Torchlight Energy Resources (ticker: TRCH) is a high growth oil and gas exploration and production company with a primary focus on acquisition and development of domestic oil fields. The company’s strategy has been to farm-out operations to third parties and then monitor both the operations and its associated costs. The majority of its properties are in the Mid-Continent.

The company released drilling results for Q1’14 in a press release on April 23, 2014. A total of 15 gross producing wells are returning 250 barrels of oil equivalent per day (BOEPD) net to TRCH. Its work primarily as a non-operator provides exponential growth opportunities and more than 1,000 potential drilling locations identified by the company. A reserve report commissioned by Netherland, Sewell and Associates identified roughly 1.5 million barrels of oil equivalent of 1P reserves – a PV-10 value of $27.8 million.

Results for Q1’14 included $640,000 in revenue, a year-over-year increase of 198%, and increased total acreage in the Hunton play to over 25,000 gross acres.

Drilling Highlights

In a conference call with analysts and investors, Will McAndrew, Chief Operating Officer of Torchlight Energy, said, “We think the best place to find oil is where its already been found, and, more importantly, where it has already been produced.”

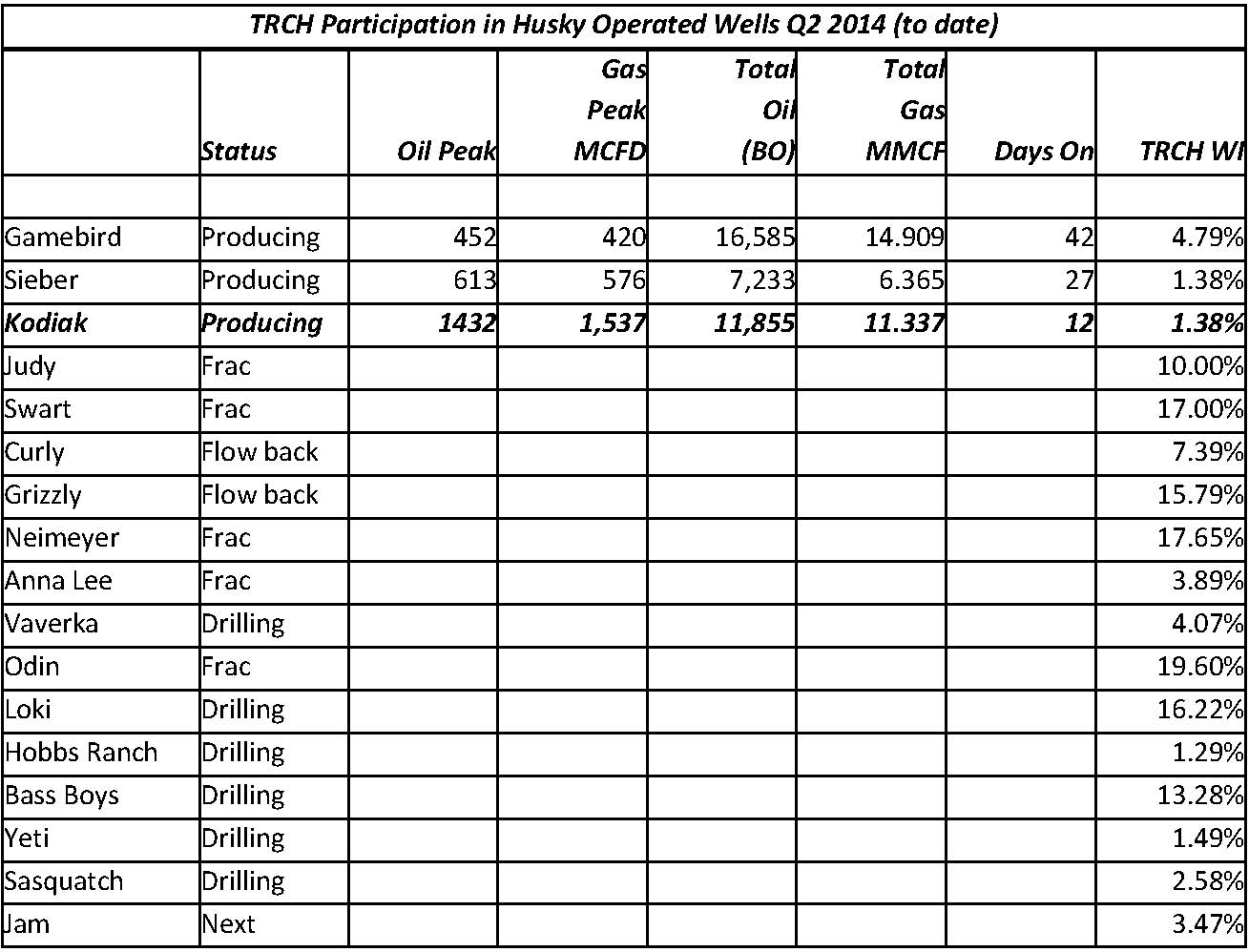

Drilling results from the initial Hunton formation wells were announced on May 19, 2014. TRCH, through its partnership with Husky Ventures, is drilling 17 horizontal wells in the Oklahoma-based project. TRCH has a minority interest, but one of the wells has been online for 12 days and produced at a peak 24-hour rate of 1,475 BOEPD. In the press release, Torchlight says, “While Torchlight’s Working Interest in these most recent wells is small, it is important to highlight the performance amongst the three most recent wells as they are indicative of the types of wells that can be brought in through this horizontal play.”

The company’s WI in the remaining 14 wells ranges from 1.3% to 19.6%. Its total WI in the 17 wells averages out to 8.3% per well. Seven are in stages of frac or flowback.

Torchlight partners with Husky Ventures in four other plays and holds 300,000 gross acres. The joint venture can drill roughly one well per month per rig, meaning five rigs are currently drilling in the play.

The partnership with Ring Energy (ticker: REI) in southwest Kansas includes a five well vertical program that has commenced drilling. TRCH acquired an 18% WI in the Smokey Hills Prospect of McPherson country (10,000 gross acres) along with a producing well. Short-term plans consist of increasing working interest to 50% and drilling 10 vertical wells by Q3’14. The company did not give a timetable for releasing results due to its partnership that requires both parties to approve the release.

Torchlight will operate its assets in Central Kansas – its first project as operator. McAndrew said: “This particular Dolomite play has everything we look for in a project. It’s shallow, low-risk, infield and developmental in nature. All of the infrastructure is in place, service companies are available for all of our needs, and in this case, over 800 successful wells have been drilled. We have all of their drilling and completion history to base our investment decisions on.”

The Marcelina Creek project in Texas is all held by production and management said operations will continue once it receives more cash flow from its Hunton and Southwest Kansas properties.

Future Plans

“We remain on target with our exploration and production goals for 2014,” said Tom Lapinski, Chief Executive Officer of Torchlight Energy. “By taking smaller working interests in a number of projects in several prospective areas, we have been able to aggressively drill more lower-risk wells without deploying significant amounts of capital on a per well basis. However, as we continue throughout the year, our working interest percentages should increase as we start to drill in new AMIs.”

Torchlight is in discussions to receive an additional $20 million to $25 million in debt financing to meet the needs of its upcoming programs. Management did not elaborate on the issue due to solicitation rules. The company still anticipates being able to drill within cash flow beyond 2014.

Ongoing operations include maintaining its five wells per month program with Husky Ventures, with the number expected to reach six per month by Q3’14. Another Austin Chalk well will be drilled in south Texas by July and operations will kick off in Central Kansas by Q3’14. TRCH anticipates production rising near the end of the year due to its back-loaded drilling schedule. According to its April 2014 presentation, Torchlight plans to participate in more than 90 wells in the fiscal year and 28 are already underway. A total of 173 gross wells are expected to be in TRCH’s portfolio by 2015 and the company is actively seeking to increase its working interest among its existing wells.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.