Total (ticker: TOT) announced two significant developments today, selling Norwegian assets and bringing a Brazilian field online.

Total will sell its interests in the Martin Linge field and the Garantiana discovery to Statoil for a total of $1.45 billion. Total currently owns 51% of Martin Linge and 40% of Garantiana. Both assets are not yet in production, but Martin Linge is currently being developed.

Statoil reports the topside facilities for Martin Linge are being constructed in South Korea and will be transported to Norway in early 2018. Current timelines indicate first oil in the first half of 2019. The field has an estimated recoverable resource of over 300 MMBOE, with a production expected into the 2030s. Statoil already owns a 19% stake in the field, so it will hold 70% of the project pro-forma.

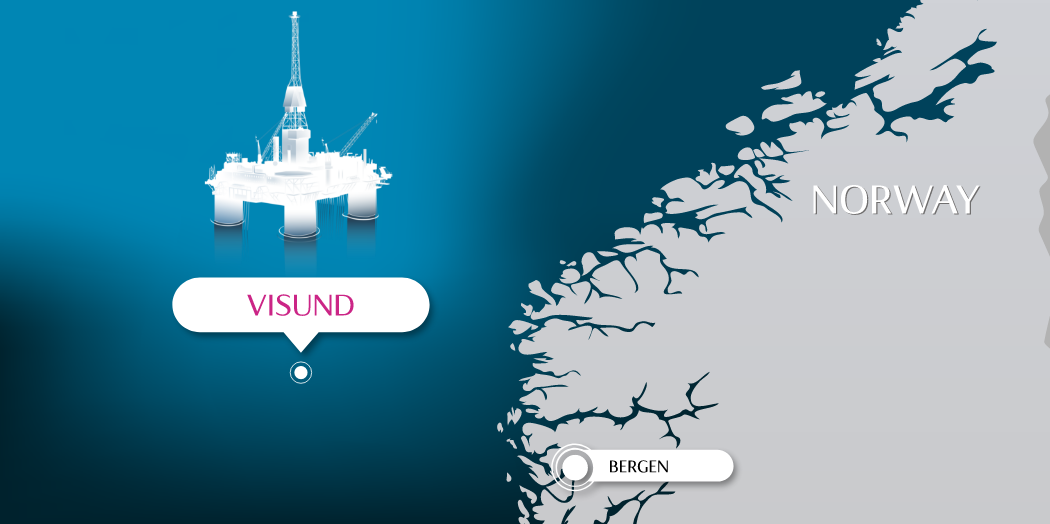

Garantiana was discovered in 2012 by a wildcat well, which found a field with an estimated 50 to 70 MMBOE. Development proposals are currently being evaluated. The field is located north of Statoil’s Visund project, so development may involve a simple tie-back to that platform.

Arnaud Breuillac, President of Exploration and Production at Total commented on the sale, saying “The forthcoming acquisition of the Maersk Oil portfolio, which will make Total the second largest operator in the North Sea, leads us to review our portfolio in this area so as to focus on the assets in which Total will be able to generate synergies and reduce their breakeven points. In this context, given that Martin Linge is Total’s only operated asset in Norway, there is limited scope to optimize operations, whereas with Statoil’s leading operating position on the Norwegian Continental Shelf, Statoil is in a better position to optimize this asset.”

10 billion barrel Libra field begins production

Total also announced first oil from the massive Libra field in Brazil. The field has 8 to 12 billion barrels of oil recoverable, making it one of the largest fields currently under development. Total owns a 20% stake in the project, and is joined by Petrobras (40%), Shell (20%), CNOOC (10%), and CNPC (10%). The companies are taking their time with the field, gathering extensive data before full development begins.

Total is currently utilizing one floating production, storage and offloading (FPSO) unit, which has a capacity of 50,000 BOPD. This will allow the group to generate revenue and collect data to optimize the field’s development in an “extended well test.” The next step for Libra will be FID for the first full-size Libra FPSO, which will have a capacity of 150,000 BOPD. Future development will involve further FPSOs of similar capacity.