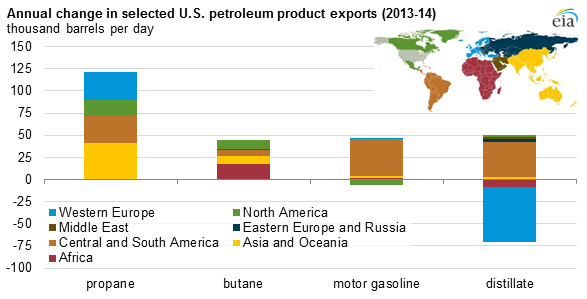

United States exports of noncrude petroleum products increased for the 13th straight year in 2014, the Energy Information Administration said in a report on March 5, 2015. The U.S. averaged 3.8 MMBOPD in 2014 – an increase of approximately 10% from 2013. The overwhelming majority of the product remained in the western hemisphere, being sent to various ports in both North and South America. Most gasoline exports are merely shipped across the border to customers in Mexico and Canada.

Gasoline exports typically peak near the end of each fiscal year due to seasonality and a decline in U.S. demand. The larger-than-normal gas volumes are sent elsewhere and led to a monthly record of 875 MBOPD in December 2014. Refinery run rates are also at all-time highs, flirting with a 90% utilization rate and receiving roughly 15 MMBOPD (including the 6 MMBOPD of imported crude). The lowered gasoline demand in the U.S. has led to a rise in prices. In the latest report, the average price for a gallon of gas is $2.42 – roughly 15% higher than the price of $2.06 in mid-January.

Are we entering another Record Setting Year?

The ban on crude exports has become a hotly contested issue, and the chatter has only increased since OPEC’s status quo approach to production cut global spot prices in half. Many executives in the oil and gas industry have publicly called on ending the ban, including Rex Tillerson, Chief Executive Officer of ExxonMobil (ticker: XOM), and Ryan Lance, Chief Executive Officer of ConocoPhillips. A report from the Brookings Institute says lifting the ban will increase America’s global power and foreign relations, while the American Petroleum Institute said scrapping the export ban would diversify the market. A detailed report from the Energy Information Administration is expected to be released in the first half of 2015.

The export of outright crude products is currently banned, but a select group of companies is allowed to send refined products abroad. Currently, the only companies with said permits are Enterprise Products Partners (ticker: EPD), Pioneer Natural Resources (ticker: PXD) and Royal Dutch Shell (ticker: RDS.B). Australia-based BHP Billiton sent products overseas without an official government ruling in November 2014, saying its product met all legal requirements. Meanwhile, ConocoPhillips (ticker: COP) is seeking a license and Kinder Morgan (ticker: KMI), a rival of EPD, is supposedly weighing its options.

Meanwhile, the government is carefully opening the door for oil trade, the Department of Commerce said in December that it had begun to approve the backlog of requests, but a government aide said “there’s not a lot of pressure to do more.” Sources of Reuters said the U.S. port authority was recently encouraging certain companies to exploit loopholes in the export ban, such as “self-classifying” the cargo.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.