Energy Shots By Mobius Risk Group

Summary:

- The New Era of Power Demand Growth: Two decades of sub-1% annual growth in electricity consumption is nearing its end as AI-fueled power demand sets a new course for the U.S. generation fleet. Forecasts from institutions like the IEA see global power demand from data centers, AI, and cryptocurrency doubling in just two years, leaving stakeholders searching for a viable, long-term solution to a multifaceted problem. Two paths are emerging: load shifting and 24/7/365 predictable, reliable, scalable, and affordable power.

- Takeaways for Energy Industry Stakeholders: AI-driven power consumption in data centers is expected to nearly double by 2026, straining the technological capabilities of intermittent renewables and a renewable-heavy grid. Big Tech needs power it can depend upon, creating an opportunity for natural gas and nuclear industries in an AI world. Fugitive methane emissions will be scrutinized under Big Tech’s decarbonization targets.

The New Era of Power Demand Growth

For over two decades, U.S. electricity consumption has grown at an average annual rate of less than 0.6%, enabling policymakers to promote a climate-only attitude toward the U.S. power supply. Those policies push for widespread adoption of intermittent renewables like wind and solar while adding financing and regulatory barriers to thermal generation resources like natural gas, nuclear, and coal.

Now, however, power needs from the advancement of AI and its hyperscale data centers are forcing an about-face in energy policy.

In the new era of power demand growth, consumers will require an “all of the above” generation mix capable of both harvesting renewable energy and servicing grid load with scalable, reliable, affordable, and predictable power.

AI: An Ethereal Product Using Real-World Resources

The computations running behind the scenes every time you use an LLM like OpenAI’s ChatGPT are deceptively power-hungry.

According to the IEA’s historical readings, data centers for AI, cloud computing, and cryptocurrencies consumed approximately 460 TWh (2% of global electricity demand) in 2022.

The IEA’s base-case forecasts see that figure growing to 800 TWh by 2026, while the high-end forecasts predict data center electricity consumption reaching 1,050 TWh by the same year — roughly equivalent to Japan’s total electricity demand.

U.S. Data Centers Complicate Grid Load Forecasts:

The U.S. is home to approximately a third of the world’s 8,000 data centers.

In 2022, those facilities consumed 200 TWh, or 4% of the U.S.’s electricity demand.

The rapid adoption of AI is driving massive investments in data centers, which, in turn, are complicating power demand forecasts for U.S. grid operators.

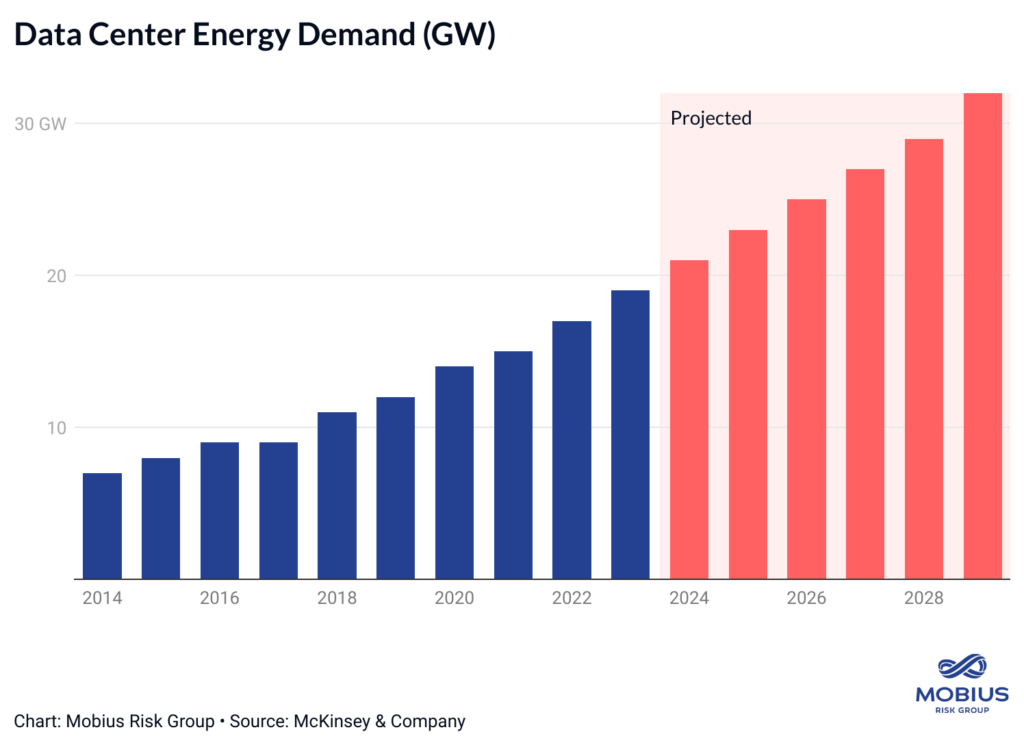

From 2022 to 2023, U.S. grid planners increased their five-year peak electricity demand growth forecasts from 2.6% to 4.7%, adding approximately 18 GW of expected load.

Grid planning forecasts are likely to underestimate real growth rates, leading to diverging predictions across the industry.

McKinsey & Co., for example, estimates data centers will require approximately 29 GW of generation capacity by 2028, equivalent to roughly 254 TWh of annual consumption.

Why Intermittent Renewables Present A Problem

Hyperscale data centers require massive amounts of power and water to keep GPUs operating.

Companies like Google, Meta, and Microsoft are keen to connect their facilities to low-carbon generation resources like wind and solar, but there’s an inherent problem with using renewables to power facilities that operate in a “steady state” (constant load):

Facilities won’t have power when the sun isn’t shining or the wind isn’t blowing.

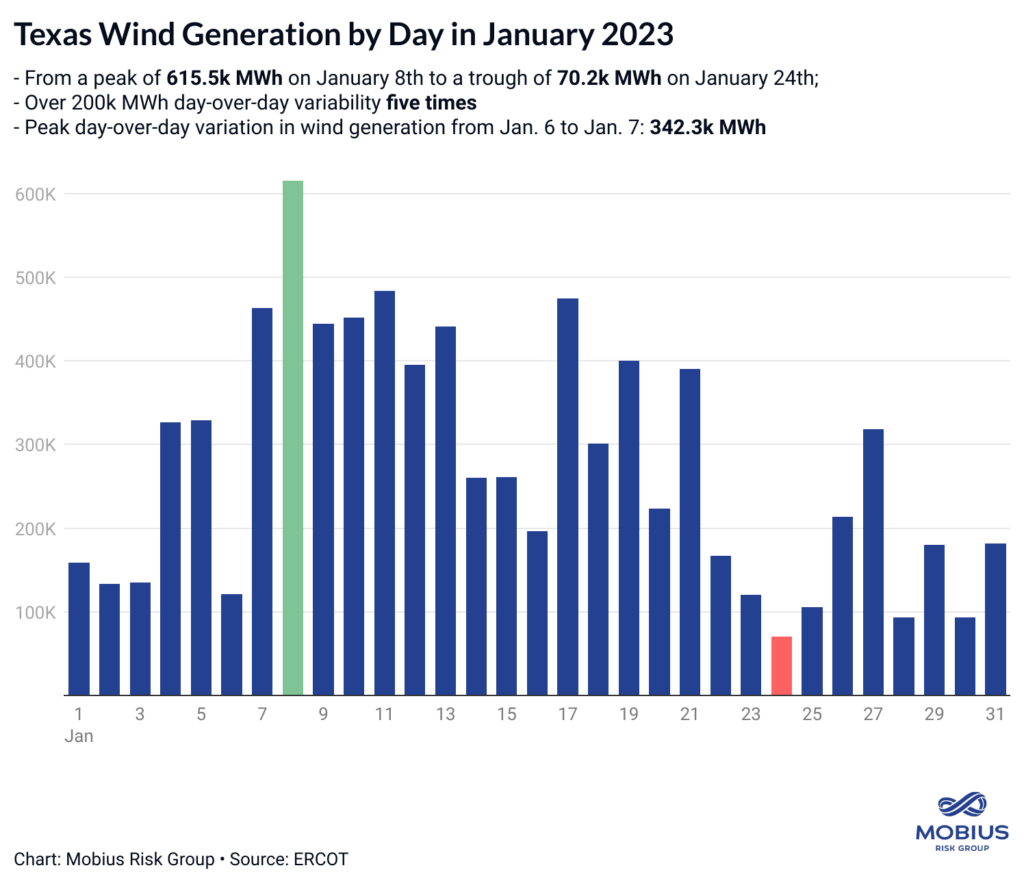

When we look at wind output in January 2023, as reported by ERCOT, we can see the dramatic swings in intermittent renewable generation:

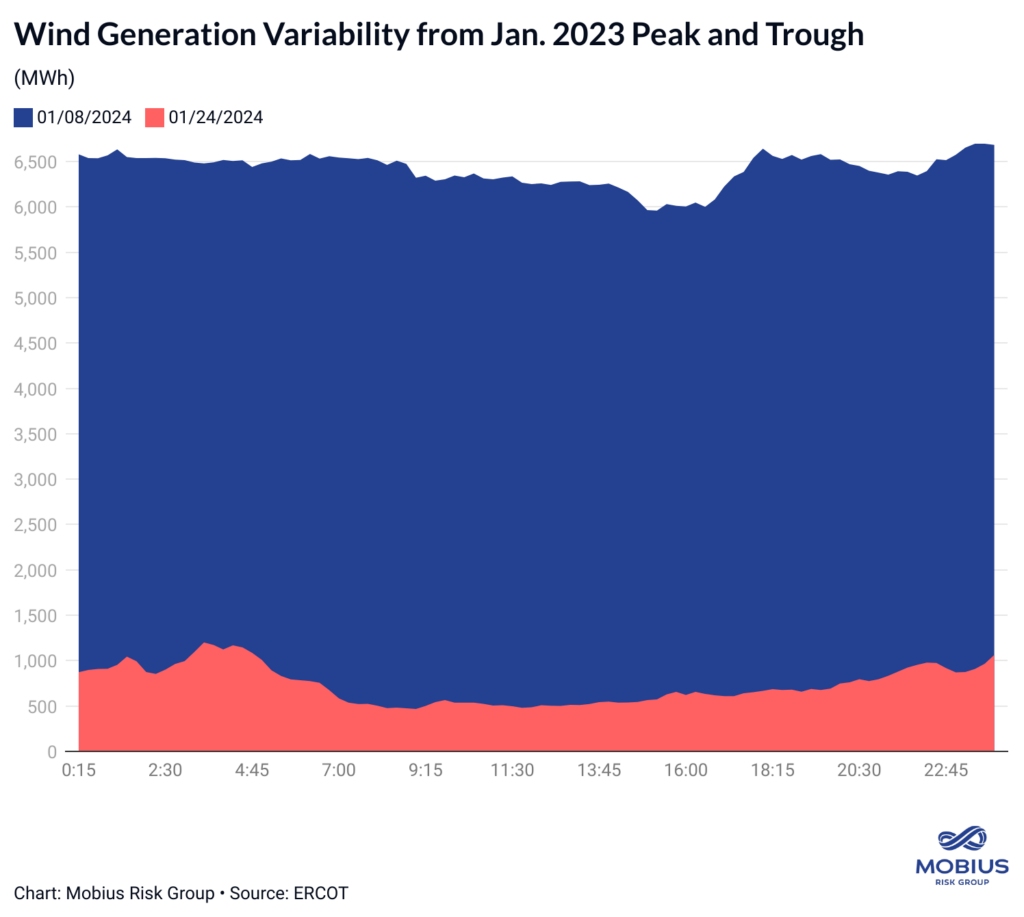

When we compare the month’s best-performing day with the month’s worst-performing day, we see a delta of over 545,000 MWh or the equivalent 24-hour power consumption of approximately 17 million homes.

While weather forecasting over several days can limit strain on grids, day-to-day and hour-to-hour variability presents a more troublesome issue for data centers seeking reliable and predictable power.

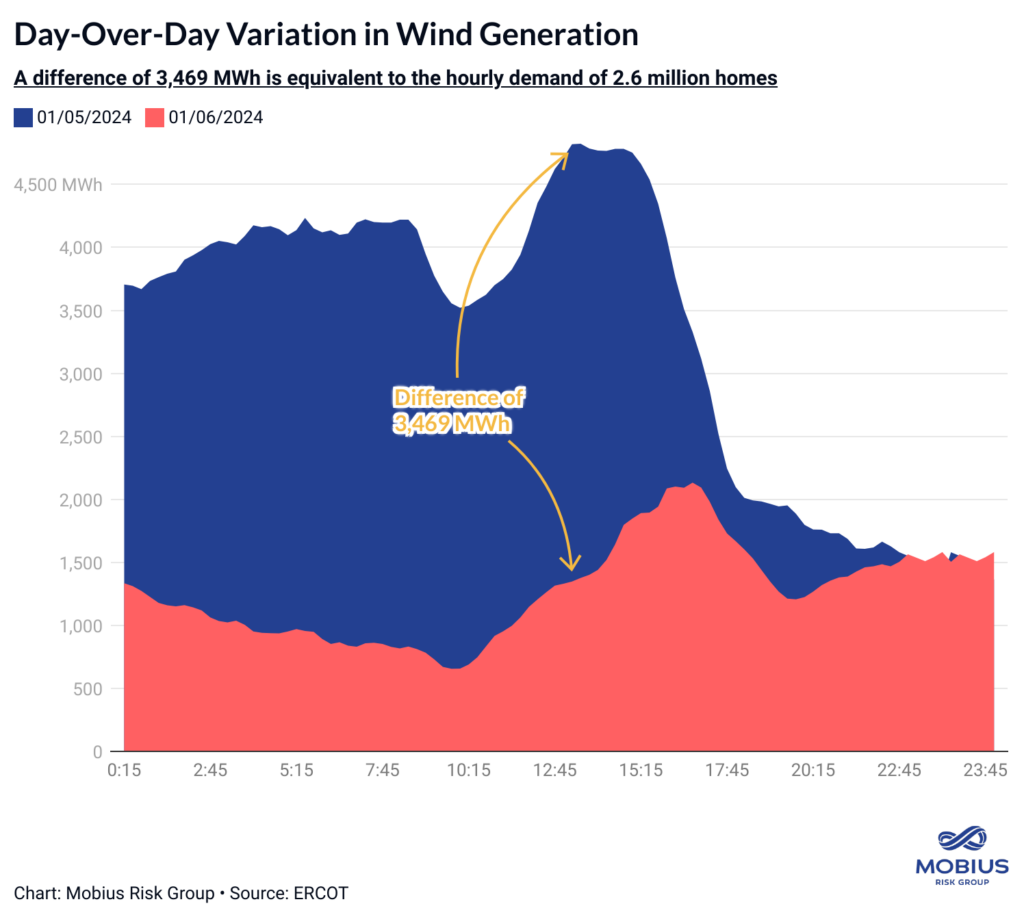

When we compare the hourly difference in wind generation from Jan. 5 to Jan. 6, we can see a peak delta of 3,469 MWh — equivalent to the hourly demand of 2.6 million homes or 10% of ERCOT’s serviced households.

The Opportunities for Traditional Energy Companies:

There are two emerging directions as Big Tech aims to scale data centers for AI:

- Load Shifting

- 24/7/365 Reliable, Scalable, and Predictable

Load Shifting:

“Hyperscalers” like Google, Meta, Microsoft, and Amazon have all set decarbonization goals, pushing these companies towards low-carbon renewables.

Still, the strategy of financing massive wind and solar farms and using carbon credits to offset emissions is limited by the inherent volatility in output.

As a result, Google is now exploring a strategy called “load shifting” by which it invests in geographically dispersed data centers and shifts operations to facilities that have sufficient renewable resources.

No companies have successfully achieved 100% clean energy using this method, and it also exposes firms to data sovereignty policies that aim to restrict data flows across borders.

24/7/365 Reliable, Scalable, and Predictable:

Since most data centers are configured to operate in a “steady state” with relatively stable electricity consumption, companies are also exploring dispersed thermal generation resources that are scalable, reliable, predictable, and affordable.

Nuclear- and natural gas-fired generation are uniquely suited to target this segment of the market.

Amazon’s acquisition of a nuclear-powered data center from Talen Energy is a perfect example from earlier this month. On March 4th, Amazon Web Services (AWS) acquired Talen’s 960-MW Cumulus Data campus in Pennsylvania for $650 million, leveraging direct access to Talen Energy’s neighboring 2.5 GW Susquehanna nuclear power plant.

While the natural gas industry already satisfies the conditions of scalability, reliability, predictability, and affordability, Big Tech’s decarbonization targets will place greater scrutiny on sustainability and fugitive methane emissions.

Ultimately, Big Tech’s growing apprehension of renewable volatility will help force energy policy and financing into a healthier balance for a diversified generation fleet.

By: Alex Melvin-Mobius Research & Insights

Discover more of Mobius Risk Group’s commodity risk insights for geopolitics, energy policy, and structural supply and demand here: https://insights.mobiusriskgroup.com