Blackbird to continue delineating its liquids-rich Montney assets

Calgary-based Blackbird Energy (ticker: BBI) announced two non-brokered private placements of common shares Tuesday. 27,150,000 shares will be issued in total for proceeds of approximately $13 million. 16,500,000 of those shares were issued on a “flow-through” basis pursuant to the Income Tax Act (ITA) in respect of Canadian Exploration Expenses (CEE) at a price of $0.485 per share for gross proceeds of approximately $8.0 million, while another 10,650,000 flow-through shares pursuant to the ITA in respect of Canadian Development Expenses (CDE) at a price of $0.47 per share for gross proceeds of approximately $5 million, the company said in a press release.

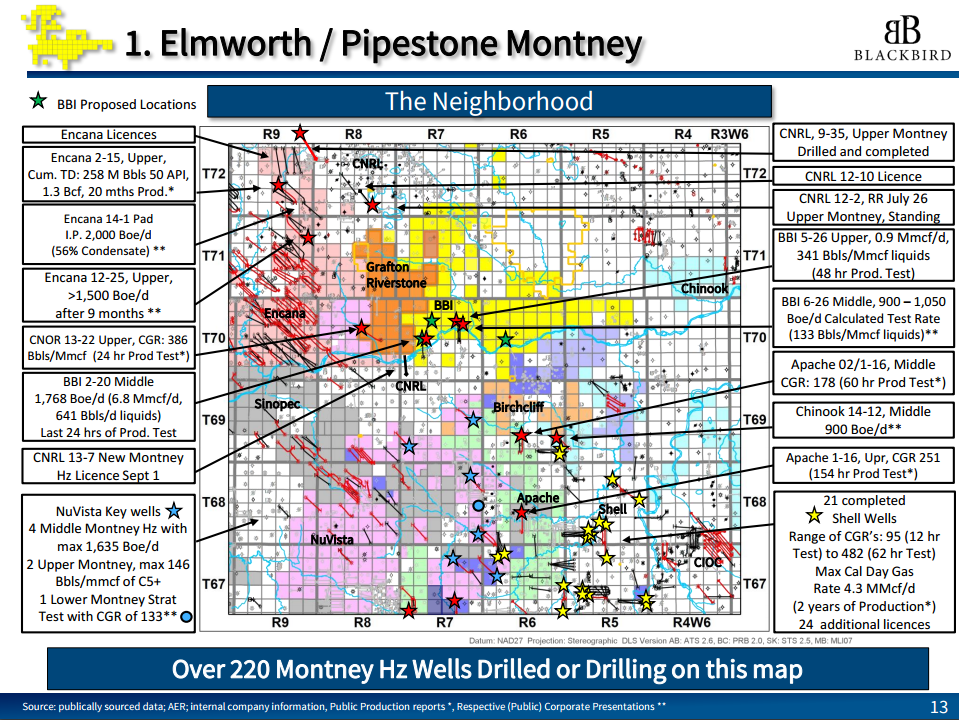

The proceeds from the private placements will allow the company to accelerate its business plan, and take advantage of “significant momentum … building in the greater Elmworth/Pipestone corridor” that the company sees building. Blackbird put out a release on October 18, highlighting activity near its acreage as operators like Encana (ticker: ECA) and Nuvista (ticker: NVA) delineate the area.

“We believe it’s opportunistic to implement an accelerated drilling program to continue delineation and value up our acreage,” Blackbird President and CEO Garth Braun told Oil & Gas 360®. “We’re going to have four wells on production by the end of the year, and these funds are going to facilitate the drilling of two additional wells,” Braun explained.

Blackbird and others exploring the Montney see four intervals that are going to be productive, and the internal rate of return in the condensate-rich portion of the play are forecast to be around 120%, which prompted the increased activity in the region, said Braun.

The company’s drilling program is targeting the condensate-rich Upper Montney (greater than 100 barrels of condensate per MMcf of gas) at Elmworth/Pipestone.

“The one product that we have a competitive advantage over the United States with is condensate, and the wells that we’re focusing on are both gas and condensate wells, but they’re very liquids-rich condensate.”

Building infrastructure in the Montney

On September 29, Blackbird announced that it received approval for its 100% owned and operated Elmworth facility and pipeline gathering system, which the company expects to complete in December of this year. The facility will have initial capacity of approximately 10 MMcf/d of natural gas processing, plus capacity for approximately 1.5 MBOPD of associated liquids processing, for aggregate throughput of 3.2 MBOEPD. The gathering system will encompass approximately 10 kilometers (6.2 miles) and will facilitate the tie-in of Blackbird’s behind pipe and future production from at least seven well pads located at its western acreage, south of the Wapiti River, the company said.