million

-

Kern County, California – Grapevine

8,000 gross acres

10% interest to Petro River, through its 20% ownership of Horizon’s 50% working interest in the prospect

Acquiring new 3D seismic in 2016; Horizon plans to drill 1 well, a re-drill of a 2014 well which tested more than 400 BOPD from the Stevens sand

-

Horizon Energy Partners

Petro River will have 20% ownership of Horizon Energy Partners upon closing of the transaction in April 2016, giving Petro River access to Horizon’s global portfolio of oil and gas assets in California, England, Northern Ireland and Denmark

-

Larne Basin – Northern Ireland

130,000 gross acres

9% direct interest to Petro River, and 3.2% indirect interest from Petro River’s 20% ownership of Horizon Energy Partners’ 16% interest in the asset

400 km of 2D seismic completed

Petro River will participate in a test well that is scheduled for 2Q 2016

Northern Ireland – Larne Basin’s First Exploration Prospect in 45 Years – Test Well on Tap for May 2016

Because of 20th century political issues in Northern Ireland, the Larne Basin remained the only Carboniferous Basin in Europe that is essentially untested for hydrocarbons. In 1971, Shell Oil Company drilled the only petroleum exploration well within the basin. Shell’s well was drilled off structure without the use of seismic, but it encountered two reservoir sands with porosities greater than 20%, one in the Triassic and the other in the Permian.

Petro River’s science team said that interpretation of recent 2D seismic data “shows structural styles similar to nearby basins such as the East Irish Sea, which has produced more than 220 MMBO and 4 Tcf of gas, and has identified several large structural traps with three- and four-way closure.”

A company developing a salt cavern gas storage project in the prospect area encountered natural gas shows during the permitting and development process for the project.

To test the basin, an initial vertical well, the Woodburn Forest-1, is permitted and scheduled to commence drilling in 2H 2016, with a planned depth of approximately 6,000 feet. The goal is to test the entire sequence of petroleum objectives, including the Carboniferous source rock. The gas storage company announced last week that wellsite construction had commenced for the Woodburn Forest-1 well, with drilling expected to commence in May 2016.

After the test well is drilled, 3D seismic will be acquired over select areas of the license, according to Petro River’s management team.

A third party report has assigned P50 prospective resources of 25 MMBO in the Triassic and Permian sandstones within the Woodburn Forest prospect, based on 2011 and 2012 seismic data. According to Petro River, the 2D seismic has identified six more prospects of comparable size.

Petro River has a 9% direct interest and a 3.2% indirect interest in the Larne Basin prospect.

Targeting Profitability at $20 Oil

“This is a very different animal we’re putting together here,” Rector told Oil & Gas 360®.

“We are building this company on well known conventional plays and capitalizing on the team’s expertise in the use of advanced seismic. We’re not looking at shale plays requiring expensive horizontal drilling and expensive completions or environmentally unpopular completions. We’re looking at plays with sand reservoirs, structural/stratigraphic traps, and in some cases, direct seismic hydrocarbon indicators. We are looking at conventional prospects we can de-risk with 3D seismic and then vertically drill. We’re confident we can do this with F&D costs in the $5 to $10 per barrel range. Our goal is to be profitable at $20 oil.”

Cohen told the EnerCom San Francisco institutional investor audience that Petro River has zero debt; the management structure carries low overhead; its planned drilling and seismic projects for 2016 are fully funded; and the company has enough cash in the bank to give it two years of running room. “If I’m thinking like a private equity manager, this is the right time to acquire low-risk assets and build an oil company,” Cohen told Oil & Gas 360®.

Petro River’s archived webcast presentation from The Oil & Services™ may be heard here.