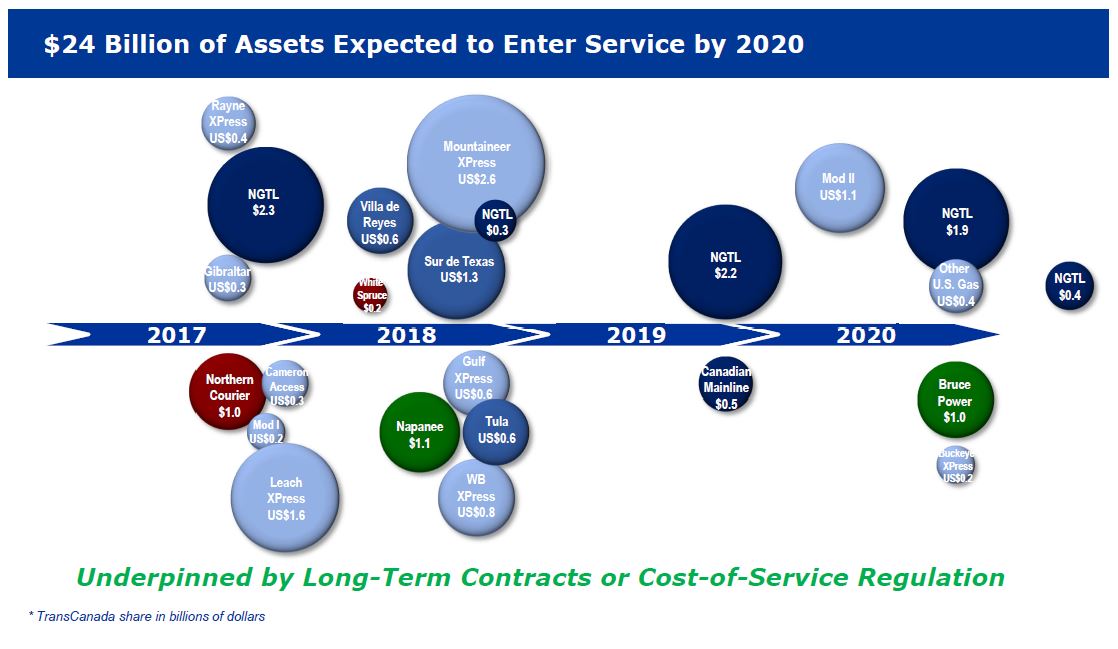

- Advancing $24 billion in commercially secured near-term growth projects

- $20 billion in projects in development including Keystone XL, the Bruce Power life extension program, and Coastal GasLink

- Expectations to grow common share dividend at an average annual rate at the upper end of an eight to ten percent range through 2020

- Quarterly dividend of $0.625 per common share for the quarter ending December 31, 2017

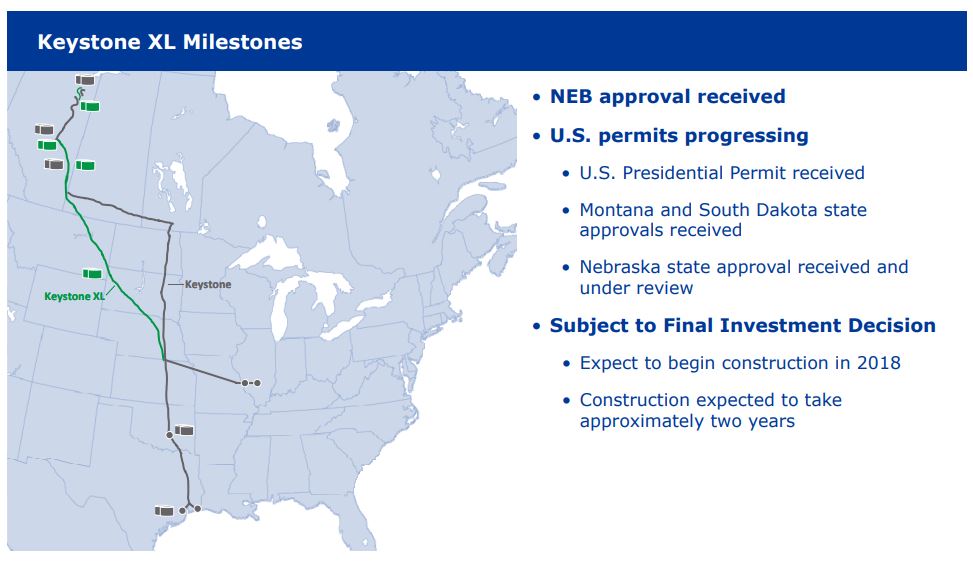

Keystone XL update

Reuters reported that the TransCanada Corporation (ticker: TRP) has begun the process of engaging Nebraska landowners for the alternative Keystone XL pipeline route that the Nebraska Public Service Commission outlined in its recent new approval for the 800-mile oil pipeline.

Environmental Impact Statements and other evaluations stand in the way of further progress. TransCanada Senior VP of Liquids Dean Patry said, “The alternate route would involve a number of new landowners for us, and as always, we’re striving to understand their perspectives on the project.”

The Keystone XL is subject to a final investment decision by TRP, however, according to this investor day presentation slide, construction is expected to begin in 2018 and will take approximately two years to complete.

According to Reuters, the Keystone XL will add 800,000 barrels per day, boosting Canada’s current pipeline capacity by nearly 25%. The currently active Keystone pipeline transports approximately ~20% of western Canada’s crude oil exports and has market access to ~6 million BBLPD of refining capacity.

TRP also filed a motion with the Nebraska Public Service Commission last week to question the regulator’s decision regarding the approved alternative route. The commission will have 60 days to rule on it.

Other projects

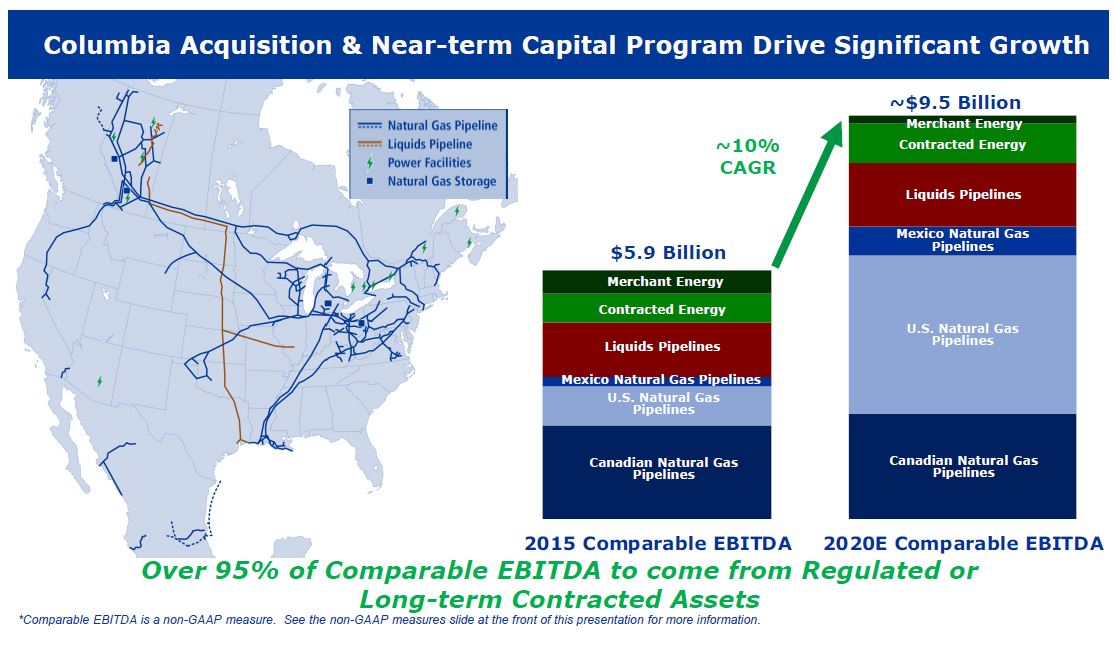

TRP did not rely entirely on the Keystone XL during the period which the application was rejected. The company acquired Columbia Pipeline Group for approximately $10.2 billion.

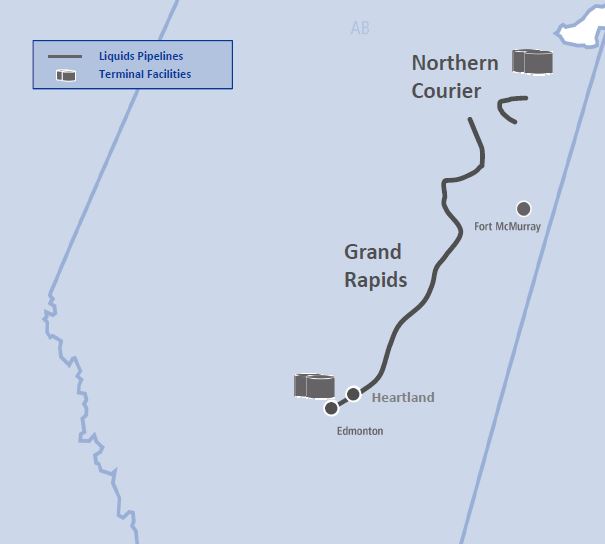

Additionally, four other pipelines were recently bought online, such as the $0.9 billion Grand Rapids, $1 billion Northern Courier, $0.4 billion Rayne Xpress, and $0.3 billion Gibraltar project – the in-progress Leach Xpress project should be in-service early 2018.

The company’s CapEx for the next three years is projected to be $17.2 billion. TRP plans to spend practically all of its CapEx on gas pipelines.

Company overview

TRP has invested over $75 billion since 2000 and has added 45,000 miles of natural gas pipelines. Currently, TRP has 56,900 miles of pipeline and 653 Bcf of storage capacity, serving 25% of continental demand. Additionally, TRP has developed 3,000 miles of liquids pipelines business. The company has also expanded its power generation portfolio by 4,500 MW.

Overall, the company said that its enterprise value has increased from $20 billion to $100 billion. TRP expects to place $5.6 billion of assets in-service in 2017 and has added over $3 billion of secured growth. $6.1 billion has been raised in capital markets to help fund growth programs.

Growing demand for energy

In 2015, North American natural gas consumption was a little under 100 Bcf/d. TRP estimates that future consumption will grow to around 110 Bcf/d, with a notable bump in LNG exports. The company’s 2030 estimate projects approximately 130 Bcf/d, with a large increase in LNG exports.

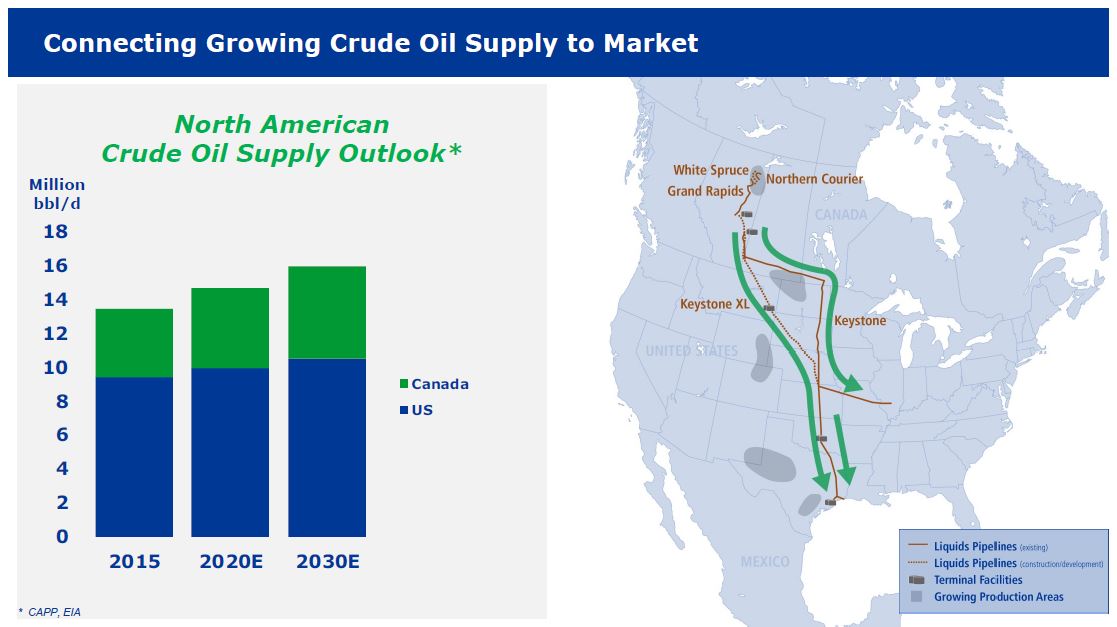

In regard to crude oil, North American consumption in 2015 was approximately 14 million barrels per day. TRP estimates modest growth in 2020 and 2030 to 15 million and 16 million barrels per day, with the U.S. being the primary consumer.