Reuters reports Enterprise Products Partners (ticker: EPD) has secured light crude oil export contracts with Mitsubishi’s Petro-Diamond Singapore and Vitol, an independent oil trader, for volumes of 40 MBOPD in 2015. The information comes from Reuters sources based on anonymity, but information arose last week about EPD seeking to expand its crude export cargoes. Although the export of raw crude is still outlawed, light grades that have either been lightly processed or refined are permissible to ship abroad.

Enterprise Products Partners is scheduled to discuss its Q4’14 results via conference call on January 29 at 10:00am EST. The company has yet to officially announce the contracts.

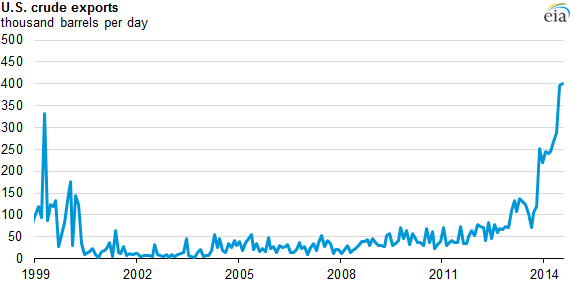

Soft Green Light for Exports

Currently, only three companies have been granted permission from the Department of Commerce (DOC) to export crude abroad. The companies, other than EPD, include Pioneer Natural Resources (ticker: PXD) and Royal Dutch Shell (ticker: RDS.B). ConocoPhillips (ticker: COP) is seeking a license and Kinder Morgan (ticker: KMI) is supposedly considering sending its product internationally. Australia-based BHP Billiton became the first company to ship U.S. crude abroad in November 2014, and did so without receiving an official ruling from the government. “We took the necessary time to thoroughly examine the issues involved and ensure the processed condensate was eligible for export,” BHP said to The Wall Street Journal.

If EPD is successful in finalizing an additional contract that speculated volumes of 20 MBOPD, its total export volumes for 2015 are projected at 60 MBOPD. The forecast would make it the top U.S. crude exporter, topping rival PXD’s forecast of 50 MBOPD.

Several U.S. government officials have lobbied to end the 40-year old crude embargo, and the DOC announced it began approving the “backlog” of export requests in December 2014. Sources of Reuters said the U.S. port authority was encouraging certain companies to exploit loopholes in the export ban, such as “self-classifying” the cargo.

No More Steps Will Be Taken?

The embargo has certainly loosened, but John Podesta, a top aide to President Obama, said the U.S. does not plan on taking any further steps. “At this stage, I think that what the Commerce Department did in December sort of resolves the debate. We felt comfortable with where they went,” Podesta said in an interview with Reuters.“If you look at what’s going on in the market and actions that the Department took, I think that … there’s not a lot of pressure to do more.”

Many executives in the oil and gas industry have publicly called on ending the ban, including Rex Tillerson, Chief Executive Officer of ExxonMobil (ticker: XOM), and Ryan Lance, Chief Executive Officer of ConocoPhillips. A report from the Brookings Institute says lifting the ban will increase America’s global power and foreign relations, while the American Petroleum Institute said scrapping the export ban would diversify the market. A detailed report from the Energy Information Administration is currently being developed.

Refiners, meanwhile, seem to be less willing than their E&P counterparts. Valero Energy (ticker: VLO), is one major industry player to oppose exports, saying the rising U.S. domestic production protects the country from geopolitical shock. Marathon Petroleum (ticker: MPC) said in its Q3’14 conference call that there is no glut of light sweet crude, which is contrary to popular industry opinion.

Senator Lisa Murkowski, the top Republican on the Senate Energy Committee, has moved forward on plans to lift the ban. “My interest is not to protect the refineries’ bottom line. They are going to have to deal with it within the industry.”

Alaska Senators Murkowski and Dan Sullivan along with Representative Don Young held a press conference yesterday to announce their joint plans to reverse the White House decision to block access to Alaska’s oil and natural gas resources by placing the Arctic National Wildlife Refuge (ANWR) into wilderness status. “It is a one-two-three kick to the gut of Alaska’s economy,” Murkowski said at the press conference. Sullivan said he would fight to protect Alaska’s economy and sovereignty.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.