TransCanada says it does not view the partnership as a “viable financing alternative”

FERC’s recent ruling on the rates charged by MLPs continues to ripple through the pipeline industry, causing turmoil in some corner offices. One large pipeline company, TC Pipelines LP (ticker: TCP) outlined its effects on the business today.

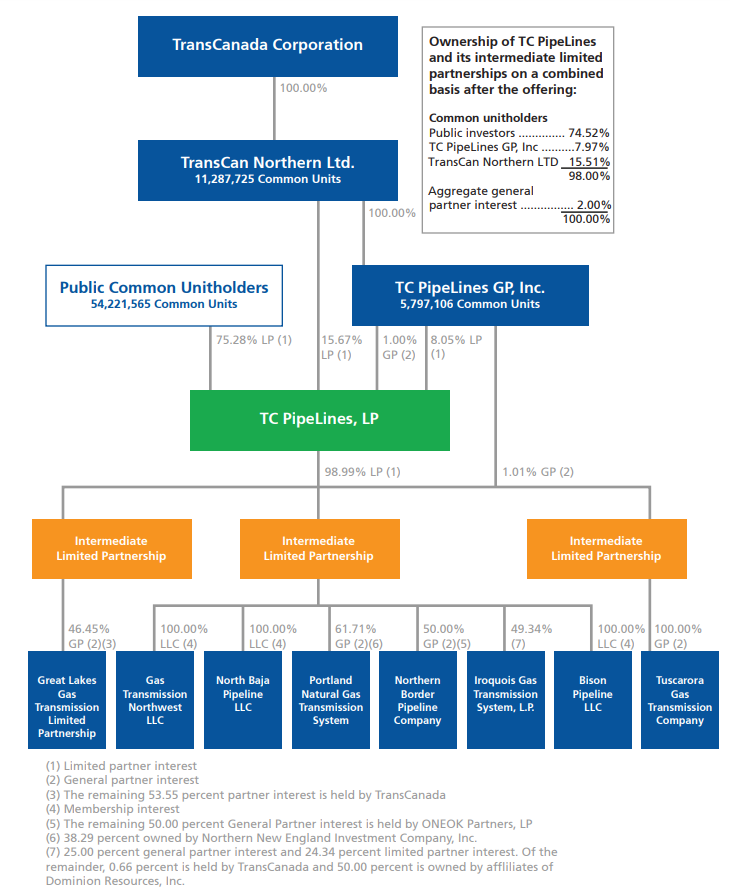

TC PipeLines, LP is a United States limited partnership that has investments in eight critical FERC-a regulated, energy infrastructure pipelines capable of moving 9.4 billion cubic feet per day of natural gas. Revenues from the assets are derived almost entirely from fee-based charges. The general partner, TC PipeLines GP, Inc., is wholly-owned by TransCanada Corporation (ticker: TRP).

TCP announced Q1 results this week, reporting net income of $96 million, up $19 million from this period last year, but FERC actions dominated the conversation.

Background on FERC rule announcements

In mid-March, FERC made several major pronouncements affecting MLPs. The most immediately significant, and the one that generated the most headlines, concerned the rates charged by pipeline operators.

FERC reversed its previous policy and ruled MLPs could not include an income-tax allowance in their cost-of-service-rates, effectively lowering the amount companies would receive in their operations.

While several MLPs have filed requests for a new hearing or clarification of how the rule would be implemented, this decision may have a significant material impact on TC Pipeline’s results.

Further uncertainty is a result of the recent tax legislation, as natural gas pipeline rates were negotiated before the tax rate was reduced. Regulation addressing this situation is still in the early phases, but gas pipelines may see rates fall in accordance with the drop in the tax rate.

TCP cuts distributions by 35%

Overall, TC Pipelines estimates that the cash flow from its assets could fall by up to $100 million per year due to the new rules, which would be significant as the company recorded $112 million in distributable cash flow this quarter. This dire forecast has led TCP to slash its distributions by 35% to $0.65 per unit, in anticipation of major changes to the company’s revenue.

Other MLPs have not yet cut distributions in response to the new rules. Some have, however, shifted from an MLP structure to a more traditional corporate structure, making the concern about the new rules moot.

Compounding the company’s difficulties, TransCanada, TC Pipelines’ parent company, has become cautious until clarification or a rehearing on the new rules occurs. TransCanada has stated that TCP is not seen as a viable funding lever based on current FERC rules, and so asset dropdowns are not expected.

TC Pipelines said it is considering reorganizing to a traditional corporate structure, which would mitigate some of the new rules, but is evaluating all strategic options.

TC Pipelines GP President Nathan Brown outlined the current state of the company and its options, saying, “the recent actions by FERC in mid-March, with respect to the revised policy that would allow for no recovery of an income tax allowance in the cost-of-service rates of our pipelines with related follow-on impacts, have had a profound impact on us and many in our industry.

“The ultimate result is not precisely known but, if implemented as expected, will result in a material decrease in cash flows from our pipelines. In view of this potential outlook, we believe it prudent to proactively manage our financial position and leverage metrics. We continue to evaluate our strategic alternatives including possible reorganizations but have determined that a reduction in our distribution at this time is in the best interest of both the Partnership and our unitholders. This will allow us to fund our near-term capex and reduce our leverage to levels consistent with the anticipated reduced level of cash flow.

“Further to our outlook, our parent company, TransCanada Corporation, noted that they do not view the Partnership as a viable financing alternative at this time. Growth from dropdowns is therefore not anticipated to materialize unless circumstances change,” continued Brown.

“Notwithstanding all of this uncertainty, we believe our high-quality assets continue to be critical in their markets and as always we will focus on the safety and reliability of our pipeline operations and take prudent action to keep this infrastructure serving our North American stakeholders.”