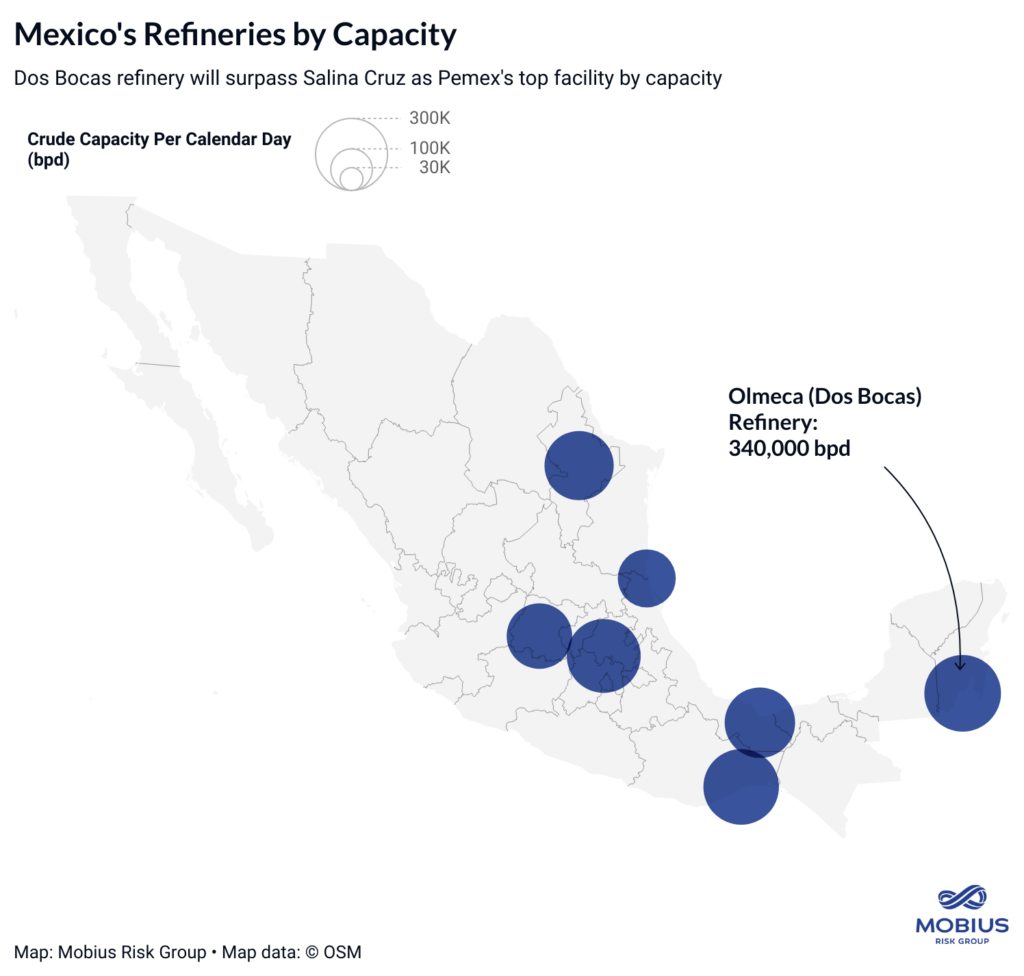

After years of delays and running $7 billion over budget, Pemex’s CEO says the company’s new Dos Bocas (Olmeca) 340,000 bpd refinery will reach maximum production by the end of March.

The new refinery will produce 170,000 bpd of gasoline and 120,000 bpd of ultra-low sulfur diesel, increasing Pemex’s fleet-wide output forecasts by 60% to 1.05 million bpd of gasoline, diesel, and jet fuel.

While a boon for Mexico’s domestic fuel output, Dos Bocas paints a different picture for U.S. refiners, who will lose:

- Demand in their top gasoline and diesel export market and

- Critical volumes of Mexico’s heavy Maya crude.

As we discuss below, the second point is further complicated by Venezuelan sanctions and Canada’s Trans Mountain Expansion project, which will ship more heavy crude to the Pacific and fewer supplies to refineries on the U.S. Gulf Coast.

Long-Delayed & Frequent Mixed Signals

Located in Mexico’s Tabasco state, Dos Bocas began early production runs in September 2023 — more than a year after President Andres Manuel Lopex Obrador (AMLO) inaugurated the facility and short of his promise of processing 290,000 bpd by the end of 2023.

Still, the refinery is one of AMLO’s flagship infrastructure projects, and the president is racing to get the facility over the finish line before leaving office this September.

Under the latest guidance from Pemex CEO Octavio Romero, the Dos Bocas facility will reach its maximum refining capacity of 340,000 bpd by the end of March. Romero’s guidance follows a January Pemex presentation that forecasted 243,000 bpd of crude processing in 2024 before reaching full capacity in 2025.

The Impact of Dos Bocas on U.S. Refineries:

Taking Heavy Crude Volumes Offline

According to Mexico’s Energy Secretary, the Dos Bocas refinery will run on crude with an API gravity between 22 and 24, which means most of the facility’s inputs will come from Mexico’s heavy Maya grade.

Since heavy grades require sophisticated and expensive refinery infrastructure, Mexico’s Maya export opportunities have historically concentrated to buyers in the U.S.

Throughout 2023, over 65% of Maya exports went to refineries in the U.S. — an average of roughly 422,000 bpd out of Mexico’s total Maya exports of 647,000 bpd.

As Dos Bocas ramps up to full capacity, the volume of Maya available for export will decline by roughly 52%.

U.S. Fuel Exports Lose Top Demand Destination

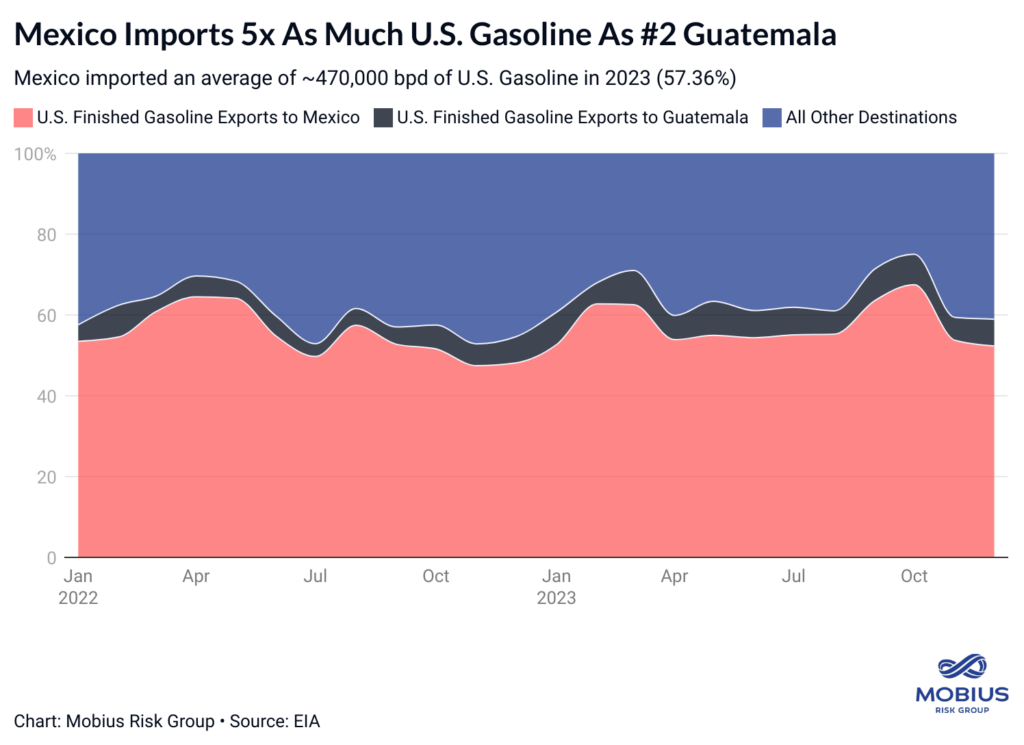

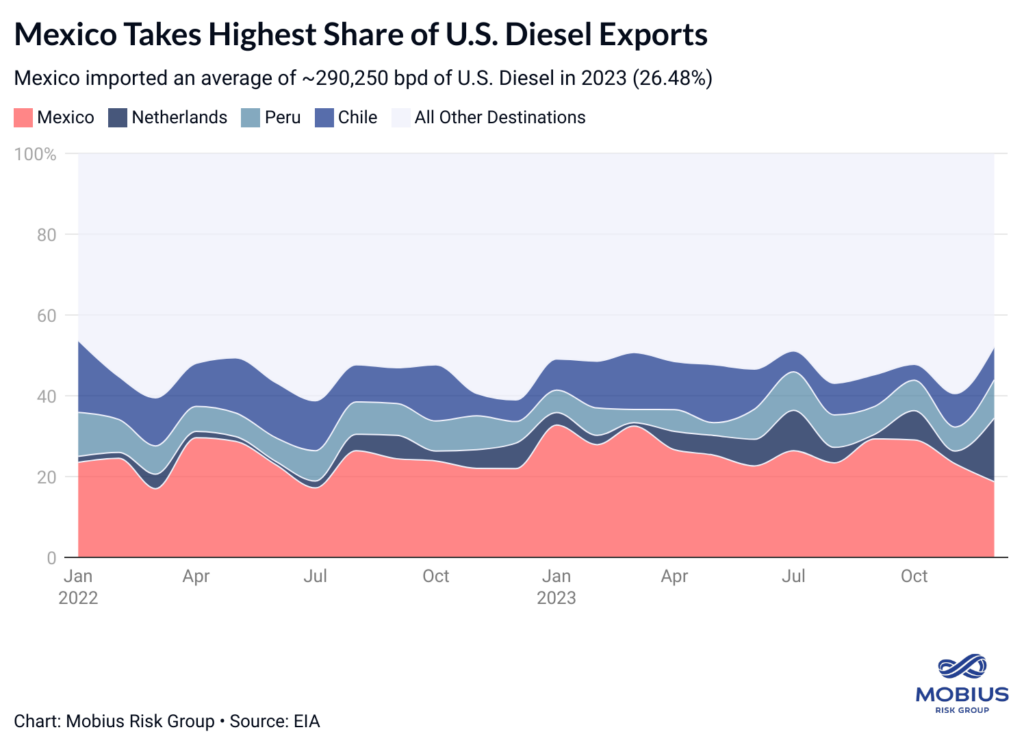

According to the EIA, Mexico imported an average of 758,000 bpd of U.S. diesel and gasoline last year, making it the top destination for U.S. refiners.

Throughout 2023, Mexico averaged approximately 469,000 bpd of U.S. finished motor gasoline imports, or over 5x the volume imported by the U.S.’s second-highest destination, Guatemala.

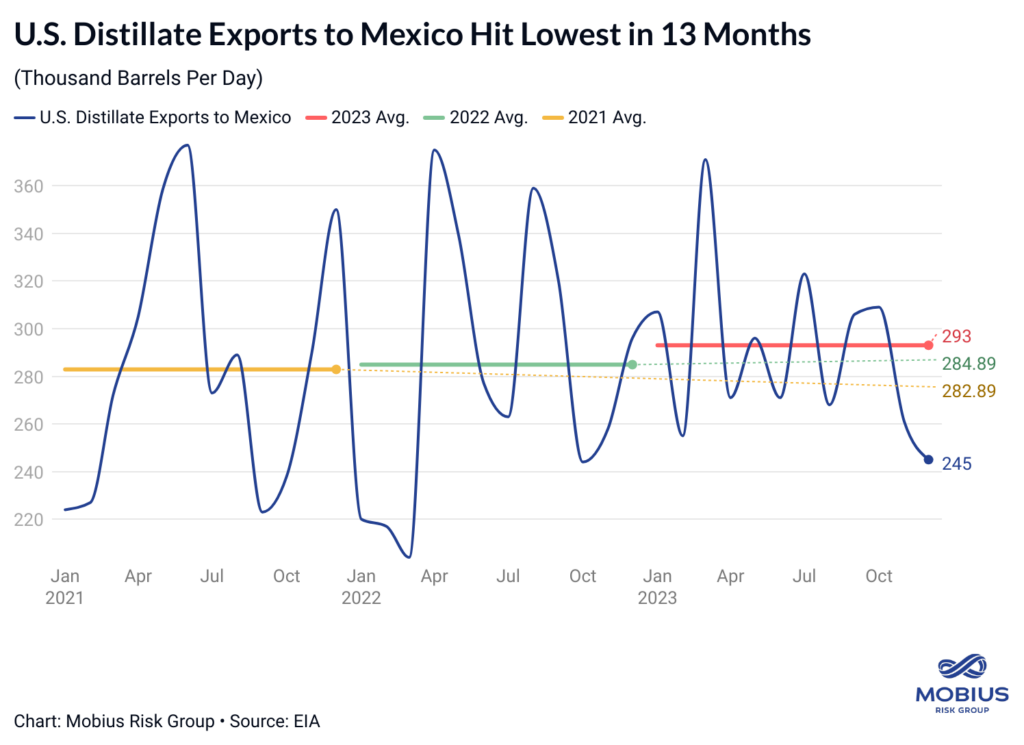

Diesel imports tell a similar story, with Mexico again taking the top slot for U.S. distillate exports at approximately 290,250 bpd through 2023 versus #2 Netherlands (EU) at an average of 61,500 bpd.

Discounting fuel demand growth, Dos Bocas will produce enough of the same products at full capacity to reduce U.S. gasoline and diesel export demand by 38%.

Early signs of the trend?

In the final month of 2023, EIA data showed U.S. distillate exports to Mexico hitting their lowest in 13 months.

Meanwhile, Mexico’s imports of U.S. finished motor gasoline held roughly 65,000 bpd higher in December than the 2023 average.

The Outlook for U.S. Refineries:

Exports to Mexico

According to ship tracking data, Mexico’s imports of U.S. finished gasoline and diesel in the first two months of 2024 were roughly 80,000 bpd lower than their 2023 average.

Still, Pemex’s track record of low refinery utilization and frequent outages suggests U.S. exports will not face the full impact of Mexico’s new processing capacity in the near term.

Mexico’s trailing 12-month average refinery utilization rate is 69%, and the added complexity of running heavy crude will keep the country’s utilization under pressure.

Heavy Crude Availability:

The startup of Dos Bocas will erode Mexico’s exports of heavy Maya crude, but Mexico isn’t the only problem on the horizon for U.S. refineries.

Alberta’s Heavy Oil Sands

On the U.S.’s northern border, Canada’s Trans Mountain Expansion (TMX) project is linking Alberta’s oil sands and terminals on the Pacific, where Canadian heavy crude will gain access to Asian buyers like China’s independent refineries (teapots).

The TMX project will enable another 590,000 bpd of crude transmission, boosting the pipeline’s capacity to roughly 890,000 bpd once in service.

According to recent earnings commentary from oil producer MEG Energy, line fill on the pipeline will commence in April, and full operations will begin later in the second quarter. Trans Mountain Corp has reportedly called for 2.1 million barrels in April, and the government-owned pipeline company said in a filing to the Canada Energy Regulator that commencement for firm service contracts is May 1st — one month later than its previous date.

Venezuelan Heavy Crude:

Venezuela’s Orinoco oil belt contains over 90% of the world’s extra-heavy oil reserves, supporting the largest share of heavy oil recovery globally.

As the 6-month sanctions relief agreement between the U.S. and Venezuela’s Maduro government nears its expiration date, questions about the country’s heavy crude could dictate the Biden administration’s policies going forward.

If the U.S. restores full sanctions on Venezuela’s crude and product exports while Mexico restricts Maya sales, the list of reliable heavy oil producers from which American refineries can import will shorten to Canada, Saudi Arabia, and Ecuador.

Takeaways for Energy Markets:

- According to Pemex CEO Octavio Romero, Mexico’s new Dos Bocas 340,000 bpd refinery will reach maximum processing capacity by the end of March. With the addition, Pemex hopes to increase fuel output by 60% to over 1 million bpd in 2024.

- Mexico’s push for domestic fuel sovereignty is especially bearish for U.S. refinery margins, as Mexico purchased over 57% of U.S. finished motor gasoline exports and over 26% of U.S. diesel exports in 2023.

- The refinery will run on 22-24 API crude, pulling from Mexico’s heavy Maya production.

- The U.S. is the largest buyer of Maya, with more than 65% of Mexico’s Maya exports going to the U.S. in 2023. The Dos Bocas refinery will reduce available export volumes by roughly 52%.

- More pressure on U.S. imports of heavy crude will come from the north, as Canada’s Trans Mountain Expansion project directly links Alberta’s oil sands to export terminals on the Pacific. U.S. refineries will have to compete for heavy crude volumes with Asian buyers.

- Heavy crude supply is further complicated by Venezuelan crude and product sanctions. Venezuela is home to the largest extra-heavy oil deposit in the world. Losing Venezuelan exports to the U.S. at the same time Mexico cuts Maya exports would leave importers with Saudi Arabia, Ecuador, and Canada for reliable heavy grades.

- US. gasoline and diesel exports to Mexico will be supported by Pemex’s dismal track record of keeping refineries online. Over the trailing 12 months, Pemex’s average refinery utilization rate was approximately 69%.

By: Alex Melvin-Mobius Research & Insights

Discover more of Mobius Risk Group’s commodity risk insights for geopolitics, energy policy, and structural supply and demand here: https://insights.mobiusriskgroup.com