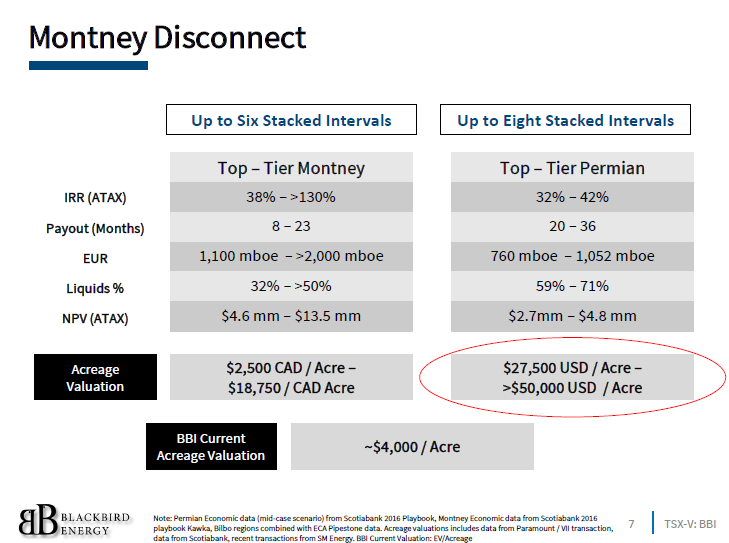

The stacked pay in the Montney is delivering higher EURs than the Permian at a fraction of the land cost

Oil and gas operators have been increasingly sending capital in the Permian Basin as they look for the strongest returns amid continued weakness in crude oil prices. Billions of dollars have poured into the basin, which currently holds 41% of the active rigs in the United States, and while a great deal of attention is being paid to the excellent results seen in the region, another liquids-rich unconventional play is being developed to the north: Canada’s Montney.

The 50,000 square mile play is roughly the size of the Bakken, but much thicker, according to Oil & Gas Equity Research Associate at TD Securities Juan Jarrah. The play is roughly the height of the Eiffel Tower (984 feet) Jarrah told an audience at EnerCom’s The Oil & Gas Conference® 21 in Denver.

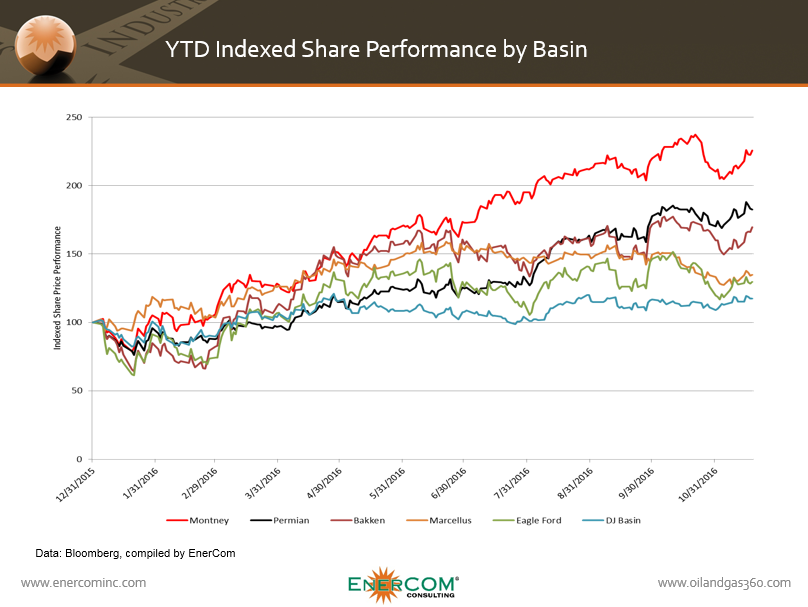

Shareholder return on Montney companies is outperforming those across the U.S.

Year-to-date, the share performance of companies in the Montney has outpaced the performance of companies in the major U.S. basins including the Permian, according to data compiled by EnerCom Analytics.

With execution and continued improvements through innovation and efficiency, investors are taking note of the basin the basin driving share price up. Based on a price weighted index, EnerCom’s Montney index is up 125% year to date. One of the companies leading the way in the Montney is Blackbird Energy (ticker: BBI), who’s share prices has increased 260% year to date.

Blackbird Energy has been seeing continued success in the region as EURs top results seen in the Permian, while acreage valuation sits at just a fraction of what E&P companies are paying for a piece of the Permian. Based on Scotiabank’s 2016 Playbook, Montney returns, measured by payout period shown in the slide below, are better than what operators are generating in the Permian.

Canadian innovation driving down costs further in the Montney

Not only is the cost per acre significantly lower in the Montney compared to the Permian, but Blackbird has also been able to reduce its drilling costs by 54% from its first well, and 41% compared to the average of the company’s first three Elmworth Montney wells, according to a press release from the company Friday.

The company’s update, which looks at Blackbird’s 02/2-20 well, reports that the Calgary-based company was able to drill and complete its latest well in 21.5 days for $5.5 million, down from an average cost of $9.7 million for Blackbird’s first three wells. The company was also able to reduce the number of days needed to complete the well to 11 from 20 through the use of Stage Completions Inc. SC Bowhead II sleeve system.

“The Stage System facilitates pin point completions with individual sliding sleeves that are activated by a collet, eliminating the need for coil tubing to activate sleeves,” Blackbird Chairman, President and CEO Garth Braun explained. “Blackbird was able to continuously pump without delays through multiple intervals of the wellbore. The continuous completion program allowed Blackbird to reduce the time spent between fracs, decreasing the direct and indirect costs substantially. The Stage System facilitates higher pump rates which improved the placement of proppant in the formation. The 02/2-20 was completed using slickwater and intervals were completed at pump rates from 8 to 10 cubic meters per minute.”

The success of the Bowhead II system in Blackbird’s wells has prompted the company to move ahead with closing its previously announced acquisition of an indirect 10% minority interest in Stage Completions for $3 million before deploying Stage System’s products into the second “condition well” that was originally a prerequisite for the deal. Blackbird’s minority interest in Stage Completions will allow BBI to purchase completion equipment from Calgary-based Stage at cost plus an administrative fee and offer Blackbird preferential access to products, the company said in an investor presentation.

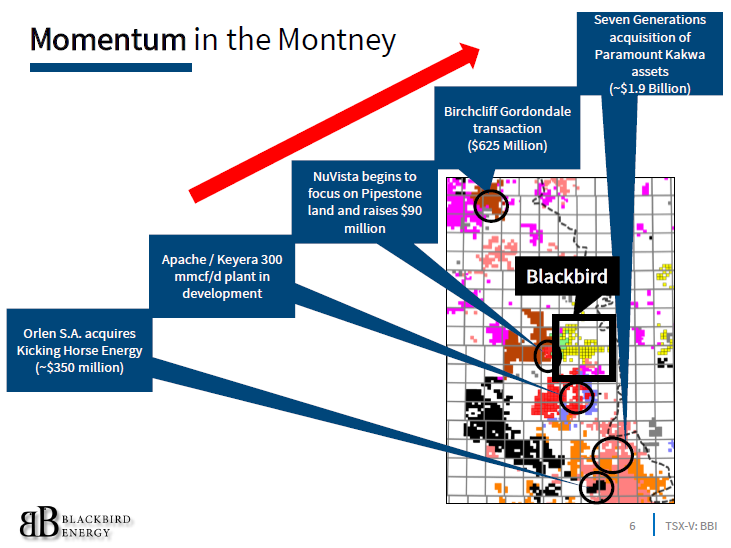

Blackbird Energy looks to take advantage of momentum in the Montney

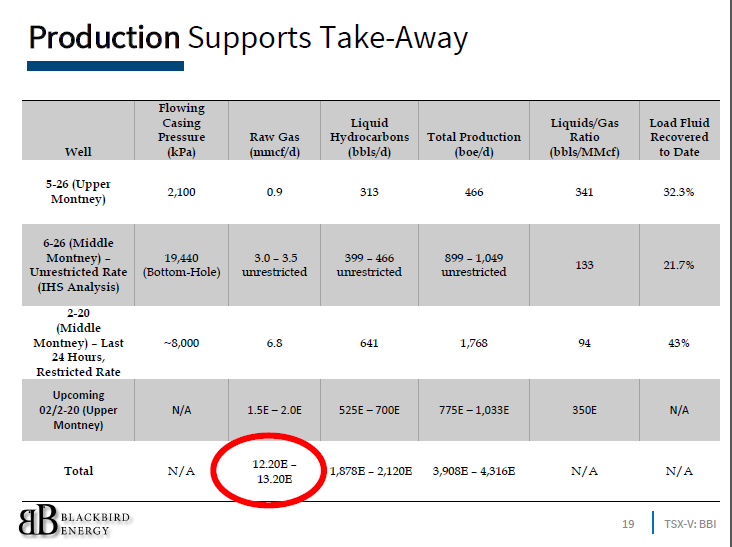

Blackbird’s release Friday also included an update on the company’s infrastructure, which is 100% owned and operated by BBI. Construction on Blackbird’s Elmworth processing facility and the associated pipeline gathering system is underway and on-schedule to be completed in late December, according to the company. The facility will have an initial capacity of approximately 10 MMcf/d of natural gas plus associated liquids of approximately 1,500 BOPD, for aggregate throughput of approximately 3,150 BOEPD. Blackbird’s infrastructure is being built out to facility further expansions as well.

According to the company’s investor presentation, the facility could eventually process as much as 30 MMcf/d of natural gas. Other operators in the play are also busy securing acreage and addressing infrastructure needs.

Blackbird currently has approximately $36 million in working capital with no debt. With the strong results from the Montney, and the on-time completion of its midstream assets, BBI plans to see cash flow in the fourth quarter, according to the company’s presentation.

“For those that are waiting for $50, $60 and $100 oil, they can continue to wait, but the liquids-rich corridor of the Montney is profitable at $45 WTI,” Braun told Oil & Gas 360®.