Full year free cash flow represented 144% of net income in 2015

Core Laboratories (ticker: CLB, CoreLab.com) released its fourth quarter and full year 2015 results this week, proving that it is a company that can continue to outperform its oilfield service peers, even through a tough commodity downcycle.

CLB reported revenue of $182.7 million in the fourth quarter and full year revenue of $798 million. The full year revenue fell 23% on a constant currency basis, year over year, due in large part to the slowdown in new drilling around the globe.

The company’s production enhancement segment, which focuses largely on North American unconventional reservoirs and deepwater completions and stimulations, was particularly hard hit as oil prices plummeted throughout 2015. Core Lab’s reservoir description segment felt less of an impact due to its more international focus, while the reservoir management group fell as well, because the projects were “very discretional in nature” for client companies.

Performance metrics: highest ROIC in its oilfield service group

Despite the effects of the overall market taking a hit on Core’s revenue, the company continued to manage through the year, exiting 2015 with free cash flow (FCF) representing 144% of net income, leading the oilfield services industry. In the fourth quarter, 24% of every revenue dollar was converted into FCF, which Core used to pay approximately $23.3 million in dividends and to repurchase 132,918 shares for $15.3 million. The share repurchasing program reduced Core’s outstanding share count to an 18-year low.

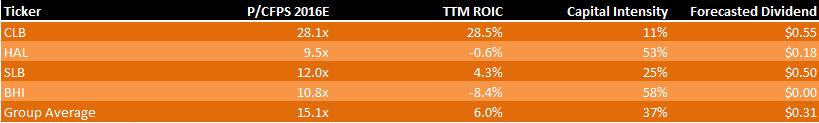

The company’s ROIC was the highest among its service company peers, Core said in its press release, both with and without factoring the weighted average cost of capital (WACC) ratio. Core Lab’s trailing twelve month ROIC was 28.5%, far above service majors like Schlumberger (ticker: SLB, SLB.com) and Halliburton (ticker: HAL, Halliburton.com), which had ROICs of 4.3% and -0.6%, respectively.

Core Lab has returned over $2 billion to shareholders

Core Lab reported that the company’s debt rose roughly by 1% to $433 million year over year. The debt is comprised of $150 million in senior notes and $283 million under CLB’s revolving credit facility, according to Chris Hill, the company’s chief accounting officer. Hill said the company had not made any additional share purchases since the end of the year, and planned to use the excess cash to pay down the balance on the revolver to $275 million on January 29, 2016.

The company’s revolver becomes due in 2019, while $69 million in senior unsecured notes comes due in 2021, and an additional $69 million will be due in 2023.

The company’s revolver becomes due in 2019, while $69 million in senior unsecured notes comes due in 2021, and an additional $69 million will be due in 2023.

CLB Executive Vice President and CFO Dick Bergmark said the company could maintain its 2016 revenue guidance of $164 million without coming close to Core Lab’s 2.5x debt to EBITDA covenant metric. The company’s substantial FCF allows it to pay down debt quickly, which “dramatically impacts that ratio,” said Bergmark.

Core’s SVP also commented that the company would not look to increase the EBITDA covenant metric in the future, saying 2.5x was a comfortable level for the company. “We don’t see a need to go to our bank group to increase that ratio,” said Bergmark. “If we do, it means our pricing grid is going to go higher… we’ll have to pay more in interest for the amount of debt that we have outstanding.”

Over the course of 2015, Core Lab used its free cash flow and its credit facility to finance $94.2 million in dividends and $159.7 million in share repurchases. The company has returned over $2.27 billion to shareholders through a combination of dividends and share count reductions, it said in its press release.

Defending the dividend and buying back shares are priorities 1 and 2

“The dividend [is] extremely important to us,” Bergmark said during the company’s conference call. “For us, the dividend is always first and then the opportunistic nature of our share buybacks would come second.”

When asked if the company planned to use any of its free cash flow for bolt-on acquisitions, Bergmark remarked that Core was not looking to deviate from what it does best.

“One thing about downcylces is better valuations do not make bad companies into good companies,” he said. “Our perspective is we haven’t seen good companies to acquire that fit our three segments… So we don’t see acquisitions really adding to this at this moment.”

Core Lab looks more like a tech company than an oilfield services company

Because of the company’s unique focus on technology, it performs more similarly to tech companies than other oilfield service competitors.

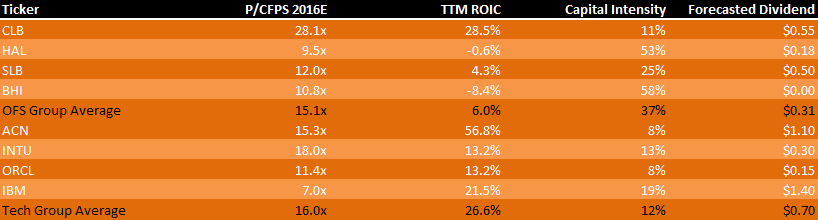

A peer group analysis compiled by EnerCom Analytics found that Core Lab’s performance was more similar to, and in some cases still outperformed large technology companies like IBM and Oracle, than the oilfield services. CLB’s ROIC throughout 2015 was nearly five times greater than the world’s largest oilfield service companies, and nearly 1.9% higher than the average for large tech companies.

Core Lab’s capital intensity, or its capital expenditures divided by EBITDA, is also significantly lower than its oilfield service peers, clocking in at less than half of Schlumberger’s. CLB’s 11% capital intensity is much more in line with the tech peer group, which averaged one percent higher at 12%.

The company also appears to be well on track for maintaining its dividends, welcome news for investors in the energy space, who have seen other companies’ dividends, along with capital budgets, cut substantially since the beginning of the commodities price dive in 2014.

“For the remainder of 2016, we envision a return to more typical seasonal business patterns, with activity increasing after spring breakup in Canada in the second quarter, with sequential quarterly improvements through the end of the year,” said Bergmark. “Because of our working capital management programs, our free cash flow is projected to exceed net income as well as the amount of our dividend, providing liquidity for our future quarterly dividend payments and the opportunistic continuation of our stock repurchase program.”