Canadian NatGas producer Tourmaline is growing—fast; free cash will pay for dividend, debt reduction

By Richard Rostad, analyst, Oil & Gas 360

Tourmaline Oil (ticker: TOU) announced fourth quarter results and reserves today, showing net earnings of $190.9 million, or $0.70 per share. The company’s Q4 2018 earnings are more than double those of Q4 2017, as improved natural gas prices boosted results.

Tourmaline reports it generated $89 million in free cash in 2018, though it outspent cash flows by about $4 million in Q4. The company outspent cash flows by over $200 million in 2017, so generating cash flow on the year is a significant accomplishment.

Tourmaline produced an average of 276.6 MBOEPD in Q4 2018, up 5% year-over-year and 9% sequentially. The company produced an average of 265 MBOEPD through the year, up 9%. Like most other Canadian natural gas producers, Tourmaline is working to diversify its price exposure beyond the AECO hub, as the Canadian benchmark often falls to very low prices. Tourmaline reports it realized $3.13/Mcf in Q4, a 99% premium over the AECO average of $1.57/Mcf.

Tourmaline now holds 2.46 billion BOE in 2P reserves, up 11% year-over-year. Based on 2P reserves, the company replaced 3.5 times production in the year for an F&D cost of $5.15/BOE.

Growth accelerating in 2019

Unlike many of its U.S. peers, Tourmaline is forecasting accelerated growth in 2019. The company plans to produce 300 MBOEPD in the year, up 13%. Liquids growth will be the focus, with a combined crude, condensate and NGL output of 66 MBOEPD, up 39% year-over-year. This increased production will be driven by $1.225 billion in CapEx in the year. While this is $75 million below prior plans, it represents a modest increase from 2018 levels in a year when most companies are cutting back.

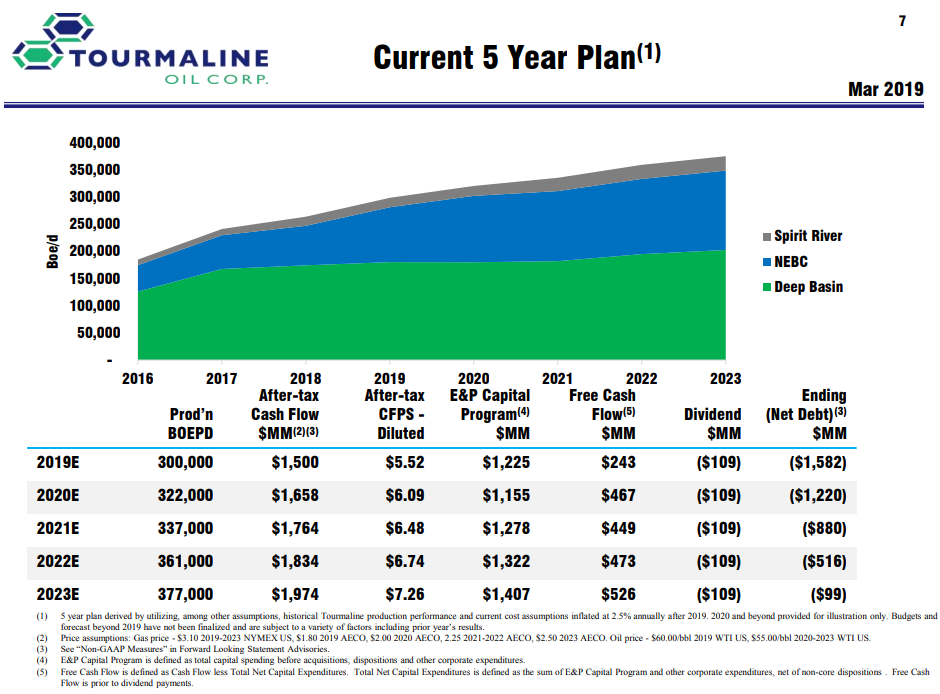

5-year plan pays off $1.6 billion in debt

Assuming $1.80 AECO and $60 WTI, Tourmaline estimates it will produce over $240 million in free cash flow in 2019, a number that will increase in coming years. Tourmaline is planning $109 million in dividend payouts per year, with any surplus cash going toward debt reduction. The company’s overall five-year plan will nearly eliminate debt by the end of 2023, with net debt falling from $1.72 billion to under $100 million.

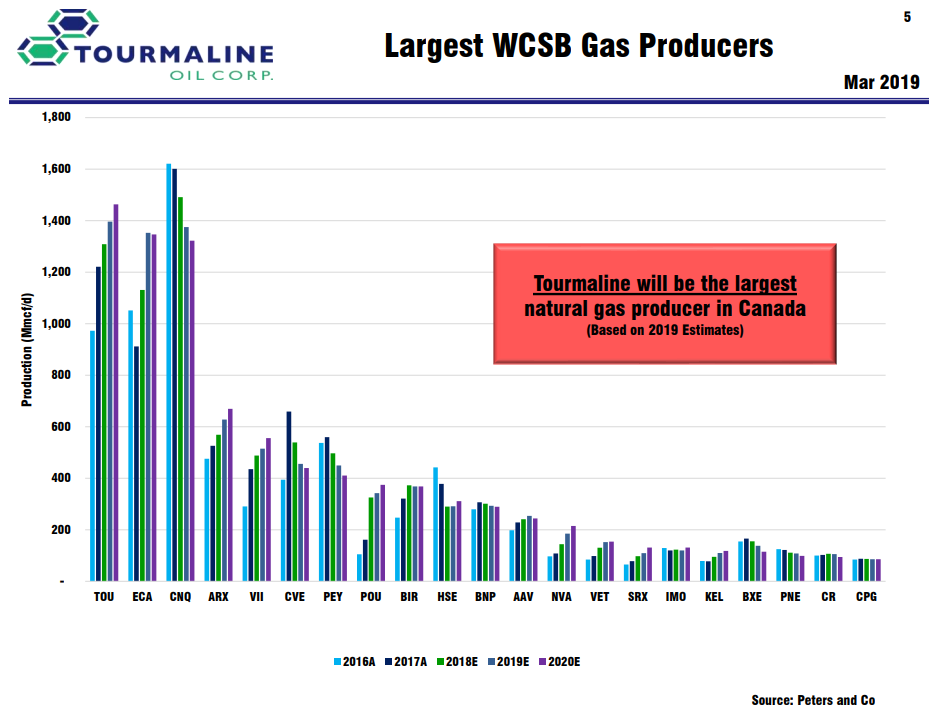

Based on announced 2019 plans, Tourmaline will be the largest natural gas producer in Canada this year, with nearly 1.4 Bcf/d in output. However, the company has reduced its expected AECO price for the year to $1.80/Mcf, a drop that may explain the company’s emphasis on liquids production. The company has doubled liquids output since late 2016, and it is targeting 72.5 MBOEPD of liquids output by the end of 2019.

Q&A from TOU conference call

Q: You guys mentioned you’ve changed your NGL price assumptions for 2019. Do you mind walking us through what they’ve changed to?

TOU: In 2018, our average NGL stream achieved about 38% of the WTI price. We’ve cut that to 27%. And of course, it’s all – we specifically analyzed each of the pentane, butane, propane, ethane streams and coming up with that. But that’s what the percentages of our WTI number that we expect to realize.

Q: I’m just wondering in terms of your kind of when you think about the bigger picture, your five-year plan and as your free cash flow continues, to increase according to your five-year plan, do you still see dividends as being the primary method of returning cash to shareholders? Just wondering in the context of given where your share price is at these days. Thanks.

TOU: I’d say that the uses of the free cash flow are the opportunity to modestly increase dividends, pay down debt, possibly sanction new E&P projects if commodity prices improve. They’re the three primary uses.

If you’re referring to a share buyback, it’s something that we look at and are still evaluating. And if we did proceed with that, I think if you look in 2020 through 2023 and the five-year plan, we have significantly more free cash flow on an annual basis, so perhaps it makes more sense then.

Q: We’ve seen in Alberta the production cuts, the mandated production cuts on the oil side. And certainly from a relative perspective, I don’t think that the picture is that much better on the gas side for the Alberta government, where do you think that’s heading? Do you think that anything can transpire on the gas side similar to what we saw on the oil side or what’s your thoughts around all that?

TOU: We think it’s very unlikely that curtailments happen on the natural gas side. It’s just oil was complicated enough, and gas is infinitely more complicated and difficult to instill curtailments on. And hey, AECO is CAD 3.

Q: How much of your production now has been shut-in because of the AECO price being as low as is? And impact of the lack of pipeline capacity out there, how big an impact is that on curtailment…

TOU: We have some volumes shut-in as we worked through our winter program, because not everything is tied in yet. Peter, it’s more a function of slowing down activity because of lack of base and egress and really we initiated that process back in late 2017 where we drastically slowed down the growth of our gas business and chose to grow the liquids business sort of underneath a ceiling of 1.35 BOEs a day. We’re doing between 1.4 BOEs and 1.45 BOEs right now. So modest growth from where we were exiting 2017 which was kind of always planned coming into 2019. And then when more firm egress options open up, we can obviously accelerate the gas business at that time.

Q: Yes. I know in the States, it just seems like we’re on a more and more of a treadmill at this point. And I assume that’s pretty much the same situation up in Canada. And I’m just wondering what the decline curve is that you’re experiencing at this point, and going forward is that going to change that much or what?

TOU: Well, by slowing down, our decline curve kind of shallows, if you like. We’re actually excited about the overall North American supply situation that we think a couple of the larger U.S. basins on the gas side may have started to roll over as operators move from Tier 1 to Tier 2 locations or start to experience a lot of parent-child relationship. So we’re encouraged by that.

Q: You know I guess my feeling is down here it’s so much of the shale is really almost like a Ponzi scheme at this point from these companies because so they’re spending more money on capital and they are – any cash flow coming back from the projects.

TOU: No, I think that’s right. I mean I think you can see from our numbers that we actually do generate earnings and are profitable on a full cycle basis.

TOU: But you know we are encouraged because the underlying natural gas demand build in both countries is really phenomenal and it’s on a steady ramp, and a lot of people believe supply is infinite and you and I know it isn’t.