OAG360 covered the dropping Permian oil prices in a feature article yesterday, as Midland oil spot prices are trading at a $10 discount to West Texas Intermediate. As it turns out, there’s also a bottleneck in two other prominent shales. In the Bakken and Eagle Ford, operators elect to burn its gas rather than stockpile.

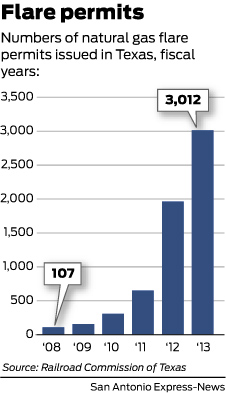

The exponential increase in drilling activity has outpaced infrastructure in regions. The Bakken and the Eagle Ford, in particular, are two shales who have struggled to build out its takeaway and processing capabilities. Bakken operators were flaring off so much gas that the North Dakota Industrial Commission stepped in, warning crude production will be capped if producers don’t slash flaring by 43% by Q1’15.

“In an American boom, the pace is fast,” said Diana Hinton, oil field historian and professor at the University of Texas of the Permian Basin.”If you don’t move fast, someone is going to get there before you.”

Why Flare?

E&Ps are spending record amounts to secure shale positions across North America. But that money burning a hole in their pockets is bent on oil, not natural gas. Producers have dialed back operations in gassier plays like the Haynesville and Barnett to focus on oil, especially since the low gas prices are making such operations less feasible.

“There will, ultimately, be pipelines built to reduce this flaring,” said Barry Smitherman, Chairman of the Texas Railroad Commission, in an interview with the San Antonio Express-News. “We’re just in a transition period right now where the price of oil is so high, everybody’s chasing after liquids.”

Producers will inevitably find gas along with the liquids. The only problem is oil is the top priority, and operators only have so much capacity to work with. Financial constraints, especially for smaller companies, can also factor into the decision. The smaller E&Ps may not have the infrastructure buildout in place compared to their larger peers. “Look at the size of the company,” said Joseph Pratt, an energy historian at the University of Houston. “The smaller companies have less option to invest in anything except to burn it. That’s the case in a lot of the shale history.”

Producers will inevitably find gas along with the liquids. The only problem is oil is the top priority, and operators only have so much capacity to work with. Financial constraints, especially for smaller companies, can also factor into the decision. The smaller E&Ps may not have the infrastructure buildout in place compared to their larger peers. “Look at the size of the company,” said Joseph Pratt, an energy historian at the University of Houston. “The smaller companies have less option to invest in anything except to burn it. That’s the case in a lot of the shale history.”

What’s the Actual Loss?

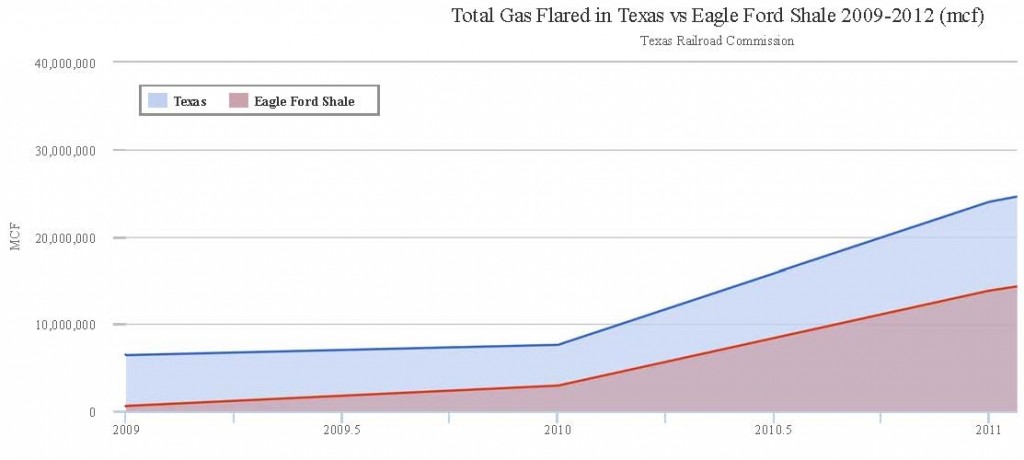

According to data compiled by Earthworks, an environmentally-conscious group, the Bakken and Eagle Ford flared 96 Bcf and 34 Bcf, respectively, in 2013. The amount averages approximately 356 MMcf/d and 130 Bcf annually, which is roughly the same amount of natural gas consumed by the entire state of West Virginia in 2012.

If comparing the 2013 averages to the Energy Information Administration’s Drilling Productivity Report for December 2013, the amounts would equal just 1.6% of all Eagle Ford gas production. The Bakken, on the other hand, flared off 19.6% of its gas, representing a steep decline from July 2013, when Reuters reported roughly 33% of Bakken gas was being flared monthly (or roughly $100 million in value).

The flaring rise reflects the production rise. The Earthworks report says only 20 Bcf of gas was flared in 2010, meaning rates in 2013 rose by 550%. Oil production has increased by approximately the same rate, according to the EIA’s Drilling Productivity Report.

Mineral rights owners are filing lawsuits against producing companies, claiming the burned resource is money out of their own pocket. Industry companies, in turn, have deflected the blame to the delayed responses of the Texas Railroad Commission, who are also struggling to keep pace with the shale boom. The Express-News reported the number of inspectors in the Commission have doubled since 2009, but are still conducting approximately 786 inspections per person on an annual basis. Approval on pipelines has also slowed.

North Dakota has not been as stringent as Texas and is now acting fast to curb the burn. Drillers will be limited to as little as 100 to 200 BOEPD if their monthly flaring rates exceed certain targets. Lynn Helms, Director of North Dakota’s Department of Mineral Resources said he expected a 4% to 5% reduction in oil production due to the new rules. The state is aiming to have only 10% of gas flared by 2020, with future plans to trim it to 5%.

Drillers Exploring Uses for Flared Gas

No matter how economical or uneconomical it is, E&Ps don’t enjoy burning off their assets.

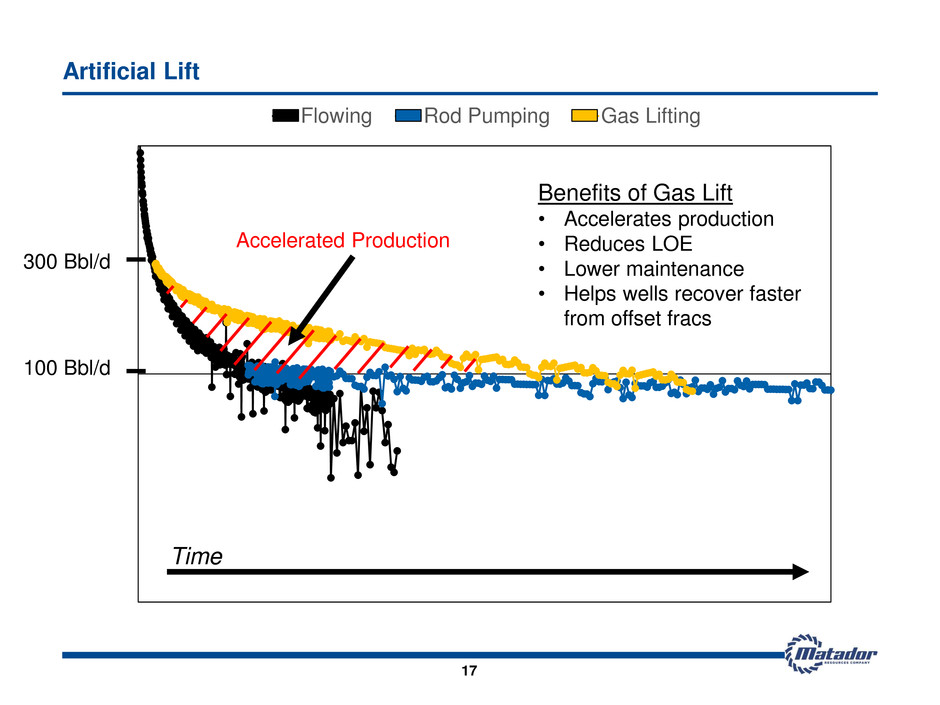

To date, a handful of companies have developed ways to reinvest the resource into current operations. Artificial uplift is being used on existing wells to increase recovery rates, and Core Laboratories (ticker: CLB) management believes a “light hydrocarbon gas flood” can be reinjected into wells sites to boost return.

Statoil (ticker: STO) is using a “CNG in a box” machine that can power well operations. A single CNG box can power an 11-well rig, and STO hopes to have six such boxes in the Bakken field by next year. General Electric (ticker: GE), the developer of the CNG box, said the equipment is beginning to move into Texas.

A Colorado-based company is deploying its first Mobile Alkane Gas Separators (MAGS) to the Bakken this month. The MAGS have a capacity of 300 Mcf/d and divide the different elements of gas so it can be sent to market. Whiting Petroleum (ticker: WLL) mentioned the MAGS will be put to use on its properties.

The North Dakota Pipeline Authority believes the liquids-rich natural gas in the Bakken gives producers more incentive to build out infrastructure, since it is roughly twice as valuable as dry gas. Hess Corporation (ticker: HES) is investing $325 to double the capacity of a nearby plant. New pipelines totaling 885 MBOEPD of capacity are expected to be online by 2016, the state announced in June 2014.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.