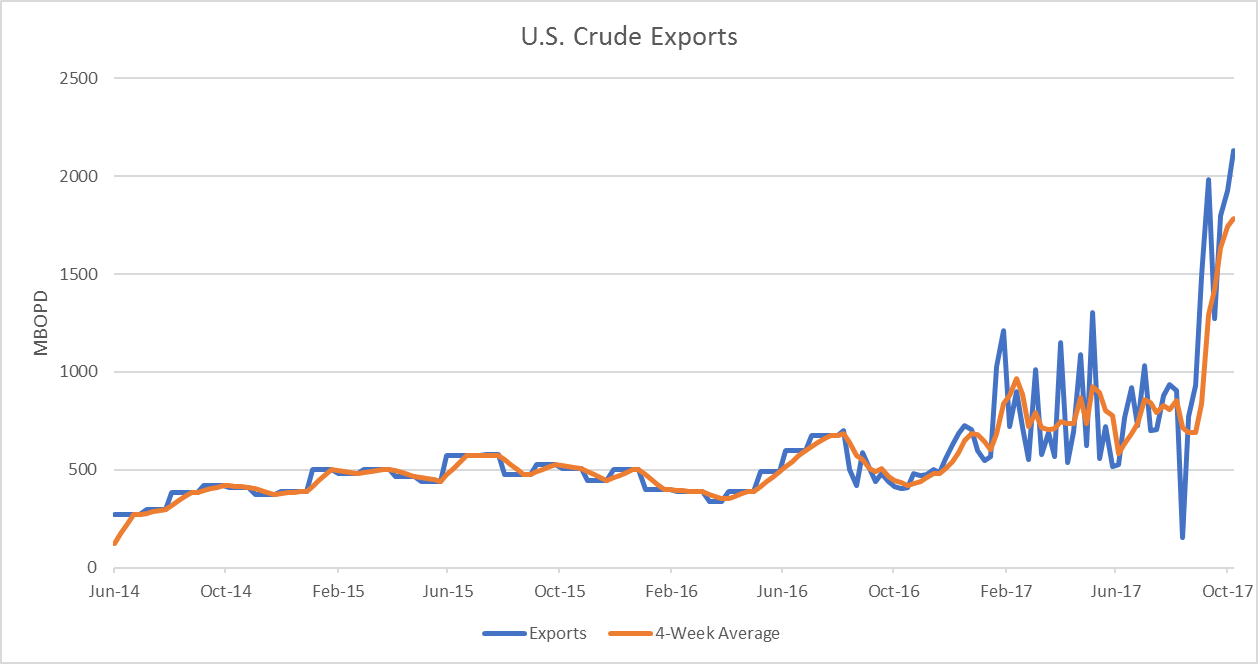

Exports broke 2 MM for first time last week

U.S. exports of crude oil have been reaching new heights, driven by favorable prices and expanding capacity.

U.S. exports of oil have been gradually rising since the export ban was lifted in late 2015, but have skyrocketed in the past month. The U.S. sent an average of just under 500 MBOPD abroad in 2016, which was, at the time, a record high. Exports rose to an average of 775 MBOPD from January to August this year, before dropping drastically in the aftermath of Hurricane Harvey.

According to the EIA, the U.S. exported an average of 902 MBOPD in the last week of August, and 153 MBOPD in the first week of September, a drop of 83% in a week. However, exports roared back and were at pre-storm levels by mid-September. Outflows have continued to rise since then, hitting a record 2.1 MMBOPD this past week. The EIA reports this is the first week the U.S. has ever exported more than 2 million barrels per day.

Lower refining output, WTI-Brent spread incentivizing exports

While Hurricane Harvey temporarily shut down nearly all exporting, the lingering effects of the storm have had much more positive implications for U.S. oil exports. The temporary shutdown of a significant portion of the U.S.’s refining capacity incentivized sending oil elsewhere for processing.

Recent economics have also provided a boost. The spread between WTI and Brent is rising, making American oil cheaper relative to the international benchmark. Currently, WTI is around $7 per barrel below Brent, the highest differential since mid-2015, meaning high export rates are likely to continue in coming weeks as global buyers seek the best price for crude.

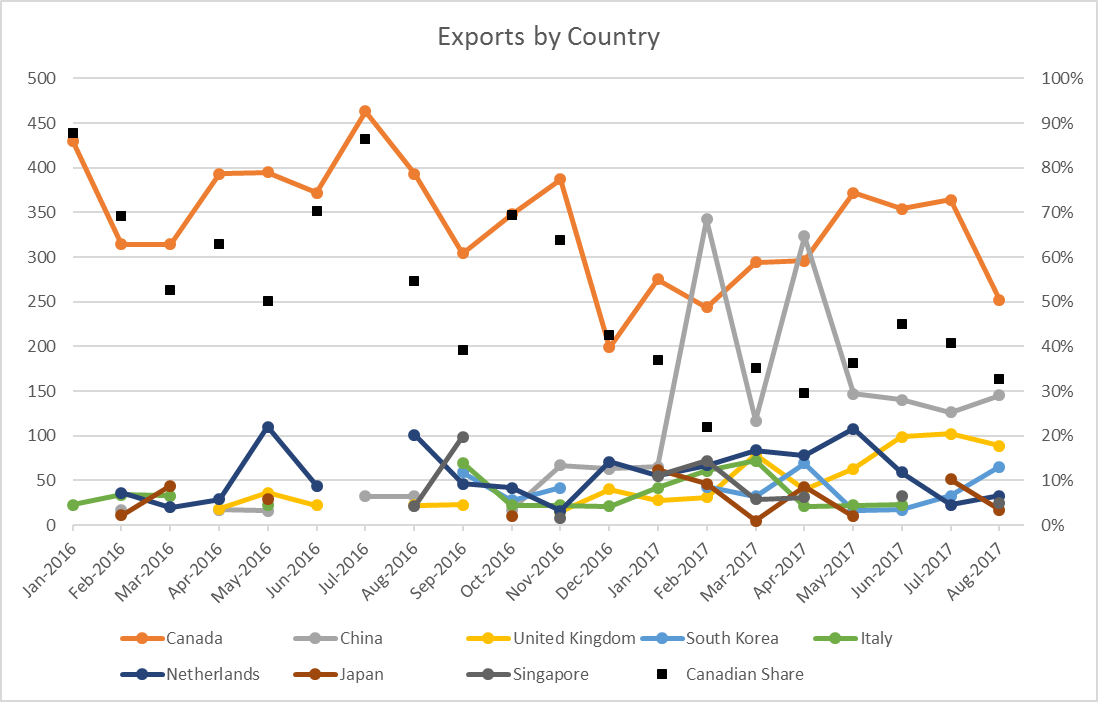

Canadian share decreasing, China increasing

In addition to sending more oil abroad, the U.S. is sending oil to more countries than ever before. According to the EIA, a total of 29 different countries have received U.S. oil in the first eight months of the year, compared to 27 in 2016 and 10 in 2015. Canada is still the top destination for oil, but its share of exports has declined sharply. In 2015, Canada received about 92% of all oil exported by the U.S. In 2017, by contrast, only 35% of all oil exported by the U.S. went to Canada.

Among individual countries, China has experienced the largest increase in oil from the U.S. The country received an average of only 1.2 MBOPD in 2015, making it the ninth-largest oil-receiving country that year. Chinese imports have increased more than 100-fold since then, and averaged 175 MBOPD in 2017. China even eclipsed Canada in two months of 2017, receiving the largest share of U.S. oil in February and April. This is the first time since at least 2000 that another country has received more American oil than Canada.