Exports delivered to more destinations than ever

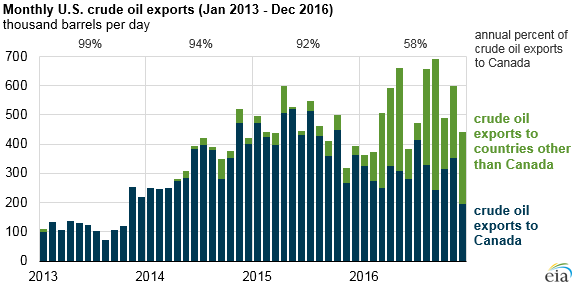

U.S. crude oil exports grew 12% in 2016, despite a decline in domestic production, according to a note released by the EIA today. In addition, these exports were delivered to more countries than ever before.

In December 2015, congress lifted the petroleum export restriction that was originally passed in 1975. This made it much easier for companies to export to countries other than Canada. Crude was exported to 26 countries last year, compared with 10 in 2015. While Canada is still the primary destination of U.S. crude exports, only 58% of exports went to Canada in 2016, down from 92% in 2015.

Netherlands, Curacao popular destinations

Aside from Canada, the Netherlands received the largest amount of exported crude, at 38,000 BOPD. Exports to other European nations like Italy, the UK and France made Europe the largest regional export destination.

The third largest destination overall is Curacao, a small island in the Caribbean. PDVSA, Venezuela’s NOC, operates a large refinery on the island with 330,000 BOPD of capacity. Press reports suggest that PDVSA is importing light U.S. crude to blend with heavy Venezuelan crude oil before processing at the refinery.

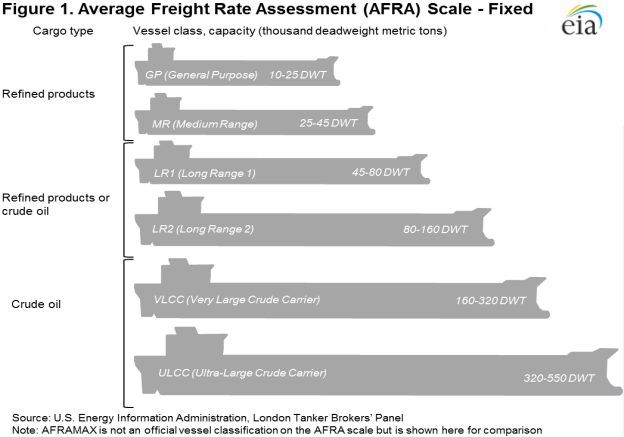

Some nations, like the Marshall Islands, Panama and the Bahamas are listed as receiving exports but are likely not the final destinations of the crude. Many ports in the U.S. are not large enough to accommodate the titanic tanker ships that are most economic to transport crude internationally. Instead, crude is loaded on smaller ships and then transferred to larger vessels outside of port. Due to a quirk of U.S. regulations, the registration nation of the receiving ship in these transfers is often listed as the actual destination. The Marshall Islands, Panama and the Bahamas are popular nations to register ships, making those countries appear to be the final destination.

U.S. crude oil imports increased in 2016, which contributed to an increase in exports. The increase in imports of crude oil meant more domestic crude was available for exporting. Tanker rates were low for most of 2016, making the economics of exporting crude more attractive. The increase in exports also made many ships available for back-haul voyages at further reduced rates, making exporting crude even more economically favorable.

The ability to export abroad is increasingly important to U.S. E&Ps

Some of the larger E&Ps in the United States are beginning to look to foreign markets to absorb their growing production. Pioneer Natural Resources (ticker: PXD) plans to send two cargoes of crude to Asia during Q1 of 2017, Executive Vice President of the South Texas Asset Team, Western Asset Team and Corporate Engineering Ken Sheffield told Oil & Gas 360®.

“We’re in the early innings of international crude exports today, but we’re engaged in it and learning about it. We’re preparing ourselves for the future. With the increase in our production, that ability to export is going to be increasingly important,” explained Sheffield.

“We believe there is incremental value attached to light sweet crude going to more transportation fuel-focused refineries,” said Sheffield. “U.S. refineries are a little oversupplied for light sweet crude, and they’re more geared to handle heavy crude. If we can redirect lighter sweet crude to hungrier markets, we think that’s a money winning proposition for the company.”